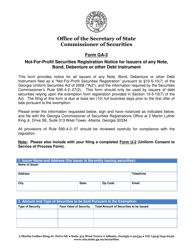

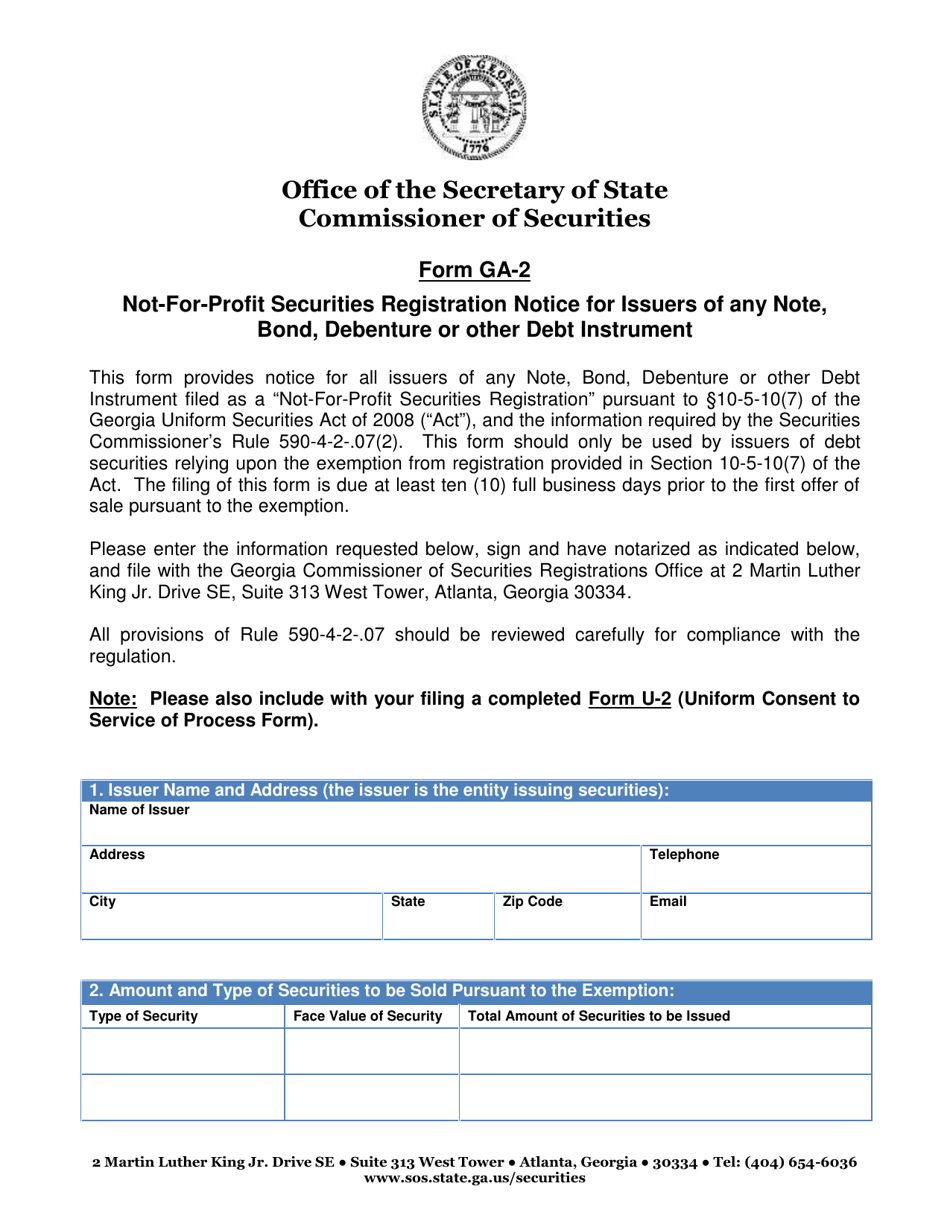

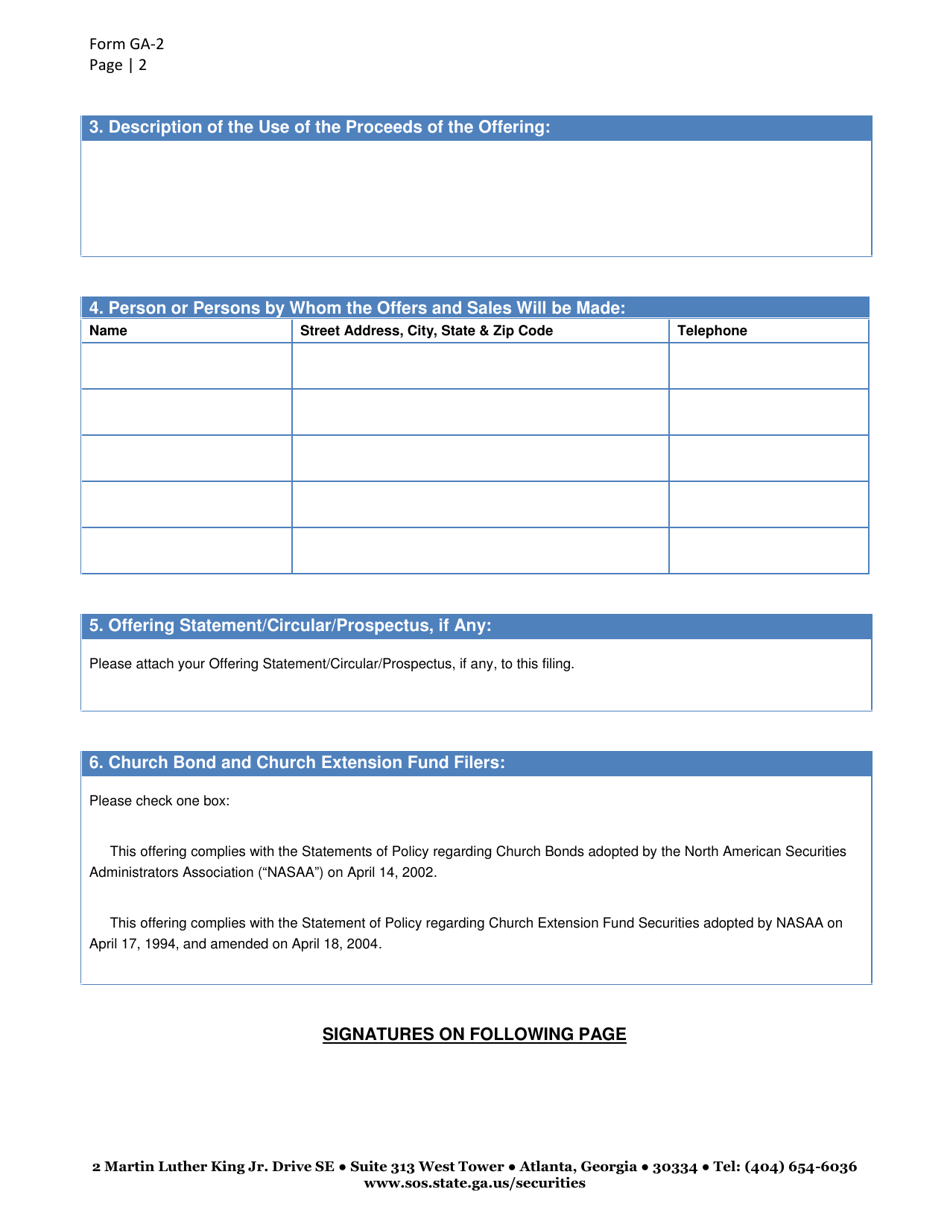

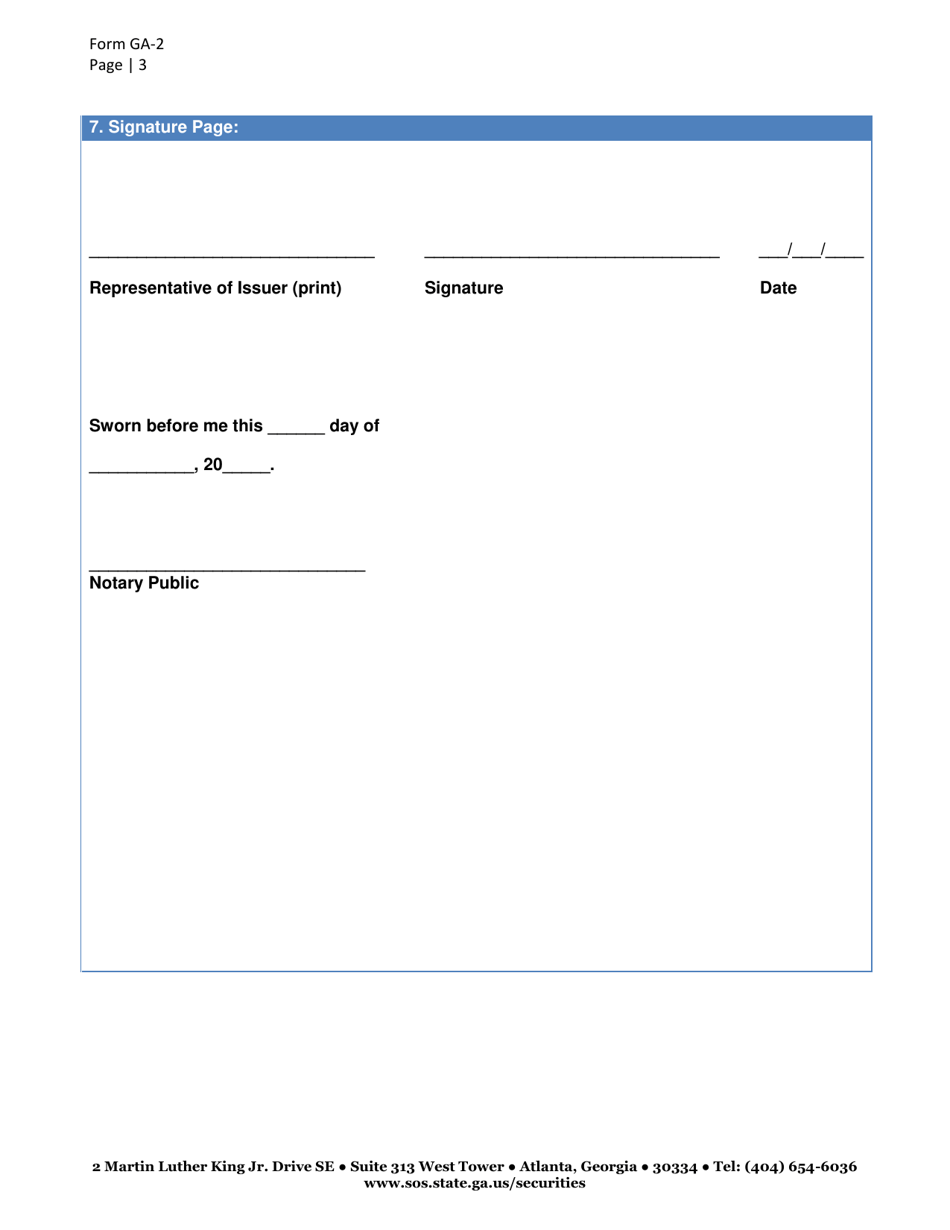

Form GA-2 Not-For-Profit Securities Registration Notice for Issuers of Any Note, Bond, Debenture or Other Debt Instrument - Georgia (United States)

What Is Form GA-2?

This is a legal form that was released by the Georgia Secretary of State - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GA-2?

A: Form GA-2 is a not-for-profit securities registration notice for issuers of any note, bond, debenture or other debt instrument in Georgia (United States).

Q: Who needs to file Form GA-2?

A: Any issuer of a not-for-profit security, such as a note, bond, debenture or other debt instrument, needs to file Form GA-2 in Georgia (United States).

Q: What is the purpose of Form GA-2?

A: The purpose of Form GA-2 is to register not-for-profit securities with the appropriate authorities in Georgia (United States).

Q: What information needs to be provided in Form GA-2?

A: Form GA-2 requires information about the issuer, the securities being offered, any exemptions being claimed, and payment of the required fees.

Q: Are there any fees associated with filing Form GA-2?

A: Yes, there are fees associated with filing Form GA-2. The specific fees depend on factors such as the aggregate amount of securities being offered.

Q: Is filing Form GA-2 a requirement for issuing not-for-profit securities in Georgia?

A: Yes, filing Form GA-2 is a requirement for issuers of not-for-profit securities in Georgia (United States).

Q: Are there any exemptions or exceptions to filing Form GA-2?

A: There may be exemptions or exceptions to filing Form GA-2 for certain types of issuers or securities. It is advisable to consult with legal counsel or the Securities Division for specific details.

Q: What are the consequences of not filing Form GA-2?

A: Failing to file Form GA-2 as required may result in penalties or legal consequences. It is important to comply with the securities registration requirements.

Form Details:

- The latest edition provided by the Georgia Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GA-2 by clicking the link below or browse more documents and templates provided by the Georgia Secretary of State.