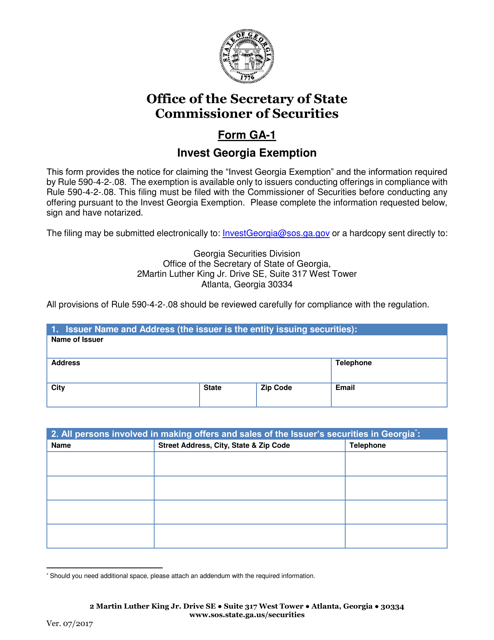

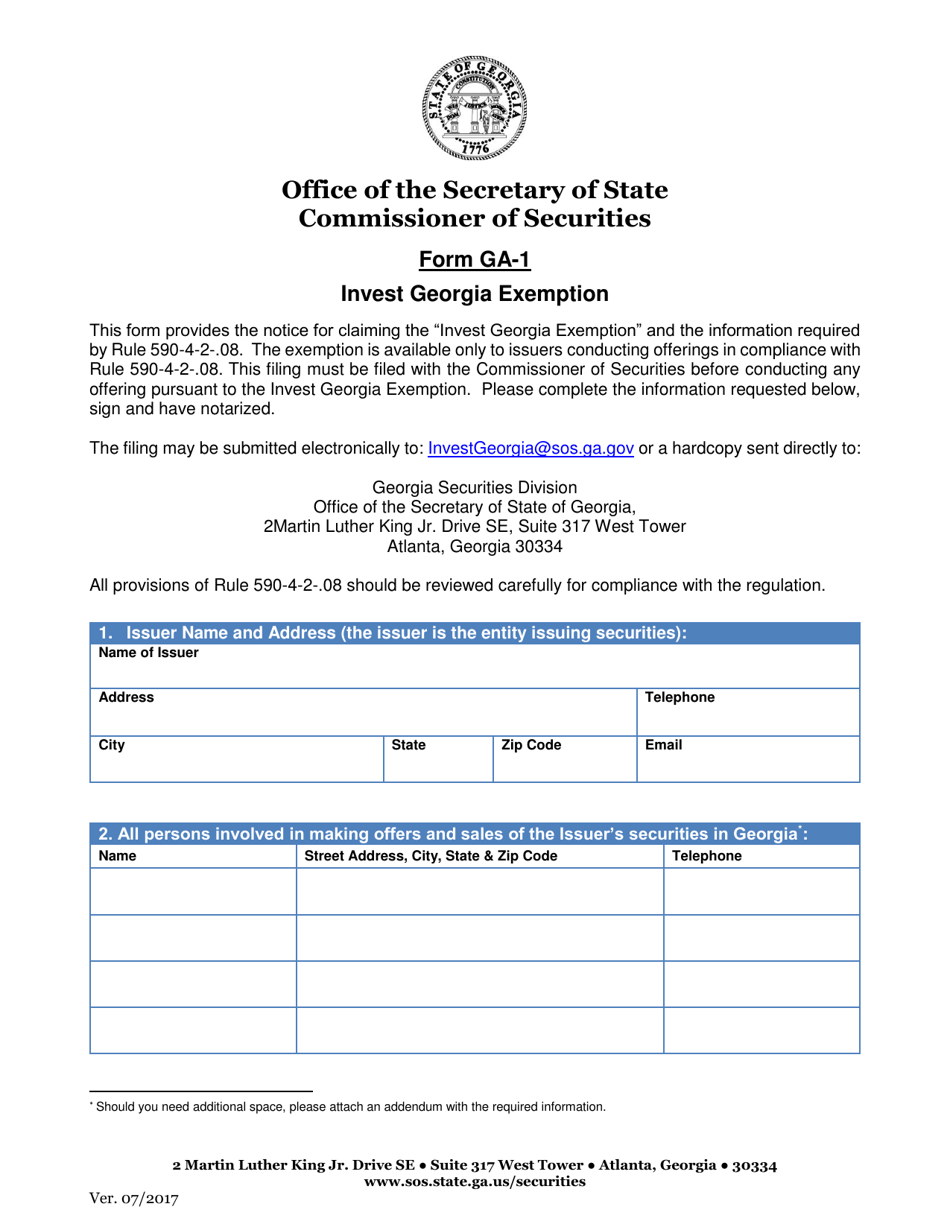

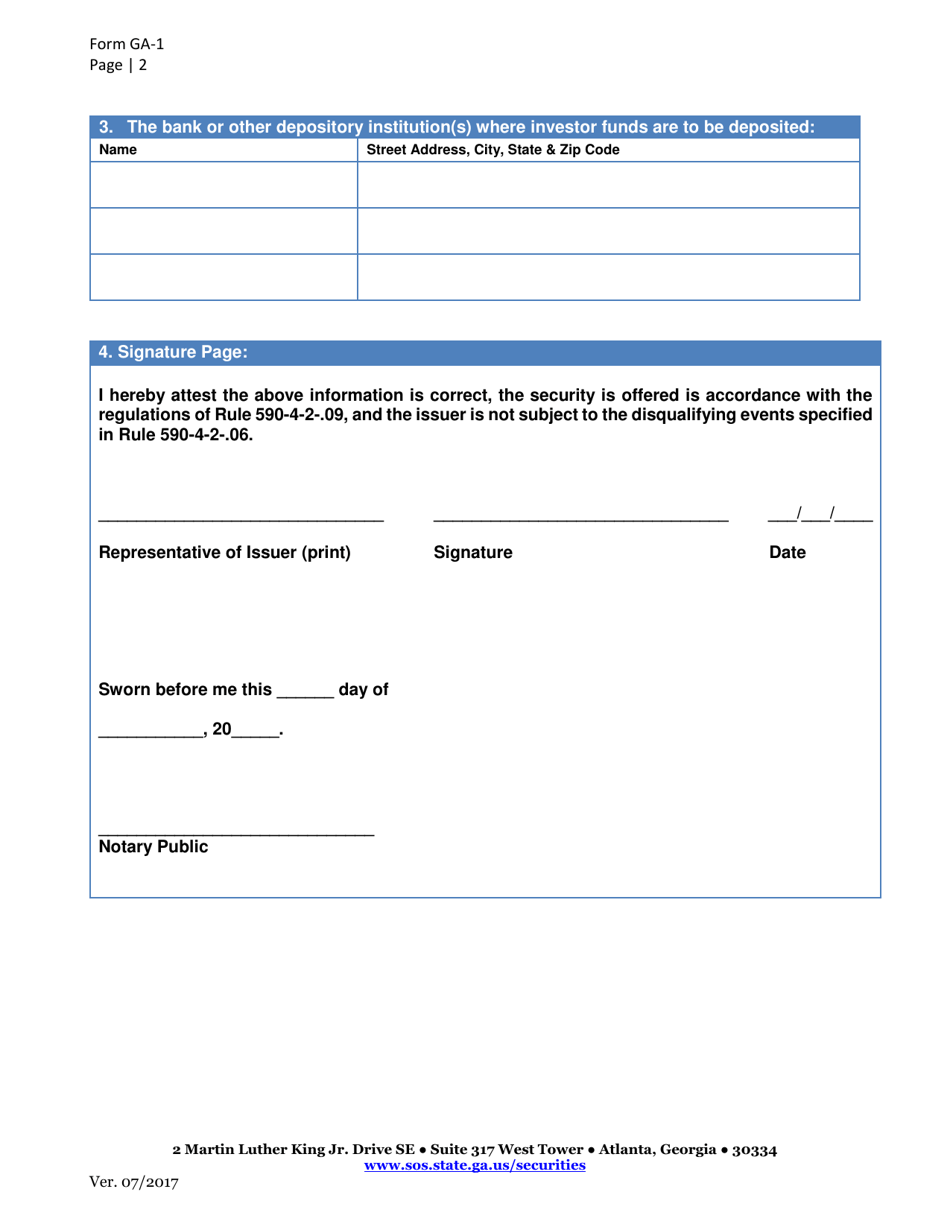

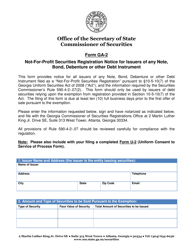

Form GA-1 Invest Georgia Exemption - Georgia (United States)

What Is Form GA-1?

This is a legal form that was released by the Georgia Secretary of State - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GA-1 Invest Georgia Exemption?

A: Form GA-1 Invest Georgia Exemption is a document used in the state of Georgia in the United States.

Q: Who can use Form GA-1?

A: Form GA-1 can be used by individuals and entities seeking an exemption from registration as an investment adviser in the state of Georgia.

Q: What is the purpose of Form GA-1?

A: The purpose of Form GA-1 is to provide information about the individual or entity seeking the exemption and their activities.

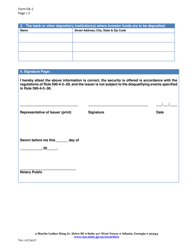

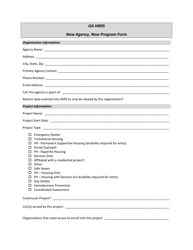

Q: What supporting documents are required with Form GA-1?

A: The specific supporting documents required with Form GA-1 can vary depending on the circumstances. However, generally, applicants may be required to submit financial statements, disclosure documents, and any other documents deemed necessary by the Securities Division.

Q: What happens after I submit Form GA-1?

A: After submitting Form GA-1, the Securities Division will review the application and supporting documents. If approved, the individual or entity will receive an exemption from registration as an investment adviser in Georgia.

Q: Are there any ongoing requirements after obtaining the exemption?

A: Yes, there are ongoing requirements after obtaining the exemption. Exempted individuals and entities must still comply with certain recordkeeping, reporting, and disclosure requirements under the Georgia Uniform Securities Act.

Q: Can the exemption be revoked?

A: Yes, the exemption can be revoked if the exempted individual or entity fails to comply with the applicable requirements or if there are other grounds for revocation as determined by the Securities Division.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Georgia Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GA-1 by clicking the link below or browse more documents and templates provided by the Georgia Secretary of State.