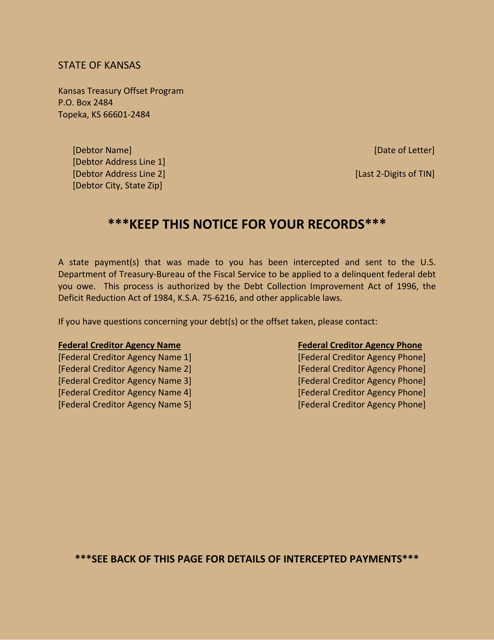

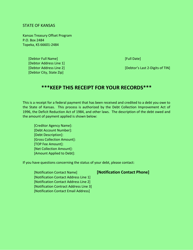

Ktop Offset Notice - Kansas

Ktop Offset Notice is a legal document that was released by the Kansas Department of Administration - a government authority operating within Kansas.

FAQ

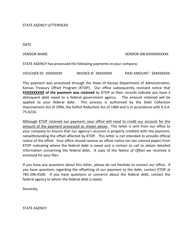

Q: What is the Ktop Offset Notice?

A: The Ktop Offset Notice is a notification issued in Kansas regarding offsetting child support payments.

Q: Why would child support payments be offset?

A: Child support payments may be offset to cover past due taxes or other debts owed to the state or federal government.

Q: Who is affected by the Ktop Offset Notice?

A: Any parent or guardian who owes child support payments in Kansas may be affected by the Ktop Offset Notice.

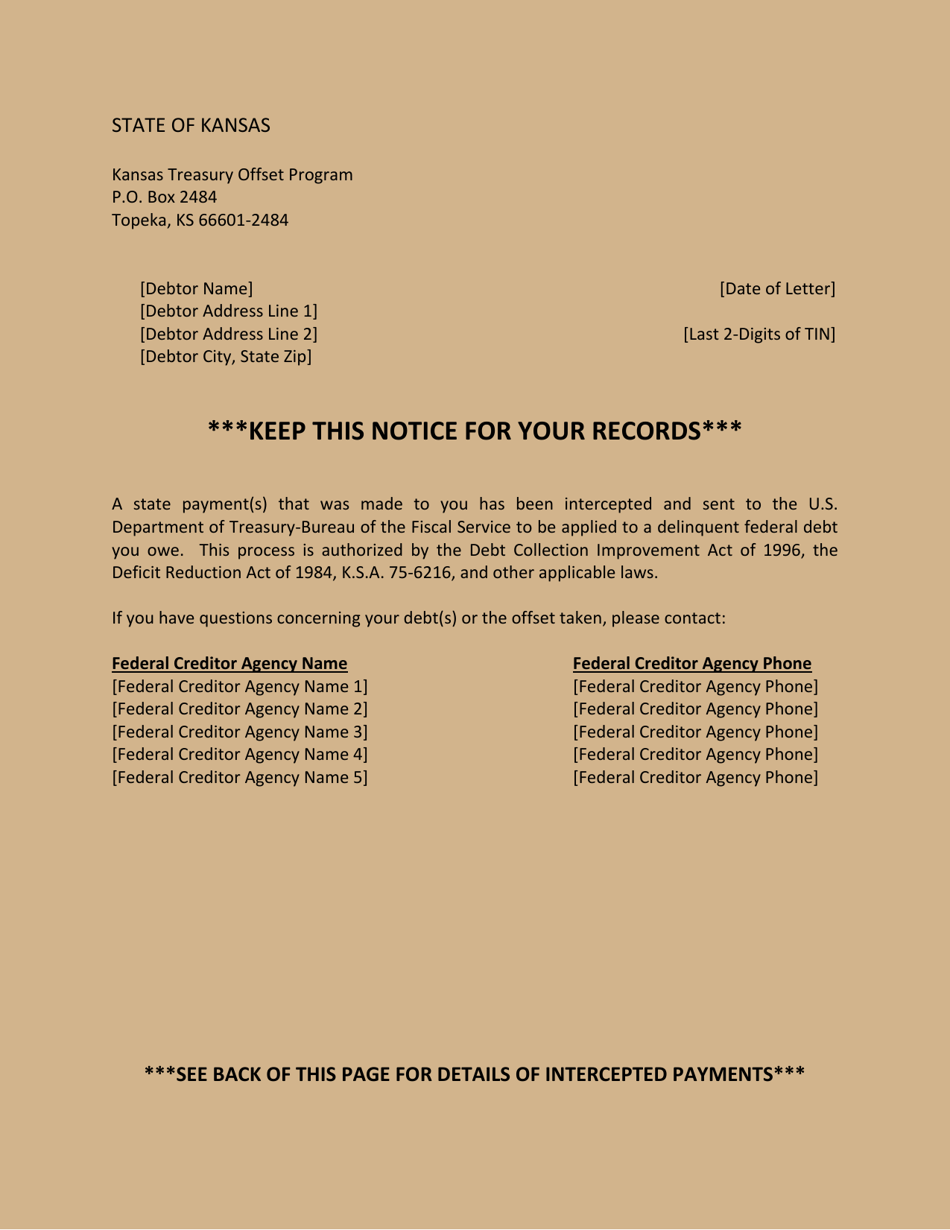

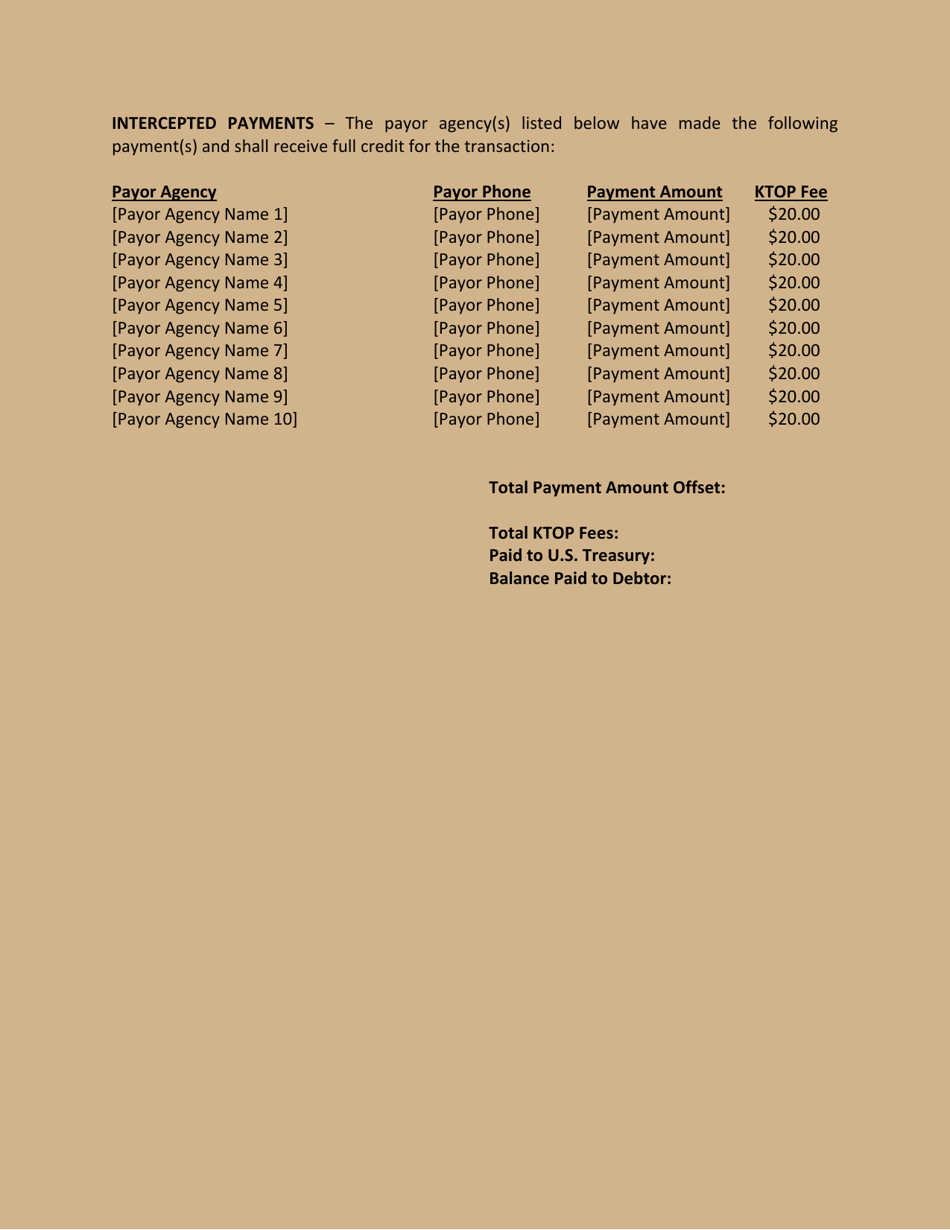

Q: How does the offset process work?

A: When child support payments are offset, the owed amount is deducted from income tax refunds or other state or federal payments owed to the individual.

Q: What should I do if I receive a Ktop Offset Notice?

A: If you receive a Ktop Offset Notice, you should review the notice carefully and contact the appropriate child support agency to address any questions or concerns.

Q: Can I appeal the offset decision?

A: Yes, you have the right to appeal the offset decision if you believe it was made in error. Contact the child support agency for instructions on how tofile an appeal.

Q: How can I avoid having my child support payments offset?

A: To avoid having your child support payments offset, it is important to stay compliant with your child support obligations and promptly address any concerns or issues that may arise.

Form Details:

- The latest edition currently provided by the Kansas Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Department of Administration.