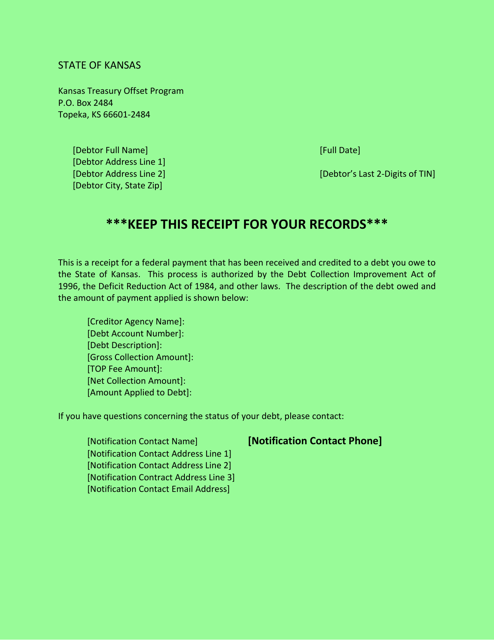

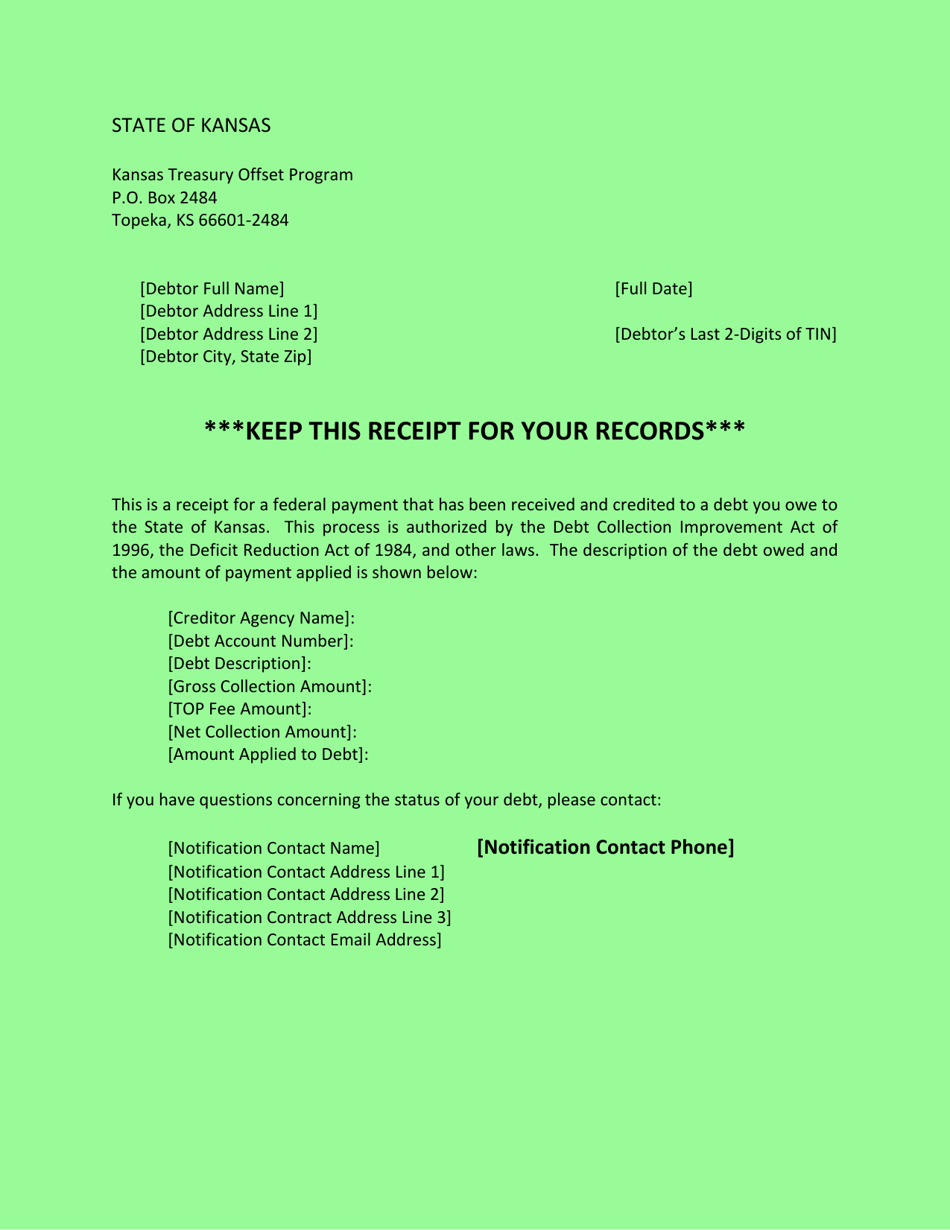

Ktop Offset Receipt - Kansas

Ktop Offset Receipt is a legal document that was released by the Kansas Department of Administration - a government authority operating within Kansas.

FAQ

Q: What is a Ktop Offset Receipt?

A: A Ktop Offset Receipt is a document that is used for the purpose of reporting and paying Kansas state sales and use tax.

Q: Who needs to use a Ktop Offset Receipt?

A: Any business or individual that sells taxable goods or services in Kansas and is required to collect and remit sales tax needs to use a Ktop Offset Receipt.

Q: How often do I need to file a Ktop Offset Receipt?

A: Ktop Offset Receipts must be filed on a monthly basis.

Q: What information is required on a Ktop Offset Receipt?

A: A Ktop Offset Receipt must include information such as the total sales and taxable sales for the reporting period, as well as any exemptions or deductions that apply.

Q: Are there any penalties for not filing a Ktop Offset Receipt?

A: Yes, there are penalties for not filing a Ktop Offset Receipt, including fines and interest charges on any unpaid tax amounts.

Form Details:

- The latest edition currently provided by the Kansas Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Department of Administration.