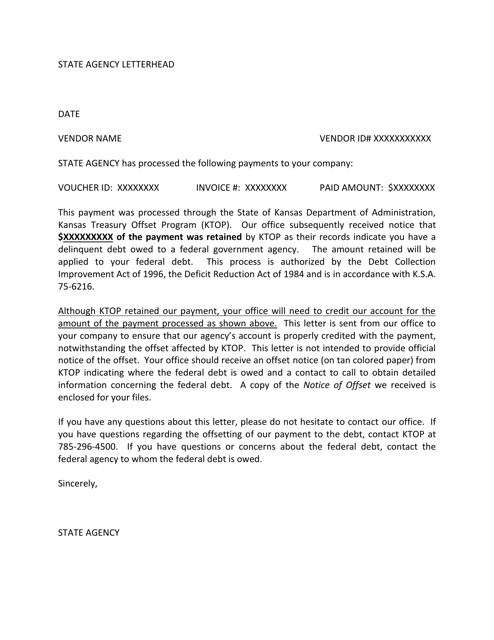

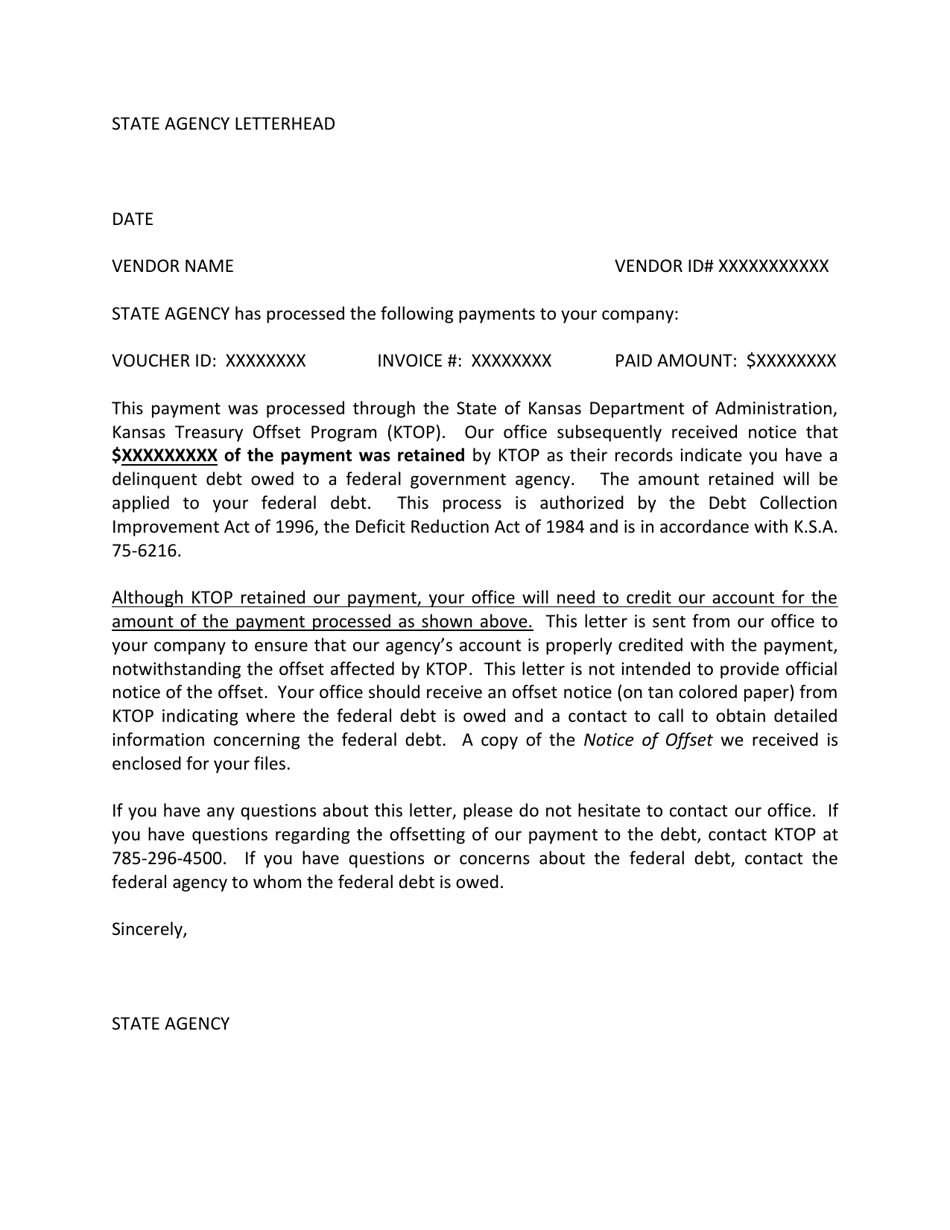

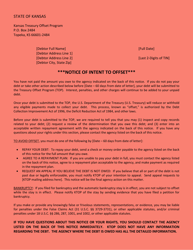

Sample Offset Notice - Kansas

Sample Offset Notice is a legal document that was released by the Kansas Department of Administration - a government authority operating within Kansas.

FAQ

Q: What is a Sample Offset Notice?

A: A Sample Offset Notice is a document sent by the government to inform you that a portion of your federal tax refund may be withheld to offset certain debts.

Q: Why would I receive a Sample Offset Notice?

A: You would receive a Sample Offset Notice if you have outstanding debts, such as unpaid taxes, child support, or student loans.

Q: What debts can be offset using my tax refund?

A: Some of the debts that can be offset using your tax refund include unpaid taxes, child support, defaulted student loans, and federal agency debts.

Q: How much of my tax refund can be withheld?

A: The amount of your tax refund that can be withheld depends on the type and amount of debt you owe. It is typically a percentage of your refund.

Q: What should I do if I receive a Sample Offset Notice?

A: If you receive a Sample Offset Notice, you should review the notice carefully and take appropriate action. This may include contacting the agency listed on the notice to address the debt.

Form Details:

- The latest edition currently provided by the Kansas Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Department of Administration.