Covid-19 and Unemployment Insurance Benefits - South Carolina

Covid-19 and Unemployment Insurance Benefits is a legal document that was released by the South Carolina Department of Employment & Workforce - a government authority operating within South Carolina.

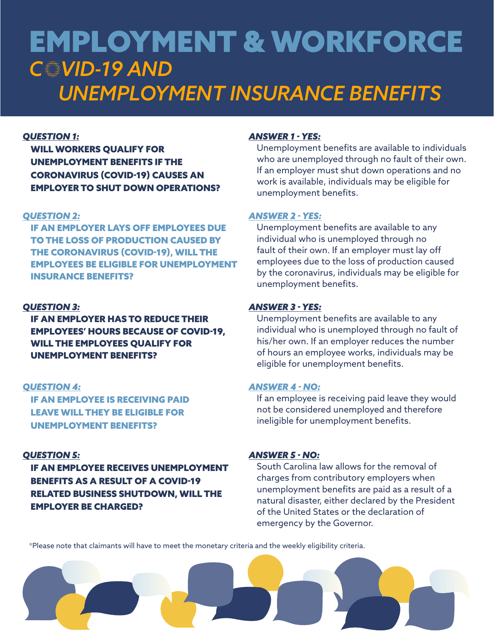

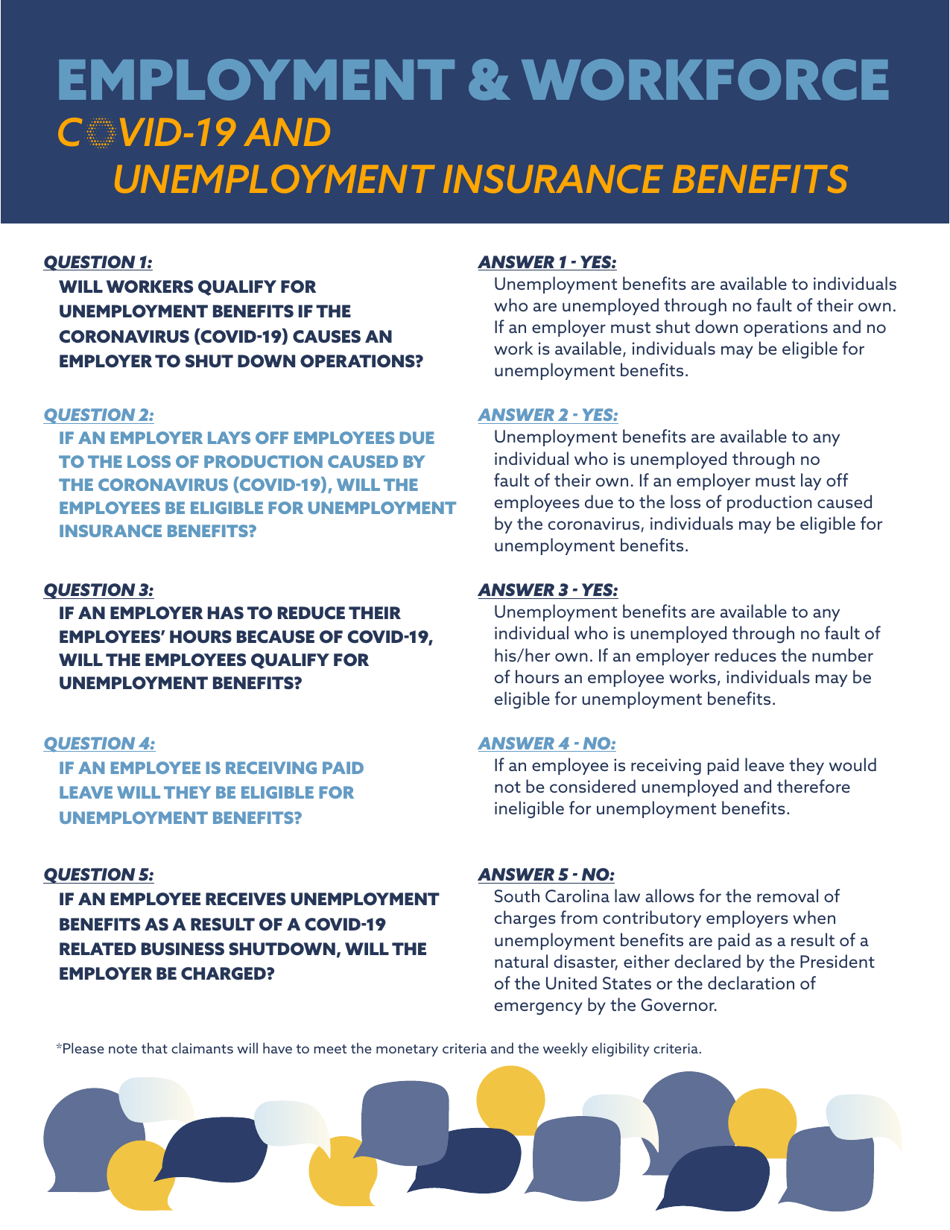

FAQ

Q: What is Covid-19?

A: Covid-19 is a highly contagious respiratory illness caused by the SARS-CoV-2 virus.

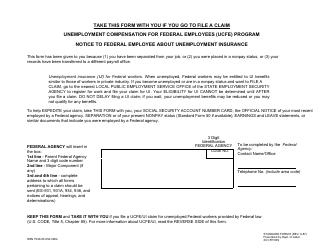

Q: What are unemployment insurance benefits?

A: Unemployment insurance benefits provide temporary financial assistance to individuals who are unemployed through no fault of their own.

Q: Who is eligible for unemployment insurance benefits due to Covid-19 in South Carolina?

A: Eligibility for unemployment insurance benefits due to Covid-19 in South Carolina has been expanded to cover individuals who have lost their job or had their hours reduced as a result of the pandemic.

Q: What documents do I need to apply for unemployment insurance benefits in South Carolina?

A: You will need your Social Security number, employment history for the past 18 months, and information about any wages you have earned during your base period.

Q: How much money will I receive in unemployment insurance benefits in South Carolina?

A: The amount of money you will receive in unemployment insurance benefits in South Carolina is based on your past earnings. The maximum weekly benefit amount is currently $326.

Q: How long can I receive unemployment insurance benefits in South Carolina?

A: In South Carolina, the maximum duration of unemployment insurance benefits is 20 weeks.

Q: Are unemployment insurance benefits taxable in South Carolina?

A: Yes, unemployment insurance benefits are considered taxable income in South Carolina and must be reported on your federal and state tax returns.

Q: Is there a waiting period to receive unemployment insurance benefits in South Carolina?

A: Yes, there is a one-week waiting period before you can begin receiving unemployment insurance benefits in South Carolina.

Q: What is the minimum earnings requirement to qualify for unemployment insurance benefits in South Carolina?

A: To qualify for unemployment insurance benefits in South Carolina, you must have at least earned $4,455 during your base period.

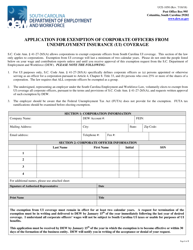

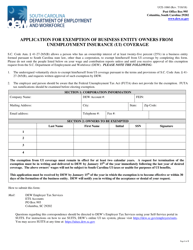

Form Details:

- The latest edition currently provided by the South Carolina Department of Employment & Workforce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Employment & Workforce.