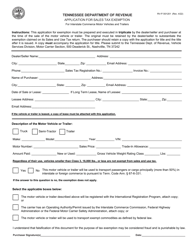

This version of the form is not currently in use and is provided for reference only. Download this version of

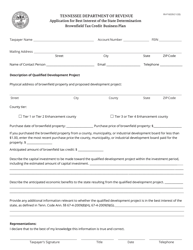

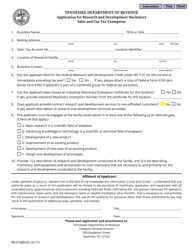

Form RV-F1308401

for the current year.

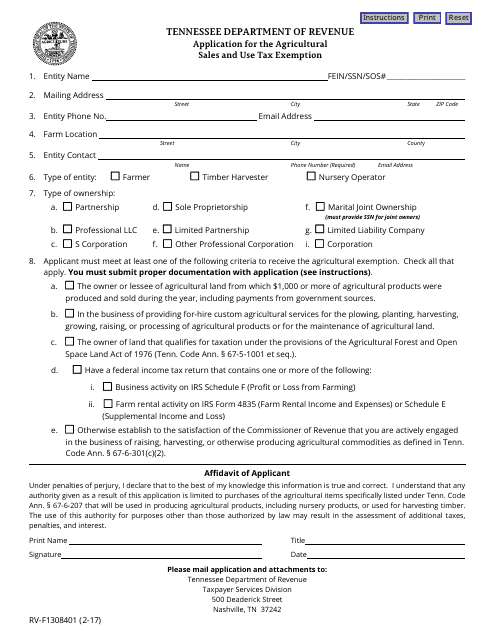

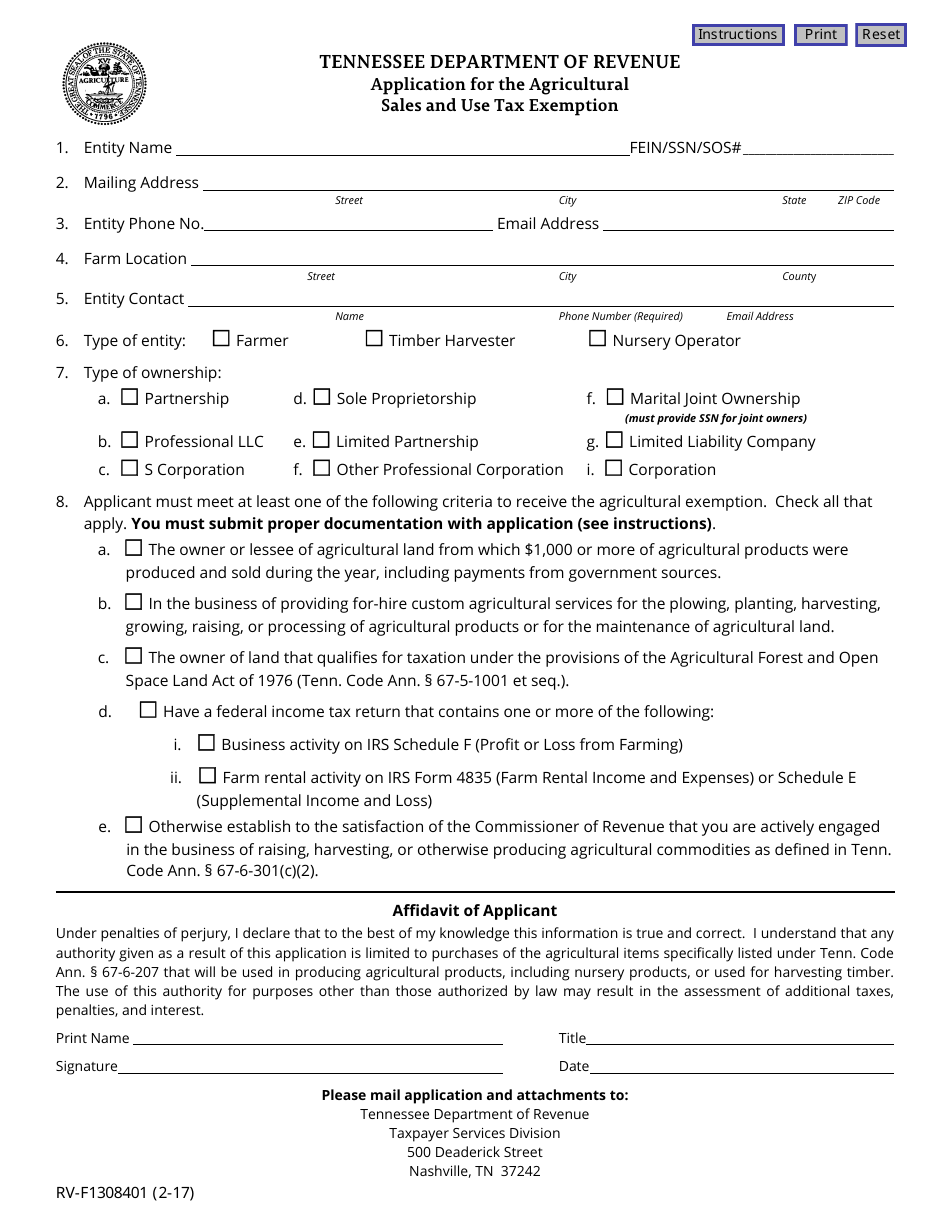

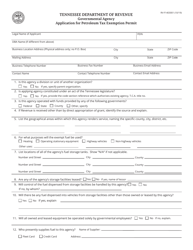

Form RV-F1308401 Application for the Agricultural Sales and Use Tax Exemption - Tennessee

What Is Form RV-F1308401?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

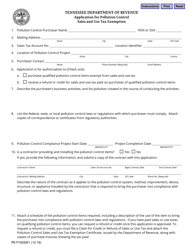

Q: What is the purpose of form RV-F1308401?

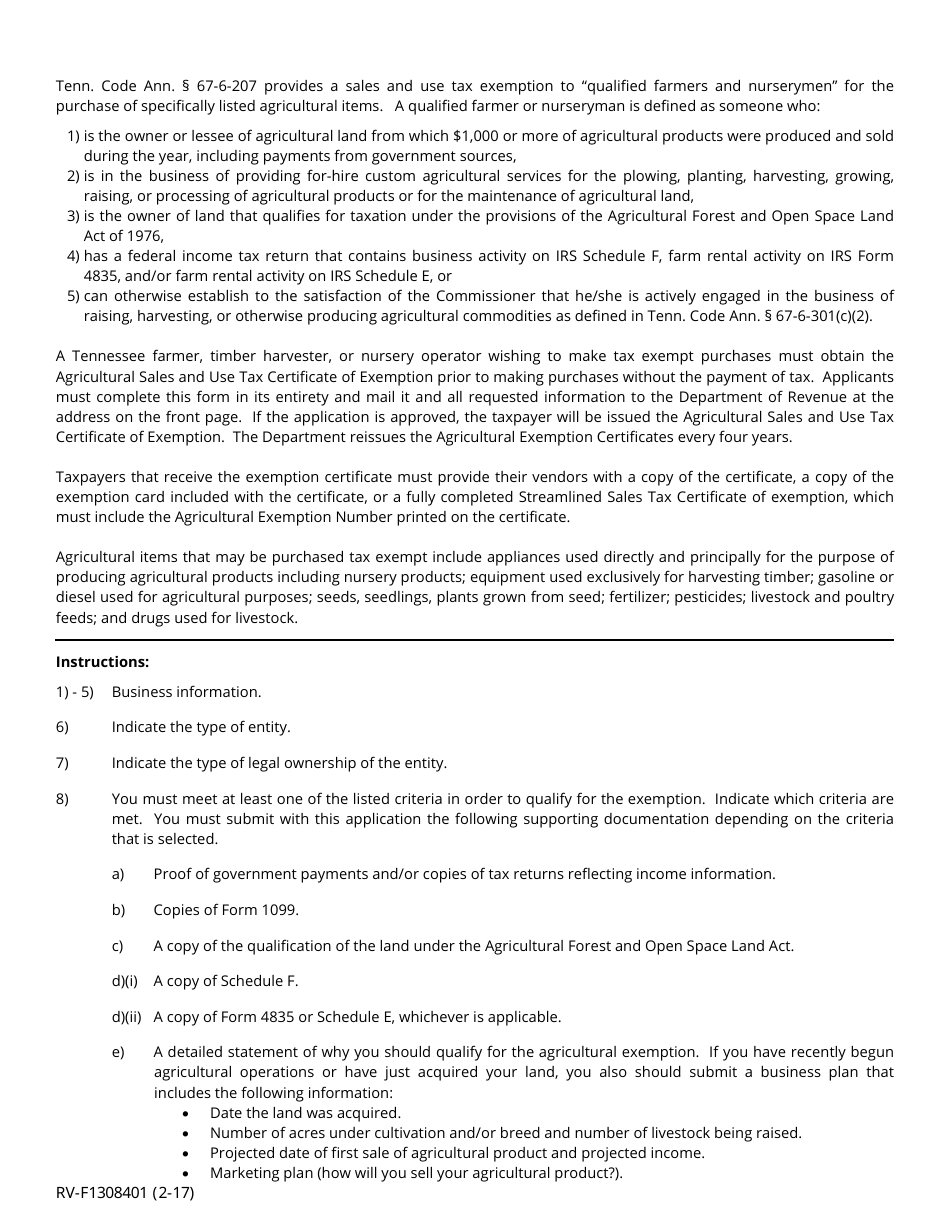

A: The purpose of form RV-F1308401 is to apply for the Agricultural Sales and Use Tax Exemption in Tennessee.

Q: Who can use form RV-F1308401?

A: Farmers and agricultural producers in Tennessee can use form RV-F1308401.

Q: What is the Agricultural Sales and Use Tax Exemption?

A: The Agricultural Sales and Use Tax Exemption is a tax exemption provided to farmers and agricultural producers in Tennessee.

Q: How can I apply for the Agricultural Sales and Use Tax Exemption?

A: You can apply for the Agricultural Sales and Use Tax Exemption by filling out form RV-F1308401 and submitting it to the appropriate authorities in Tennessee.

Q: Are there any eligibility requirements for the Agricultural Sales and Use Tax Exemption?

A: Yes, there are eligibility requirements for the Agricultural Sales and Use Tax Exemption. You must be a farmer or agricultural producer in Tennessee.

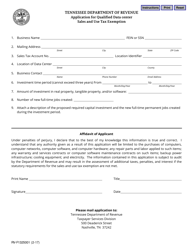

Q: Is there a deadline to submit form RV-F1308401?

A: There is no specific deadline mentioned on form RV-F1308401. However, it is recommended to submit the form as soon as possible to ensure timely processing.

Q: Is the Agricultural Sales and Use Tax Exemption permanent?

A: The Agricultural Sales and Use Tax Exemption is not permanent. It is subject to periodic renewal and verification.

Q: What type of sales and use tax is exempted under this exemption?

A: The Agricultural Sales and Use Tax Exemption applies to sales and use tax on agricultural inputs, such as seeds, fertilizers, and machinery.

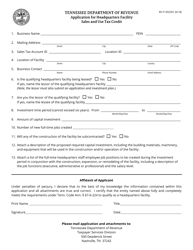

Q: Can I claim a refund for taxes paid before receiving the exemption?

A: No, the Agricultural Sales and Use Tax Exemption does not provide for refunds on taxes paid prior to receiving the exemption.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F1308401 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.