Single-Member LLC Operating Agreement Template - Illinois

If you want to form an Illinois Single-Member LLC Operating Agreement , you should be aware that this form is only applicable for sole owners of a business. If there is more than one owner of the business, this form will not apply to your case. The importance of this document lies in the fact that it provides a thorough explanation of the business, covering information from the ownership of the business to the standard everyday practices that are implemented within the company. Because of this, the personal possessions of the company owner are shielded from debt collection, and in the unfortunate event that the business becomes bankrupt or is sued by another party - only the assets of the business will be affected and collected for debt recovery.

It is important to note that in Illinois this is not a legal requirement, but this is not to say that this is not worth doing - particularly if the company owner wants to preserve their private possessions. You should start with an Illinois Single-Member LLC Operating Agreement Template and enter the specific information relating to your business.

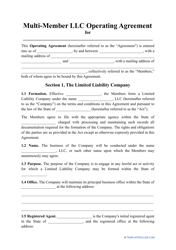

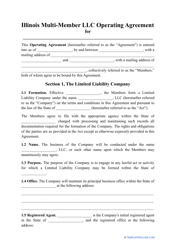

Haven't found the template you're looking for? Take a look at the related templates and forms below: