Third Party Financing Addendum Template

What Is a Third Party Financing Addendum?

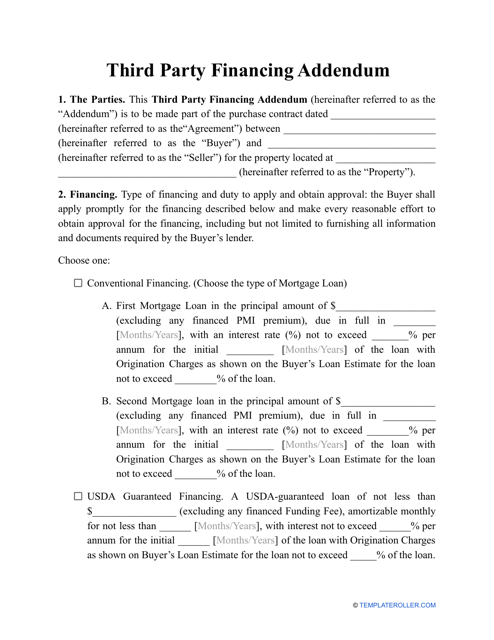

A Third Party Financing Addendum is prepared in addition to a Sales Agreement which describes the conditions relating to a loan by a third party (i.e. not the selling or buying parties). In the majority of cases, a bank acts as this party that gives specific funds to the individual making the purchase of a property.

Alternate Names:

- 3rd Party Financing Addendum;

- Third Party Financing Addendum Form.

The success and implementation of the sales agreement will only come into force once the conditions described in the addendum are fulfilled. If this does not happen, the agreement is terminated and any money already put forward by the buying party will be returned to them. However, if all conditions are fulfilled and the buying party successfully gains approval for the finances - the deal should be closed within a specific period of time. There is a deadline for this which is often no longer than thirty days.

A Third Party Financing Addendum template can be downloaded by clicking the link below.

How to Fill Out a Third Party Financing Addendum?

For example in Texas, the TREC clearly details what needs to be included in a TREC Third Party Financing Addendum, and generally, filling in this addendum will not cause too many issues particularly if you use an editable template that will already contain the required format. We have put together some of our top tips and hints that will make this process hassle-free:

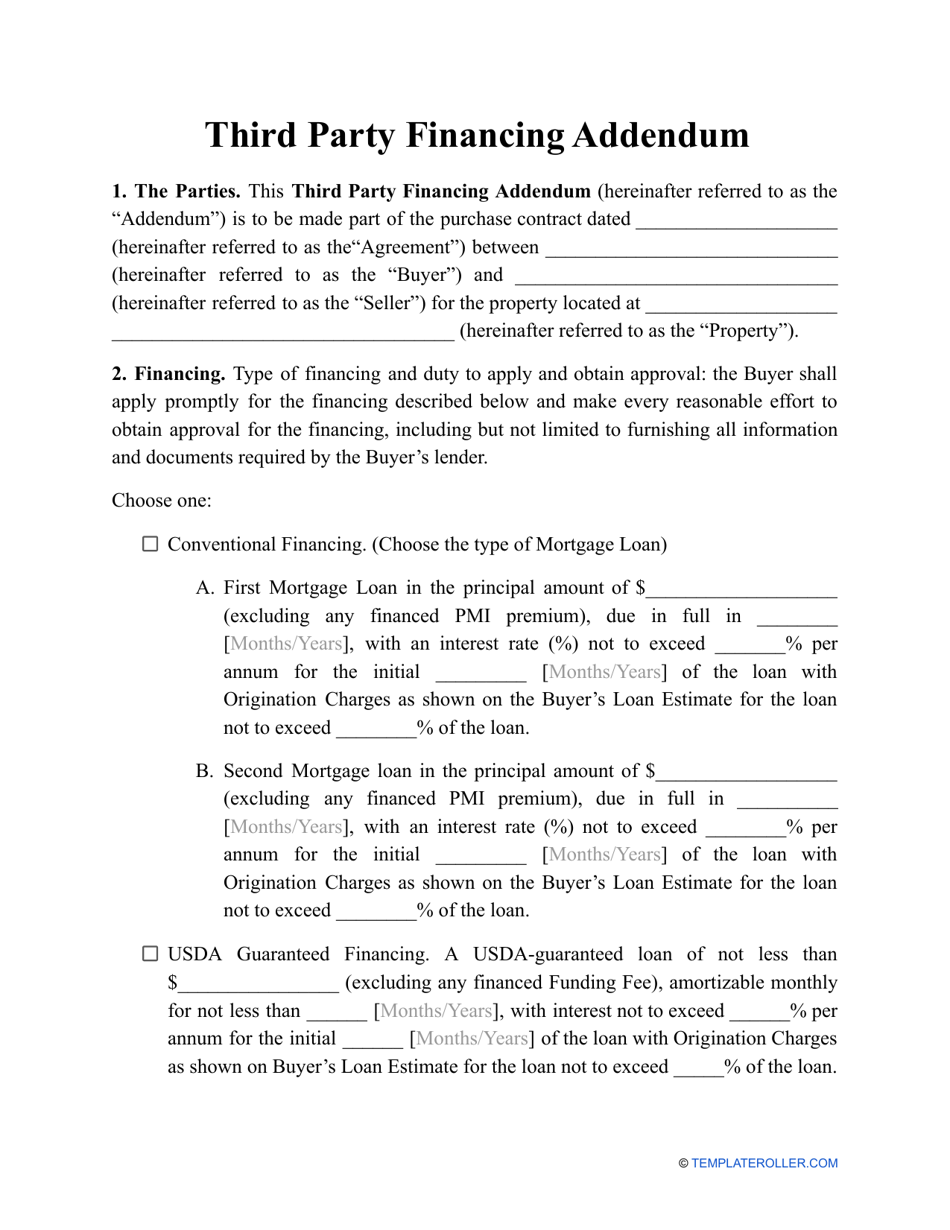

- Start by stating the date of document draft and include the details regarding the parties - specifically, the names of the buying and selling parties;

- Then you ought to provide information about the real estate that is up for sale . This requires the full address including the number of the property, the street, zip code, and the location in regards to the state and city;

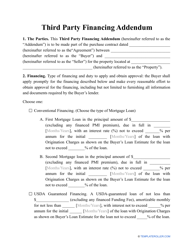

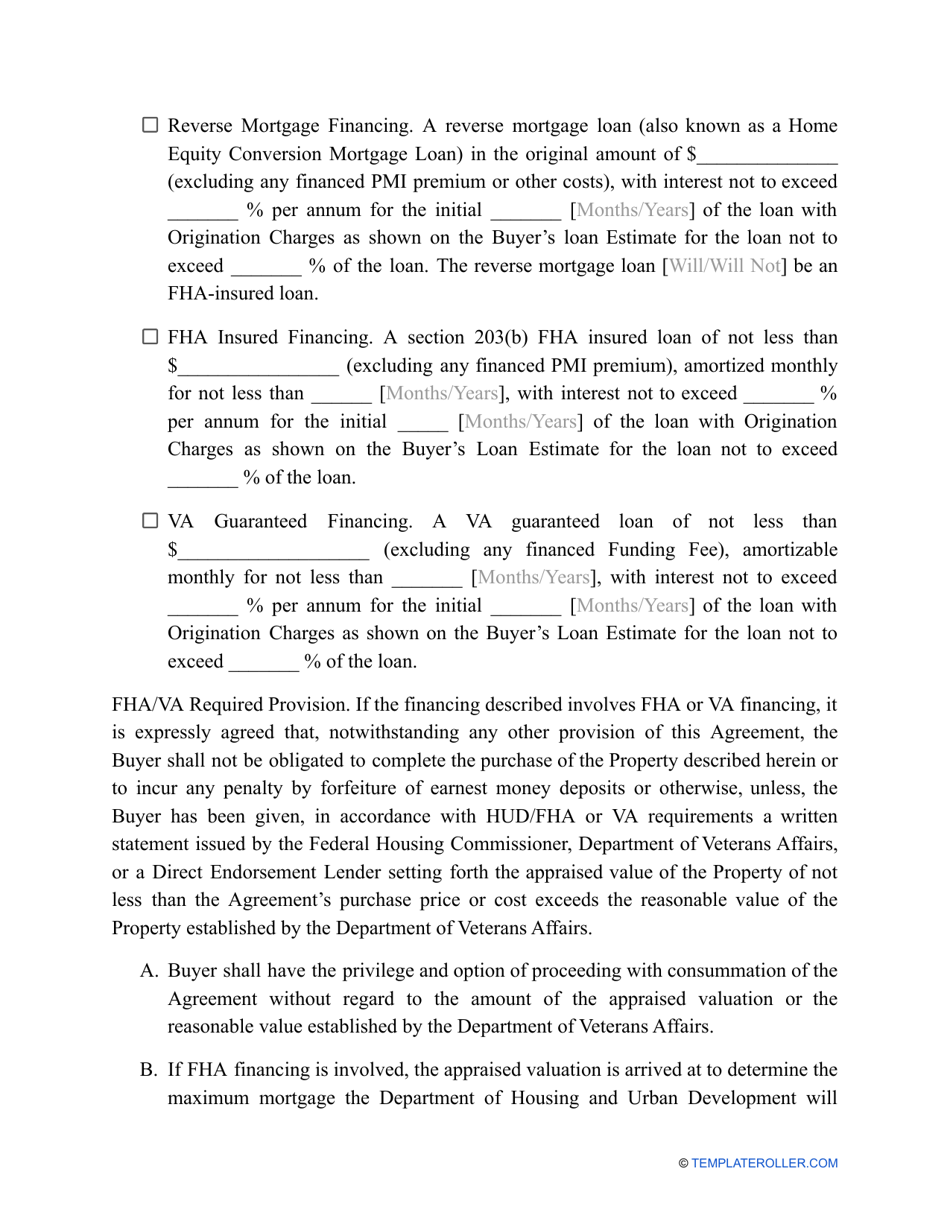

- Clearly outline the specific method of financing that the buyer is seeking to obtain in order to buy the property in question . You must choose from one of the options that is best suited and most appropriate for the buyer;

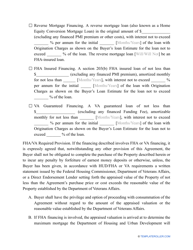

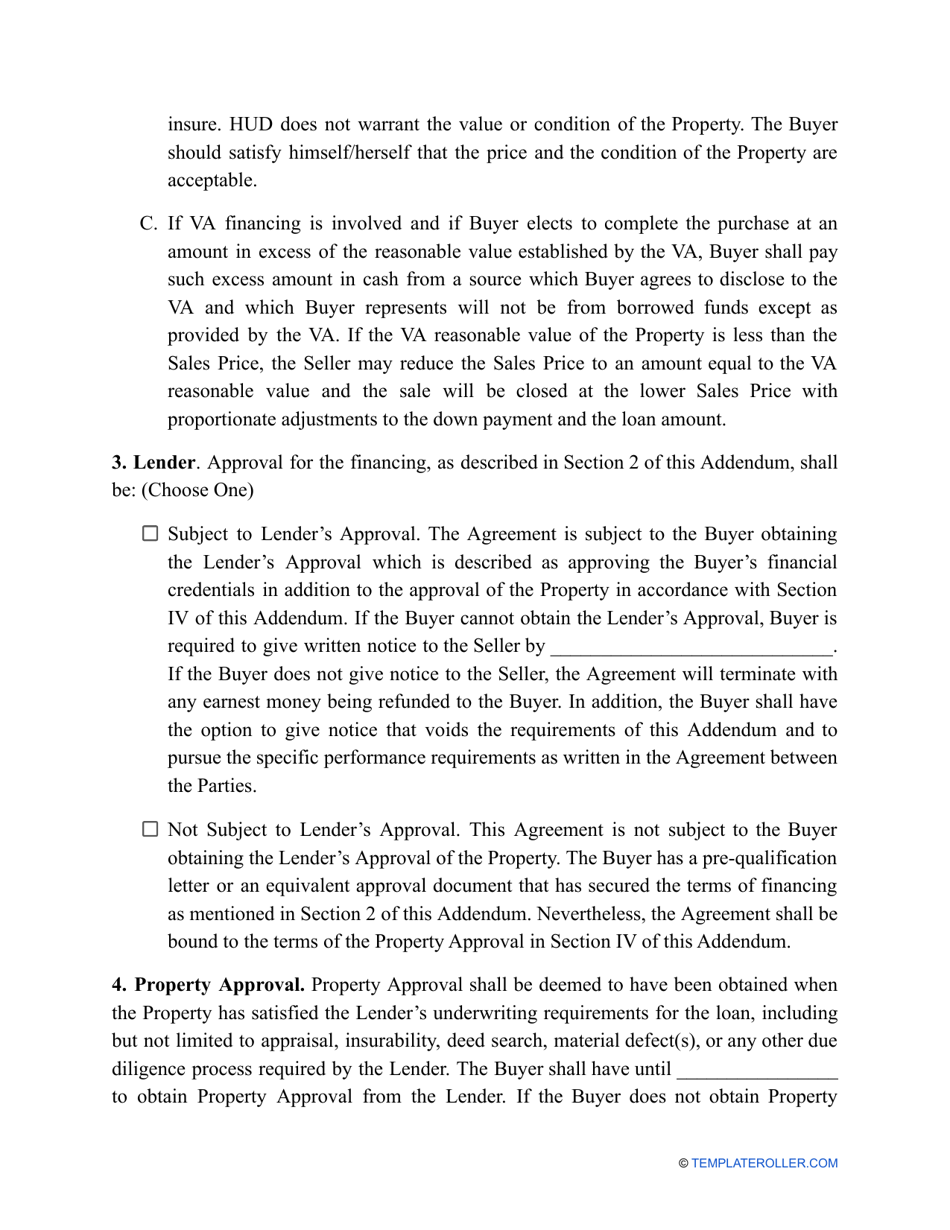

- In some instances, the lending party will need to confirm and accept the chosen type of financing from the buyer to show that they agree to it . If this is required, this needs to be clearly indicated and a deadline date should be set by which the lender should confirm their acceptance in writing. If the buying party fails to do this by the specified deadline, the agreement will be terminated. If this is not required, it should be made clear in the document;

- The buyer should get approval in regards to the property from the lending party . There is also a deadline for this and as previously, failure to meet this deadline will result in termination of the agreement;

- Once you have inputted all of the required information specific to your sale, all of the involved parties (buying and selling) must sign the document, write their name in full and state the date that the contract was signed.

Haven't found the template you're looking for? Take a look at the related templates below: