In Kind Donation Receipt Template

What Is an In Kind Donation Receipt?

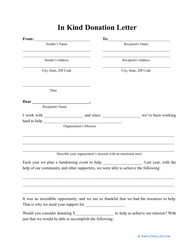

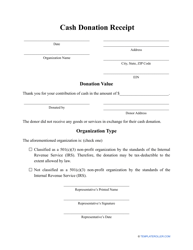

An In Kind Donation Receipt is created when certain items or properties are donated to another party. These donations can cover clothes, special equipment or any other items which may be of use to a party. Receiving a receipt for an In Kind Donation is important for the person donating the items as they can use this receipt as proof of a donation, which is a required document if the individual wants this sum to be deducted from taxes. As an example, a company may decide to give specialized scientific equipment, such as microscopes, to a school as a donation. Maybe you have even received an In Kind Donation Letter from the school asking for a donation.

The donating party must also note down the value of the goods being donated - this is solely their responsibility. If the total value is greater than five thousand dollars, the Internal Revenue Service (IRS) will most likely need to evaluate these figures themselves.

However, it is important to know that such documents only concern physical goods. If an individual wants to donate certain services, unfortunately an In Kind Donation Receipt cannot be created for this.

An In Kind Donation Receipt template can be downloaded by clicking the link below.

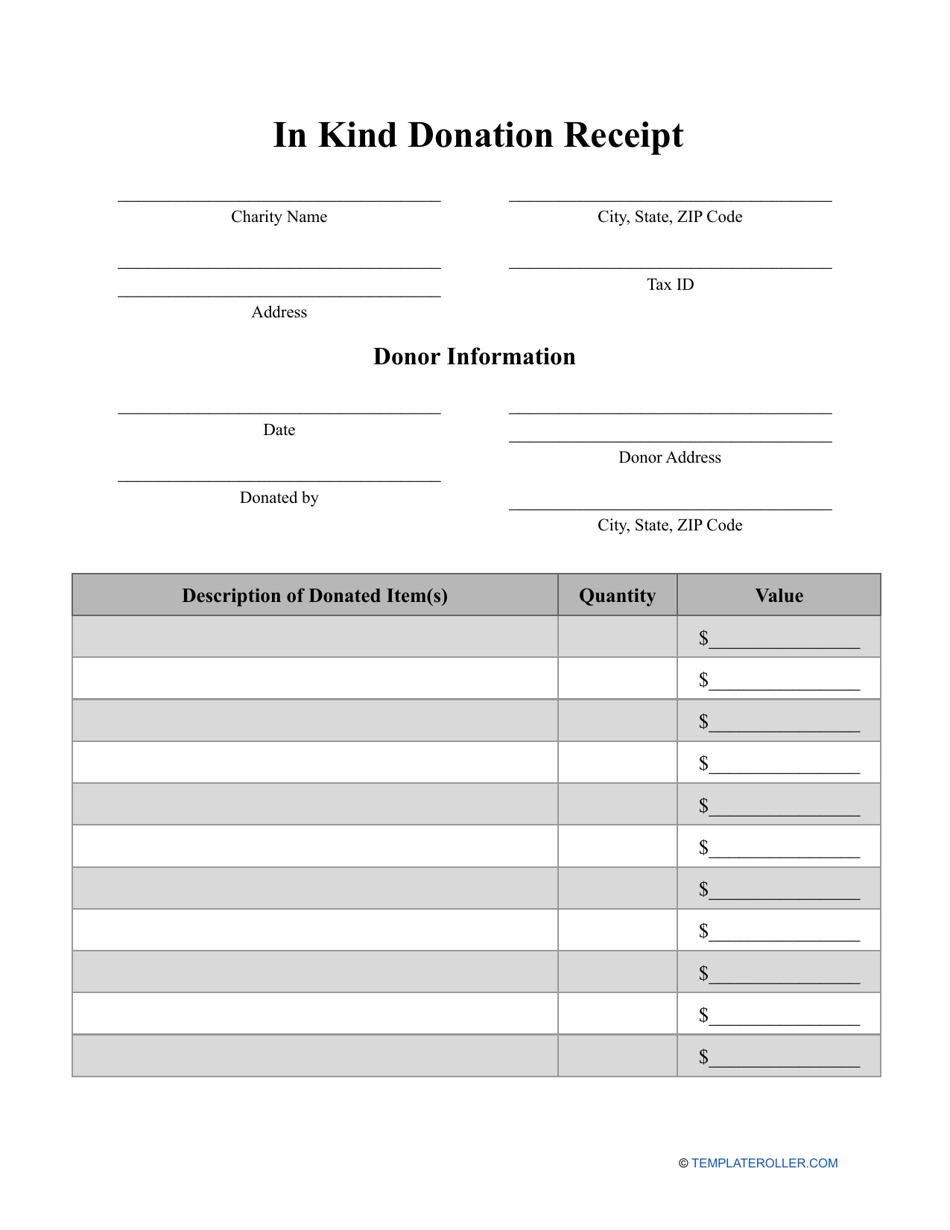

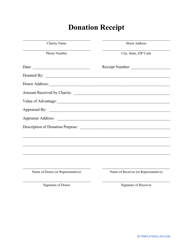

How to Write an In Kind Donation Receipt?

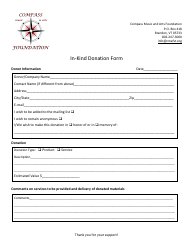

Writing an In Kind Donation Receipt is not at all challenging, particularly if you are using an editable template. The first step would be to download the template and then:

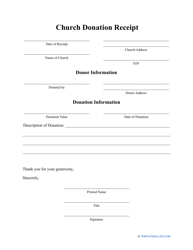

- Provide information about the party receiving the donation. This would include their full name (or name of organization) along with the address and if applicable, the tax number;

- Detail information regarding the individual or organization making the donation along with their address and the date that the donation was made;

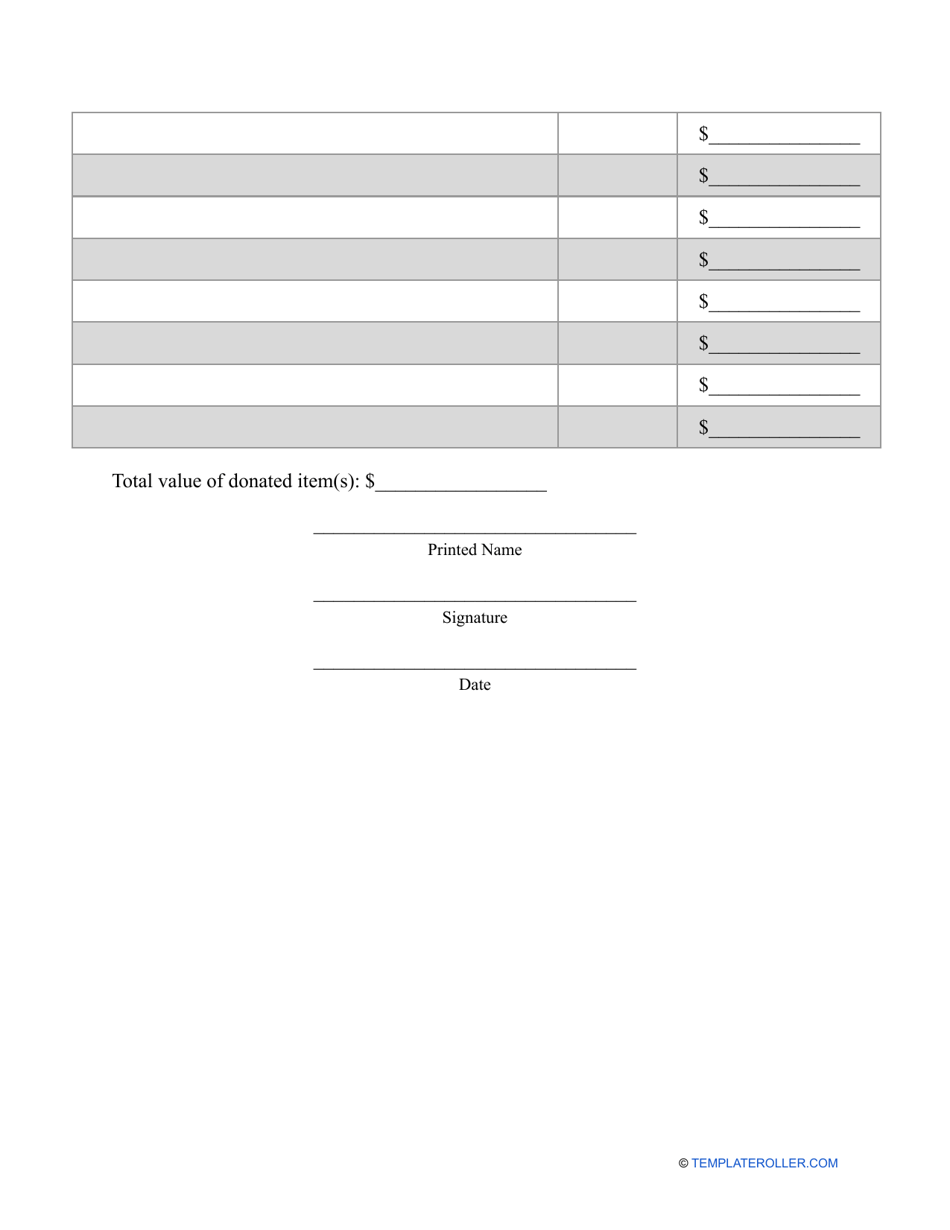

- Detail a breakdown of all the goods that were donated along with their quantity and value;

- Include the total price that the donations came to;

- Sign the document, write down your name and in some instances, you may also be required to state your position.

Haven't found the template you're looking for? Take a look at the related templates below: