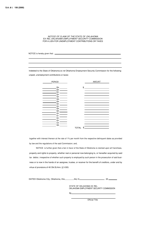

This version of the form is not currently in use and is provided for reference only. Download this version of

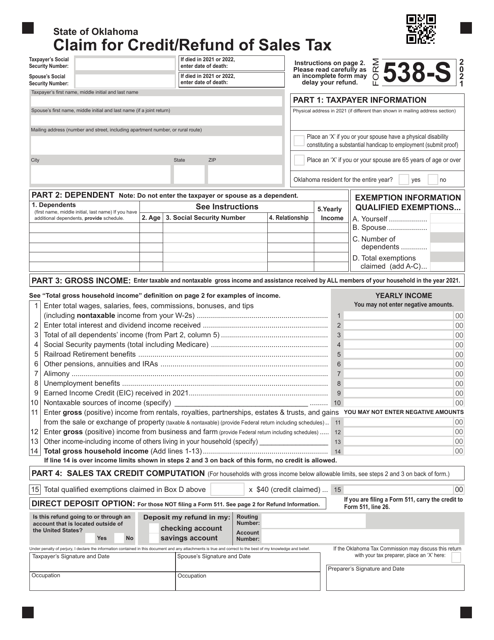

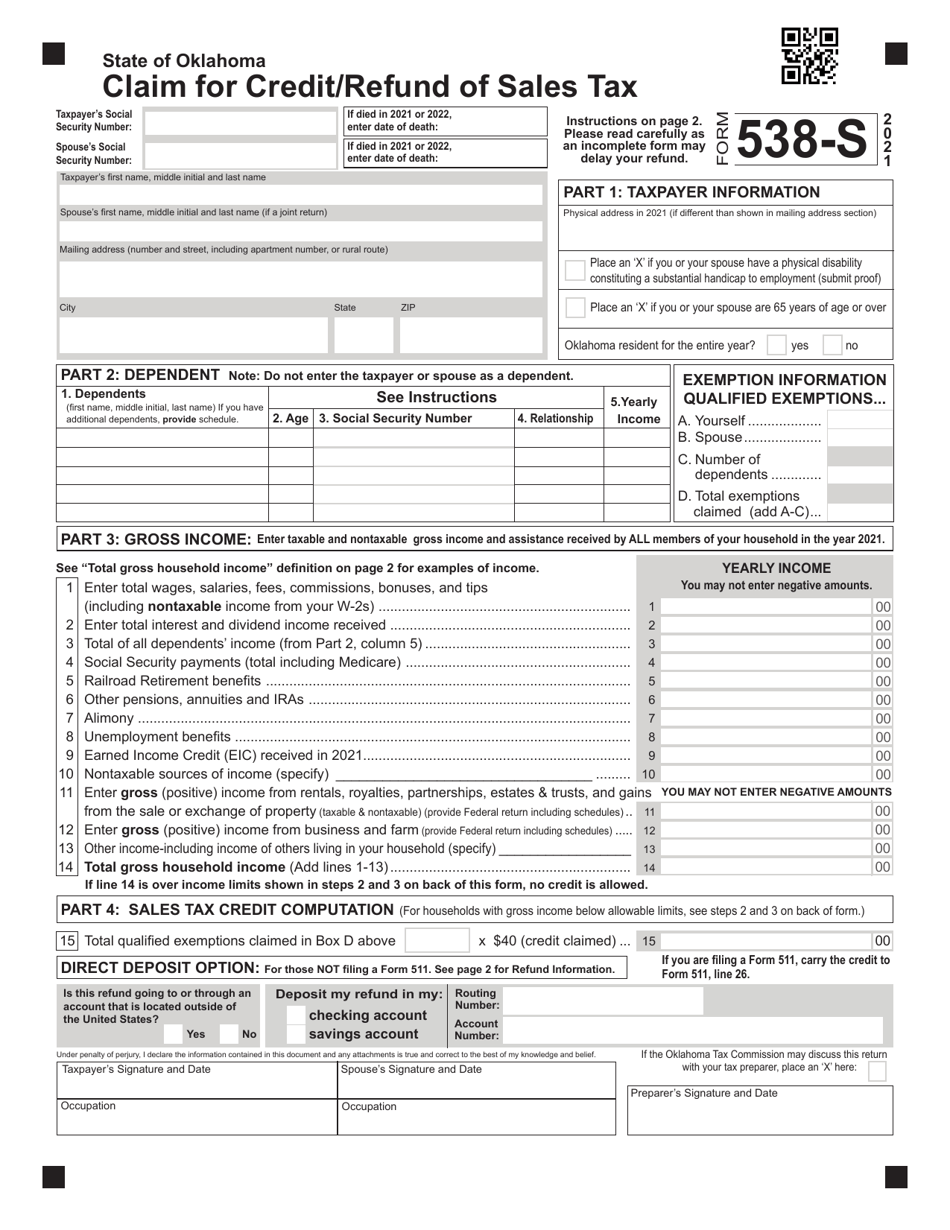

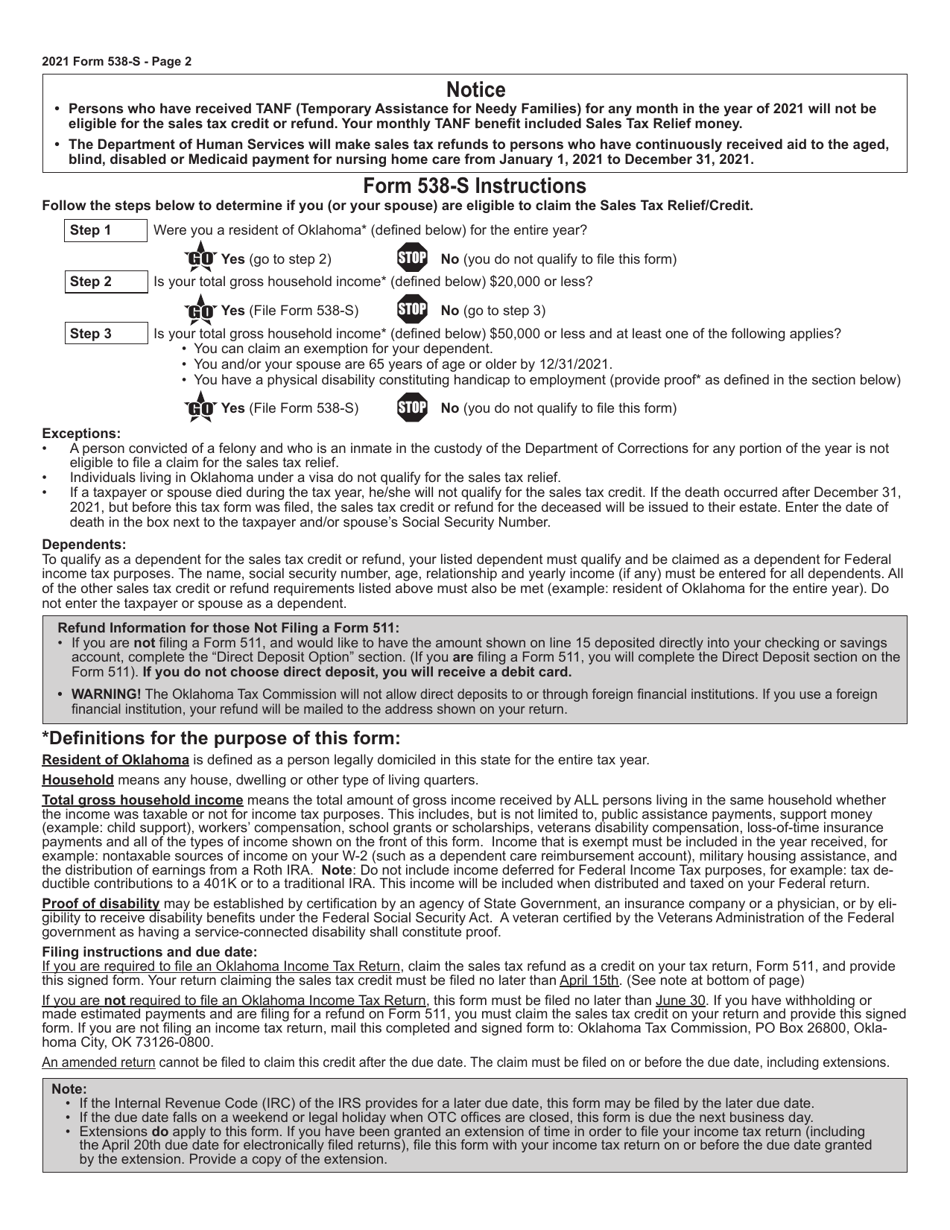

Form 538-S

for the current year.

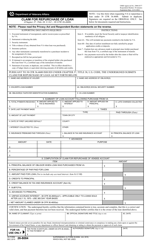

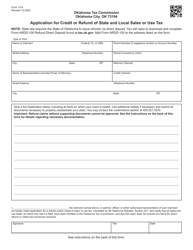

Form 538-S Claim for Credit / Refund of Sales Tax - Oklahoma

What Is Form 538-S?

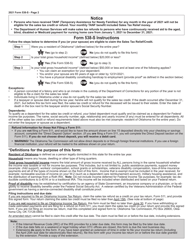

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 538-S?

A: Form 538-S is the Claim for Credit/Refund of Sales Tax specific to Oklahoma.

Q: Who can use Form 538-S?

A: Form 538-S can be used by individuals who want to claim a credit or refund of sales tax in Oklahoma.

Q: What is the purpose of Form 538-S?

A: The purpose of Form 538-S is to allow individuals to claim a credit or refund of sales tax paid in Oklahoma.

Q: What information do I need to provide on Form 538-S?

A: You will need to provide details such as your name, address, social security number, the amount of sales tax paid, and the reason for the claim.

Q: Is there a deadline for filing Form 538-S?

A: Yes, Form 538-S must be filed within three years from the due date of the original tax return or within two years from the date the tax was paid, whichever is later.

Q: How long does it take to process Form 538-S?

A: The processing time for Form 538-S may vary, but it typically takes several weeks.

Q: Can I track the status of my Form 538-S?

A: Yes, you can track the status of your Form 538-S by contacting the Oklahoma Tax Commission.

Q: Are there any fees associated with filing Form 538-S?

A: There are no fees associated with filing Form 538-S.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 538-S by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.