Business Receipt Template

What Is a Business Receipt?

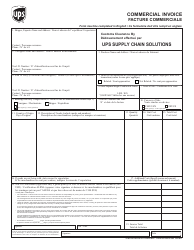

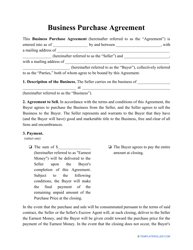

A Business Receipt is a confirmation that certain goods or services were provided and paid for by the client. It differs from an invoice in that an invoice will request payment, whereas a receipt is only formed and given out once a payment has gone through successfully. These receipts can come in handy if the client wants to return or exchange the purchased item.

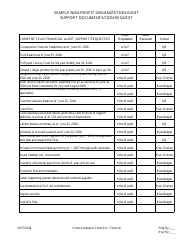

It is important for businesses to keep receipts on hand which will be required when the company files their taxes. There is a legal requirement by the Internal Revenue Service for companies to keep these business receipts filed away for three years. If the numbers in a business get into the minus, the company will be required to keep these receipts for seven years. Therefore, it is crucial that businesses, particularly the smaller businesses, know how to file their receipts correctly in order to keep everything in order. There are various different Small Business Receipt Tracking tools available which vary from company to company. Some opt to keep these in organized files whilst others prefer to do this online.

A Business Receipt template can be downloaded by clicking the link below.

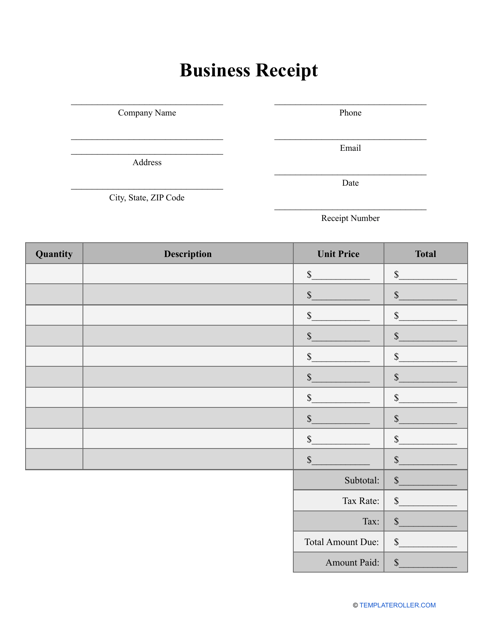

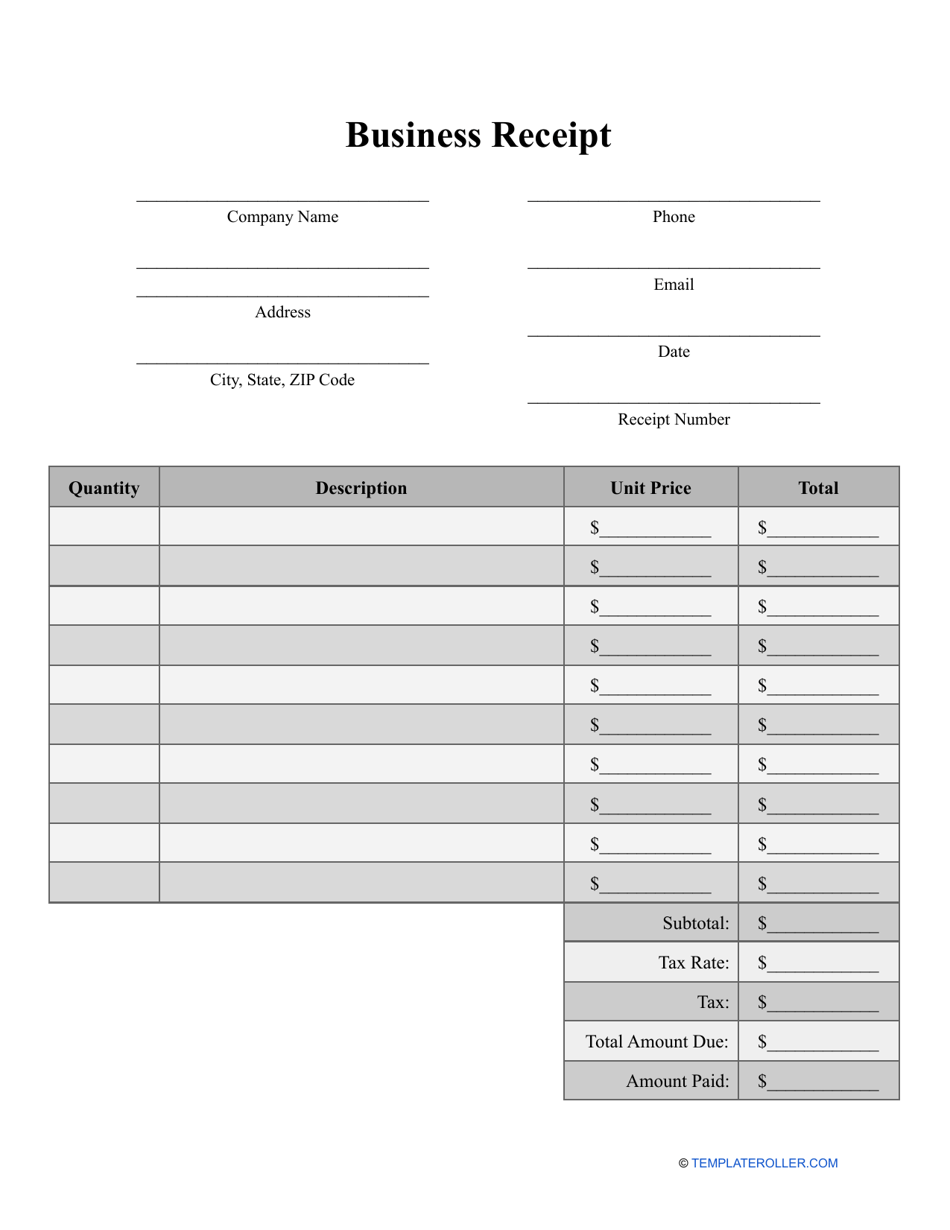

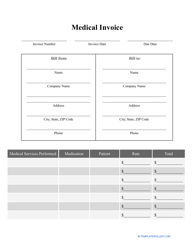

How to Make a Business Receipt?

Making a Business Receipt is quite simple, particularly if you use an editable template. We would highly recommend downloading a template that will allow you to add a personalized touch to best reflect your business and the business values. Once the template is created, you can simply print off several copies and add these to a Business Receipt book. This way you will have a general receipt ready that would only need to include specific information about the client and goods or services.

Be sure to include the following tips and hints when making your Business Receipt:

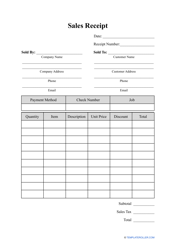

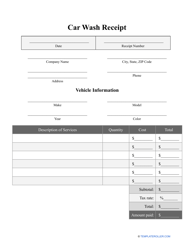

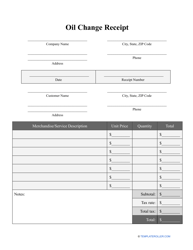

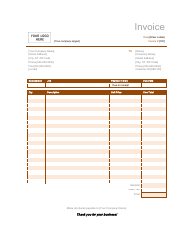

- Title the Business Receipt appropriately;

- Include the full name and address of the company, including a telephone number and email address;

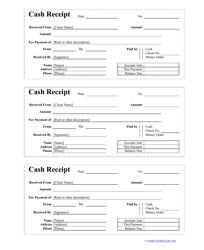

- Here you can also write the date that the receipt was handed out and allocate it a unique receipt number for your convenience . This way it will solve any problems in regards to potential exchanges or returns;

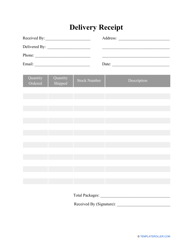

- Next you should detail all the goods or services that were purchased by the client in the column . You should also state the price per unit and the quantity of the purchased goods or services. The more information you provide the better. You want to avoid being ambiguous with this information;

- Include a summarized subtotal taking into account all services and goods that were purchased . Here you should clearly label taxes and if any discounts have been applied to the receipt. This way, the customer will know exactly how much to pay;

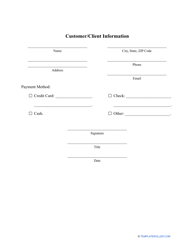

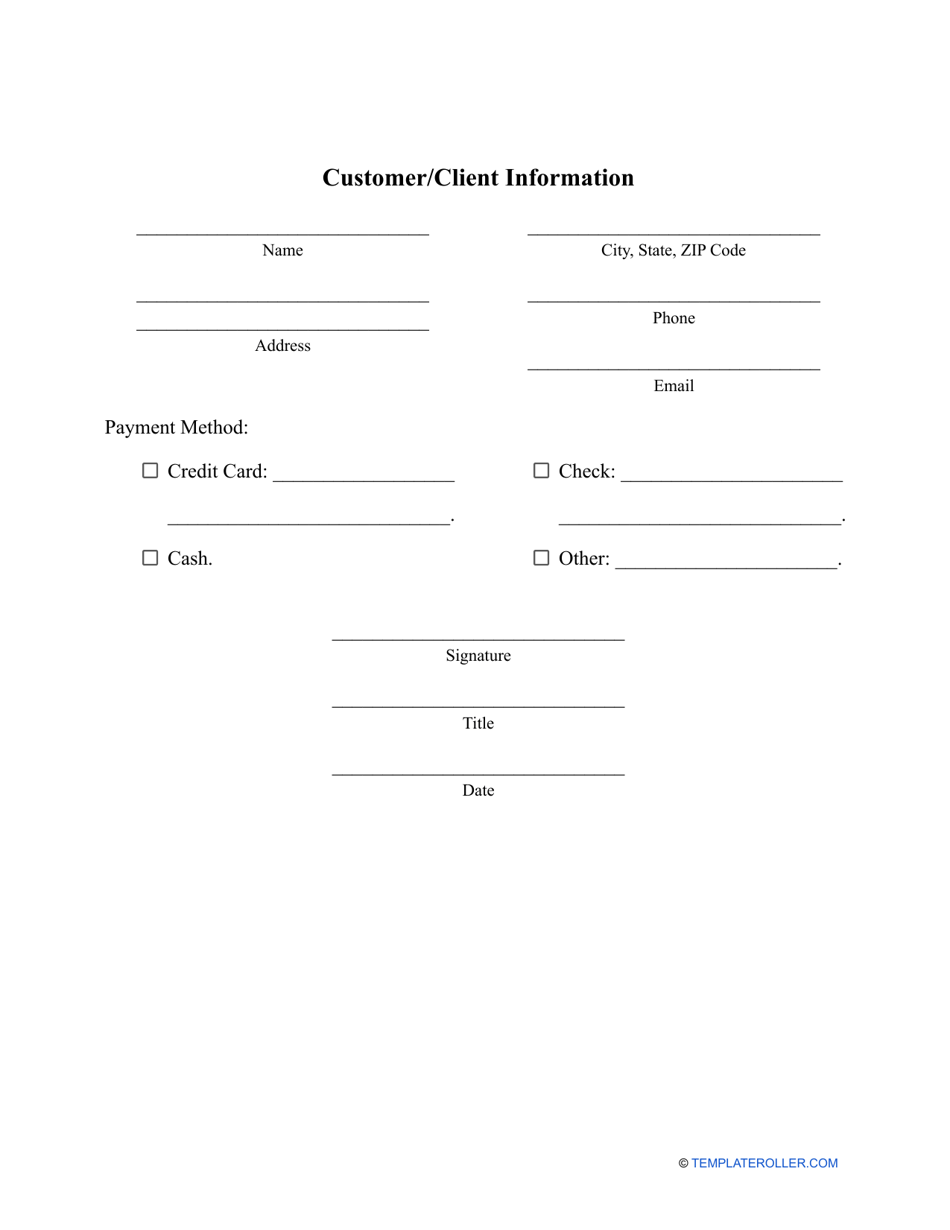

- You should also provide information regarding the customer by including their full name, address and other contact details;

- Make a note of the method of payment . This will make it easier to track down where the payment has gone;

- Do not forget to sign and date your receipt, including a company seal if you possess one.

Still looking for a particular template? Take a look at the related templates below: