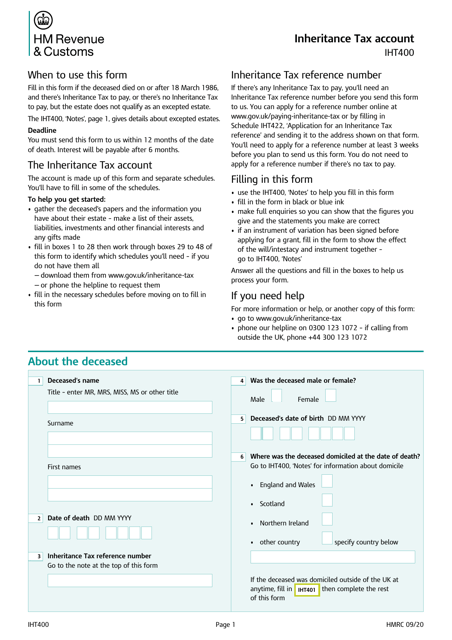

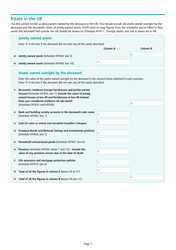

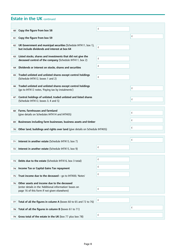

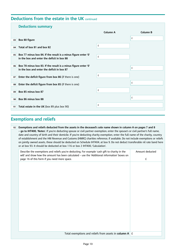

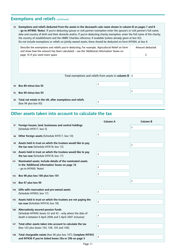

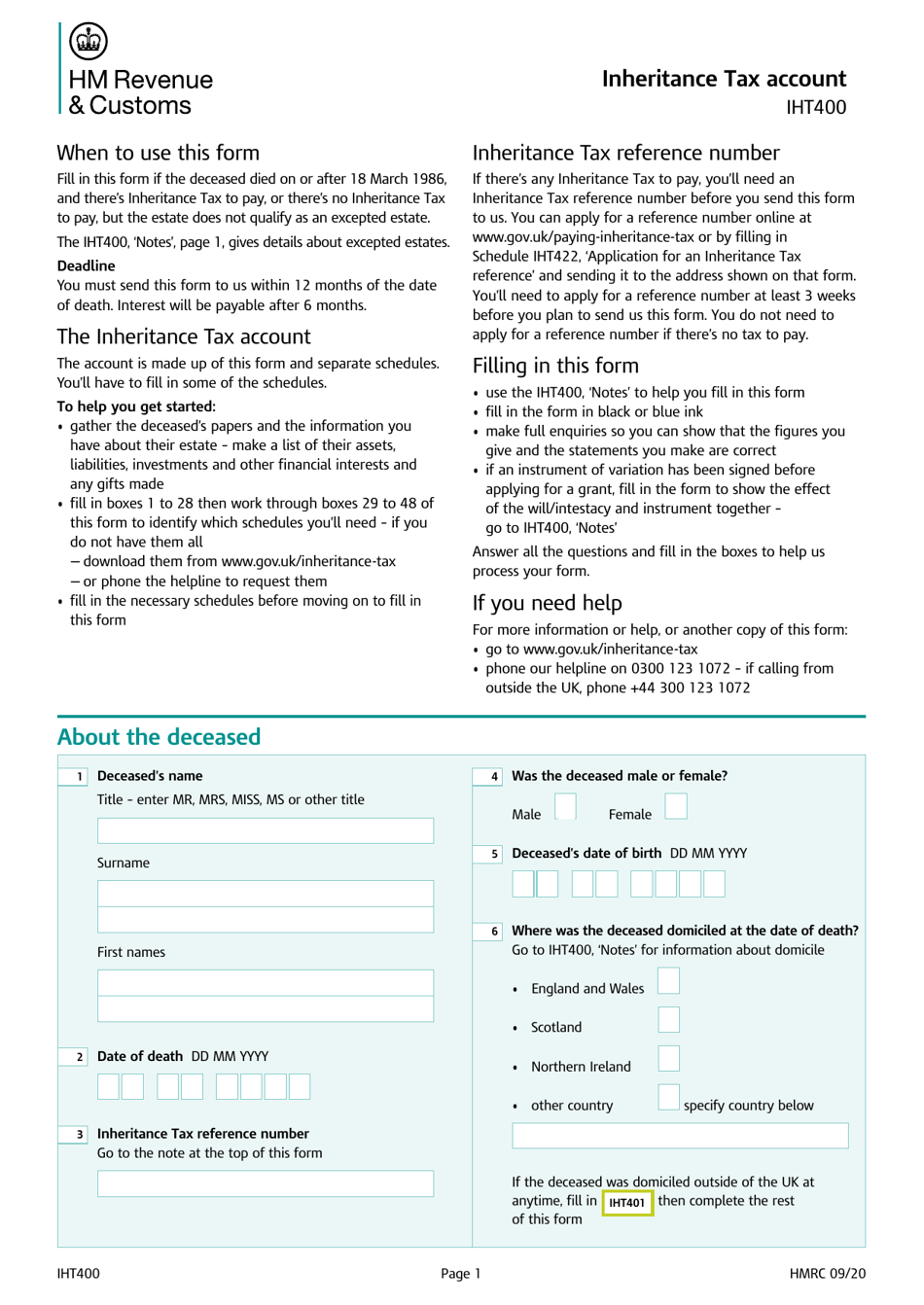

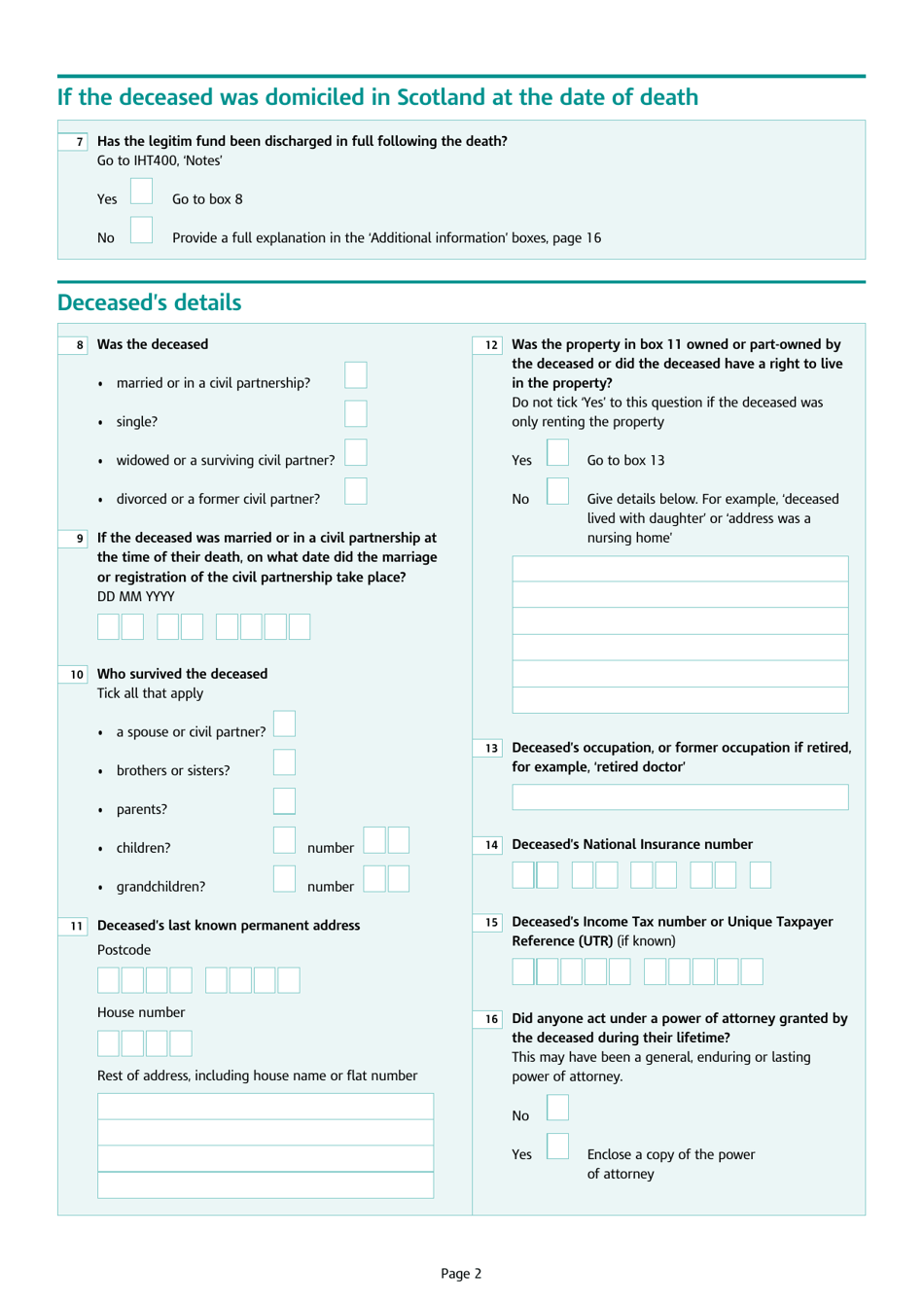

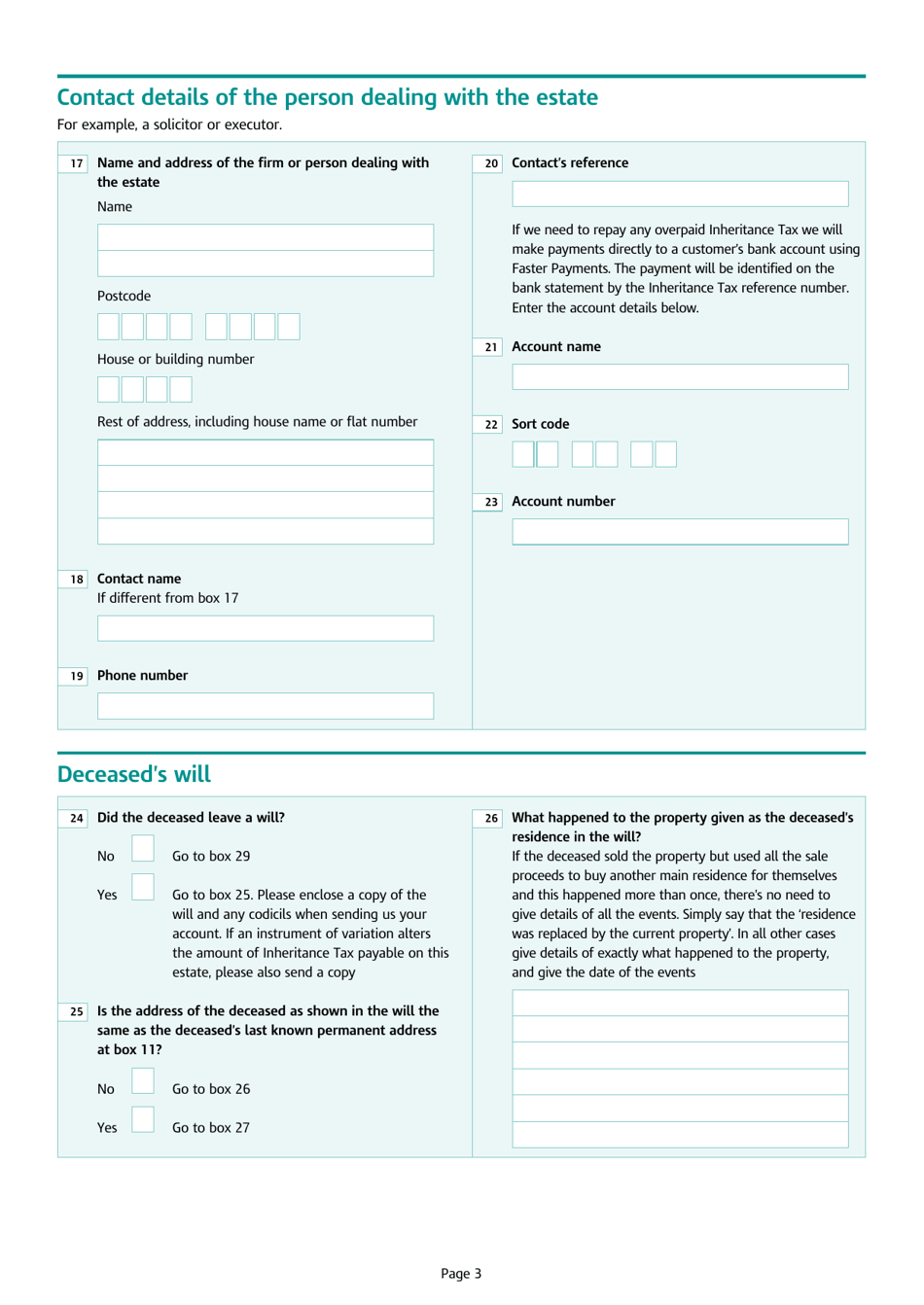

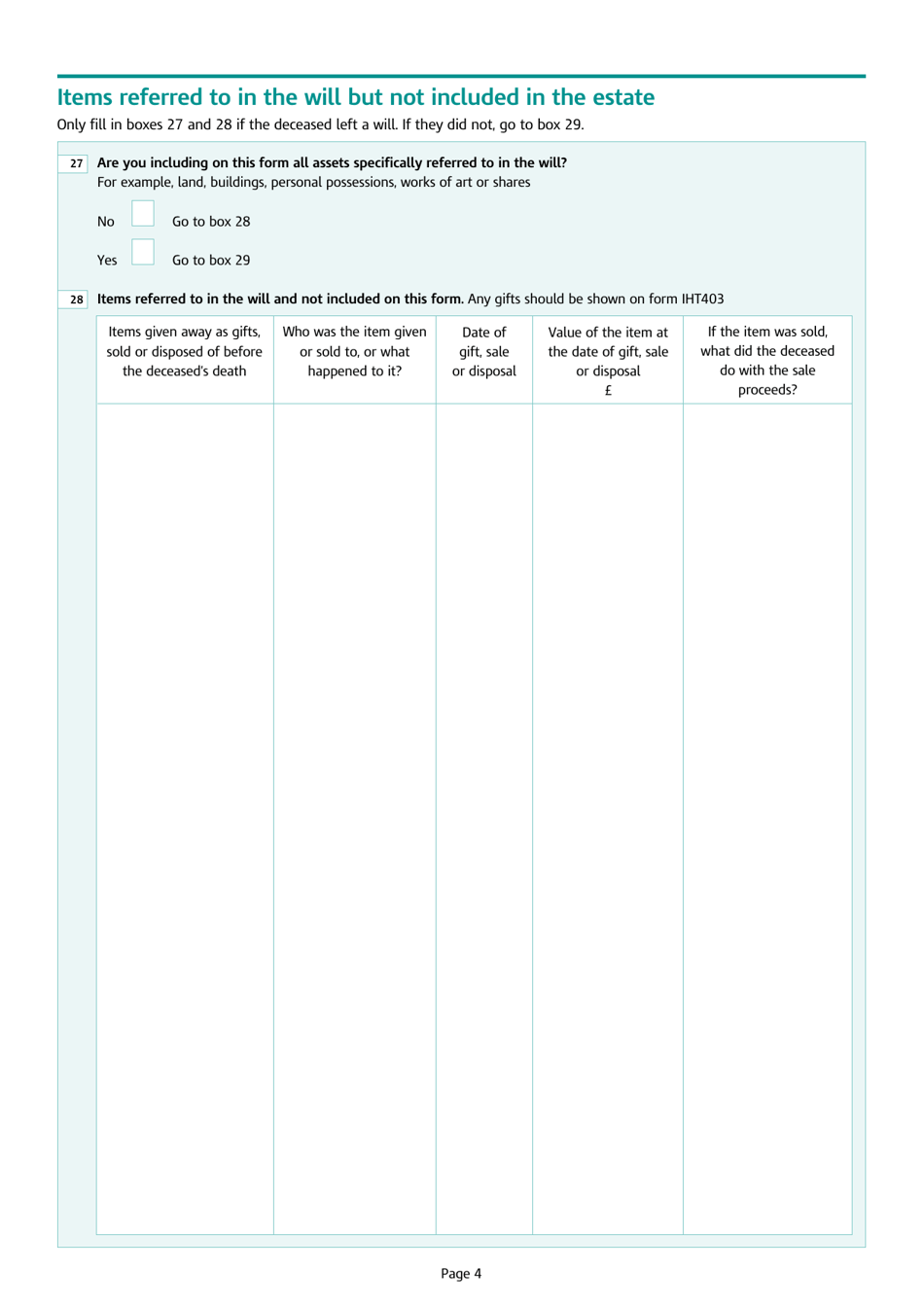

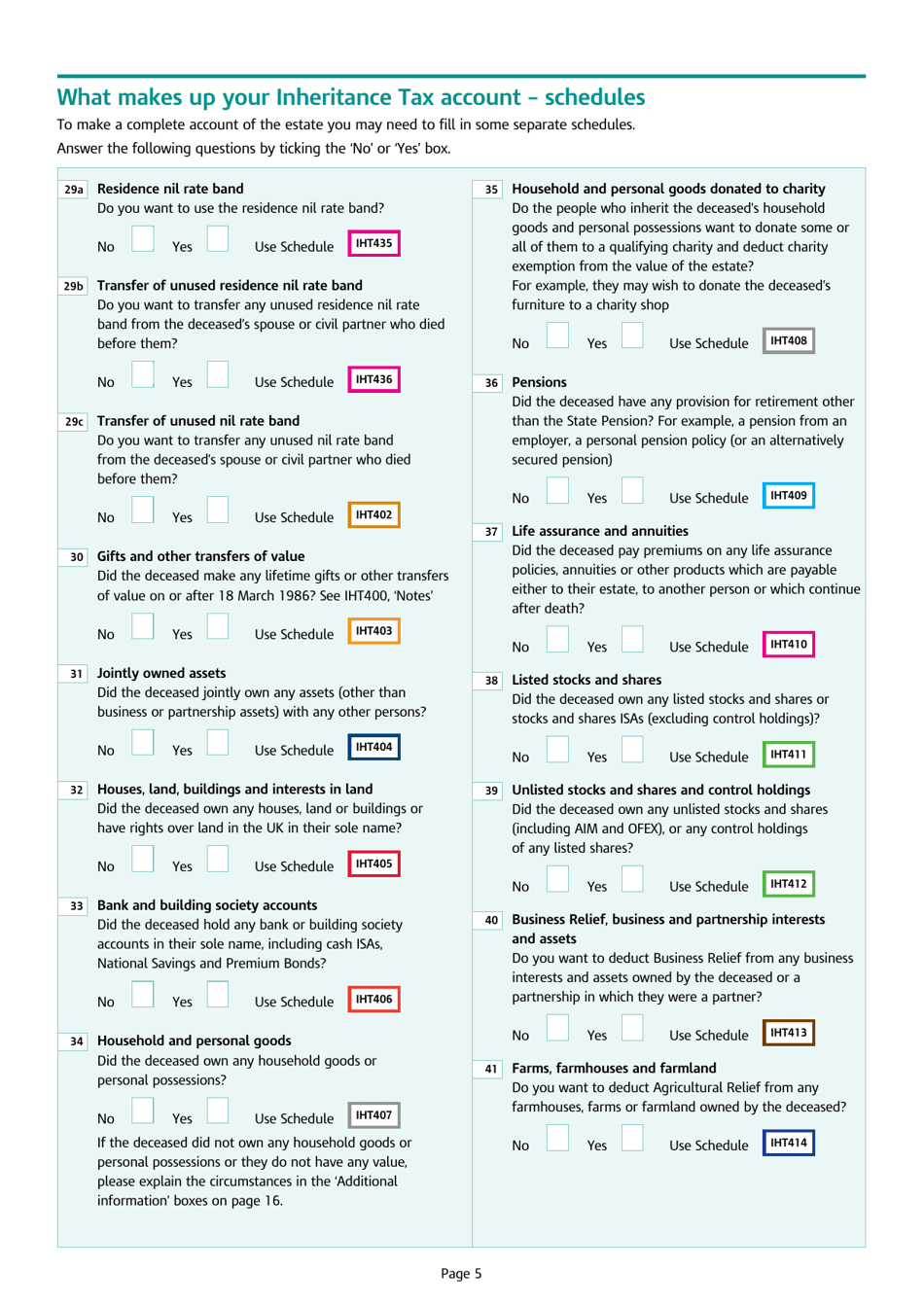

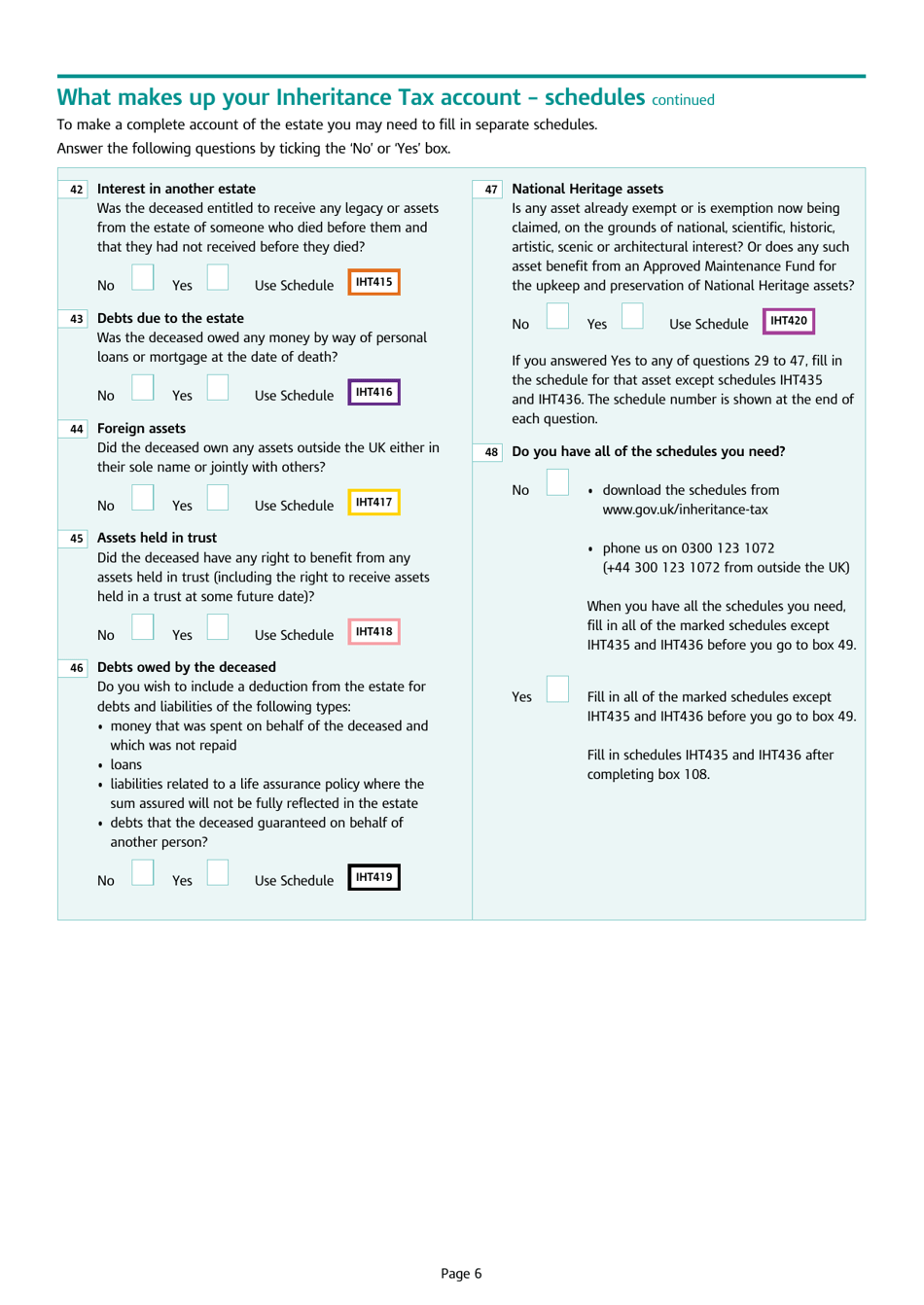

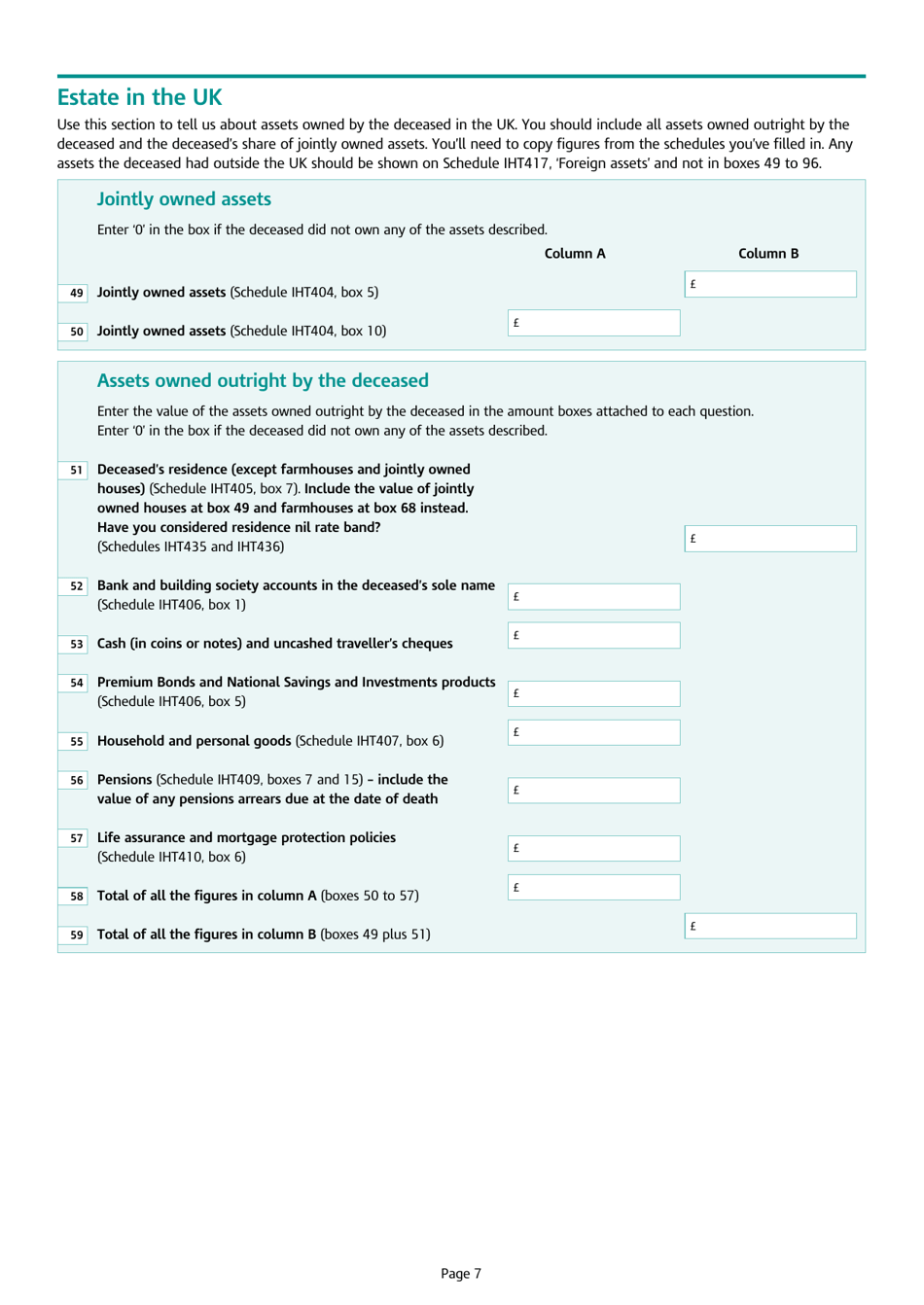

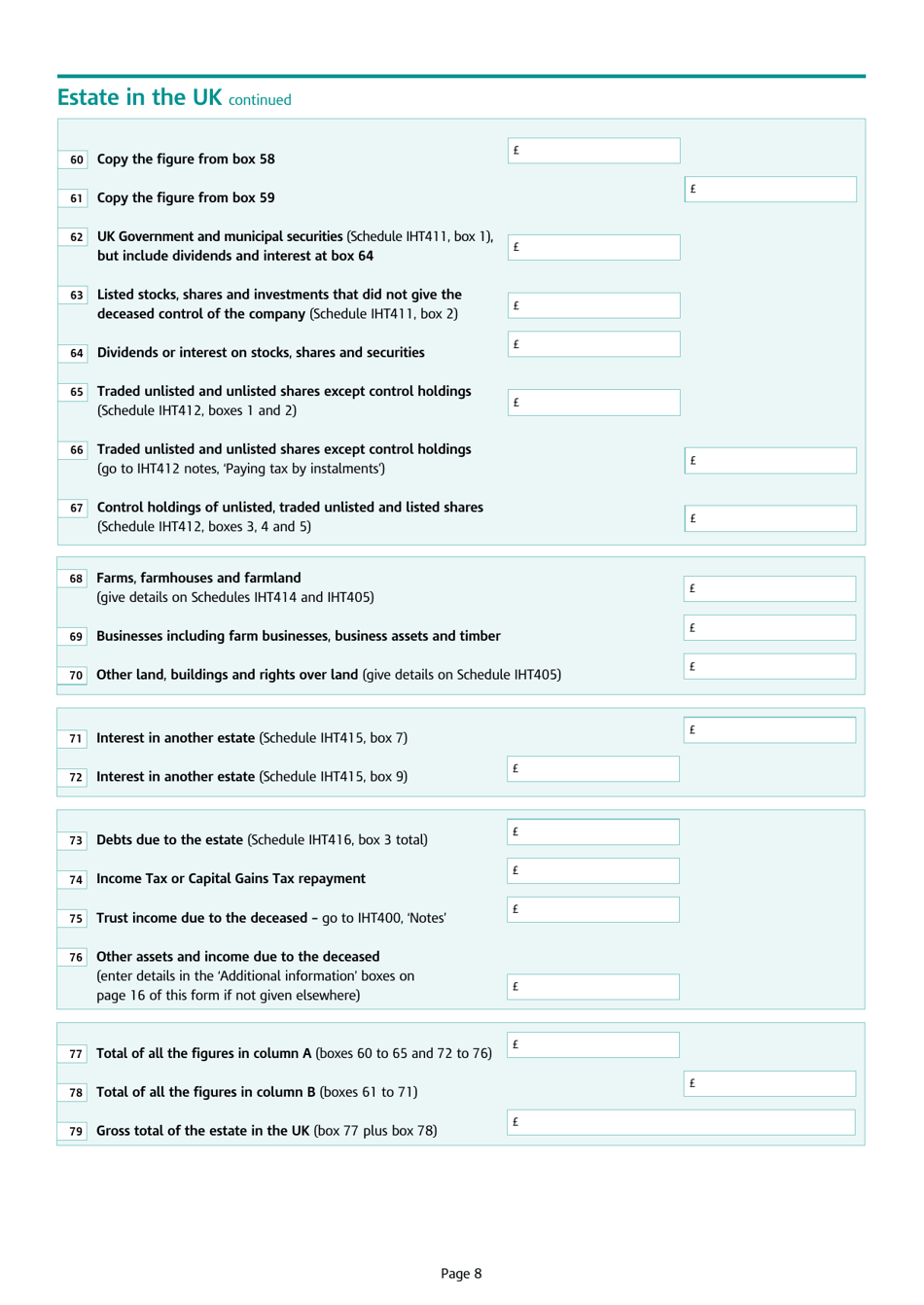

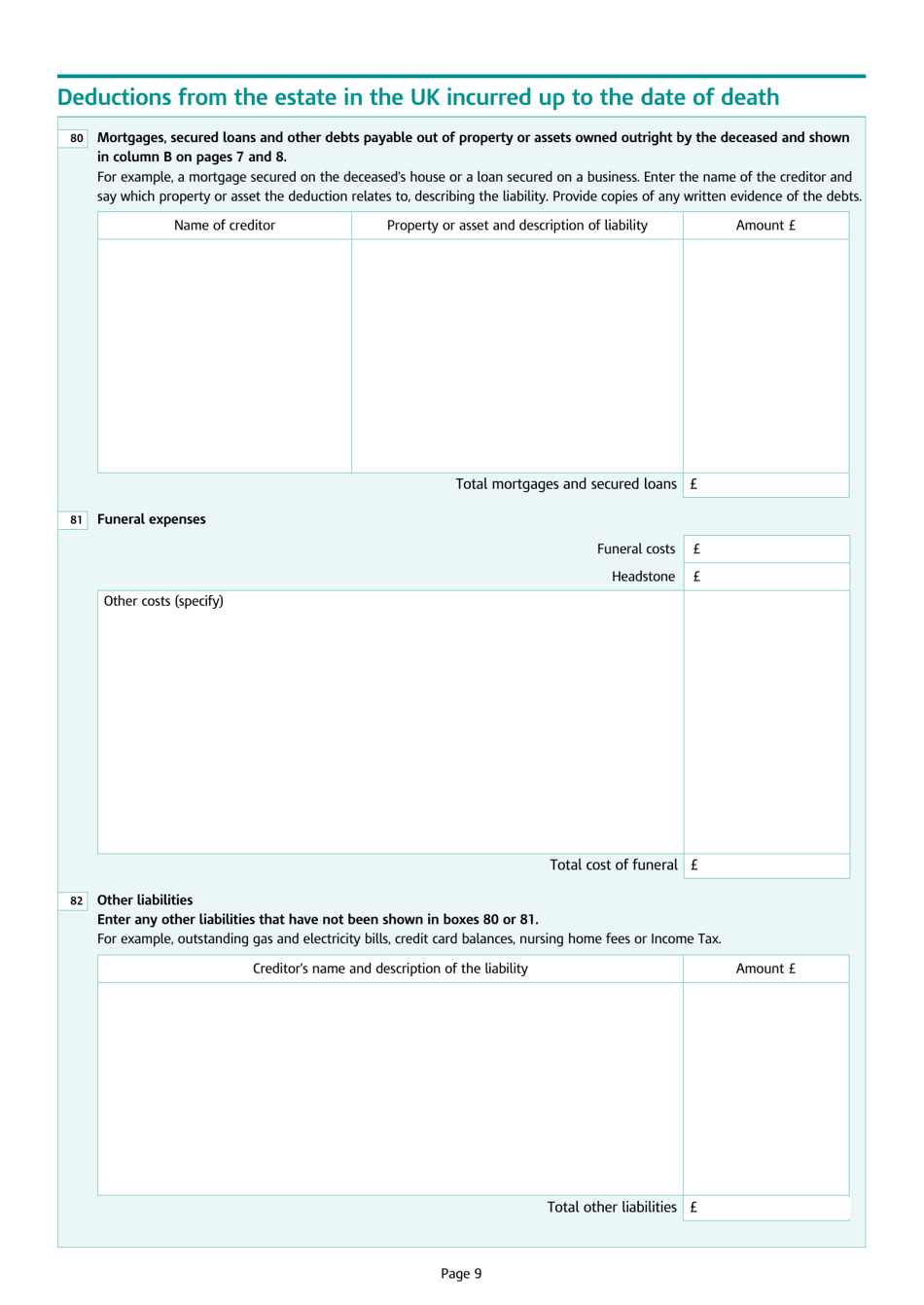

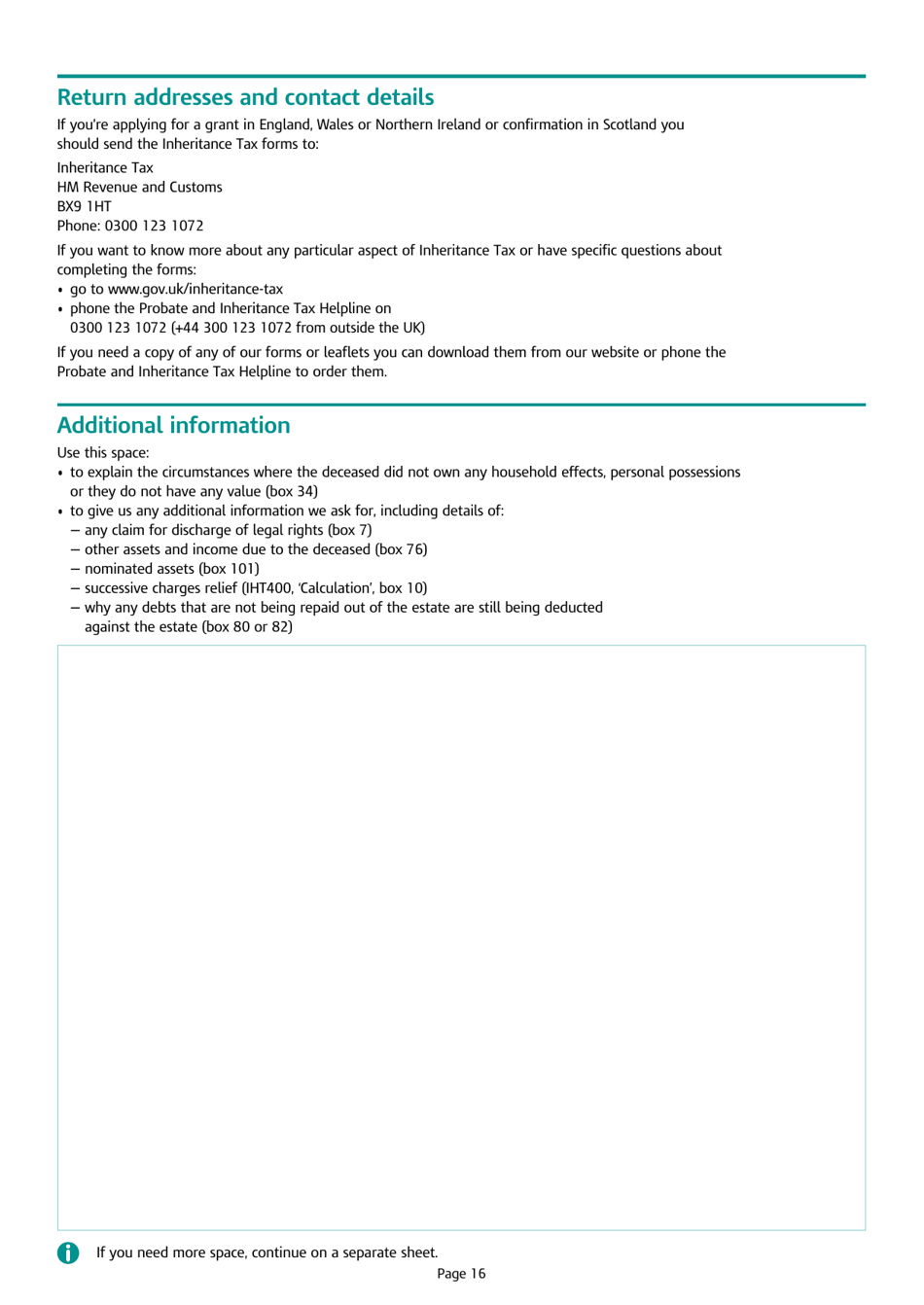

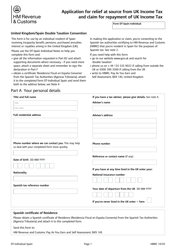

Form IHT400 Inheritance Tax Account - United Kingdom

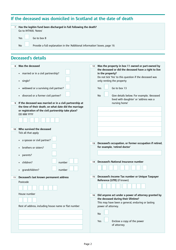

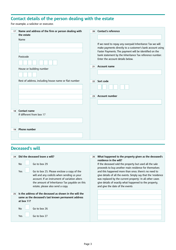

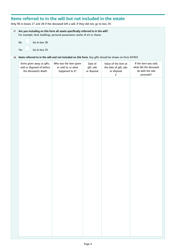

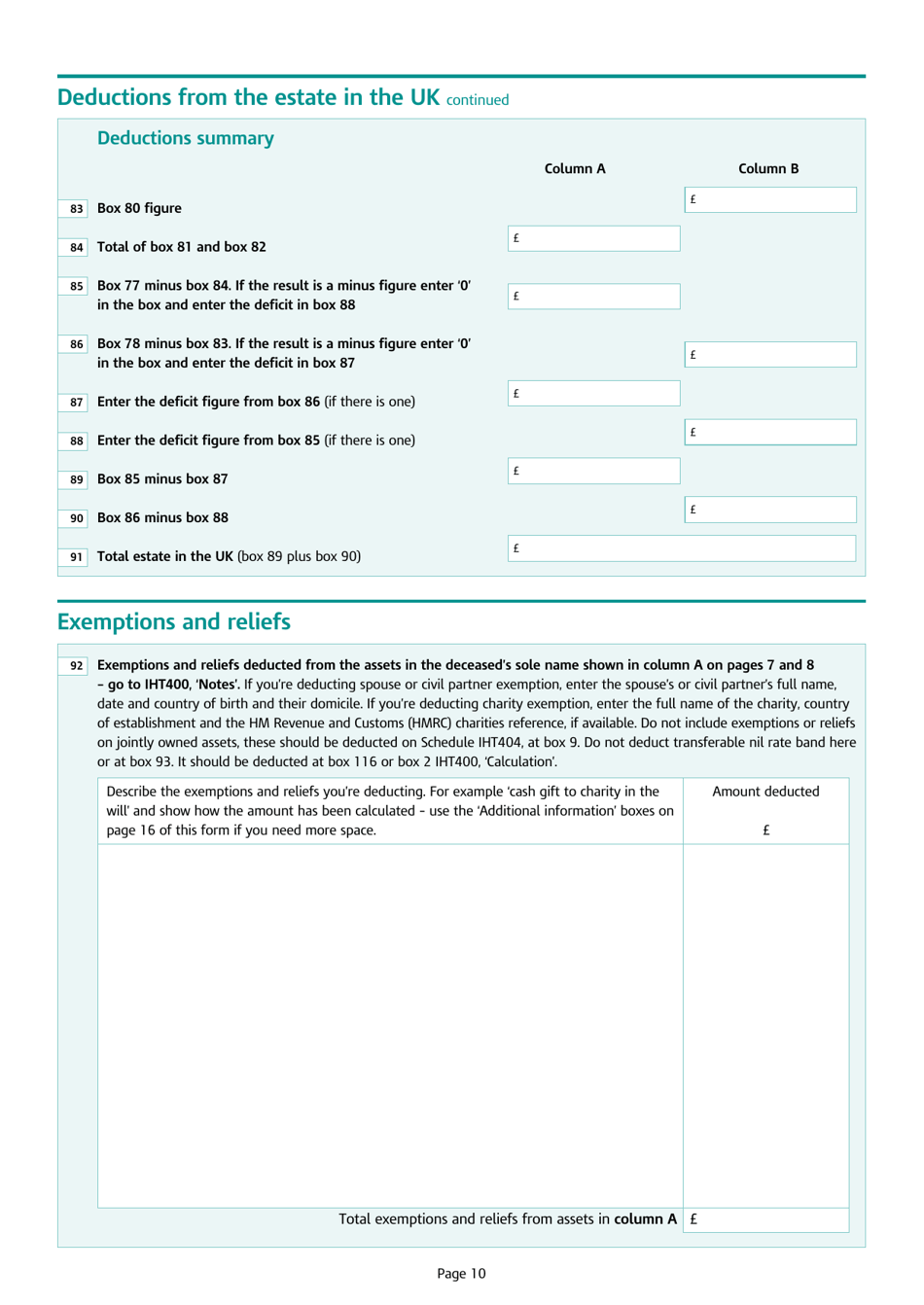

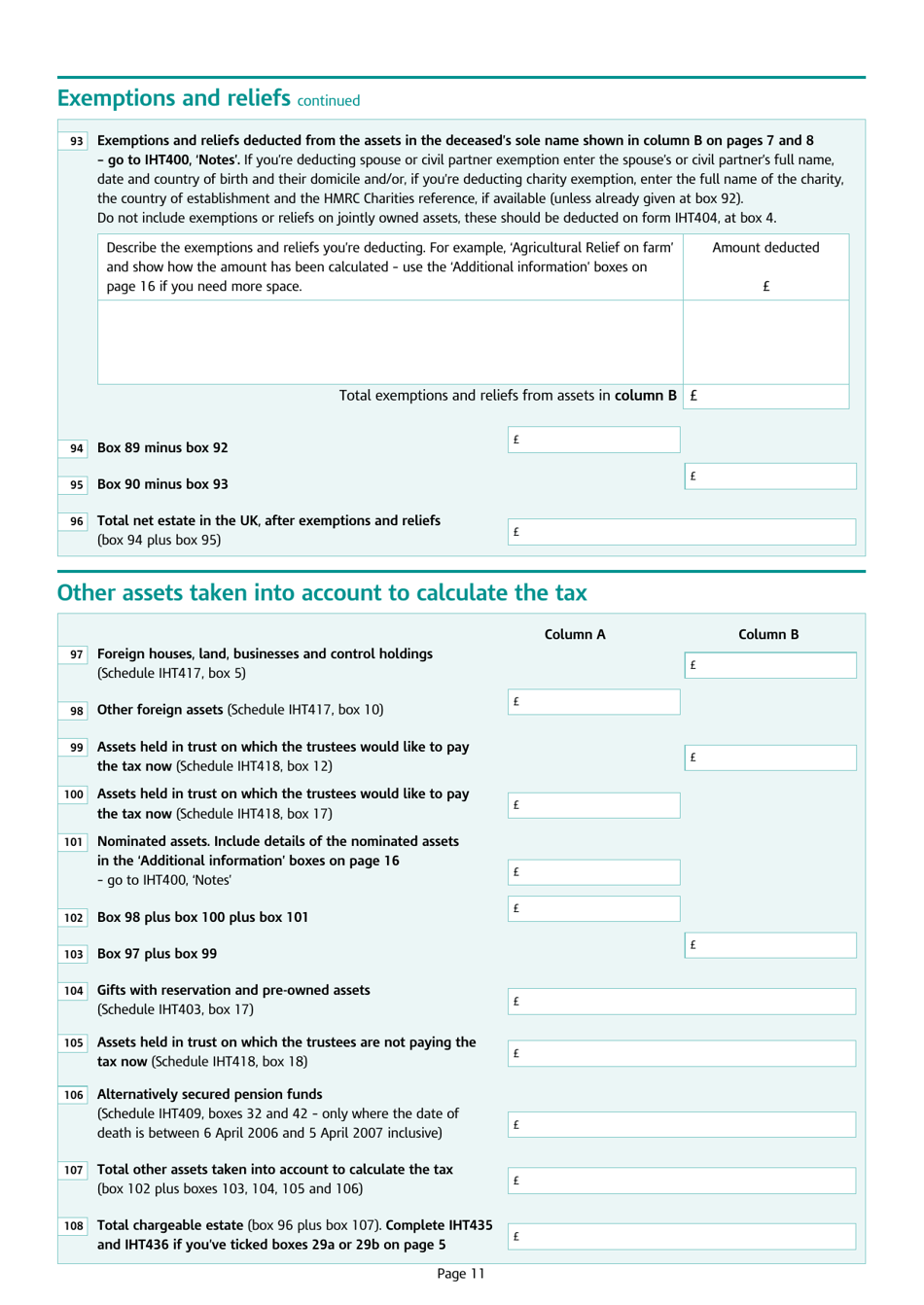

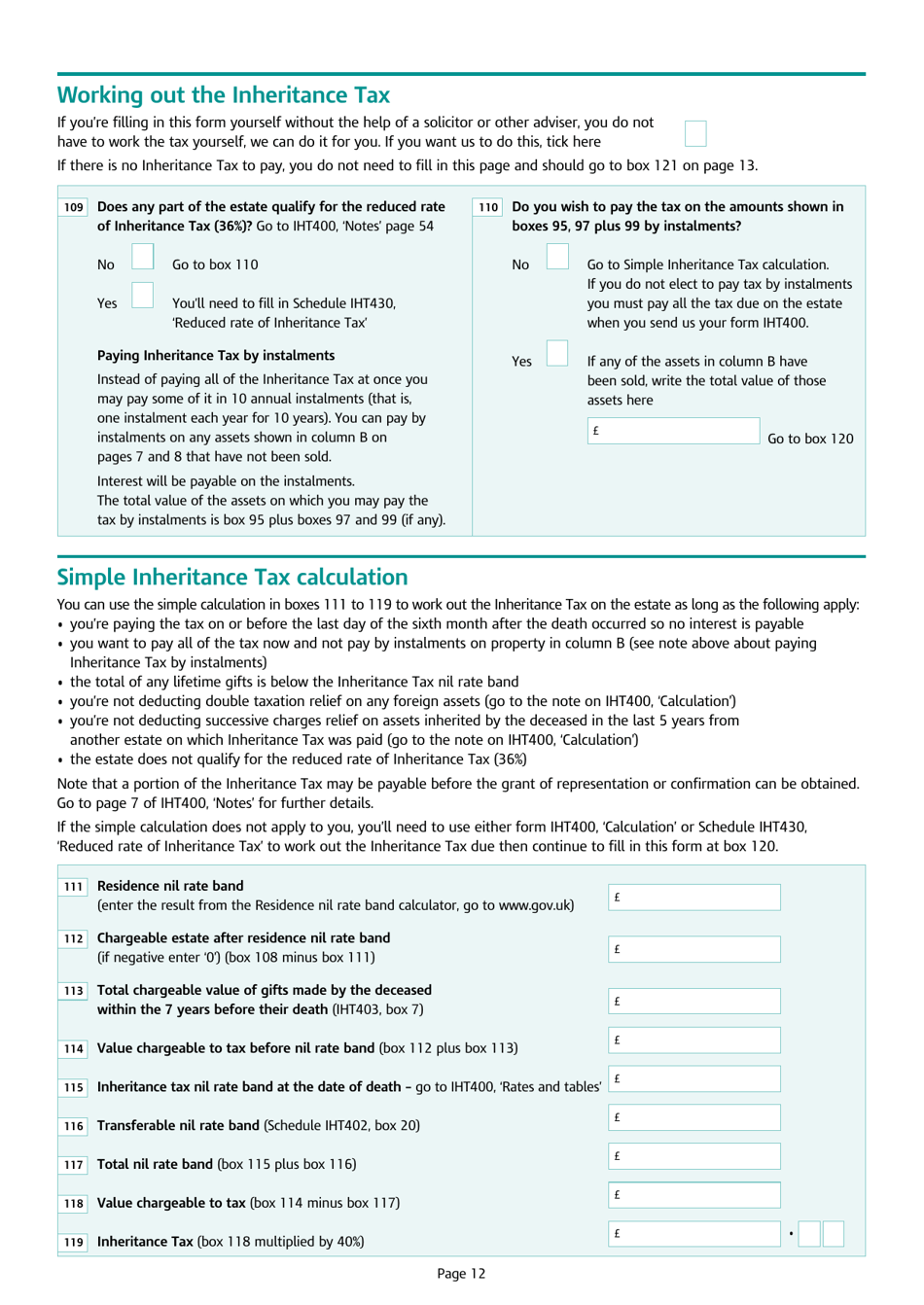

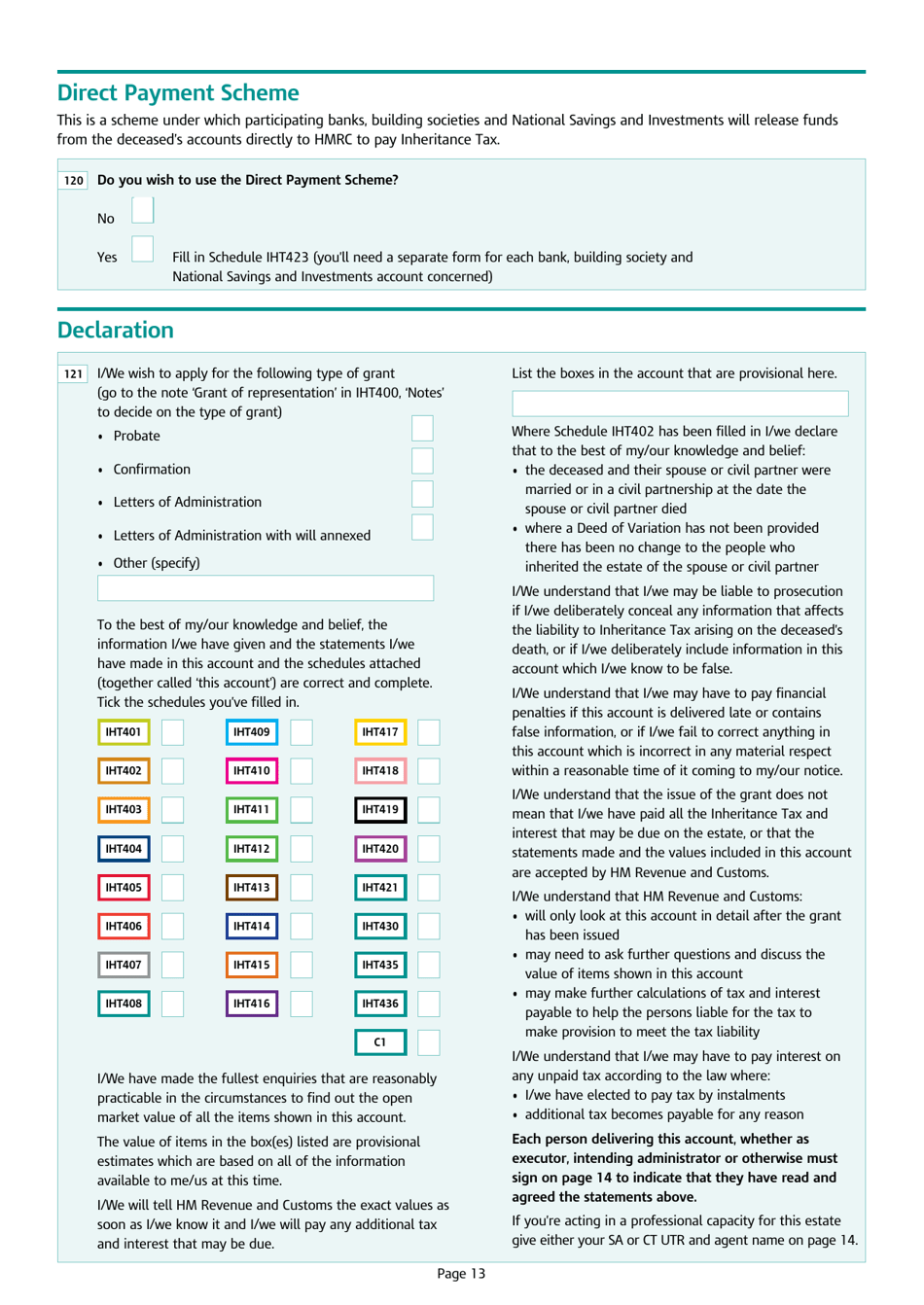

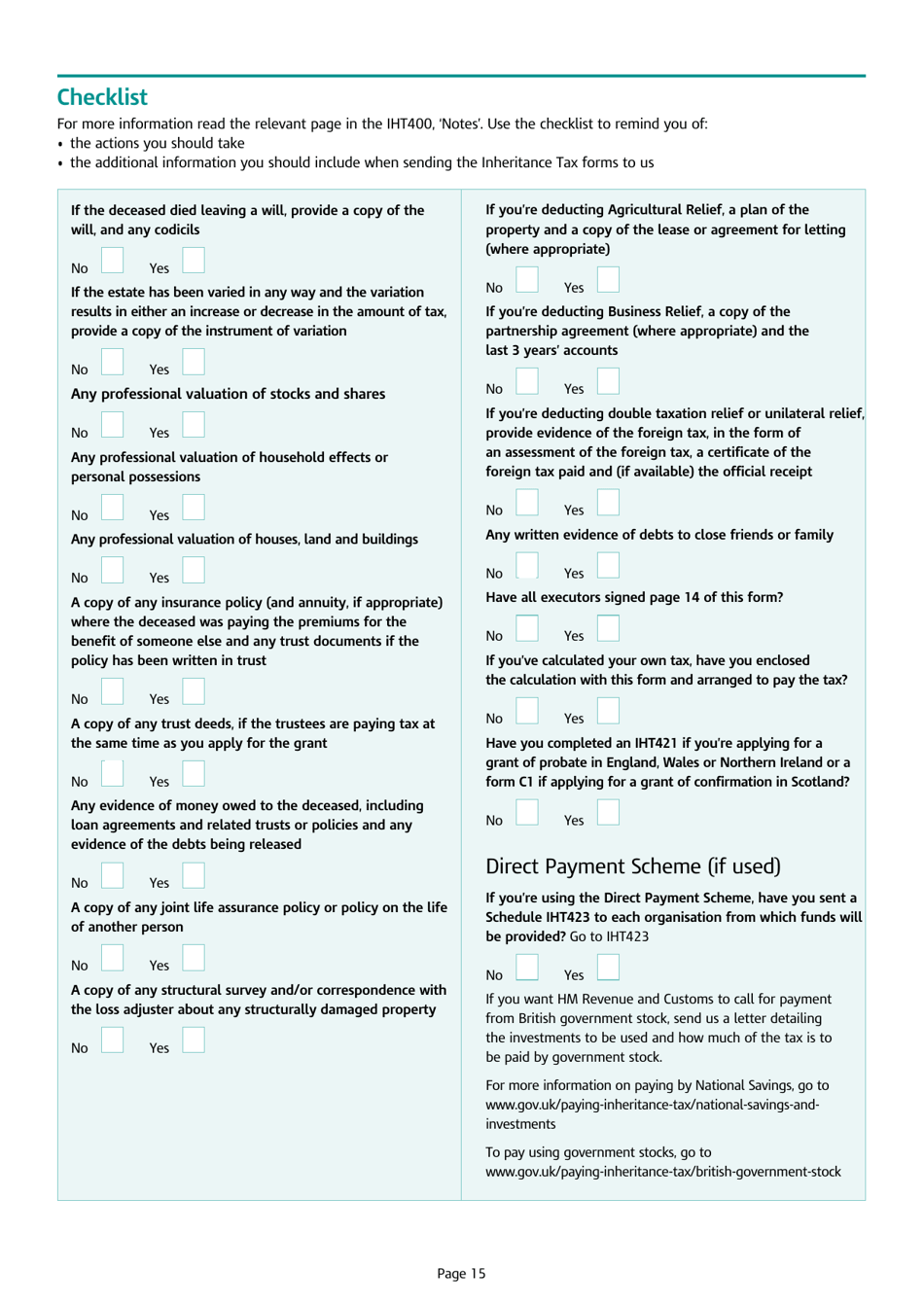

Form IHT400 Inheritance Tax Account is used in the United Kingdom for reporting and calculating the amount of inheritance tax due on an estate after someone has passed away. It provides details about the assets, liabilities, and exemptions of the deceased person.

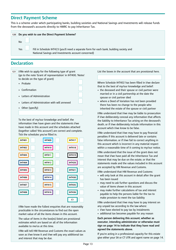

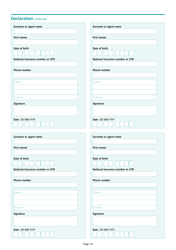

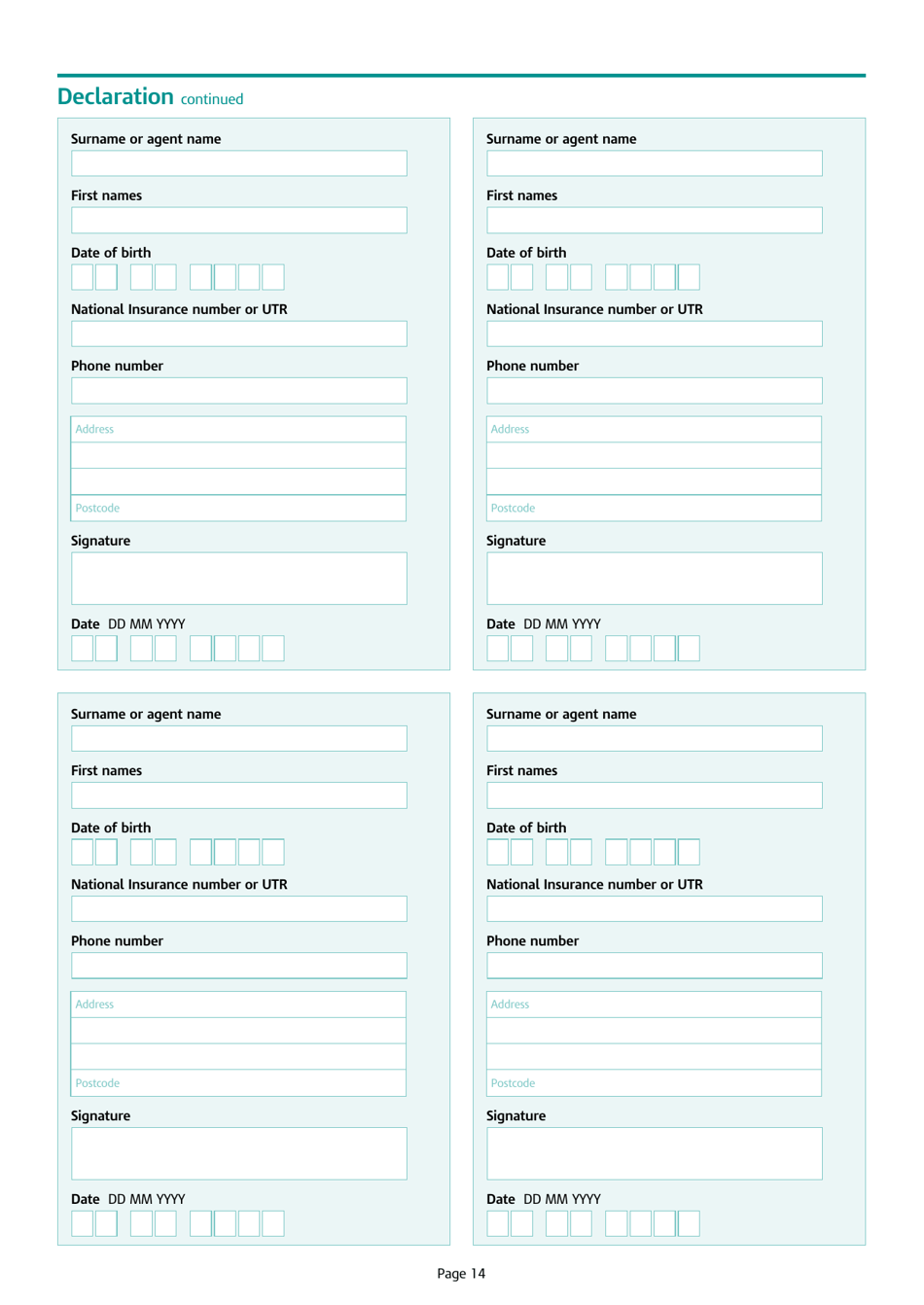

The person responsible for filing the Form IHT400 Inheritance Tax Account in the United Kingdom is the executor or administrator of the deceased person's estate.

FAQ

Q: What is Form IHT400?

A: Form IHT400 is the Inheritance Tax Account used in the United Kingdom.

Q: What is Inheritance Tax?

A: Inheritance Tax is a tax on the estate (money, property, and possessions) of someone who has died.

Q: Who needs to fill out Form IHT400?

A: Form IHT400 needs to be filled out by the executor or administrator of the deceased person's estate.

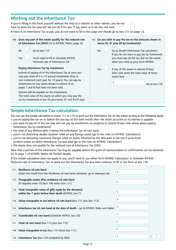

Q: What information is required in Form IHT400?

A: Form IHT400 requires information about the deceased person's assets, liabilities, and any exemptions or reliefs they may be eligible for.

Q: When is Form IHT400 due?

A: Form IHT400 should be submitted to Her Majesty's Revenue and Customs (HMRC) within 12 months of the end of the month in which the person died.

Q: Is there a fee for submitting Form IHT400?

A: Yes, there may be a fee for submitting Form IHT400. The fee depends on the value of the estate.

Q: Can I get help with filling out Form IHT400?

A: Yes, you can seek professional help from a solicitor or tax advisor to assist you with filling out Form IHT400.

Q: What happens after Form IHT400 is submitted?

A: After Form IHT400 is submitted, HMRC will review the information and determine the amount of Inheritance Tax that needs to be paid.