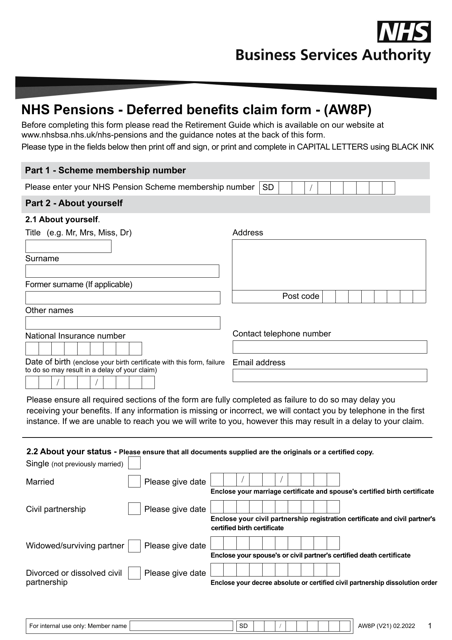

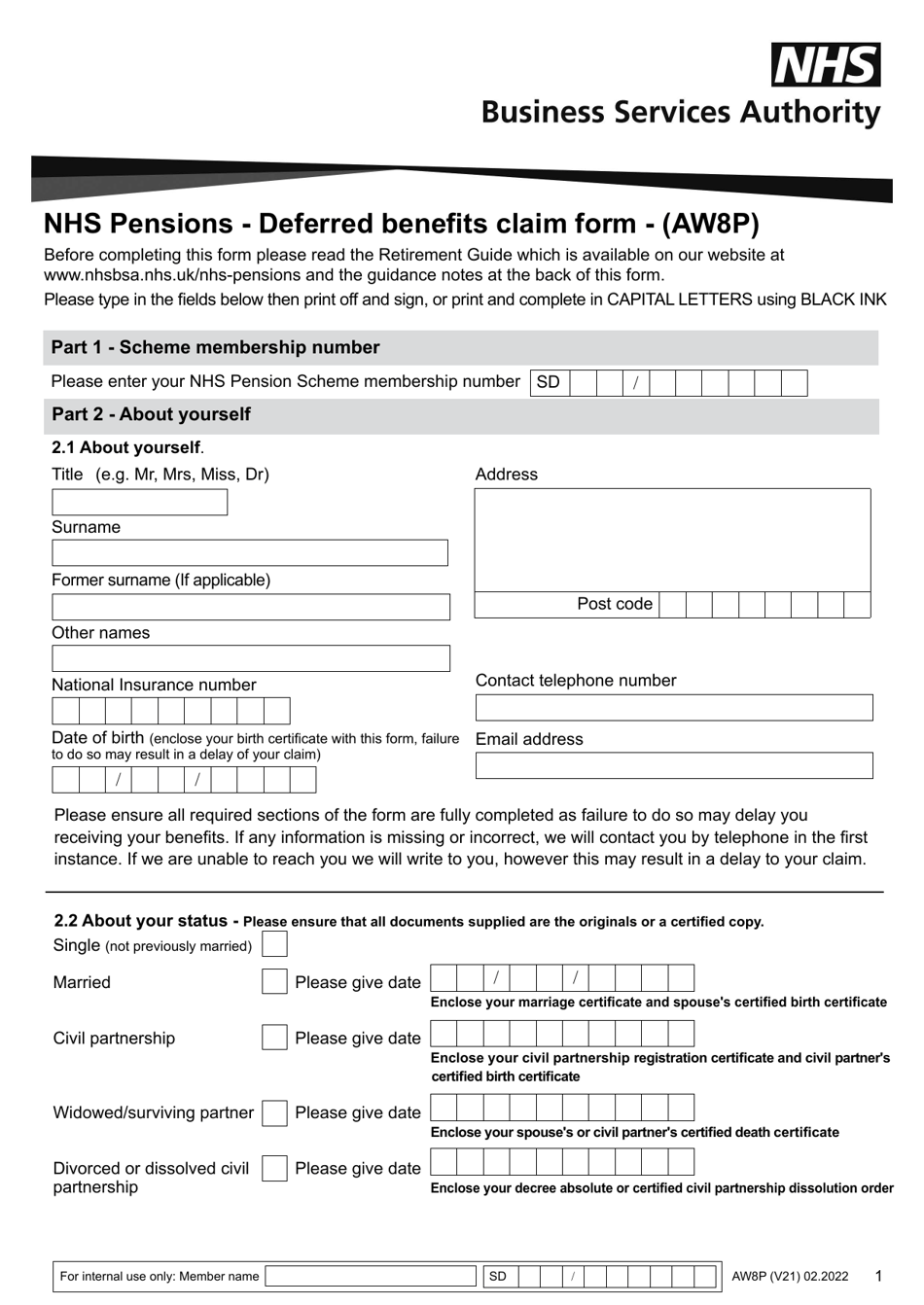

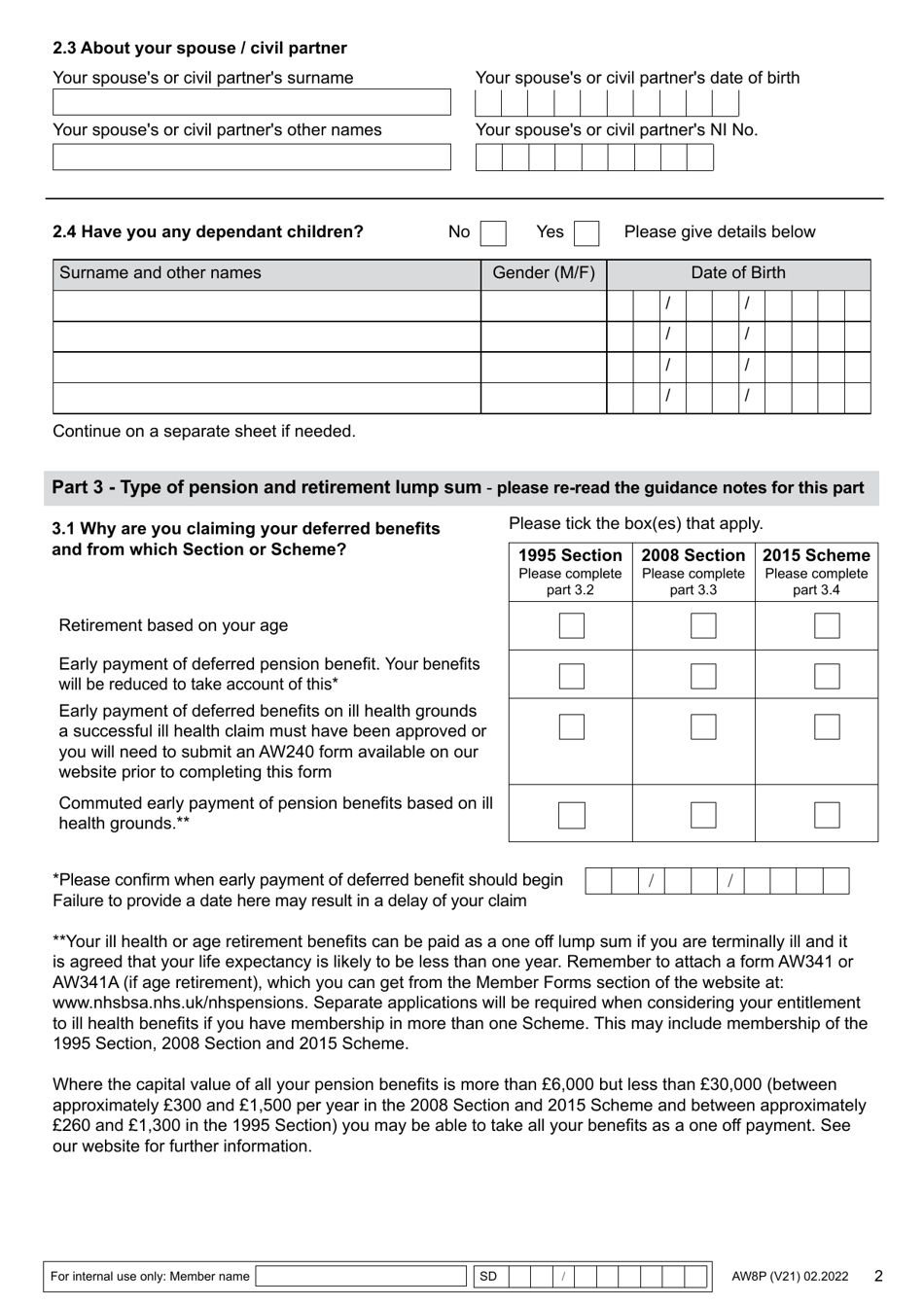

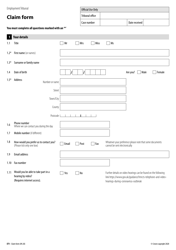

Form AW8P Nhs Pensions - Deferred Benefits Claim Form - United Kingdom

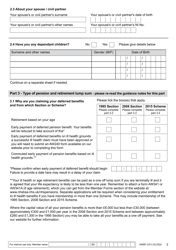

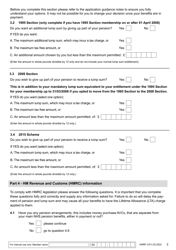

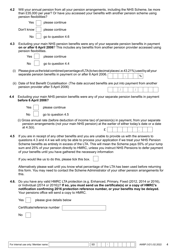

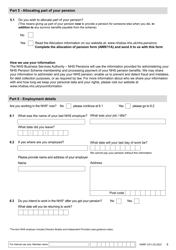

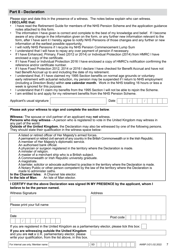

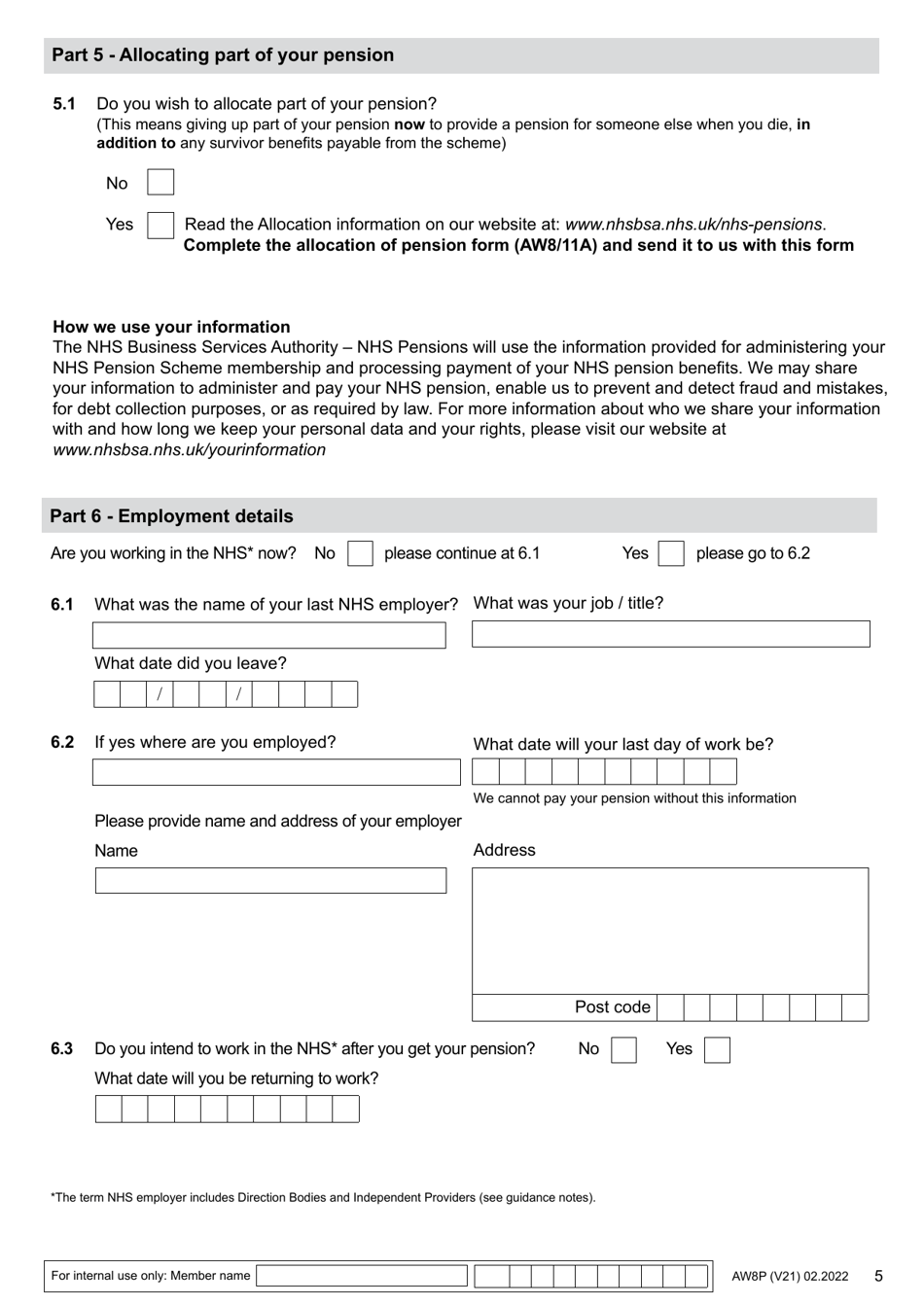

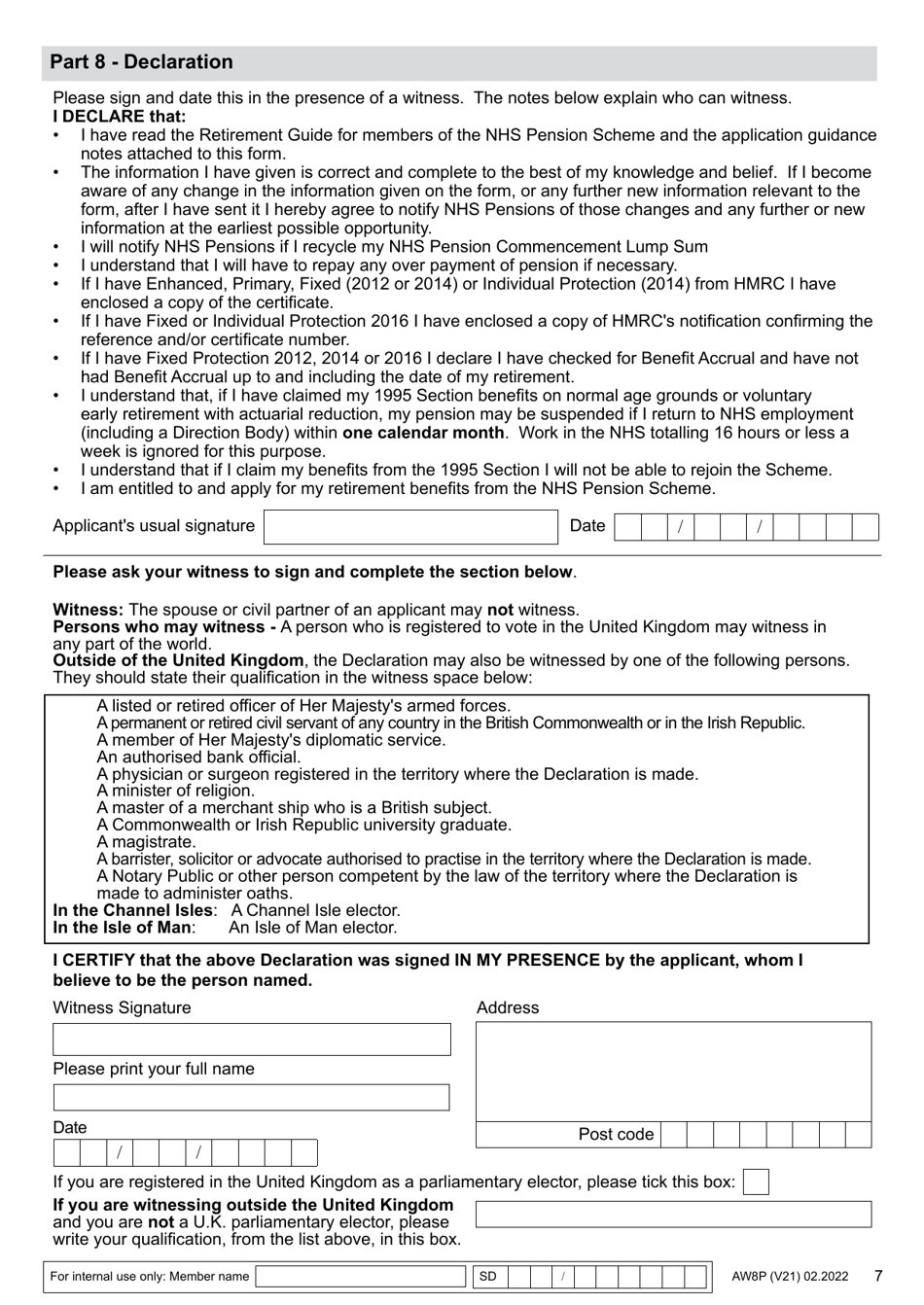

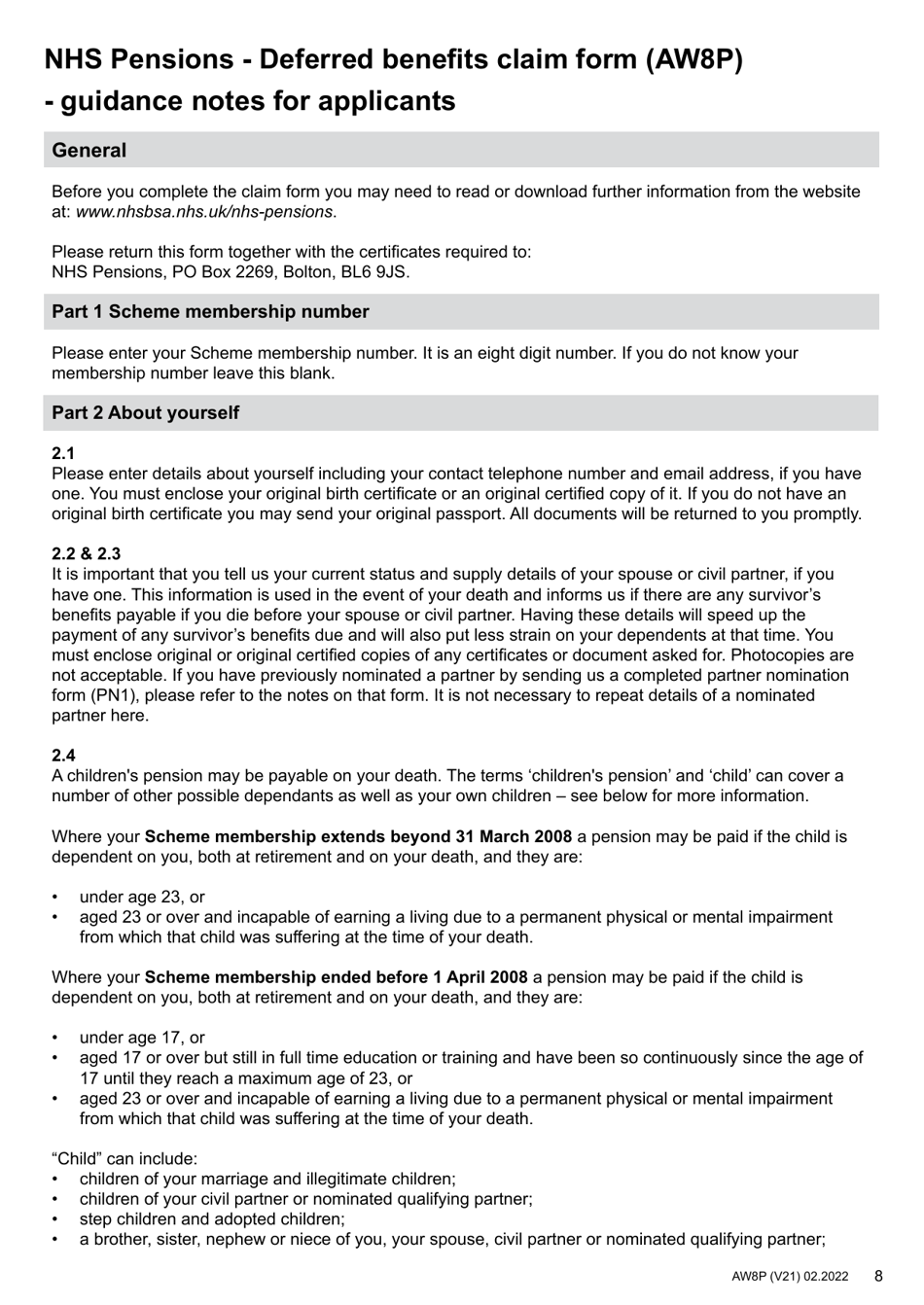

Form AW8P Nhs Pensions - Deferred Benefits Claim Form is used in the United Kingdom for individuals who are claiming deferred benefits from the National Health Service (NHS) Pensions scheme. This form allows eligible individuals to apply for the benefits they have accrued from their previous service in the NHS, which they are entitled to claim upon reaching a certain age or meeting specific criteria. It helps the NHS Pensions authority to process the claim and determine the amount of benefits the applicant is eligible for.

The Form AW8P Nhs Pensions - Deferred Benefits Claim Form in the United Kingdom is typically filed by individuals who have contributed to the National Health Service (NHS) Pension Scheme and are now eligible to claim their deferred benefits. This form is used to request the payment of pension benefits that have been accumulated but not yet claimed by the individual.

FAQ

Q: What is Form AW8P?

A: Form AW8P is an Nhs Pensions Deferred Benefits Claim Form in the United Kingdom.

Q: What are Deferred Benefits?

A: Deferred Benefits are pension benefits that have been accrued but not yet claimed.

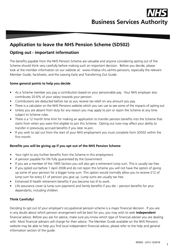

Q: Who is eligible to use Form AW8P?

A: Form AW8P is intended for individuals who have previously been members of the NHS Pension Scheme and wish to claim their deferred benefits.

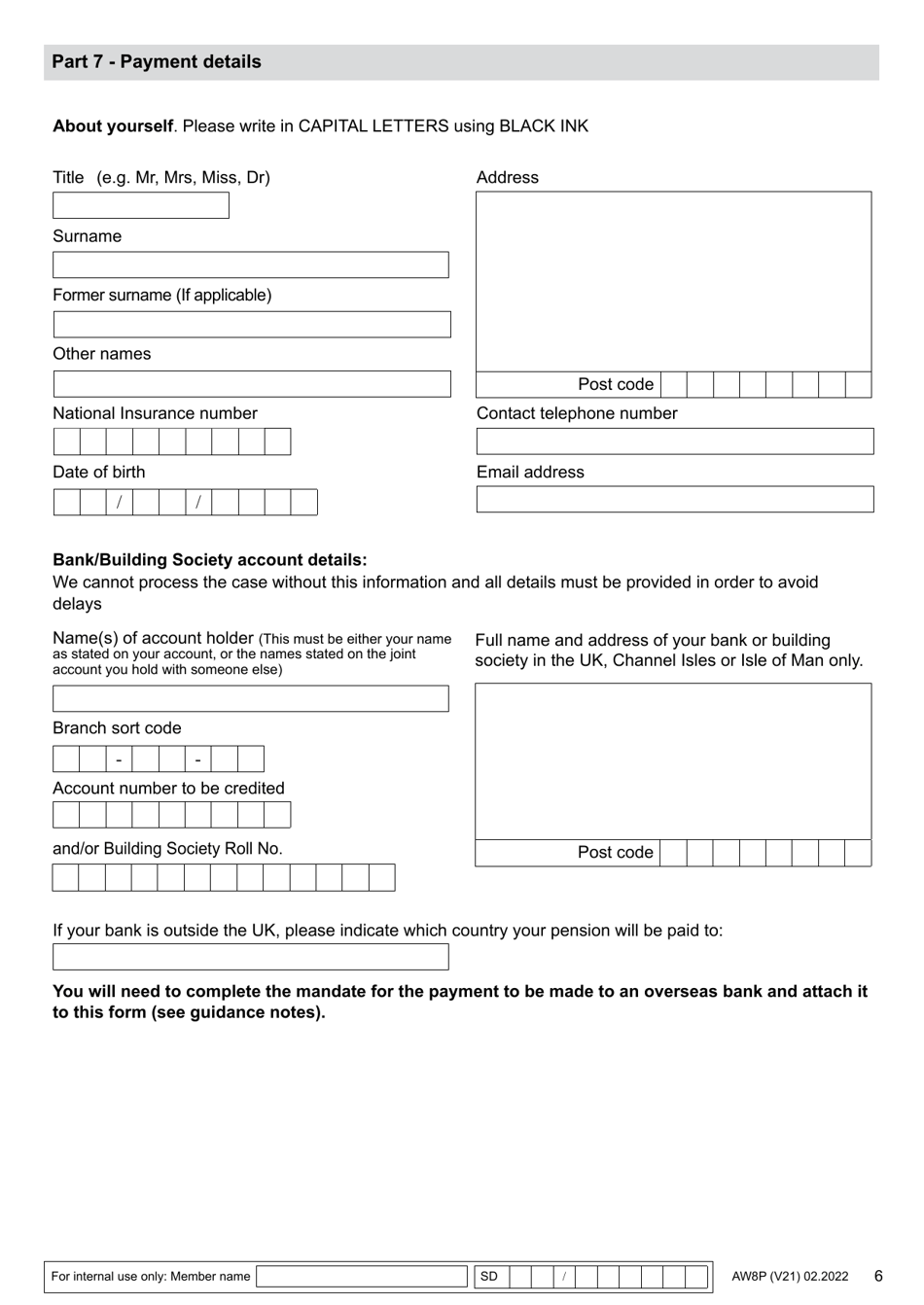

Q: What information is required on Form AW8P?

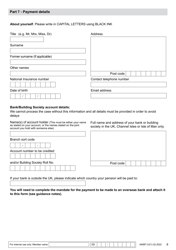

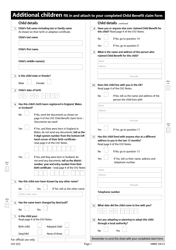

A: Form AW8P requires personal information such as name, address, National Insurance number, and details of previous NHS employment.

Q: How do I submit Form AW8P?

A: Completed Form AW8P should be sent to the NHS Pensions office by mail or email, as instructed on the form.

Q: Is there a deadline for submitting Form AW8P?

A: There is no specific deadline for submitting Form AW8P, but it is recommended to submit the form as soon as possible.

Q: How long does it take to process a deferred benefits claim?

A: The processing time for a deferred benefits claim can vary, but you should receive a response from NHS Pensions within a few months.

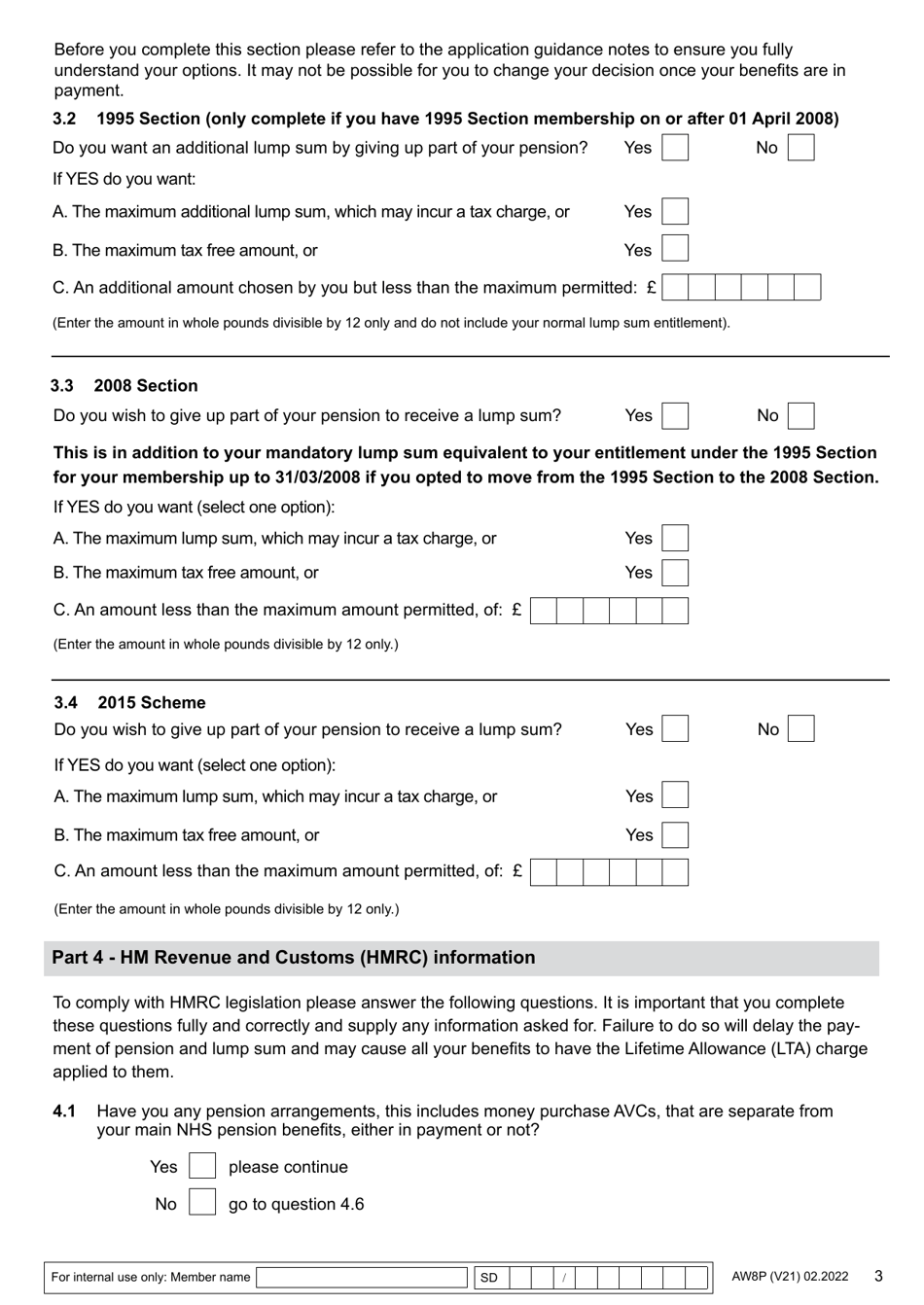

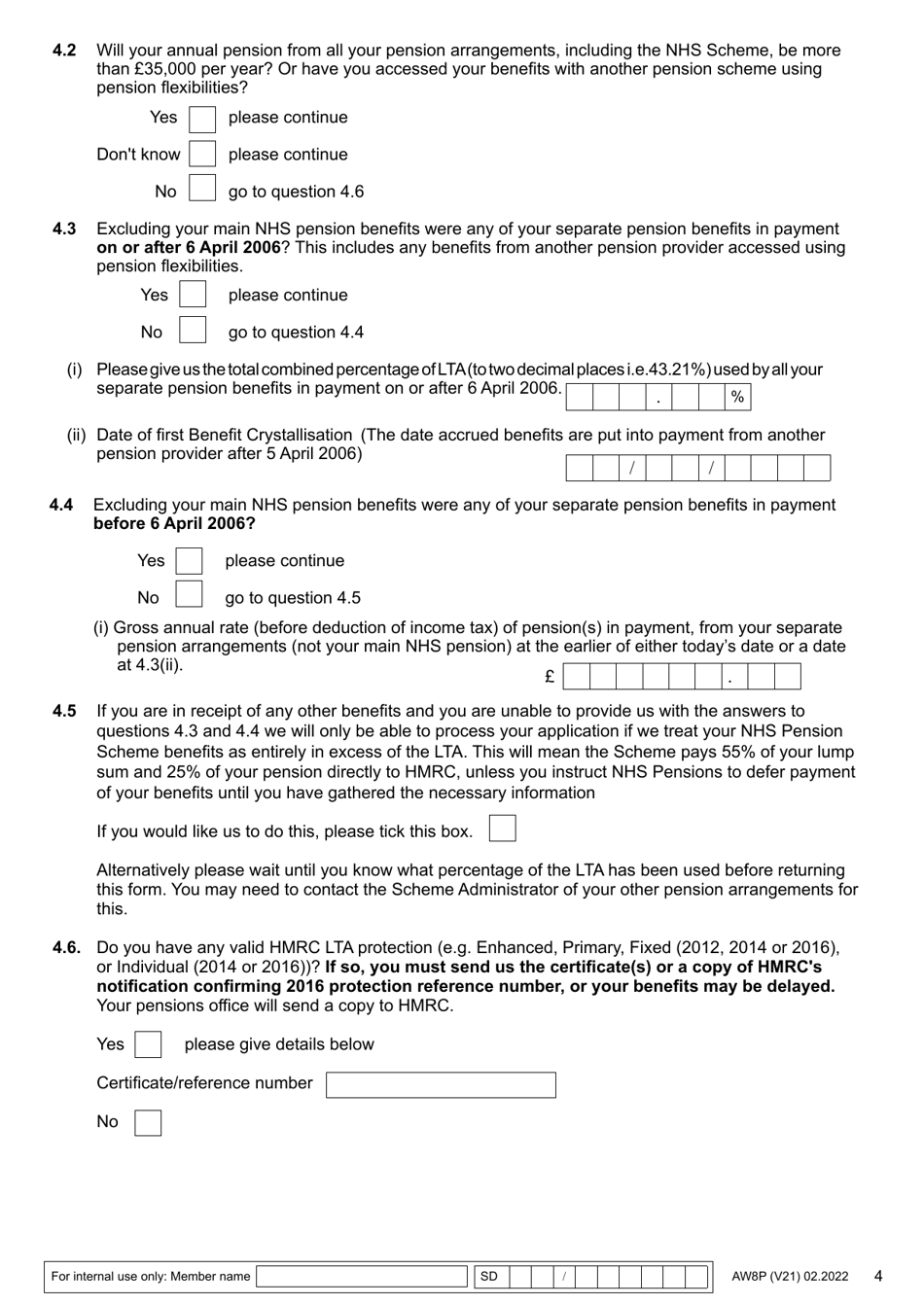

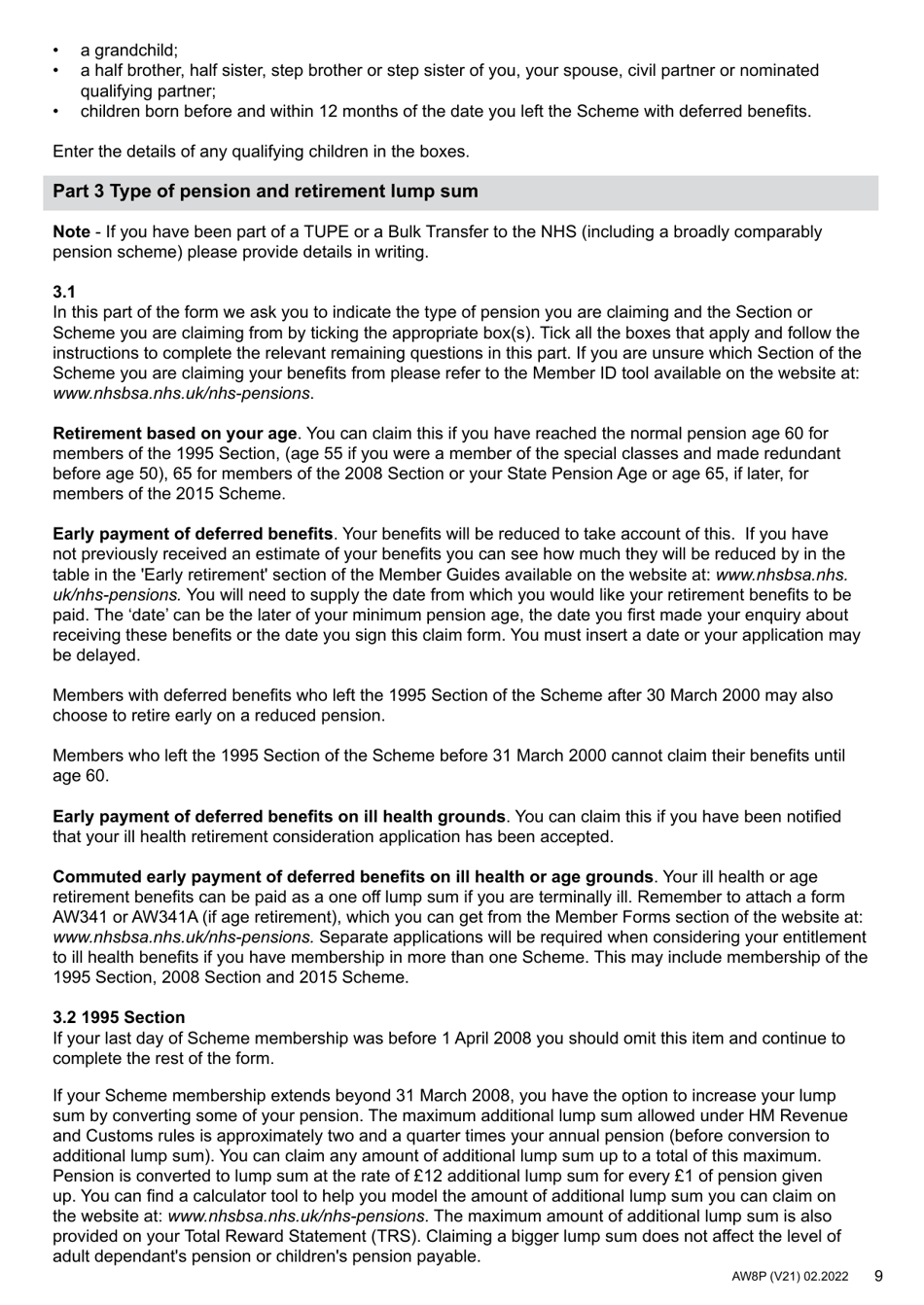

Q: Can I receive my deferred benefits as a lump sum?

A: In most cases, deferred benefits are paid as a regular pension income, but there may be options to receive a lump sum payment.

Q: What should I do if I have lost my Form AW8P?

A: If you have lost your Form AW8P, you should contact the NHS Pensions office for assistance in obtaining a replacement form or submitting the claim in an alternative manner.