Medicare Premiums: Rules for Higher-Income Beneficiaries

Medicare Premiums: Rules for Higher-Income Beneficiaries is a 16-page legal document that was released by the U.S. Social Security Administration and used nation-wide.

FAQ

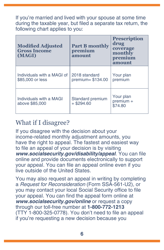

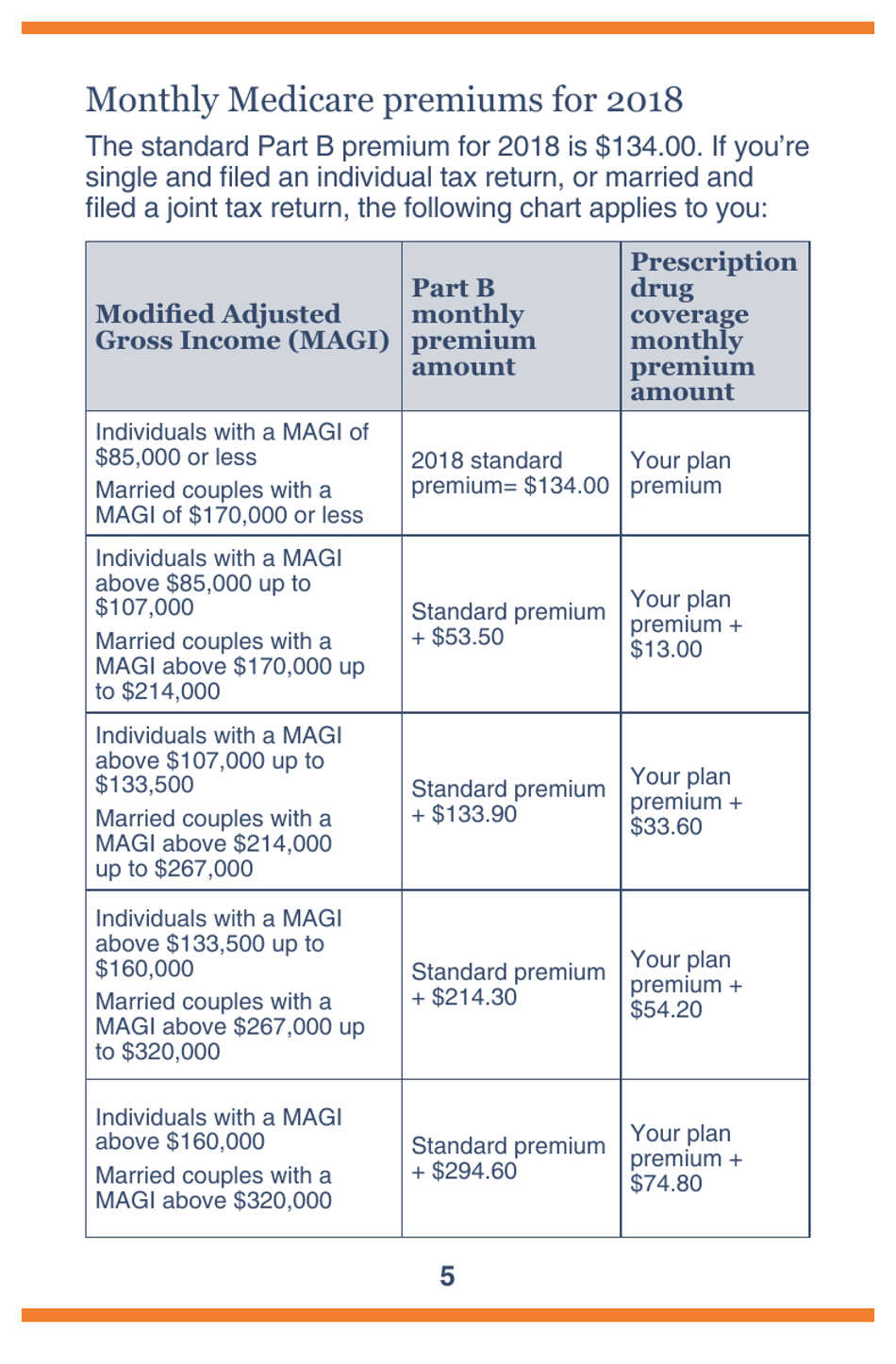

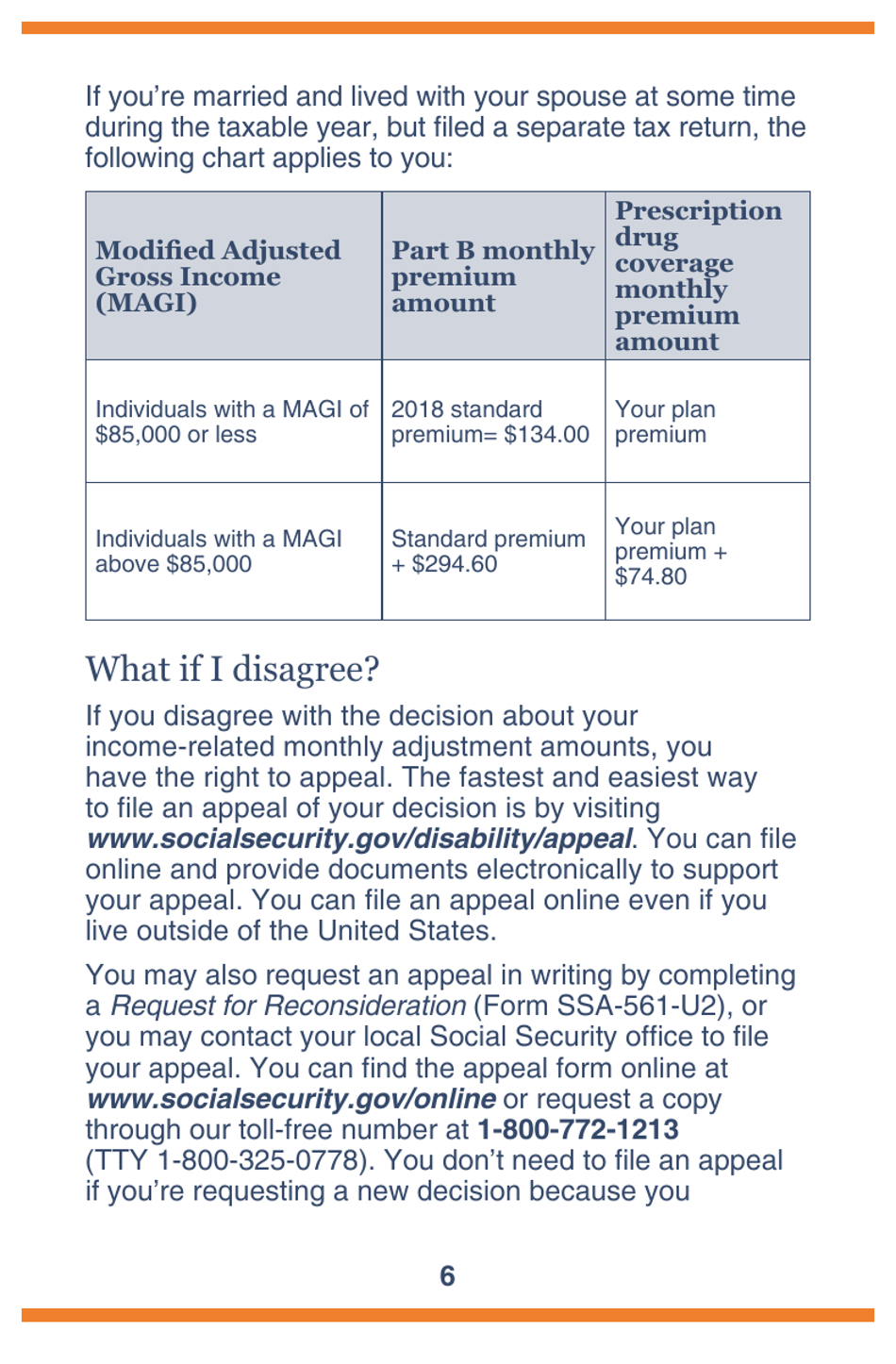

Q: Who are higher-income beneficiaries?

A: Higher-income beneficiaries are individuals or couples with a modified adjusted gross income (MAGI) above a certain threshold.

Q: What is MAGI?

A: MAGI stands for modified adjusted gross income and includes income such as wages, self-employment income, dividends, and interest.

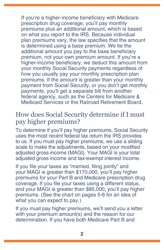

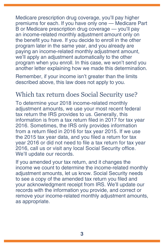

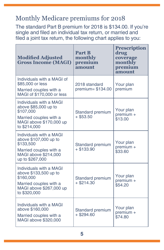

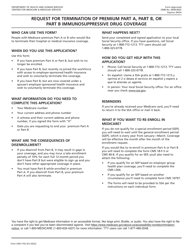

Q: How are Medicare premiums affected for higher-income beneficiaries?

A: Medicare premiums for higher-income beneficiaries are subject to an income-related monthly adjustment amount (IRMAA), which increases the standard premium amount.

Q: Is there a specific income threshold for higher-income beneficiaries?

A: Yes, there are specific income thresholds based on your tax filing status. These thresholds may change each year.

Q: How is the IRMAA determined?

A: The IRMAA is determined based on the beneficiary's MAGI and tax filing status. It is calculated by the Social Security Administration.

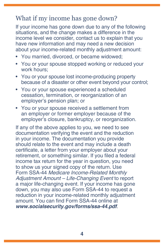

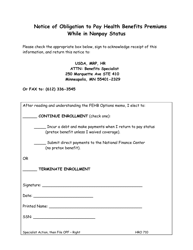

Q: What happens if my income changes?

A: If your income changes, your Medicare premiums may be adjusted accordingly. It is important to report any income changes to the Social Security Administration.

Form Details:

- The latest edition currently provided by the U.S. Social Security Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.