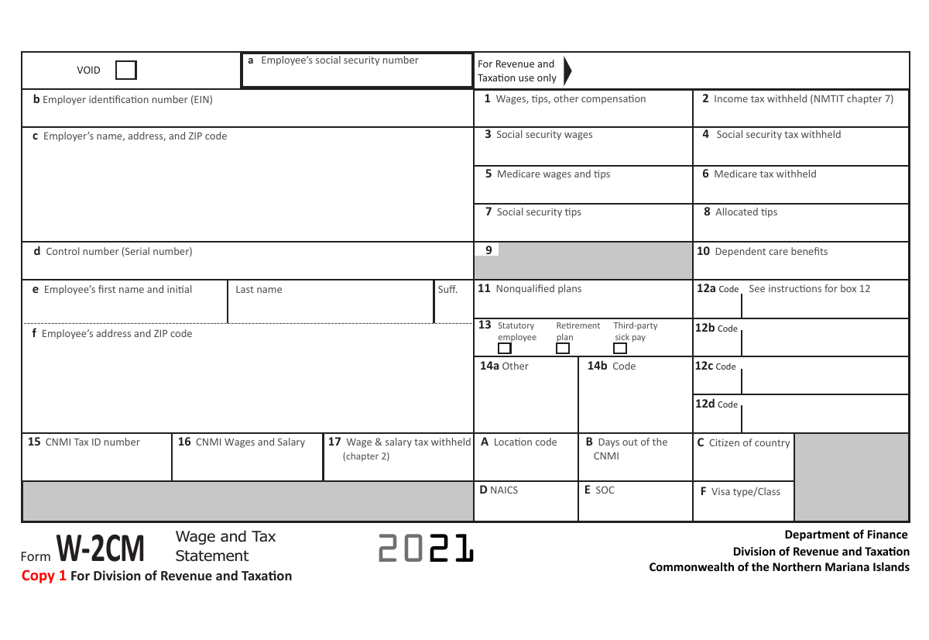

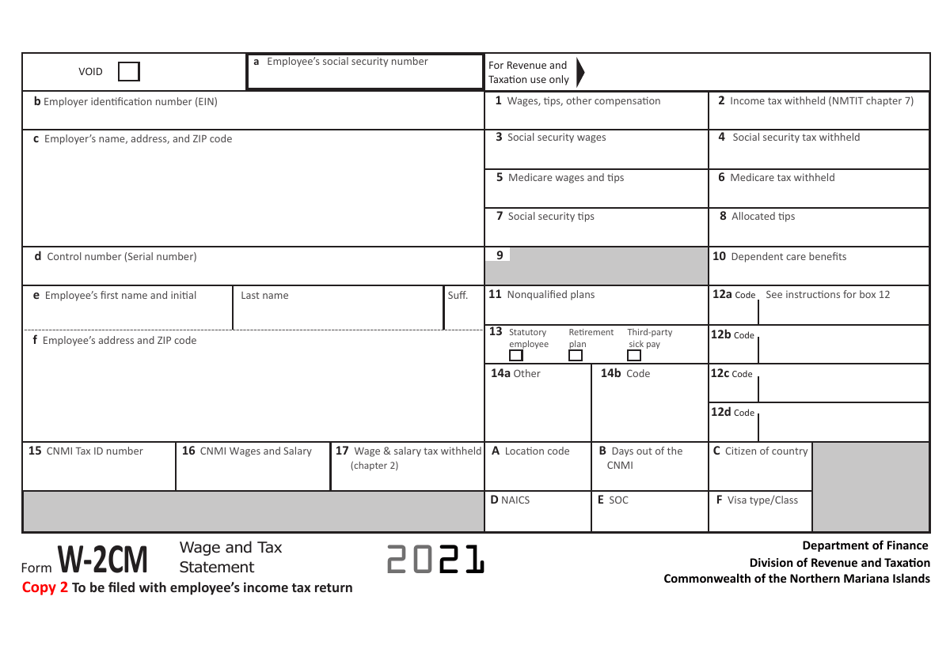

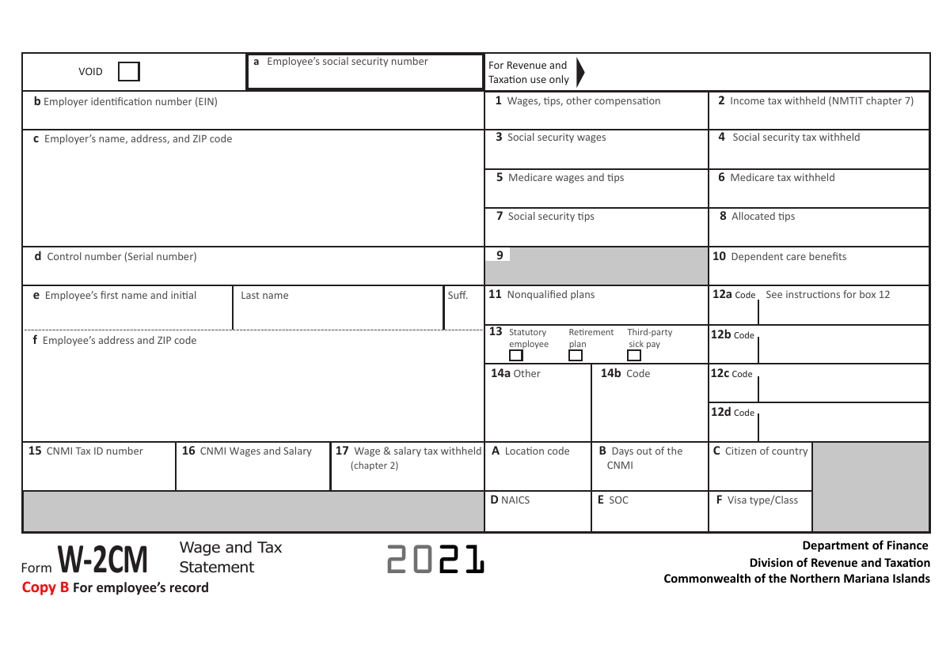

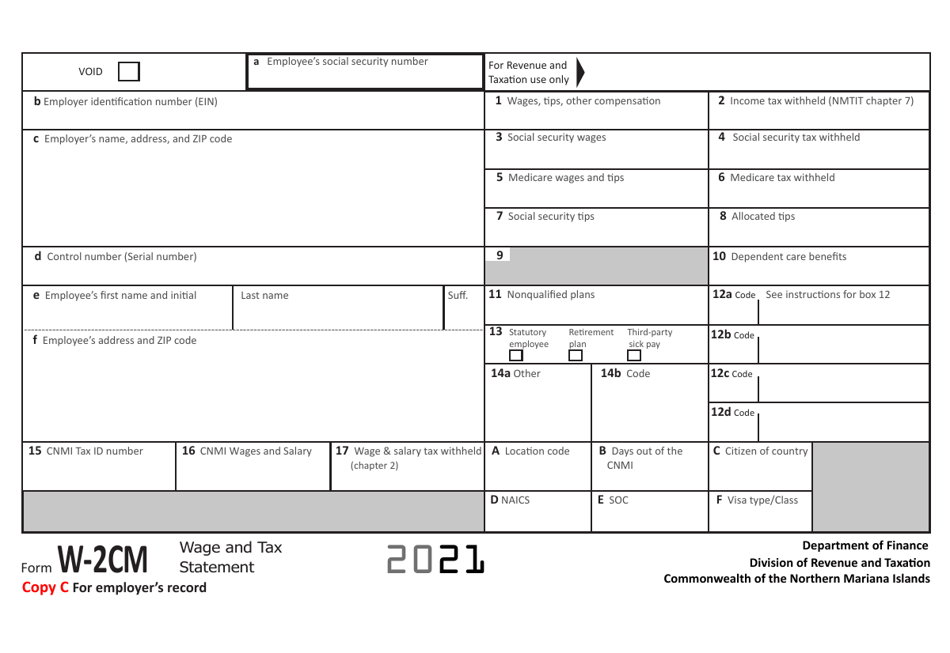

Form W-2CM Wage and Tax Statement - Northern Mariana Islands

What Is Form W-2CM?

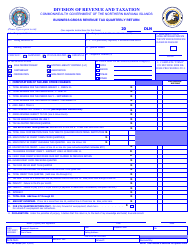

This is a legal form that was released by the Commonwealth of the Northern Mariana Islands Department of Finance - a government authority operating within Northern Mariana Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

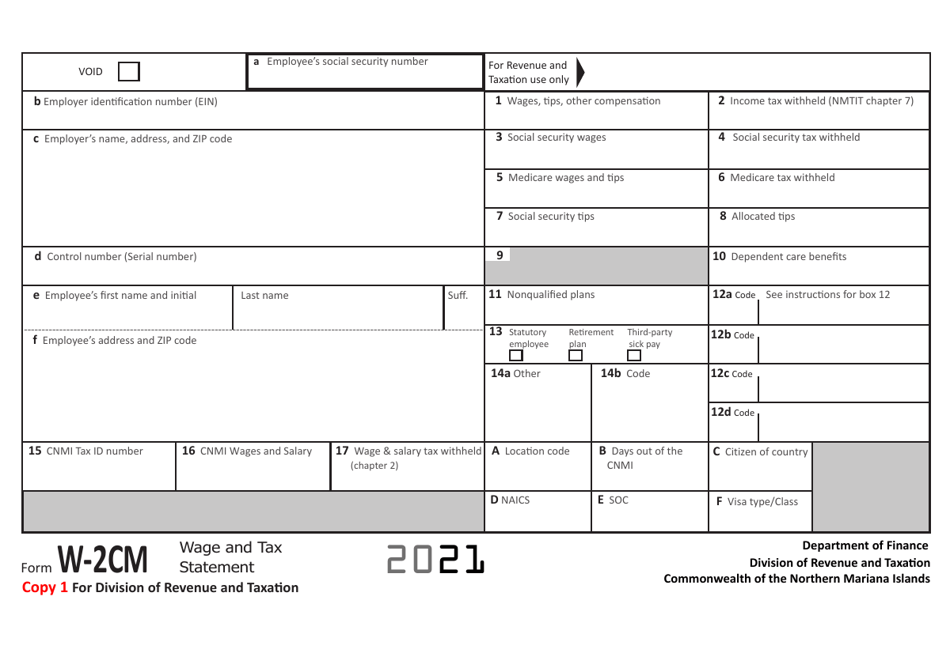

Q: What is Form W-2CM?

A: Form W-2CM is the Wage and Tax Statement specific to the Northern Mariana Islands.

Q: Who should use Form W-2CM?

A: Employers in the Northern Mariana Islands should use Form W-2CM to report wages and taxes withheld for their employees.

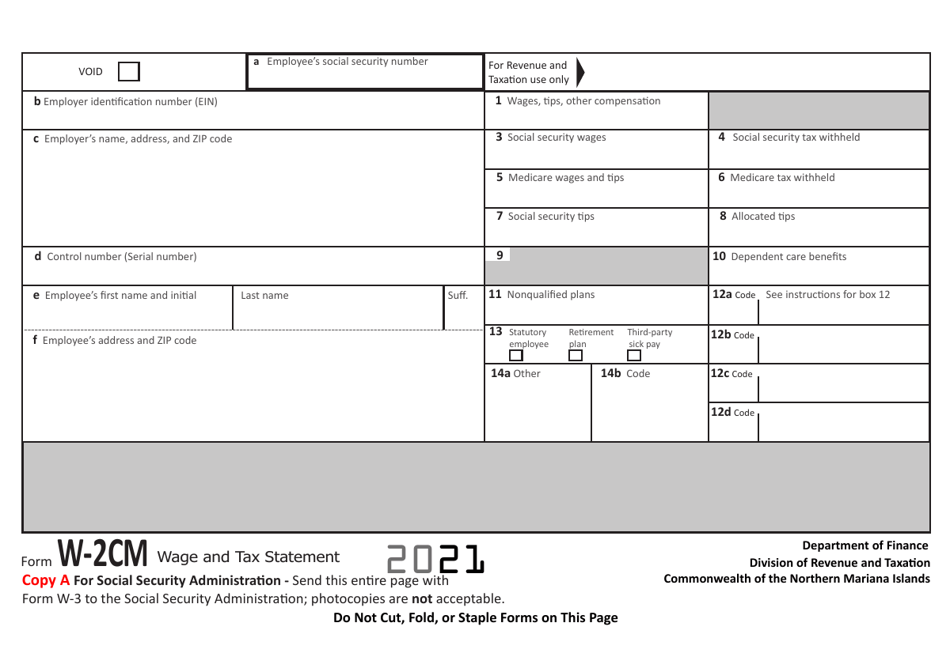

Q: What information is reported on Form W-2CM?

A: Form W-2CM reports the wages paid to employees in the Northern Mariana Islands, as well as the taxes withheld, such as Federal Income Tax, Social Security Tax, and Medicare Tax.

Q: When should Form W-2CM be filed?

A: Form W-2CM must be filed with the Northern Mariana Islands Division of Revenue and Taxation and the Social Security Administration by the last day of February.

Q: Is Form W-2CM the same as Form W-2?

A: No, Form W-2CM is specific to the Northern Mariana Islands and should be used instead of the regular Form W-2 in that jurisdiction.

Form Details:

- The latest edition provided by the Commonwealth of the Northern Mariana Islands Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-2CM by clicking the link below or browse more documents and templates provided by the Commonwealth of the Northern Mariana Islands Department of Finance.