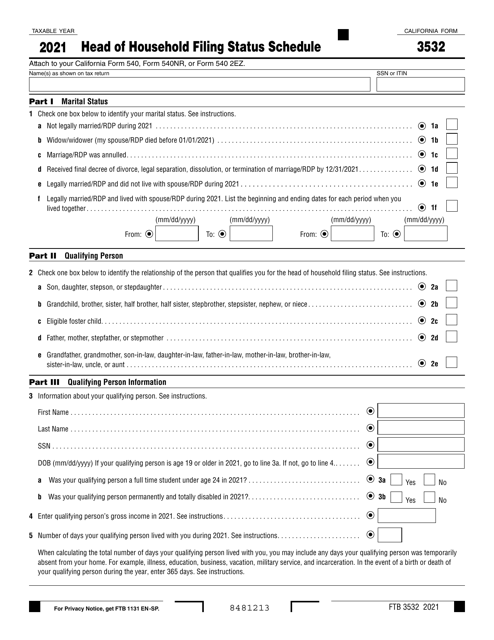

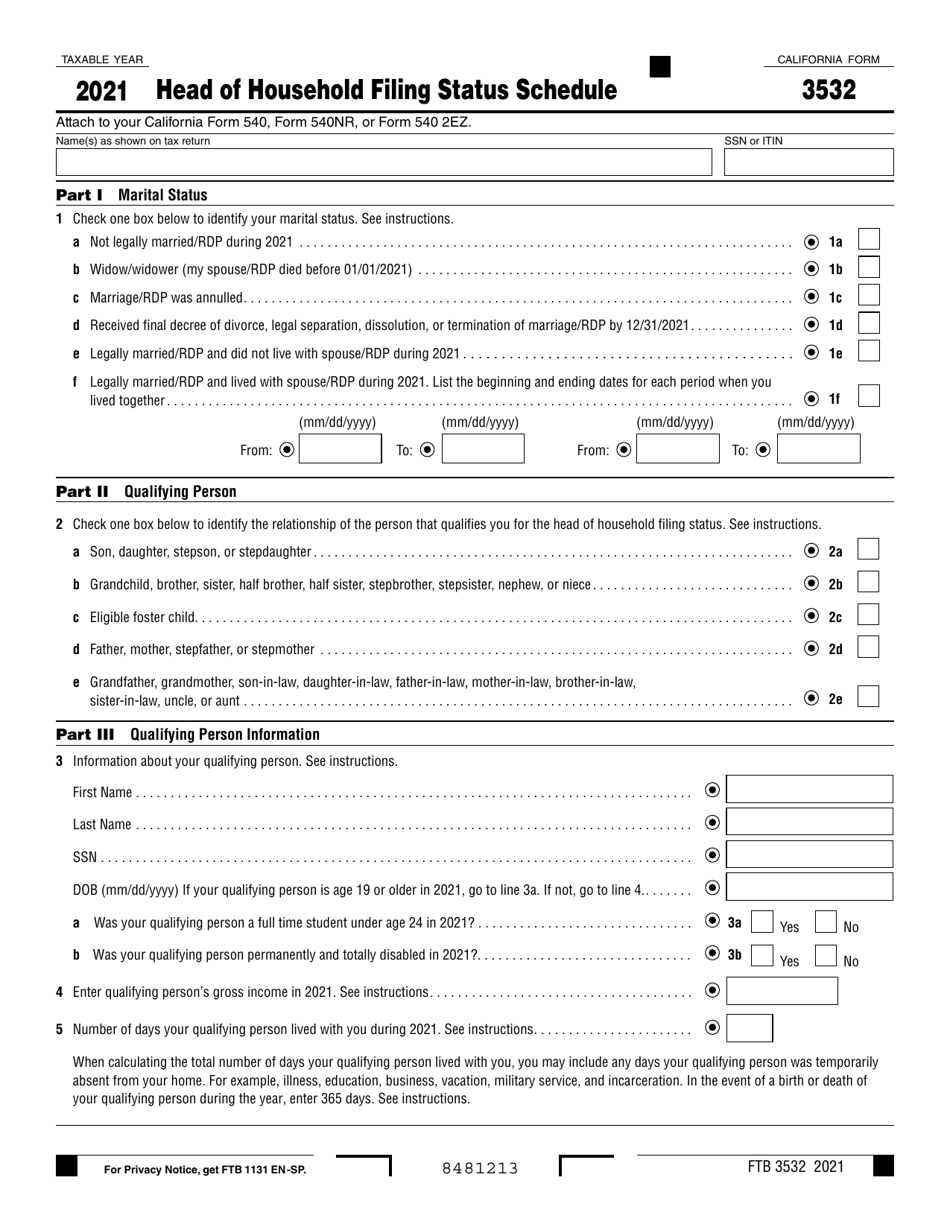

Form 3532 Head of Household Filing Status Schedule - California

What Is Form 3532?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3532?

A: Form 3532 is the Head of Household Filing Status Schedule.

Q: What is the purpose of Form 3532?

A: The purpose of Form 3532 is to determine if you qualify for head of householdfiling status in California.

Q: Who should use Form 3532?

A: Form 3532 should be used by California residents who meet certain criteria to claim head of household filing status.

Q: What are the criteria for head of household filing status?

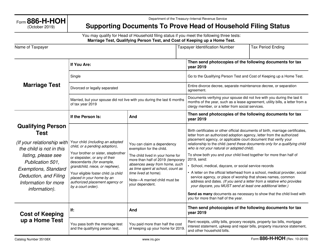

A: To qualify for head of household filing status, you must be unmarried or considered unmarried for the entire tax year, pay more than half the cost of keeping up a home for yourself and a qualifying person, and have a qualifying person who lived with you in your home for more than half the year.

Q: What is a qualifying person?

A: A qualifying person is someone who is related to you or qualifies as your dependent, such as a child or other dependent relative.

Q: What are the benefits of filing as head of household?

A: Filing as head of household can result in a lower tax rate and a higher standard deduction compared to filing as a single taxpayer.

Q: When is the deadline for filing Form 3532?

A: The deadline for filing Form 3532 is the same as the deadline for filing your California state income tax return, which is generally April 15th.

Q: Do I need to attach Form 3532 to my tax return?

A: Yes, you need to attach Form 3532 to your California state income tax return when claiming head of household filing status.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3532 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.