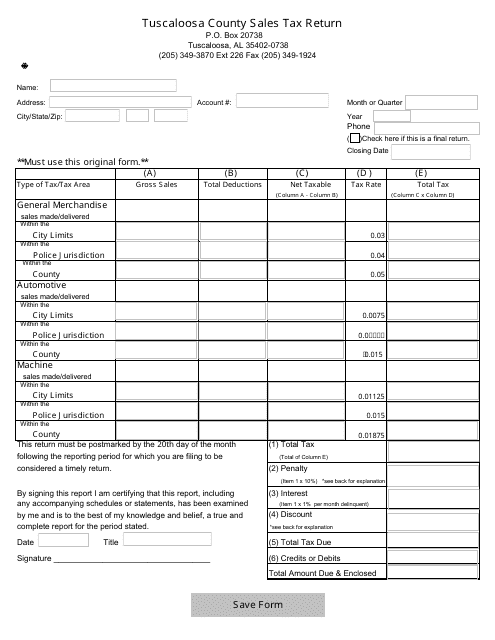

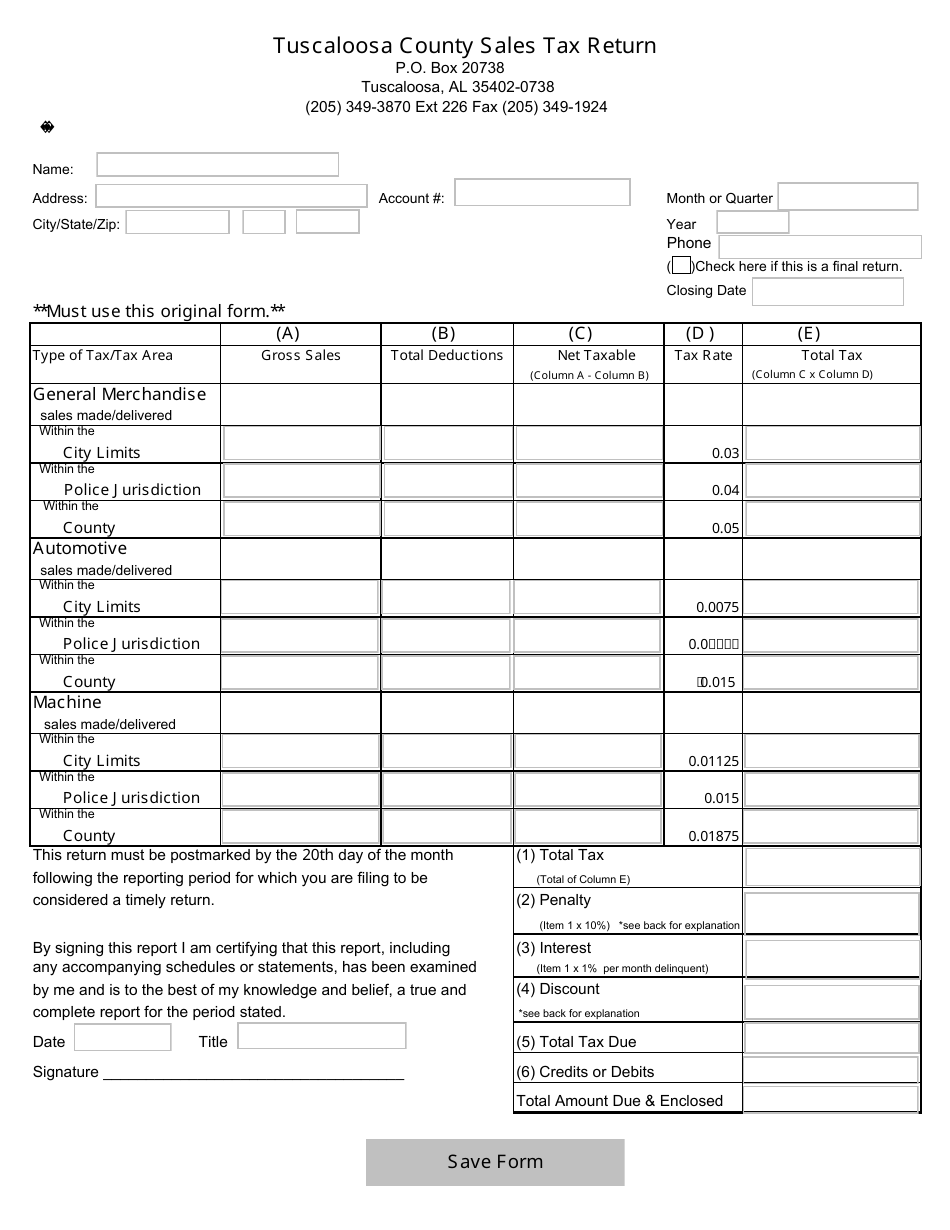

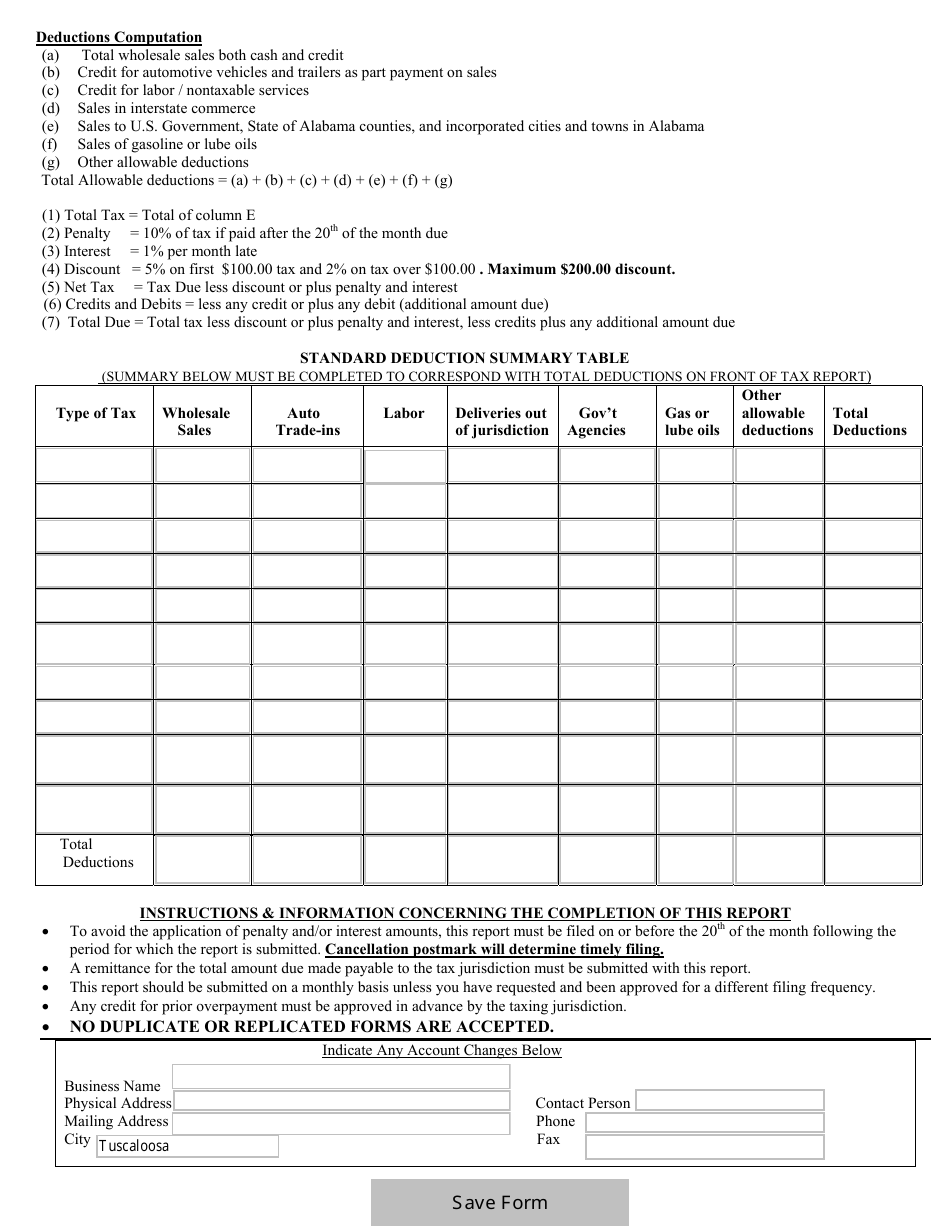

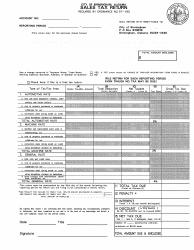

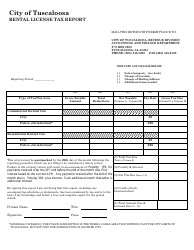

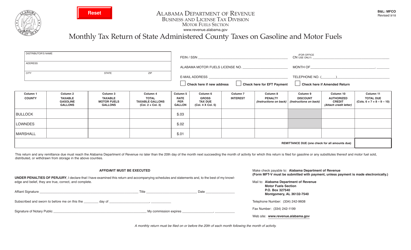

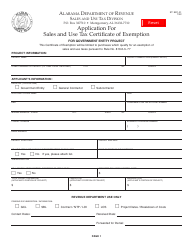

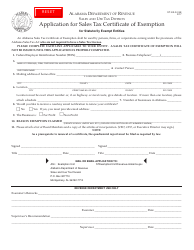

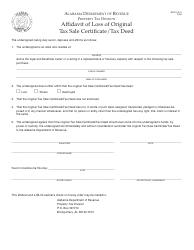

Sales Tax Return Form - City of Tuscaloosa, Alabama

Sales Tax Return Form is a legal document that was released by the Alabama Department of Revenue - a government authority operating within Alabama. The form may be used strictly within City of Tuscaloosa.

FAQ

Q: What is the sales tax rate in the City of Tuscaloosa, Alabama?

A: The sales tax rate in the City of Tuscaloosa, Alabama, is 9%.

Q: Do I need to file a sales tax return in the City of Tuscaloosa, Alabama?

A: Yes, if you have sales tax obligations in the City of Tuscaloosa, Alabama, you are required to file a sales tax return.

Q: How often do I need to file a sales tax return in the City of Tuscaloosa, Alabama?

A: Sales tax returns in the City of Tuscaloosa, Alabama, are typically due on a monthly basis.

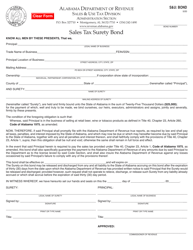

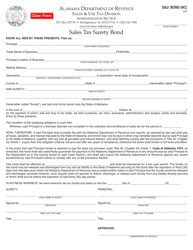

Form Details:

- The latest edition currently provided by the Alabama Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.