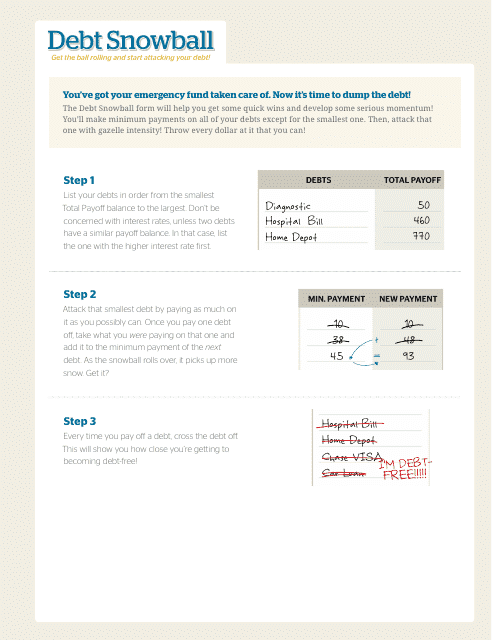

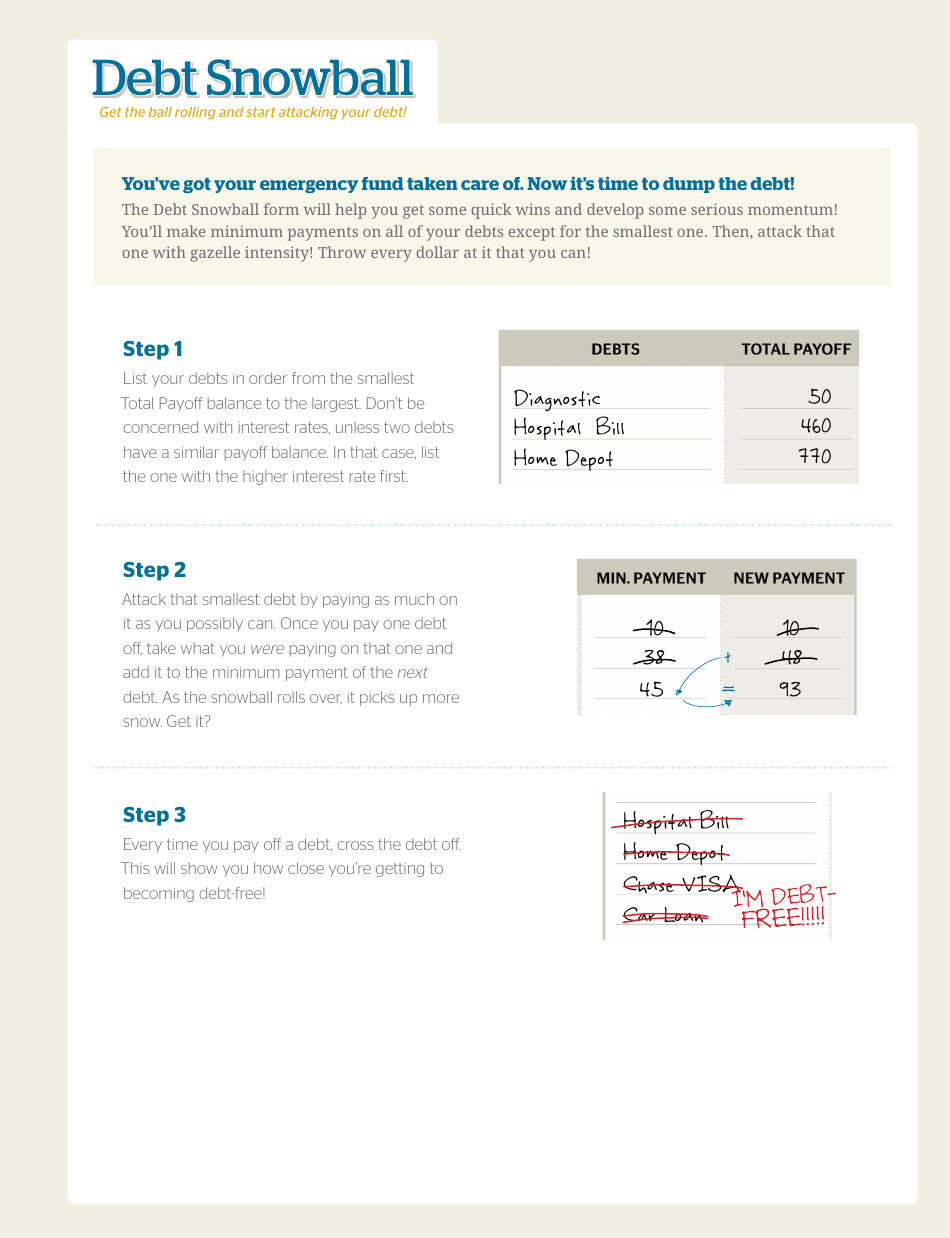

Debt Snowball Spreadsheet - Dave Ramsey's Financial Peace University

The Debt Snowball Spreadsheet is a tool used in Dave Ramsey's Financial Peace University to help individuals track and pay off their debts in a systematic way. It helps prioritize debts by focusing on paying off the smallest debt first while making minimum payments on other debts. This method aims to provide a sense of accomplishment and motivation as debts are gradually paid off.

The individual using Dave Ramsey's Financial Peace University would typically file the Debt Snowball Spreadsheet.

FAQ

Q: What is a debt snowball spreadsheet?

A: A debt snowball spreadsheet is a tool used to help individuals pay off their debts using Dave Ramsey's debt snowball method.

Q: What is Dave Ramsey's debt snowball method?

A: Dave Ramsey's debt snowball method is a strategy where you pay off your debts starting with the smallest balance first, while continuing to make minimum payments on the rest of your debts.

Q: How does the debt snowball spreadsheet work?

A: The debt snowball spreadsheet helps you track your debts and payments. It allows you to input your debts, including the balance, interest rate, and minimum payment. Based on this information, it calculates how to allocate your extra payments to pay off the smallest debt first.

Q: Why is the debt snowball method effective?

A: The debt snowball method is effective because it provides a sense of accomplishment by paying off smaller debts first. As you pay off each debt, you gain momentum and motivation to continue paying off the remaining debts.