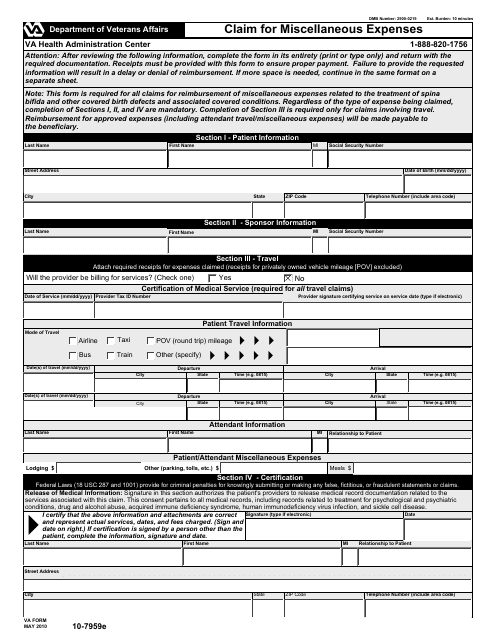

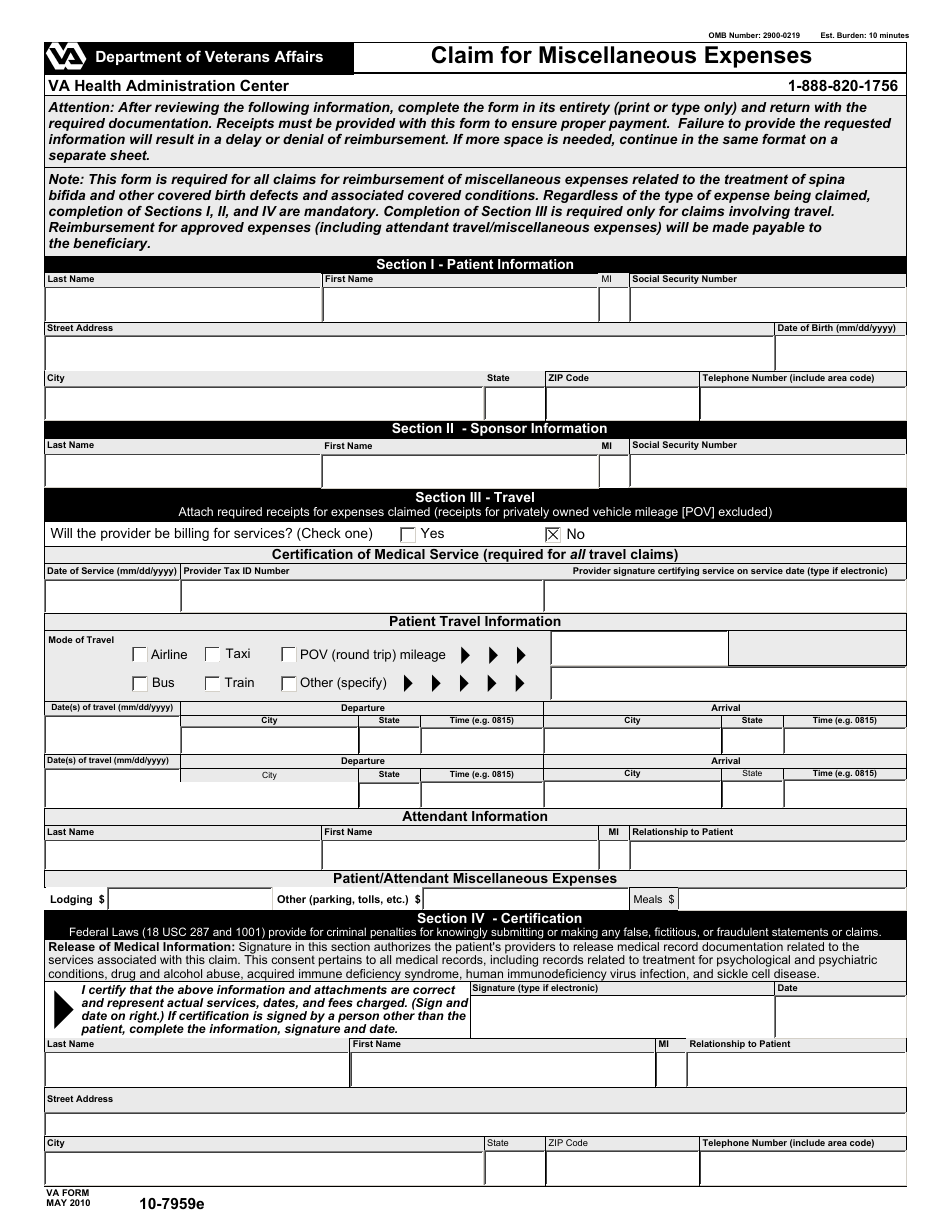

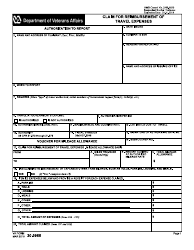

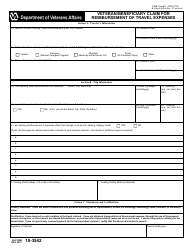

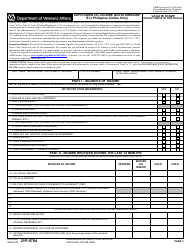

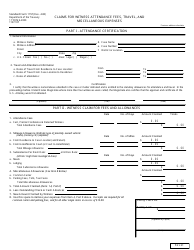

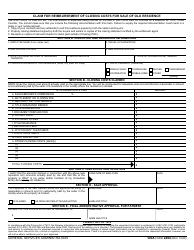

VA Form 10-7959e Claim for Miscellaneous Expenses

What Is VA Form 10-7959e?

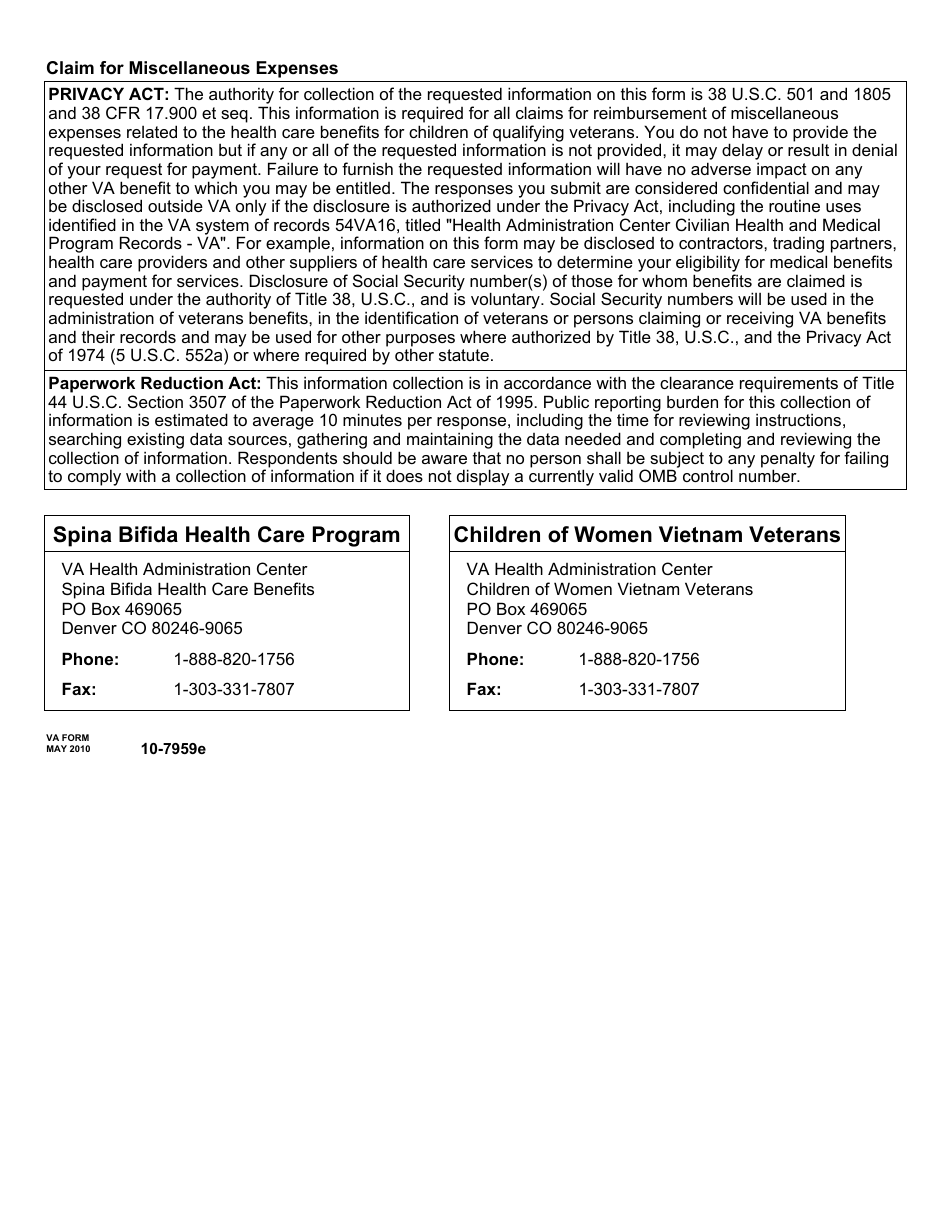

This is a legal form that was released by the U.S. Department of Veterans Affairs on May 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VA Form 10-7959e?

A: VA Form 10-7959e is a form used to claim miscellaneous expenses for veterans.

Q: Who can use VA Form 10-7959e?

A: Veterans who have incurred miscellaneous expenses related to their VA benefits or medical treatment can use VA Form 10-7959e.

Q: What types of expenses can be claimed with VA Form 10-7959e?

A: Expenses related to transportation, lodging, meals, and other miscellaneous costs can be claimed using VA Form 10-7959e.

Q: Is there a deadline for submitting VA Form 10-7959e?

A: Yes, VA Form 10-7959e should be submitted within one year from the date the expenses were incurred.

Q: Are there any supporting documents required with VA Form 10-7959e?

A: Yes, you may need to submit supporting documents such as receipts or invoices to substantiate your claimed expenses.

Q: Can I claim expenses for a family member with VA Form 10-7959e?

A: No, VA Form 10-7959e is only for claiming your own miscellaneous expenses, not those of a family member.

Q: What happens after I submit VA Form 10-7959e?

A: After submitting VA Form 10-7959e, your claim will be reviewed and processed by the VA to determine if your claimed expenses are eligible for reimbursement.

Form Details:

- Released on May 1, 2010;

- The latest available edition released by the U.S. Department of Veterans Affairs;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VA Form 10-7959e by clicking the link below or browse more documents and templates provided by the U.S. Department of Veterans Affairs.