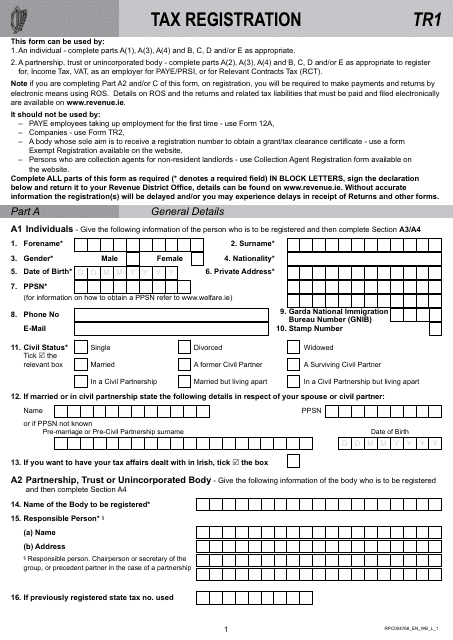

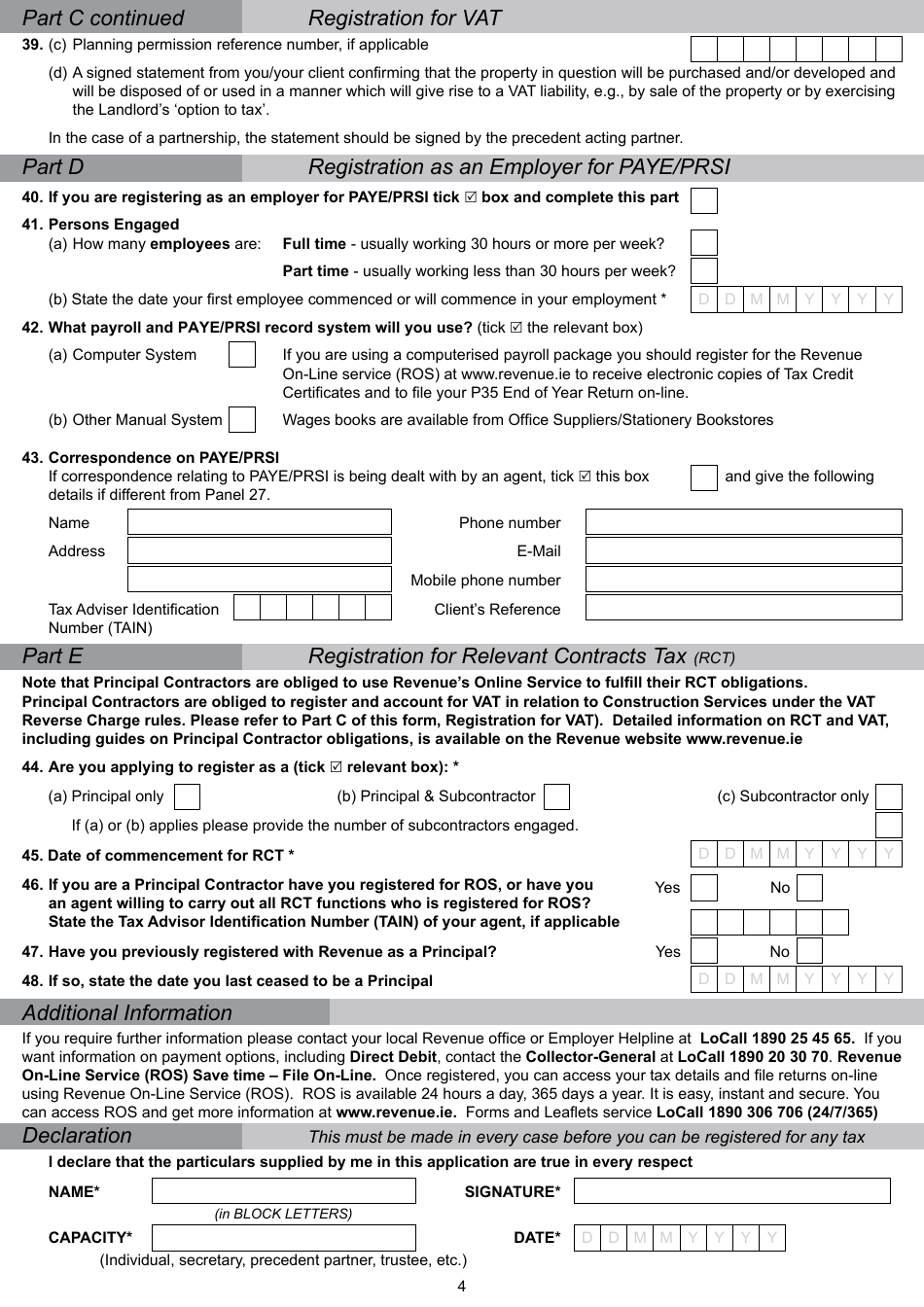

Form TR1 Tax Registration - Ireland

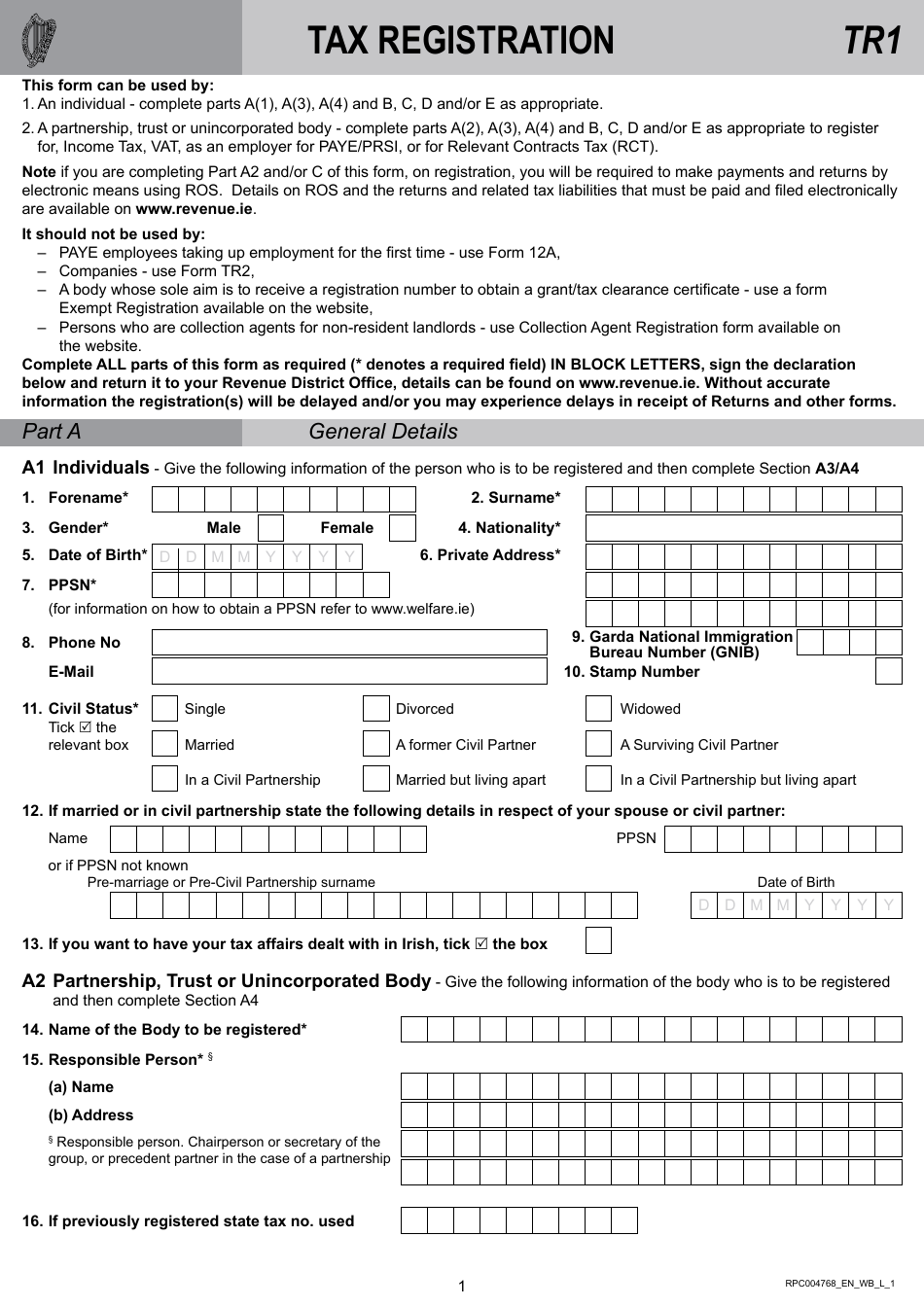

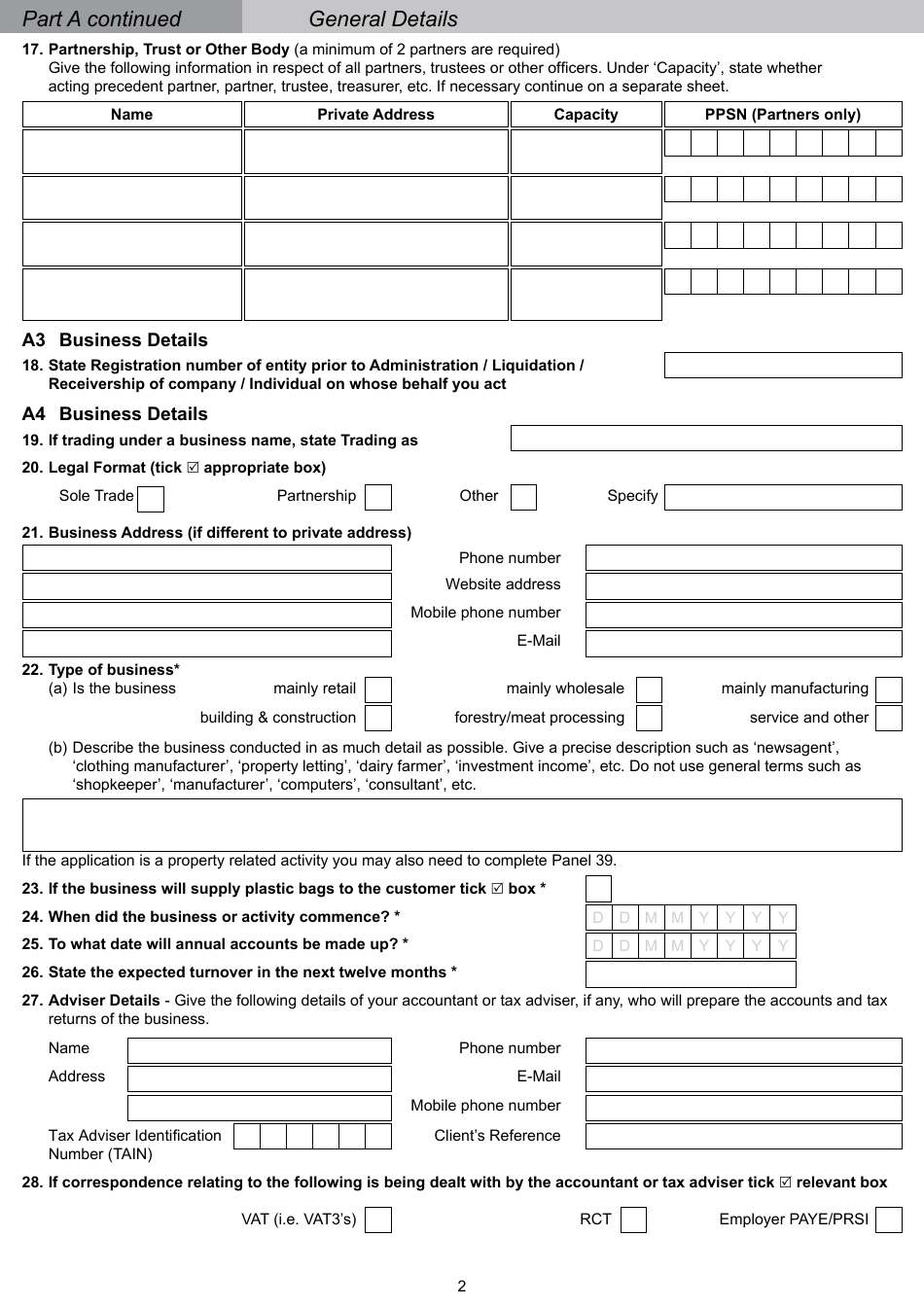

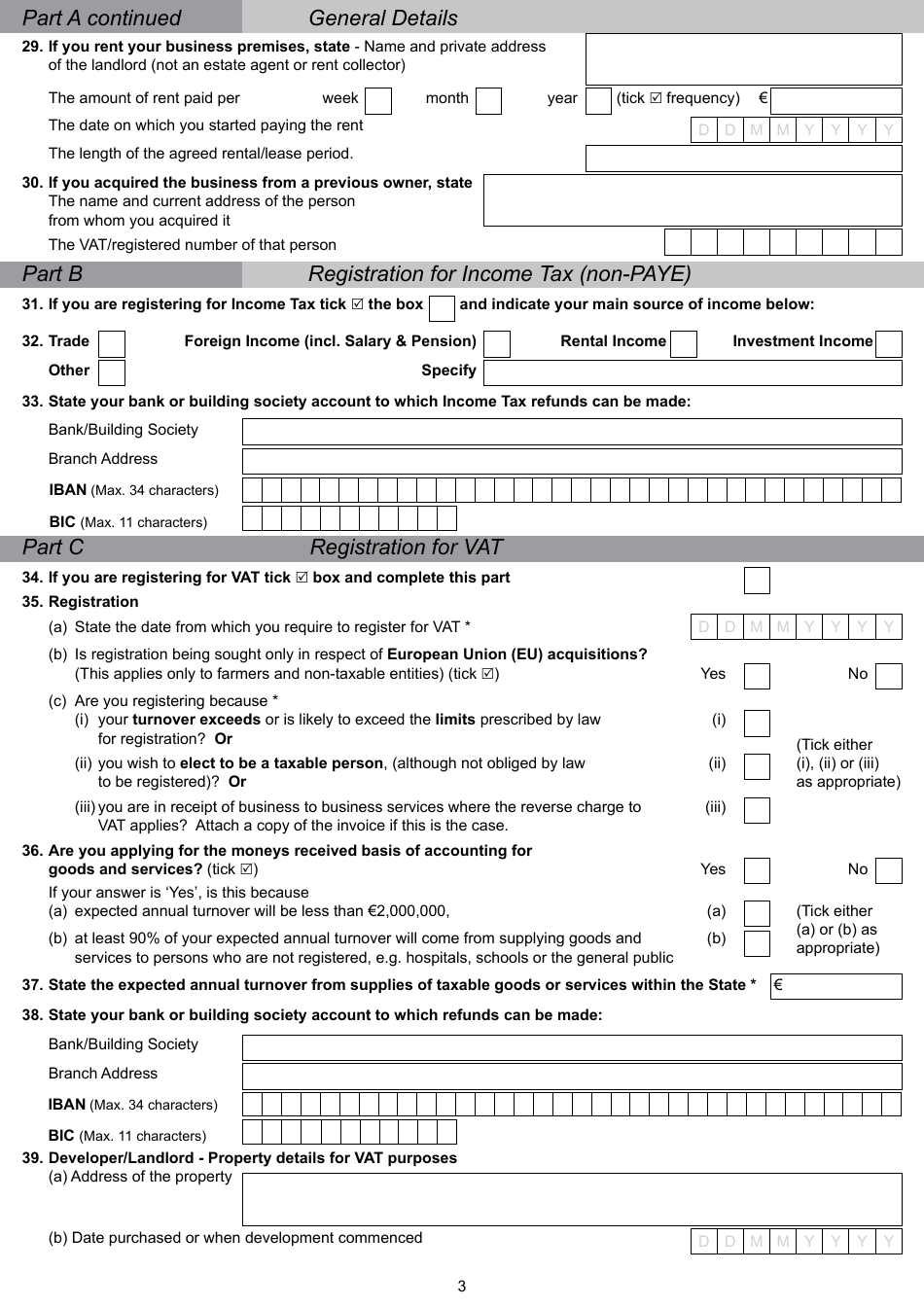

Form TR1 Tax Registration in Ireland is used for the registration of individuals and businesses with the Irish tax authorities (Revenue Commissioners) for various tax purposes, such as income tax, value-added tax (VAT), payroll taxes, and other business taxes. It is necessary for individuals and businesses operating in Ireland to register with the Revenue Commissioners to fulfill their tax obligations.

The Form TR1 Tax Registration in Ireland is typically filed by individuals or businesses who need to register for taxes with the Irish Revenue Commissioners.

FAQ

Q: What is a Form TR1?

A: Form TR1 is a tax registration form in Ireland.

Q: What is the purpose of Form TR1?

A: The purpose of Form TR1 is to register for tax in Ireland.

Q: Who needs to fill out Form TR1?

A: Anyone who is liable to pay tax in Ireland needs to fill out Form TR1.

Q: What information is required on Form TR1?

A: Form TR1 requires information such as name, address, PPS number, and details of income.

Q: When should Form TR1 be submitted?

A: Form TR1 should be submitted before you start earning income in Ireland.

Q: Are there any penalties for not submitting Form TR1?

A: Yes, there can be penalties for not submitting Form TR1, including fines and interest on any late payments.

Q: Is Form TR1 only for individuals?

A: No, Form TR1 is not only for individuals. It can also be used by businesses or self-employed individuals.

Q: What taxes can be registered for using Form TR1?

A: Form TR1 can be used to register for various taxes in Ireland, including income tax, VAT, and PAYE.