This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 14095

for the current year.

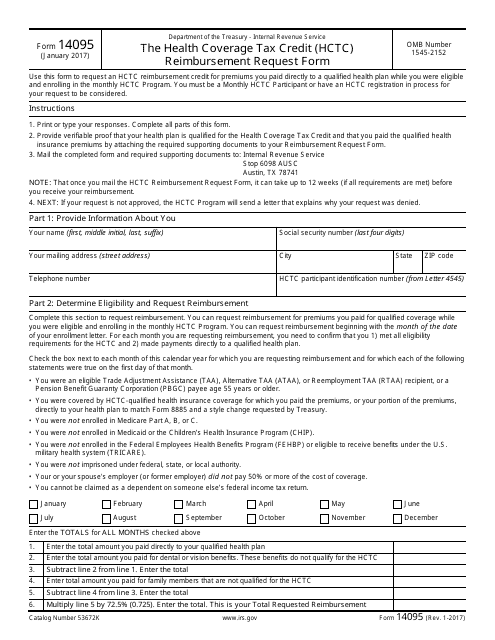

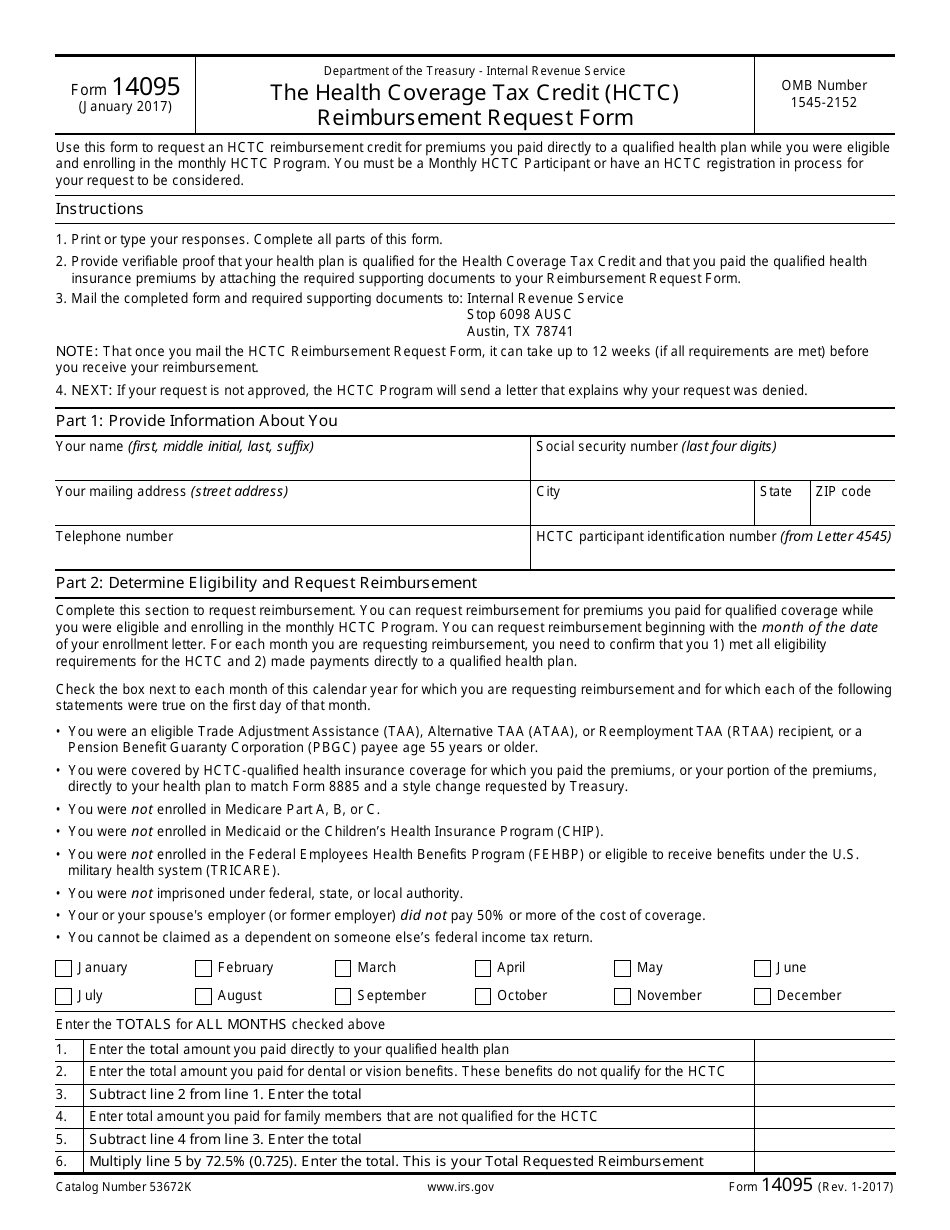

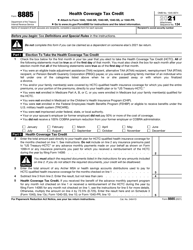

IRS Form 14095 The Health Coverage Tax Credit (Hctc) Reimbursement Request Form

What Is IRS Form 14095?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14095?

A: IRS Form 14095 is the Health CoverageTax Credit (HCTC) Reimbursement Request Form.

Q: What is the Health Coverage Tax Credit (HCTC)?

A: The Health Coverage Tax Credit (HCTC) is a tax credit program that helps eligible individuals and their families with the cost of health insurance premiums.

Q: Who is eligible for the Health Coverage Tax Credit (HCTC)?

A: Eligibility for the Health Coverage Tax Credit (HCTC) depends on factors such as being receiving certain types of trade adjustment assistance, pension recipients, and individuals who are between the ages of 55 and 65 and receive benefits from the Pension Benefit Guaranty Corporation (PBGC) under certain circumstances.

Q: What is the purpose of IRS Form 14095?

A: The purpose of IRS Form 14095 is to request reimbursement for qualified health insurance premiums paid by eligible individuals under the Health Coverage Tax Credit (HCTC) program.

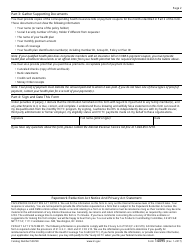

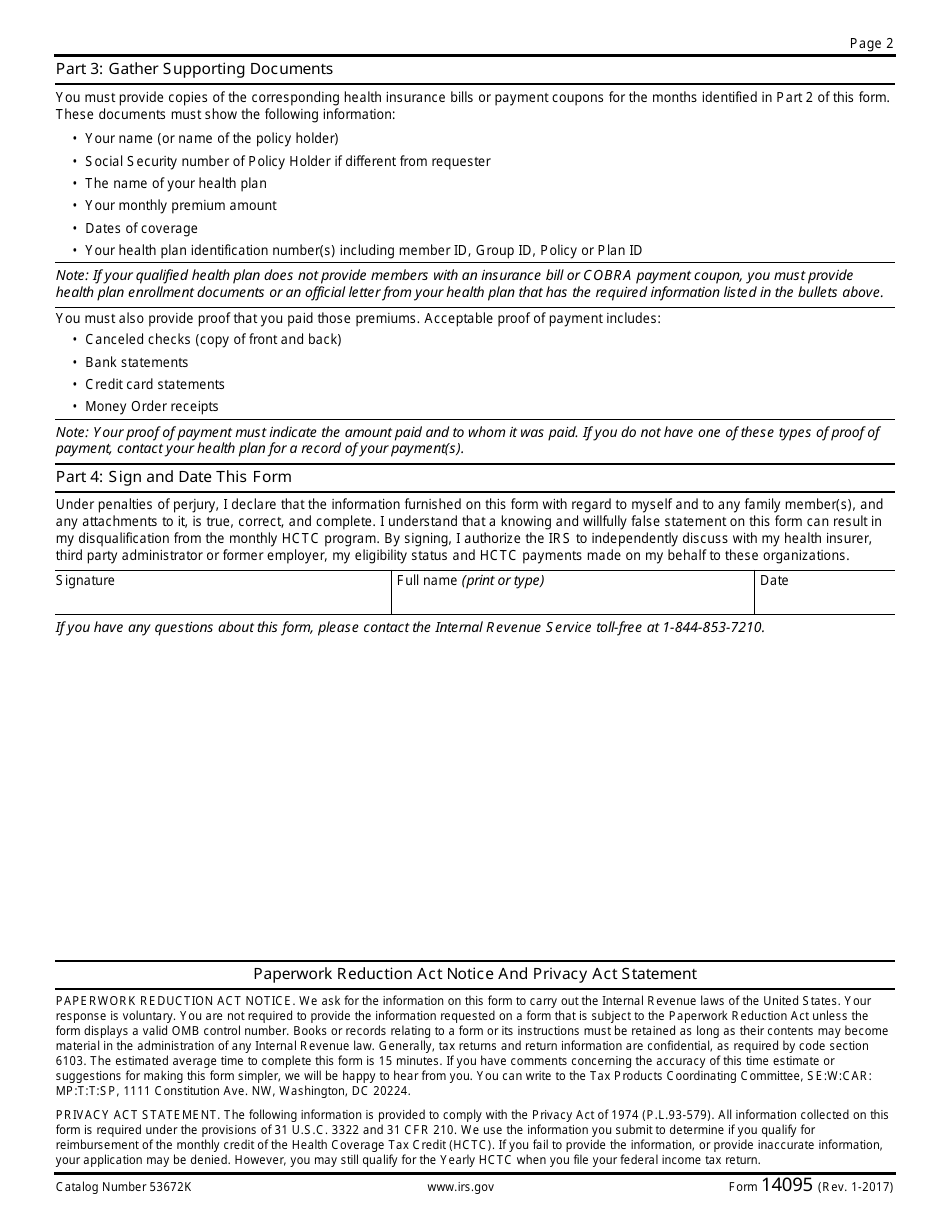

Q: How do I fill out IRS Form 14095?

A: To fill out IRS Form 14095, you will need to provide your personal information, details about your health insurance coverage, and submit supporting documents to substantiate your claim for reimbursement.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a printable version of IRS Form 14095 through the link below or browse more documents in our library of IRS Forms.