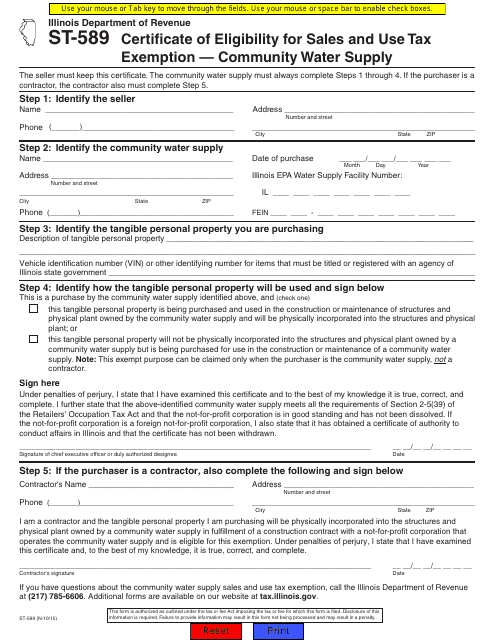

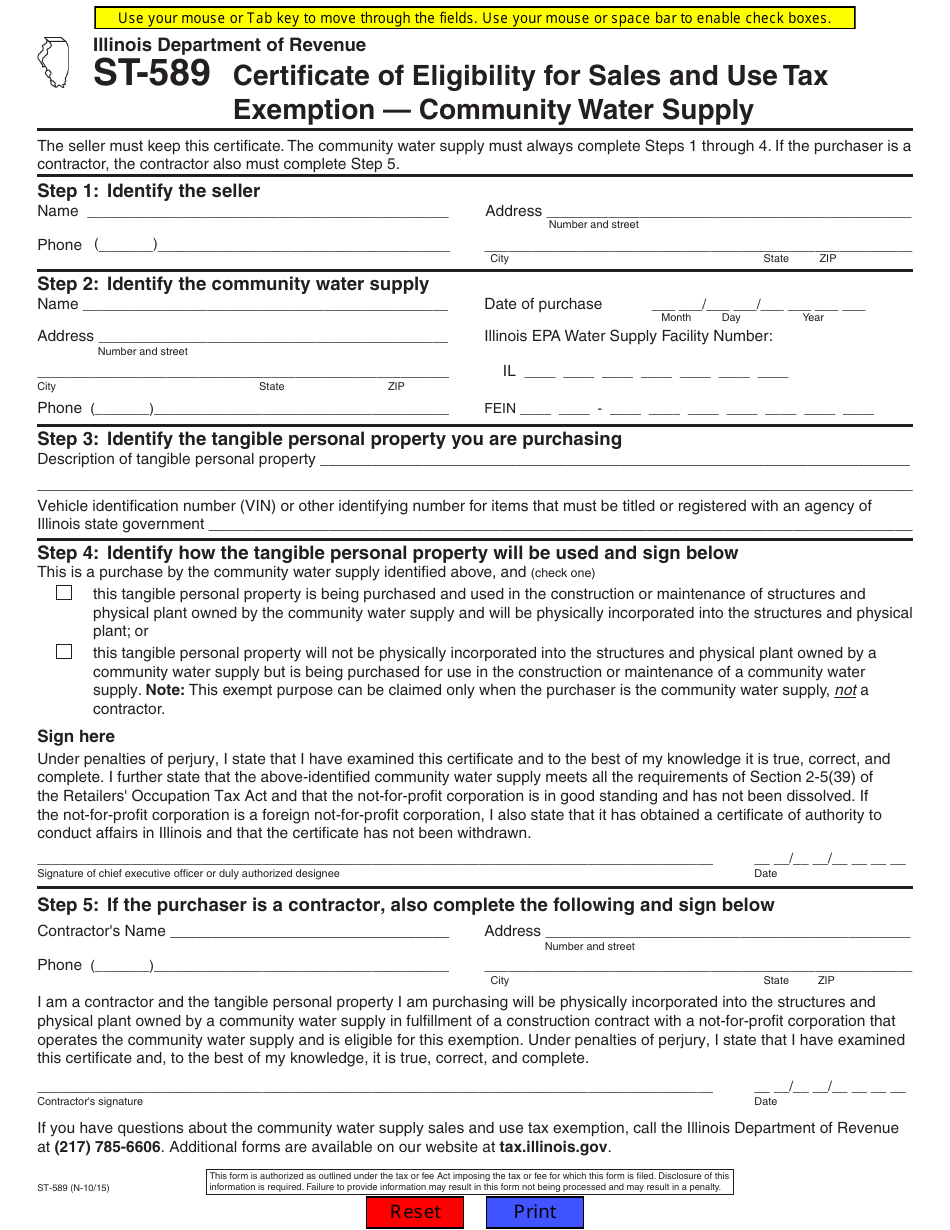

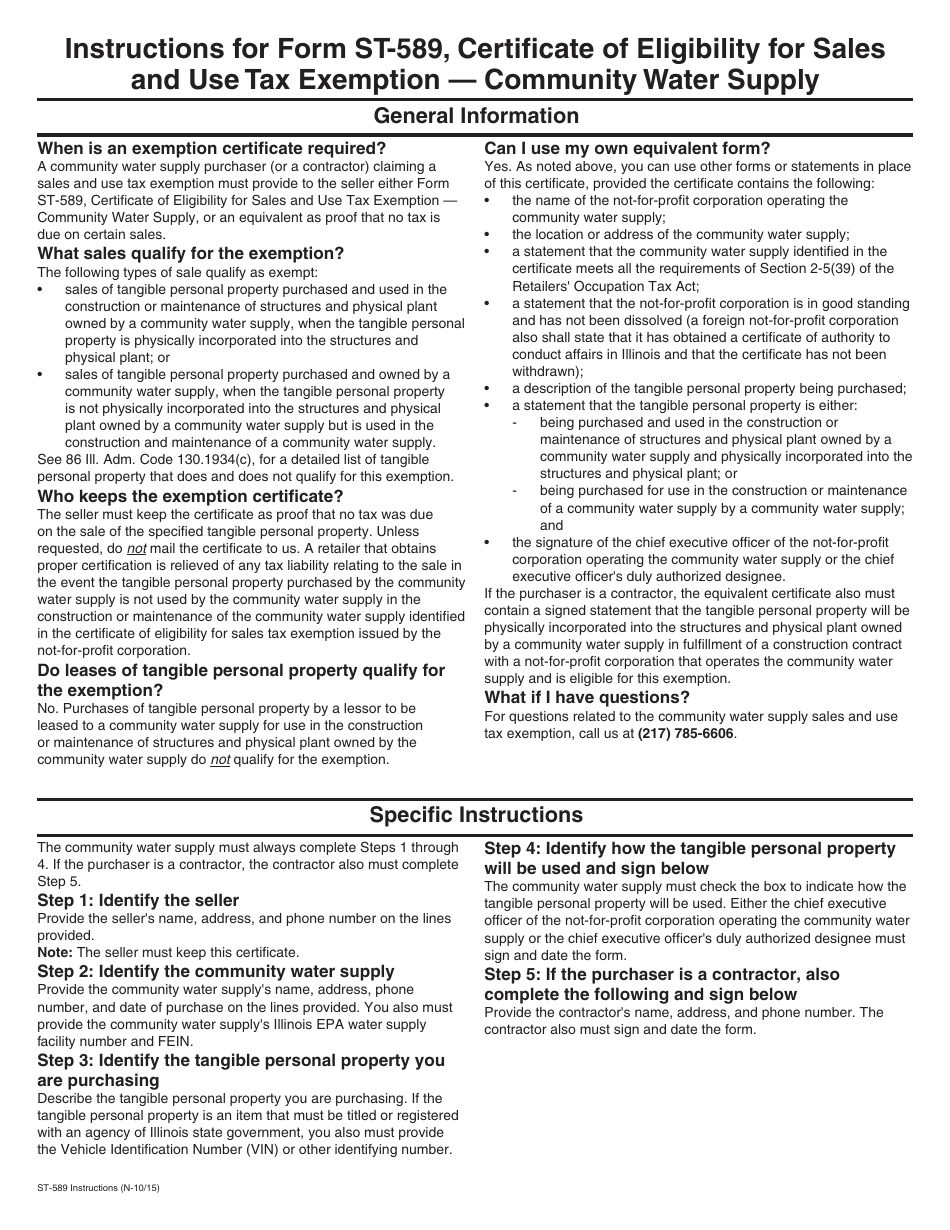

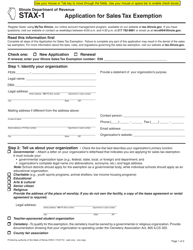

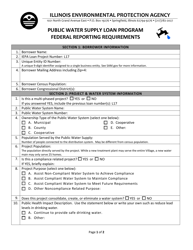

Form ST-589 Certificate of Eligibility for Sales and Use Tax Exemption " Community Water Supply - Illinois

What Is Form ST-589?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-589?

A: Form ST-589 is the Certificate of Eligibility for Sales and Use Tax Exemption for Community Water Supply in Illinois.

Q: Who is eligible to use Form ST-589?

A: Community Water Supply organizations in Illinois are eligible to use Form ST-589.

Q: What is the purpose of Form ST-589?

A: The purpose of Form ST-589 is to claim an exemption from sales and use tax for eligible purchases made by Community Water Supply organizations.

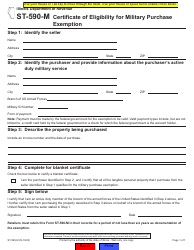

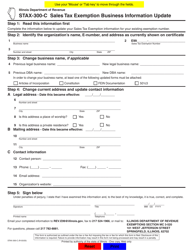

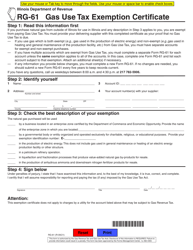

Q: What information is required on Form ST-589?

A: Form ST-589 requires information such as the organization's name, address, tax ID number, and a description of the items being purchased.

Q: Is there a fee for submitting Form ST-589?

A: No, there is no fee for submitting Form ST-589.

Q: How long does it take to process Form ST-589?

A: The processing time for Form ST-589 may vary, but it is typically processed within a few weeks.

Q: Are there any limitations to the tax exemption?

A: Yes, there are limitations to the tax exemption. It only applies to eligible purchases made by Community Water Supply organizations.

Q: Can Form ST-589 be used for multiple purchases?

A: Yes, Form ST-589 can be used for multiple purchases made by Community Water Supply organizations within the same tax period.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-589 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.