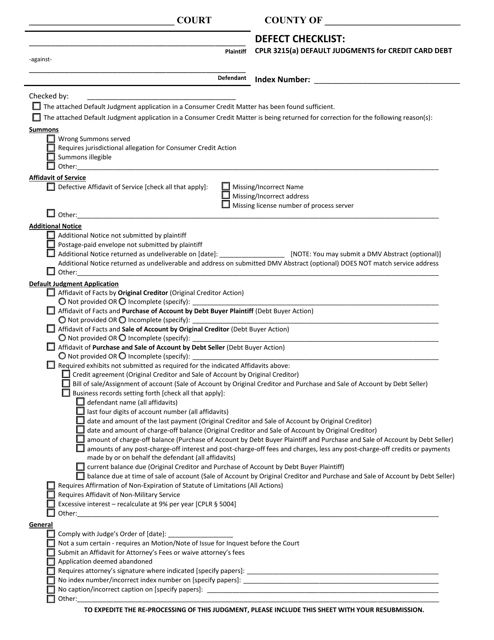

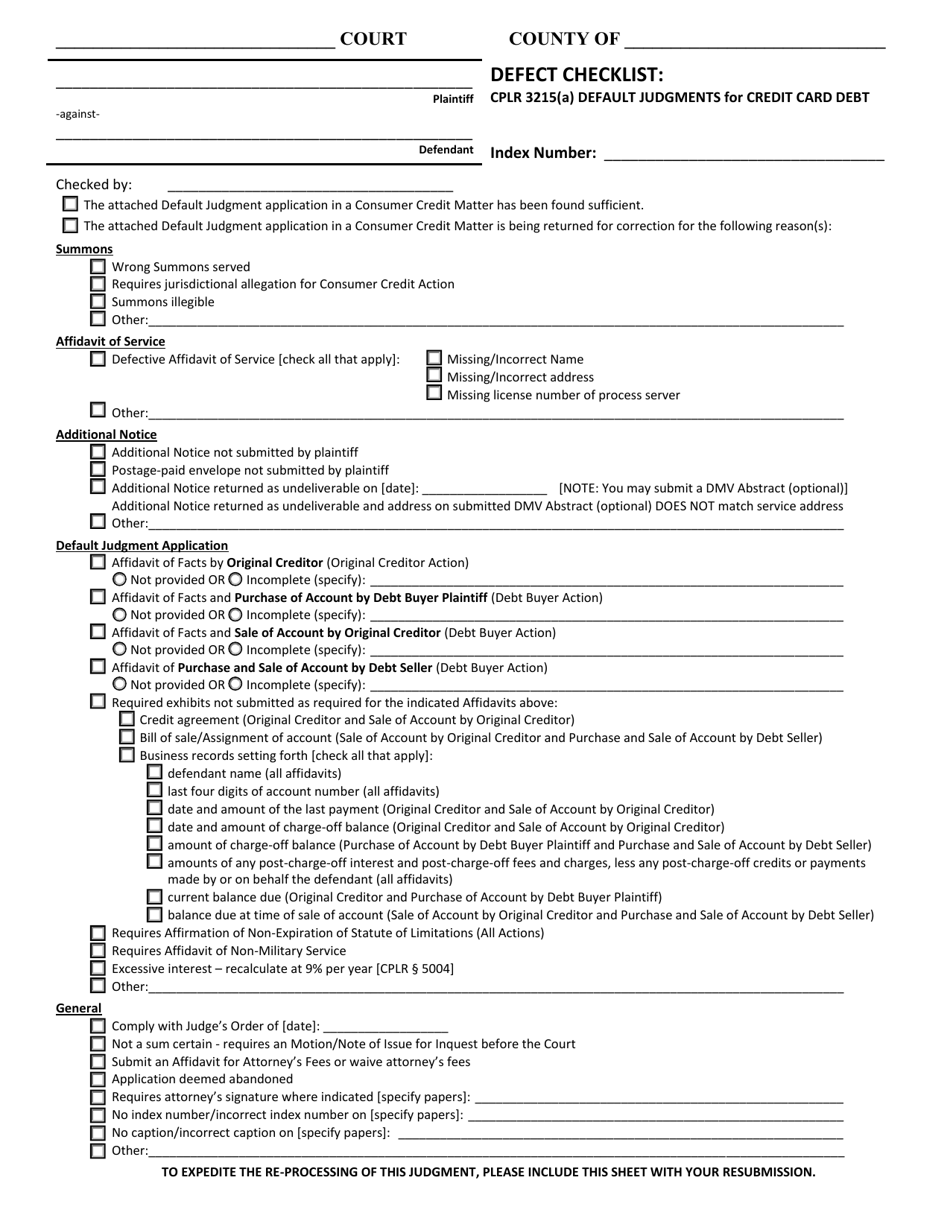

Defect Checklist - Cplr 3215(A) Default Judgments for Credit Card Debt - New York

Defect Checklist - Cplr 3215(A) Default Judgments for Credit Card Debt is a legal document that was released by the New York State Unified Court System - a government authority operating within New York.

FAQ

Q: What is CPLR 3215(A)?

A: CPLR 3215(A) refers to a section of the Civil Practice Law and Rules in New York.

Q: What does CPLR 3215(A) pertain to?

A: CPLR 3215(A) pertains to default judgments for credit card debt in New York.

Q: What is a default judgment?

A: A default judgment is a judgment entered in favor of a party when the other party fails to respond or appear in court.

Q: How does CPLR 3215(A) apply to credit card debt?

A: CPLR 3215(A) provides guidelines for obtaining default judgments specifically for credit card debt cases.

Q: What is a defect checklist?

A: A defect checklist is a document that outlines the potential flaws or deficiencies in a legal case.

Q: What is the purpose of a defect checklist?

A: The purpose of a defect checklist is to ensure that all necessary procedural requirements are met before a default judgment is granted.

Q: Why is a defect checklist important?

A: A defect checklist is important because failure to meet certain procedural requirements can result in the denial of a default judgment.

Q: Who is responsible for preparing a defect checklist?

A: The party seeking a default judgment for credit card debt is responsible for preparing the defect checklist.

Q: What are some common defects in credit card debt cases?

A: Some common defects in credit card debt cases may include incorrect or missing documentation, lack of proper notice to the debtor, or failure to properly serve the summons and complaint.

Q: How can a party cure defects in a credit card debt case?

A: A party can cure defects in a credit card debt case by addressing and correcting the specific issues identified in the defect checklist.

Form Details:

- The latest edition currently provided by the New York State Unified Court System;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York State Unified Court System.