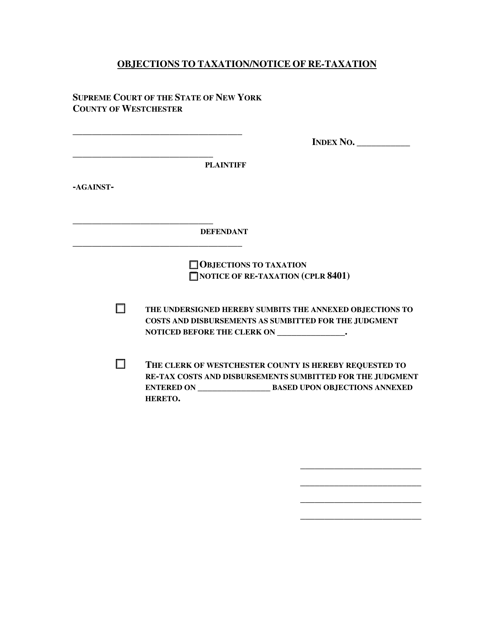

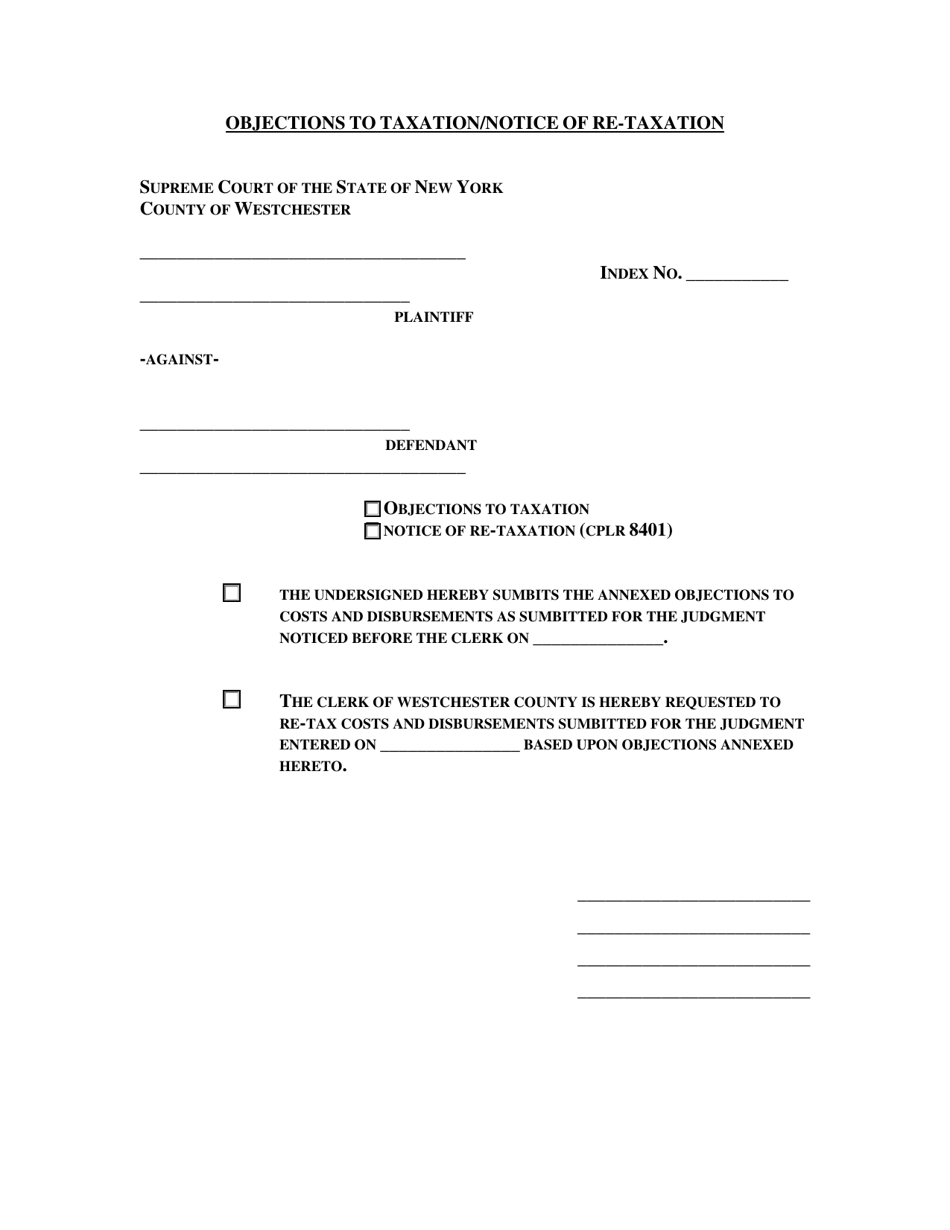

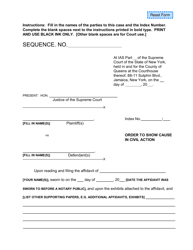

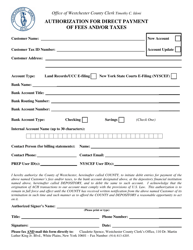

Objections to Taxation / Notice of Re-taxation - Westchester County, New York

Objections to Taxation/Notice of Re-taxation is a legal document that was released by the Supreme Court - Westchester County, New York - a government authority operating within New York. The form may be used strictly within Westchester County.

FAQ

Q: What is a Notice of Re-taxation?

A: A Notice of Re-taxation is a notification from the local government that your property taxes will be increased.

Q: Why would my property taxes be increased?

A: Property taxes can be increased for various reasons such as changes in property assessment, changes in tax rates, or changes in local government budget.

Q: Can I object to the tax increase?

A: Yes, you have the right to object to the tax increase by filing an Objection to Taxation.

Q: What is an Objection to Taxation?

A: An Objection to Taxation is a legal document that allows you to formally challenge the increase in your property taxes.

Q: How can I file an Objection to Taxation?

A: To file an Objection to Taxation, you need to complete the necessary forms provided by the local government and submit them within the specified deadline.

Q: What happens after I file an Objection to Taxation?

A: After you file an Objection to Taxation, your case will be reviewed by a local tax assessment review board or a similar authority.

Q: Can I represent myself or do I need a lawyer?

A: You have the option to represent yourself in the Objection to Taxation process, but hiring a lawyer who is experienced in property tax matters can be beneficial.

Q: What are some common arguments for tax objections?

A: Common arguments for tax objections include incorrect property assessment, comparable sales data, excessive tax rates, and property-specific circumstances.

Q: Can I request a reassessment of my property?

A: Yes, in some cases you may be able to request a reassessment of your property if you believe the current assessment is unfair or inaccurate.

Q: Is there a deadline to file an Objection to Taxation?

A: Yes, there is typically a deadline to file an Objection to Taxation, so it's important to check with the local government for the specific deadline.

Form Details:

- The latest edition currently provided by the Supreme Court - Westchester County, New York;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Supreme Court - Westchester County, New York.