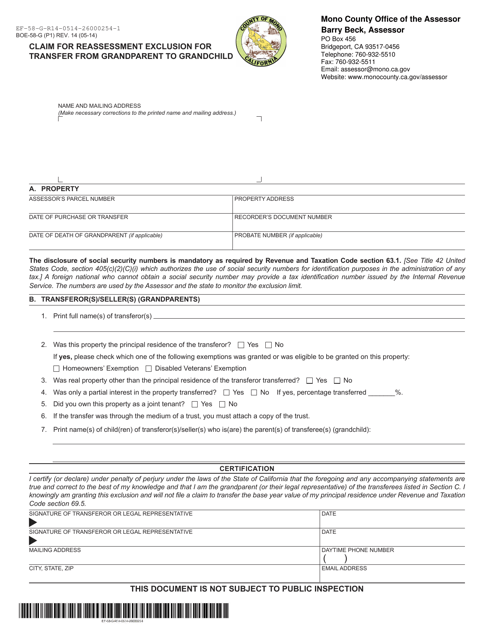

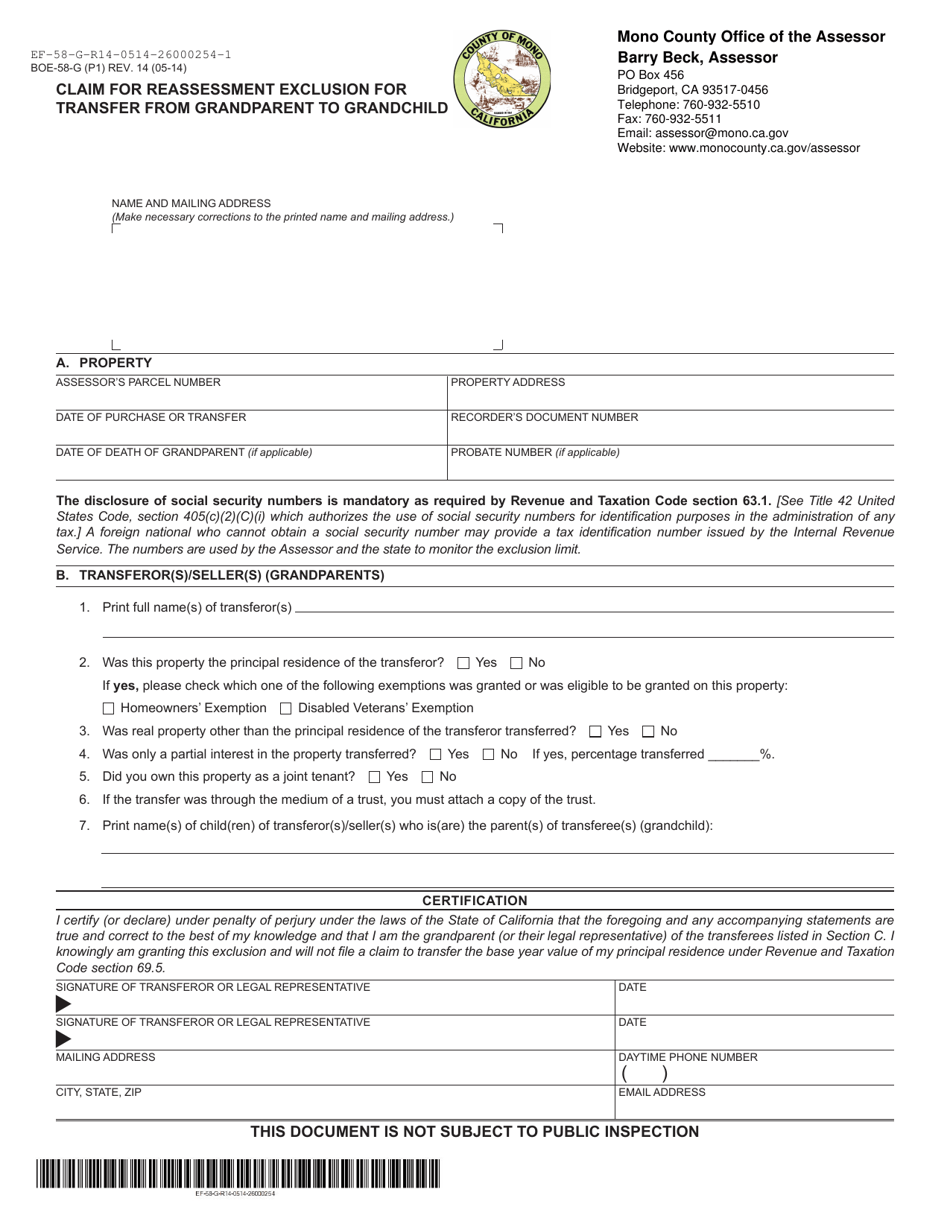

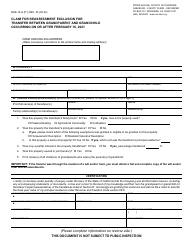

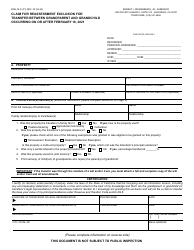

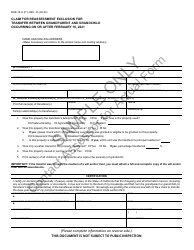

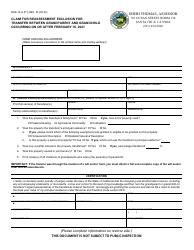

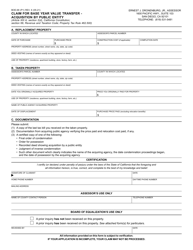

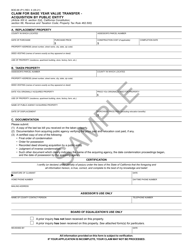

Form BOE-58-G Claim for Reassessment Exclusion for Transfer From Grandparent to Grandchild - Mono County, California

What Is Form BOE-58-G?

This is a legal form that was released by the Assessor's Office - Mono County, California - a government authority operating within California. The form may be used strictly within Mono County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-58-G?

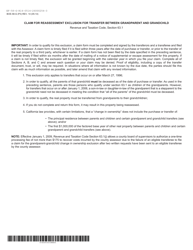

A: Form BOE-58-G is a claim for reassessment exclusion for transfers from a grandparent to a grandchild in Mono County, California.

Q: What is the purpose of Form BOE-58-G?

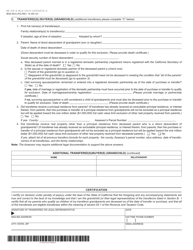

A: The purpose of Form BOE-58-G is to apply for an exclusion from property tax reassessment when transferring real property from a grandparent to a grandchild.

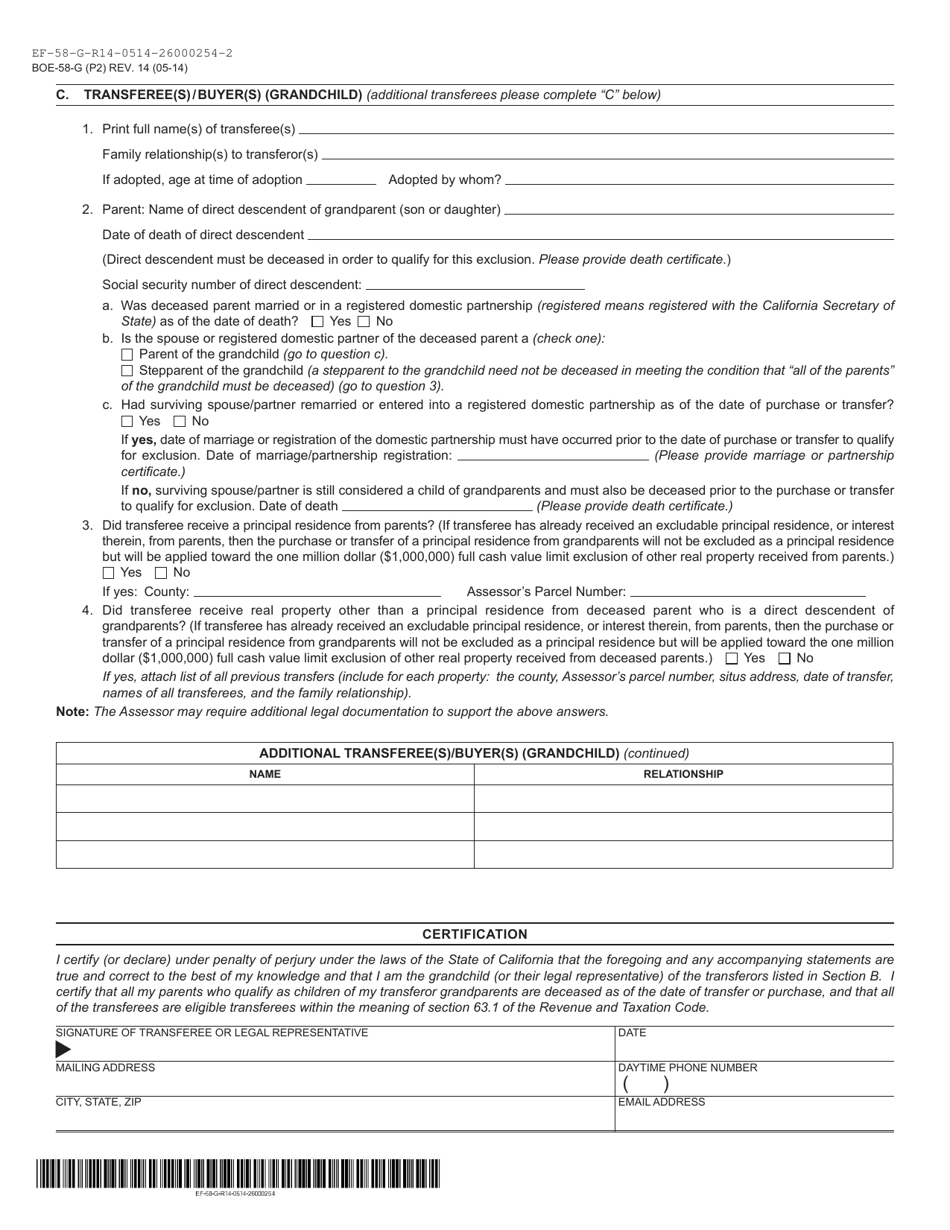

Q: Who can use Form BOE-58-G?

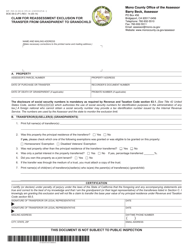

A: Form BOE-58-G can be used by individuals who are transferring real property from a grandparent to a grandchild in Mono County, California.

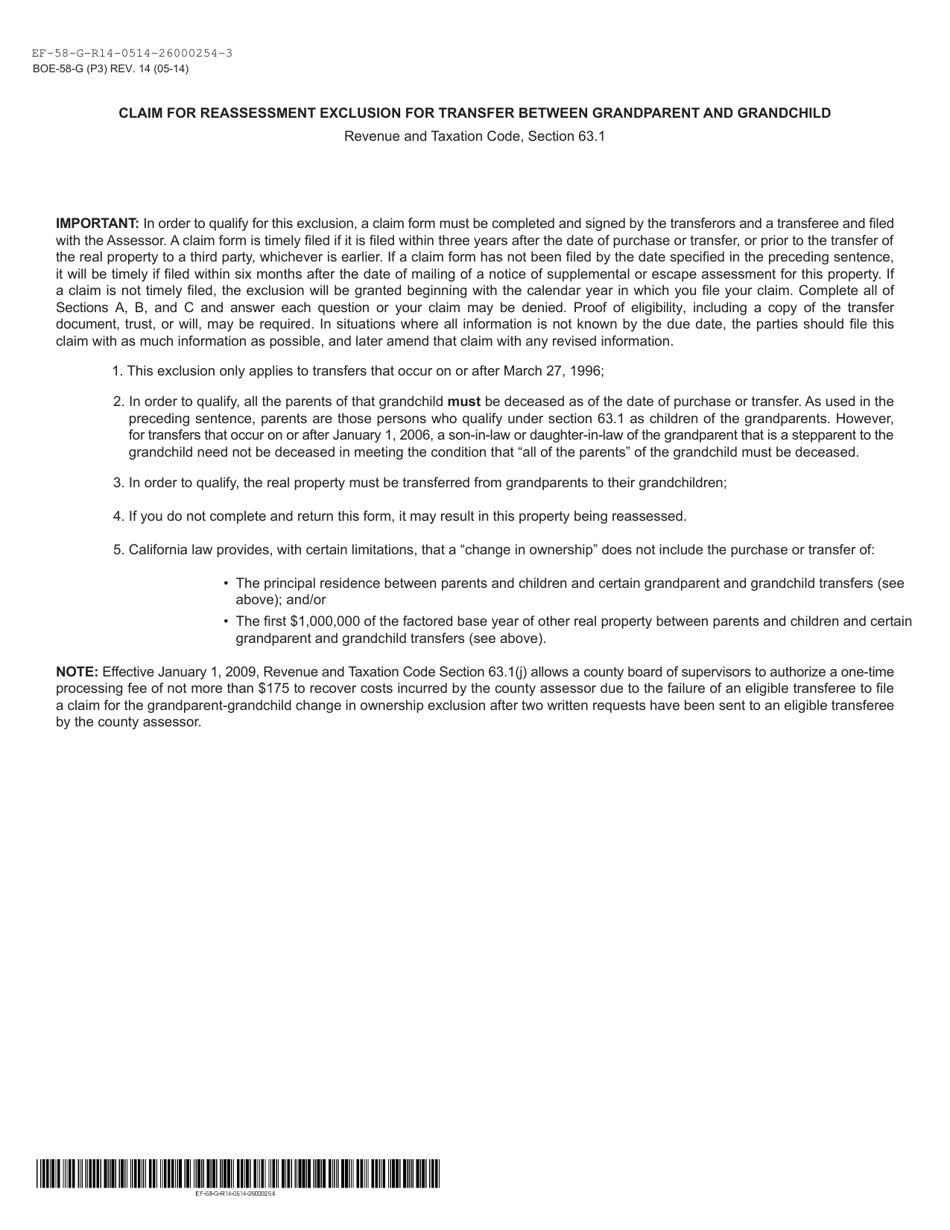

Q: What is the reassessment exclusion for transfers from grandparent to grandchild?

A: The reassessment exclusion allows eligible transfers of real property from a grandparent to a grandchild to be excluded from property tax reassessment.

Q: Are there any eligibility requirements for the reassessment exclusion?

A: Yes, there are eligibility requirements that must be met in order to qualify for the reassessment exclusion. Contact the Mono County Assessor's Office for more information.

Q: What should I do with the completed Form BOE-58-G?

A: The completed Form BOE-58-G should be filed with the Mono County Assessor's Office.

Q: Is there a deadline to submit Form BOE-58-G?

A: Yes, Form BOE-58-G must be filed within three years of the date of the transfer of the real property.

Q: Can I use Form BOE-58-G for transfers between other family members?

A: No, Form BOE-58-G is specifically for transfers from a grandparent to a grandchild. Other family transfers may have different forms or requirements.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Assessor's Office - Mono County, California;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-58-G by clicking the link below or browse more documents and templates provided by the Assessor's Office - Mono County, California.