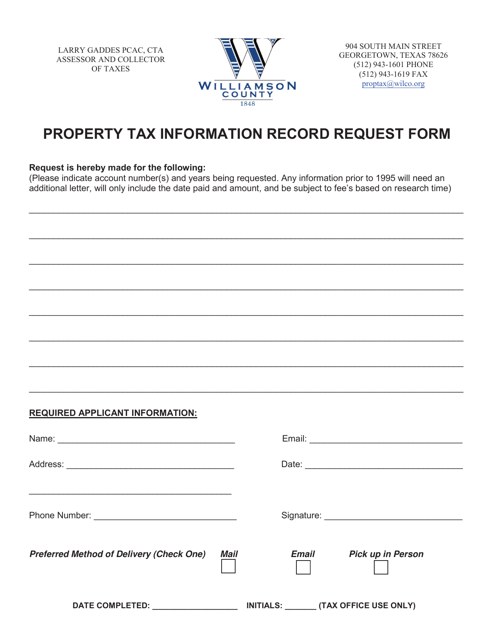

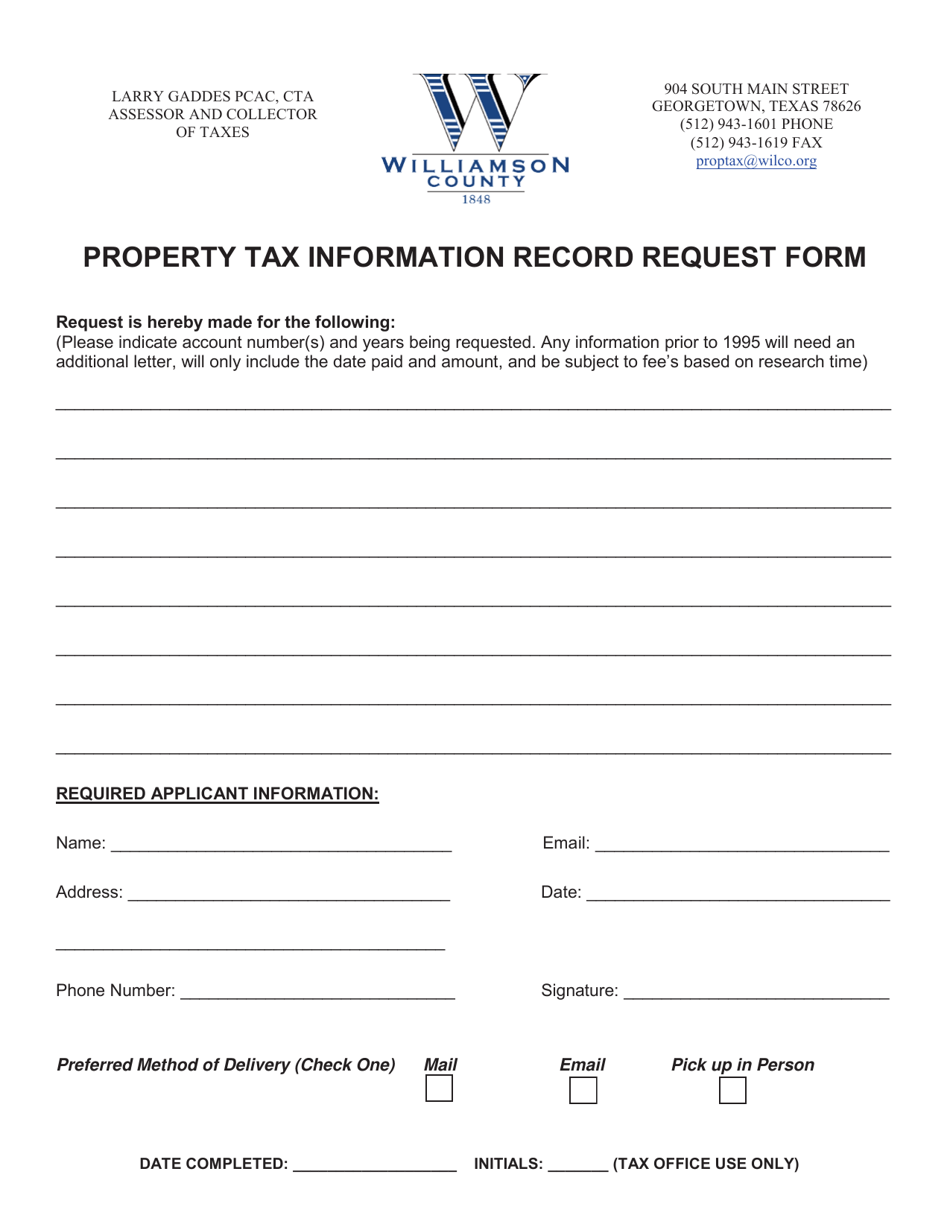

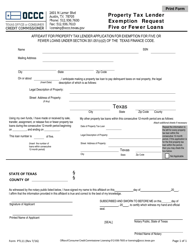

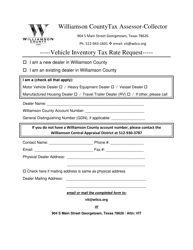

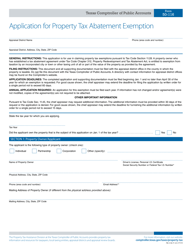

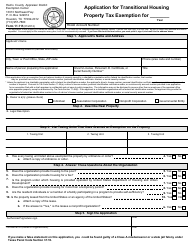

Property Tax Information Record Request Form - Williamson County, Texas

Property Tax Information Record Request Form is a legal document that was released by the Tax Assessor/Collector's Office - Williamson County, Texas - a government authority operating within Texas. The form may be used strictly within Williamson County.

FAQ

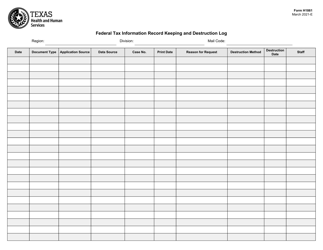

Q: What is the Property Tax Information Record Request Form?

A: The Property Tax Information Record Request Form is a document used in Williamson County, Texas to request information about property taxes.

Q: What information do I need to provide on the form?

A: You will need to provide your contact information and specific details about the property for which you are requesting tax information.

Q: What can I use the Property Tax Information Record Request Form for?

A: You can use the form to request information about property taxes, such as assessment values, tax rates, and payment history.

Q: Is there a fee for submitting the form?

A: There may be a fee associated with submitting the Property Tax Information Record Request Form. Contact the Williamson County, Texas government office for more information.

Q: How long does it take to receive the requested information?

A: The processing time for the request may vary. Contact the Williamson County, Texas government office for an estimate on the time it will take to receive the requested information.

Q: Can I submit the form electronically?

A: You will need to check with the Williamson County, Texas government office to determine if they accept electronic submissions of the Property Tax Information Record Request Form.

Q: What should I do if I have additional questions about property taxes in Williamson County, Texas?

A: If you have additional questions about property taxes in Williamson County, Texas, you can contact the Williamson County tax office for assistance.

Form Details:

- The latest edition currently provided by the Tax Assessor/Collector's Office - Williamson County, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tax Assessor/Collector's Office - Williamson County, Texas.