Gift of Equity Letter Template

A Gift of Equity Letter Template is typically used in real estate transactions when a property owner decides to transfer a portion of the property's equity to another person as a gift. This template serves as a written document that outlines the terms of the gift and provides a legal record of the transaction. It is often used by homeowners who want to help a family member or friend with purchasing a home by giving them a portion of the property's equity as a gift. The letter template helps ensure that both parties understand the terms of the gift and can be used for documentation purposes during the real estate transaction process.

The gift of equity letter template is typically filed and submitted by the individual or party giving the gift of equity.

FAQ

Q: What is a gift of equity?

A: A gift of equity refers to the transfer of ownership of a property in the form of a gift, typically from the current homeowner to a family member or a close relative at a reduced price or with favorable terms.

Q: Why would someone give a gift of equity?

A: There can be several reasons for giving a gift of equity. It may be done to help a family member or relative purchase a home, to assist with estate planning, or to potentially minimize taxes and fees associated with the property transfer.

Q: Is a gift of equity taxable?

A: While I am not a tax professional, generally a gift of equity is not taxable for the recipient in the United States. However, it's important to consult with a tax advisor or attorney to understand any potential tax implications of a specific gift of equity.

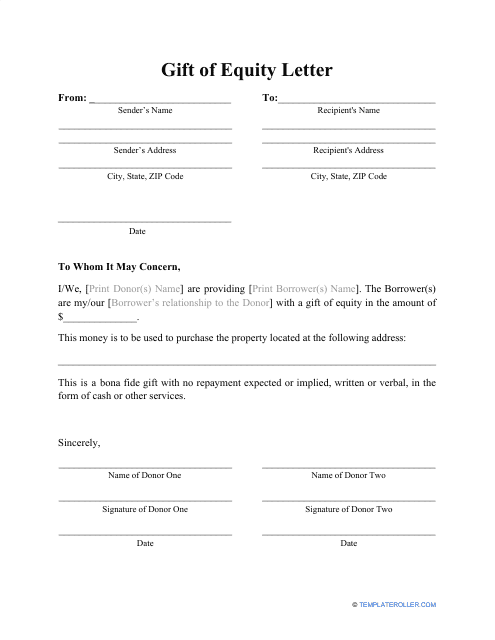

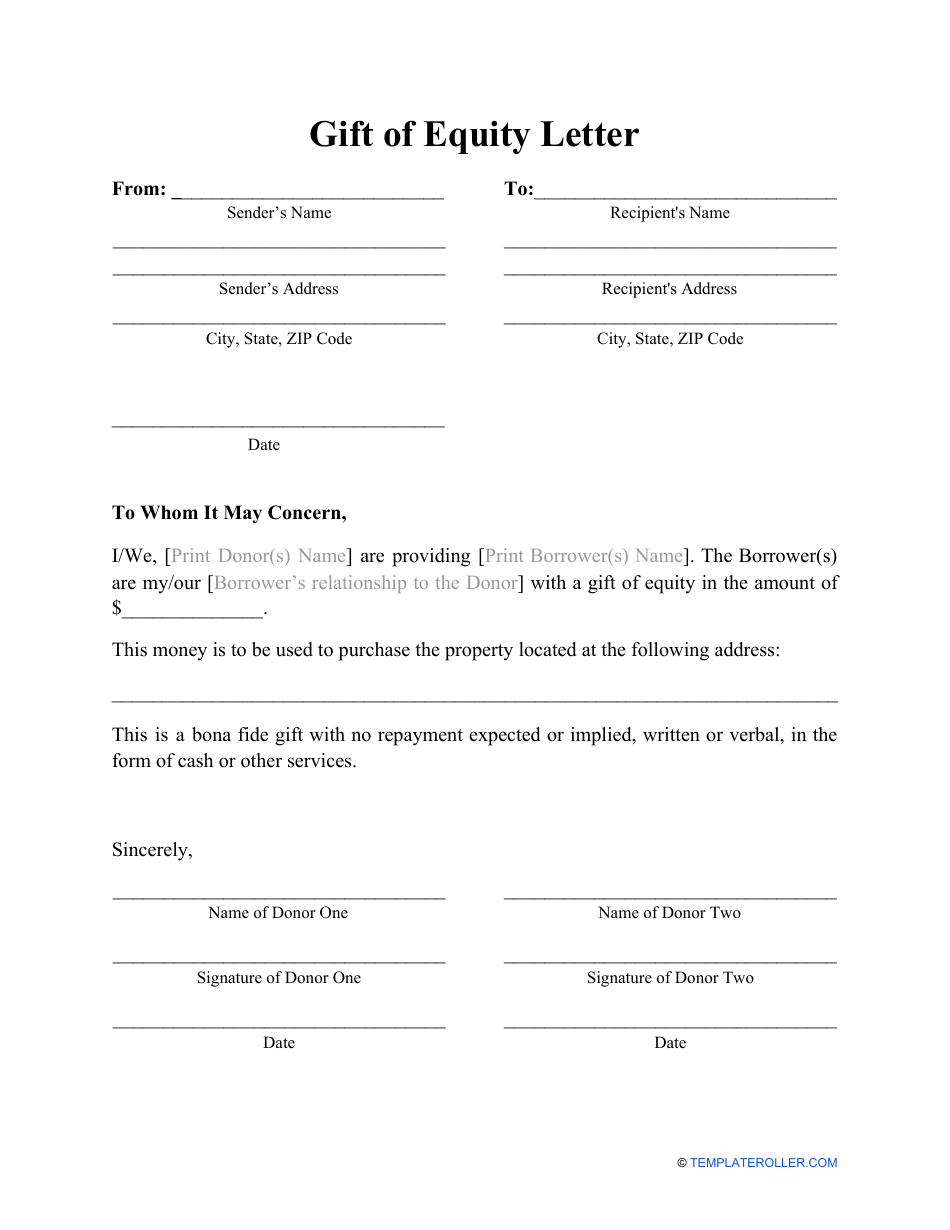

Q: What should be included in a gift of equity letter?

A: A gift of equity letter should include the following details: 1) The intention to give a gift of equity, 2) The donor's name, address, and contact information, 3) The recipient's name, address, and contact information, 4) The property address, 5) The relationship between the donor and recipient, 6) The amount or percentage of equity being gifted, and 7) Signatures of the donor and recipient.

Q: Is a gift of equity legally binding?

A: Yes, a gift of equity can be legally binding. However, it's recommended to consult with a real estate attorney to ensure that all legal requirements are met, and to properly document the gift of equity to protect the interests of both the donor and the recipient.

Q: Can a gift of equity be used as a down payment?

A: Yes, a gift of equity can be used as a down payment towards the purchase of a property. However, it's important to check with the mortgage lender to understand their specific requirements and guidelines regarding the use of gift funds for a down payment.