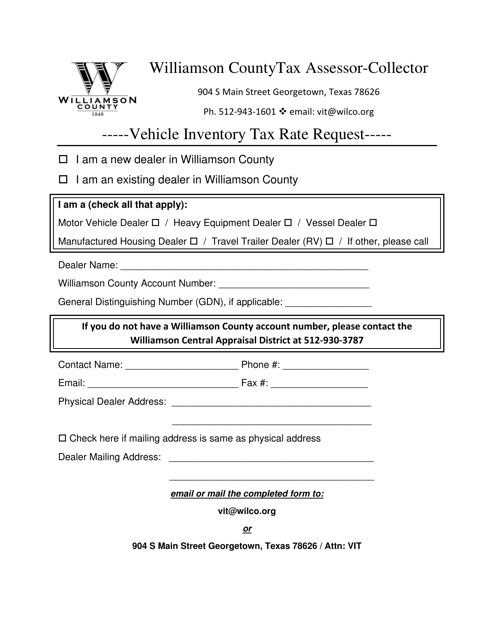

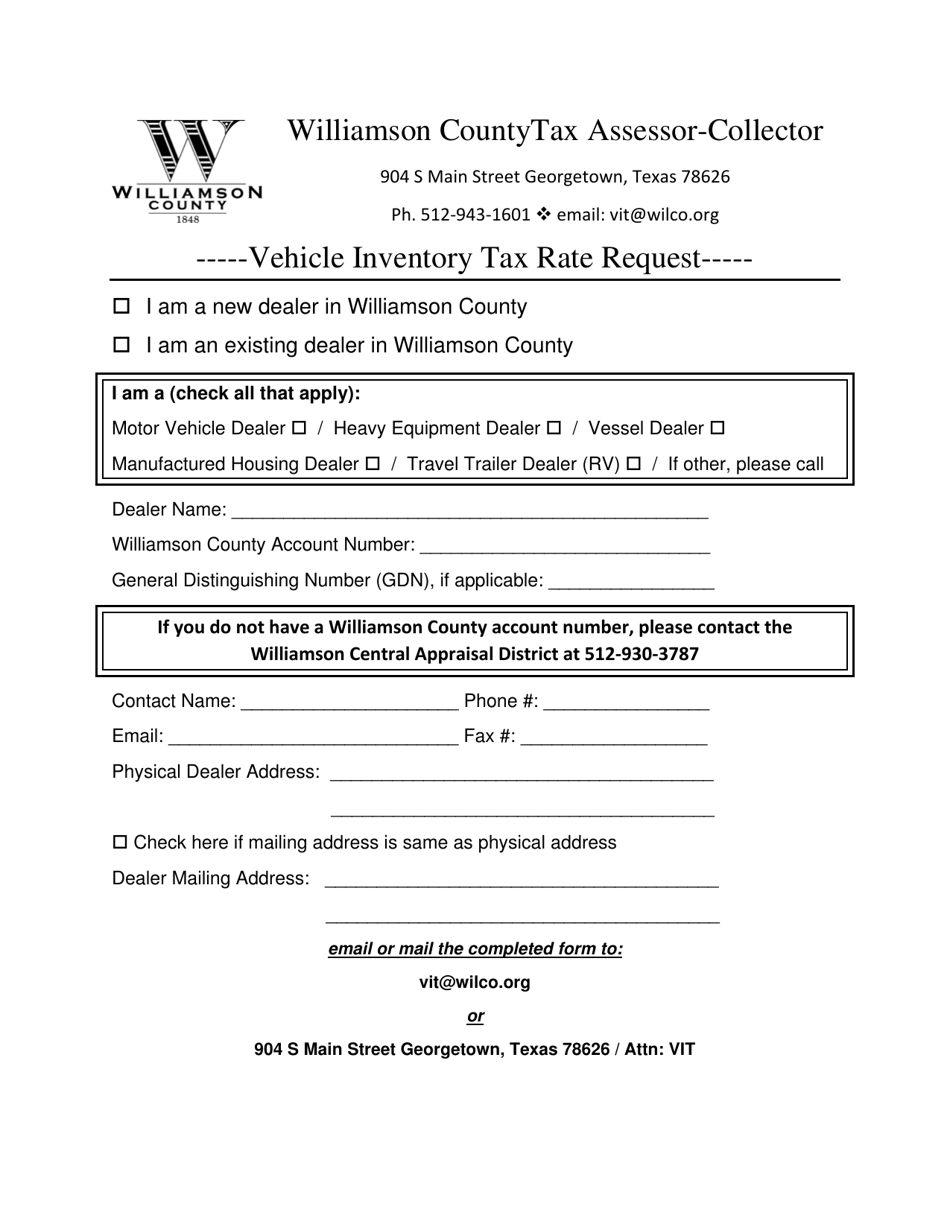

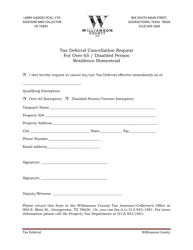

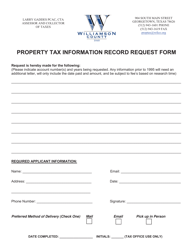

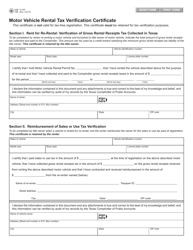

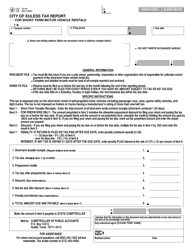

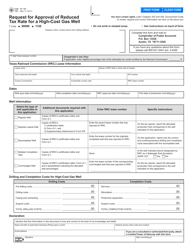

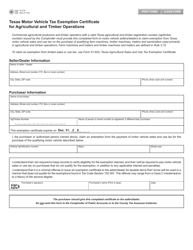

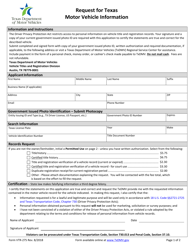

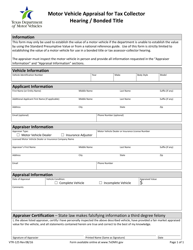

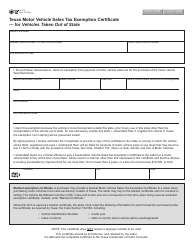

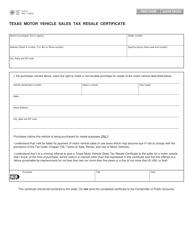

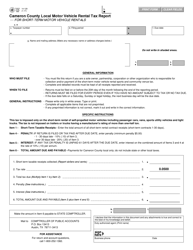

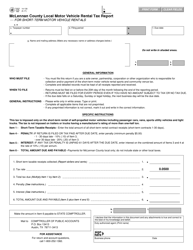

Vehicle Inventory Tax Rate Request - Williamson County, Texas

Vehicle Inventory Tax Rate Request is a legal document that was released by the Tax Assessor/Collector's Office - Williamson County, Texas - a government authority operating within Texas. The form may be used strictly within Williamson County.

FAQ

Q: What is the vehicle inventorytax rate in Williamson County, Texas?

A: The vehicle inventory tax rate in Williamson County, Texas varies depending on the location. It is set by the local taxing units.

Q: How is the vehicle inventory tax rate determined?

A: The vehicle inventory tax rate is determined by the local taxing units based on their budgetary needs.

Q: Does the vehicle inventory tax rate differ within Williamson County?

A: Yes, the vehicle inventory tax rate can differ within Williamson County as it is set by each specific taxing unit.

Q: Can the vehicle inventory tax rate change?

A: Yes, the vehicle inventory tax rate can change from year to year based on the budgetary needs of the local taxing units.

Form Details:

- The latest edition currently provided by the Tax Assessor/Collector's Office - Williamson County, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Tax Assessor/Collector's Office - Williamson County, Texas.