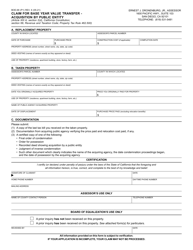

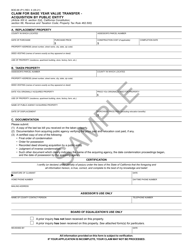

This version of the form is not currently in use and is provided for reference only. Download this version of

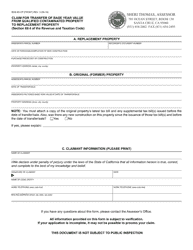

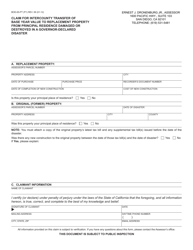

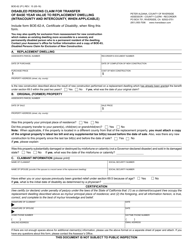

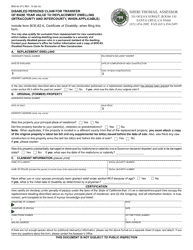

Form BOE-65-P

for the current year.

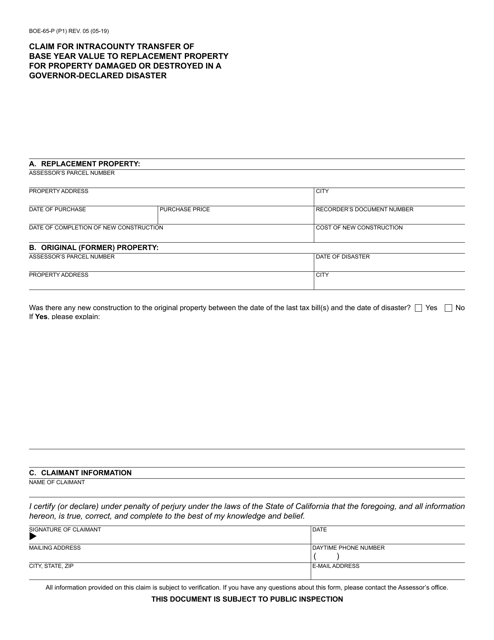

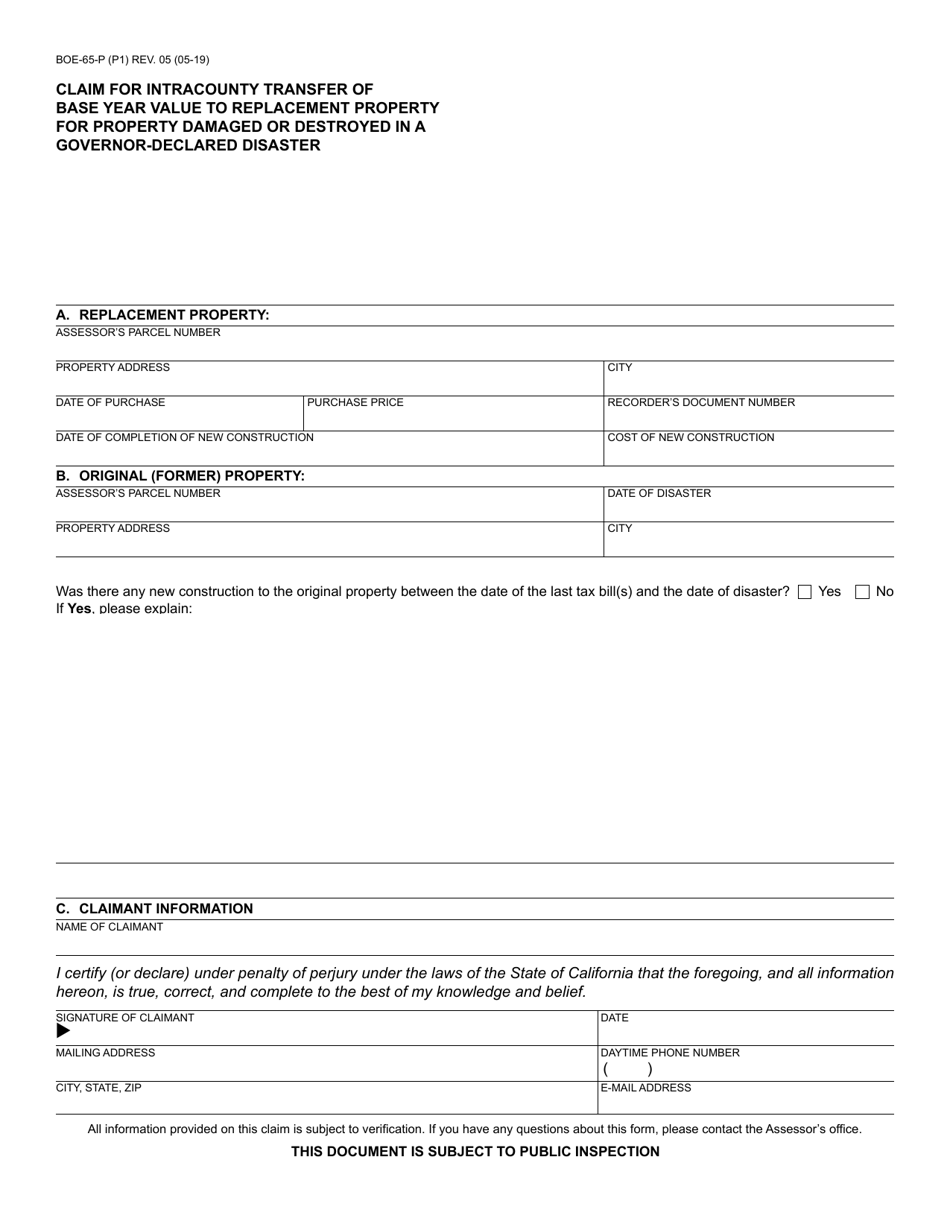

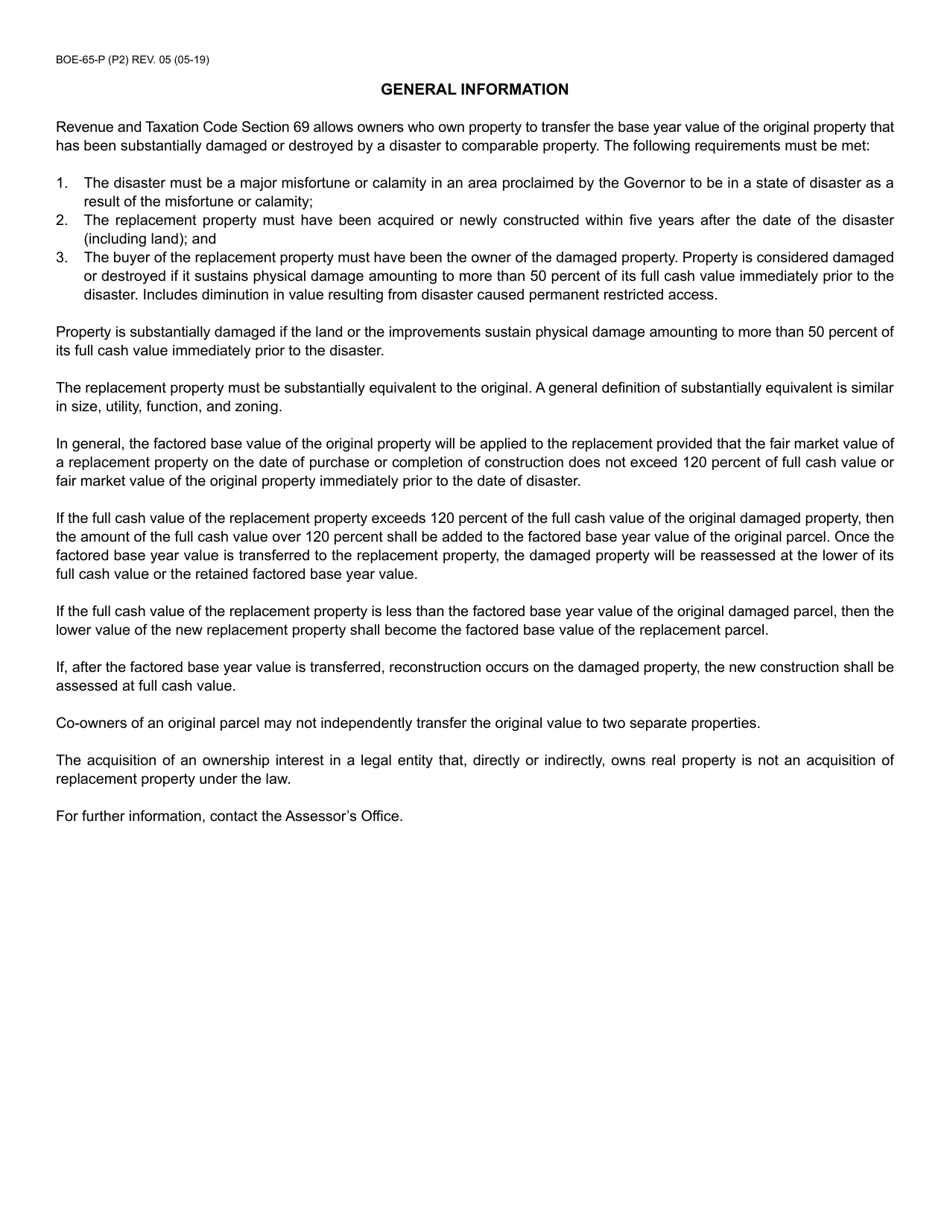

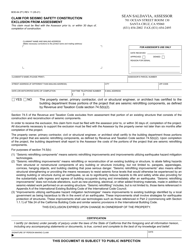

Form BOE-65-P Claim for Intracounty Transfer of Base Year Value to Replacement Property for Property Damaged or Destroyed in a Governor-Declared Disaster - California

What Is Form BOE-65-P?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a BOE-65-P form?

A: The BOE-65-P form is used to claim an intracounty transfer of base year value to replacement property for property damaged or destroyed in a Governor-declared disaster in California.

Q: What is an intracounty transfer of base year value?

A: An intracounty transfer of base year value allows the base year value of a property that has been damaged or destroyed in a Governor-declared disaster to be transferred to a replacement property in the same county.

Q: When should I use the BOE-65-P form?

A: You should use the BOE-65-P form if your property has been damaged or destroyed in a Governor-declared disaster in California and you want to transfer the base year value to a replacement property in the same county.

Q: What is a Governor-declared disaster?

A: A Governor-declared disaster is an official declaration by the Governor of California that a disaster has occurred and emergency assistance may be required.

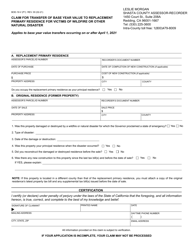

Q: Are there any fees associated with filing the BOE-65-P form?

A: No, there are no fees associated with filing the BOE-65-P form.

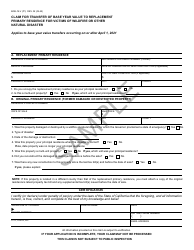

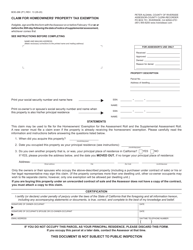

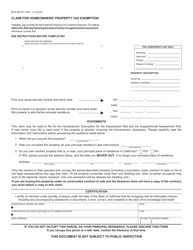

Q: What documentation do I need to submit with the BOE-65-P form?

A: You will need to submit documentation that proves your property was damaged or destroyed in a Governor-declared disaster, such as photographs, insurance claims, or repair estimates.

Q: Is there a deadline for filing the BOE-65-P form?

A: Yes, there is a deadline for filing the BOE-65-P form. It must be filed within 12 months from the date the property was damaged or destroyed.

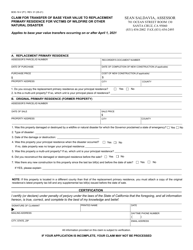

Q: What happens after I file the BOE-65-P form?

A: After you file the BOE-65-P form, the county assessor will review your claim and determine whether you are eligible for an intracounty transfer of base year value.

Q: Can I appeal the county assessor's decision regarding my BOE-65-P claim?

A: Yes, if you disagree with the county assessor's decision regarding your BOE-65-P claim, you can appeal the decision to the Assessment Appeals Board.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-65-P by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.