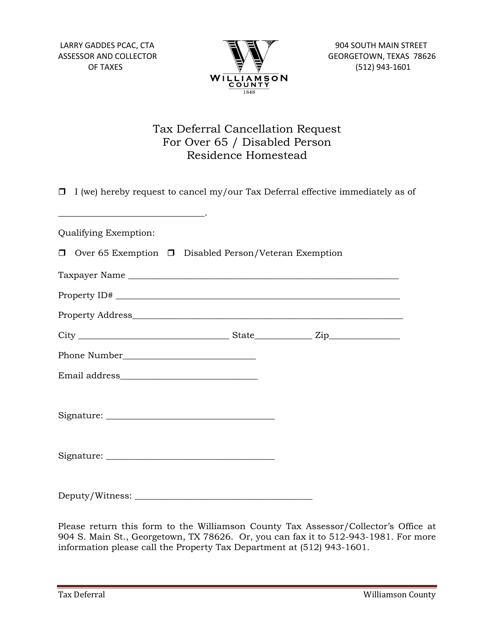

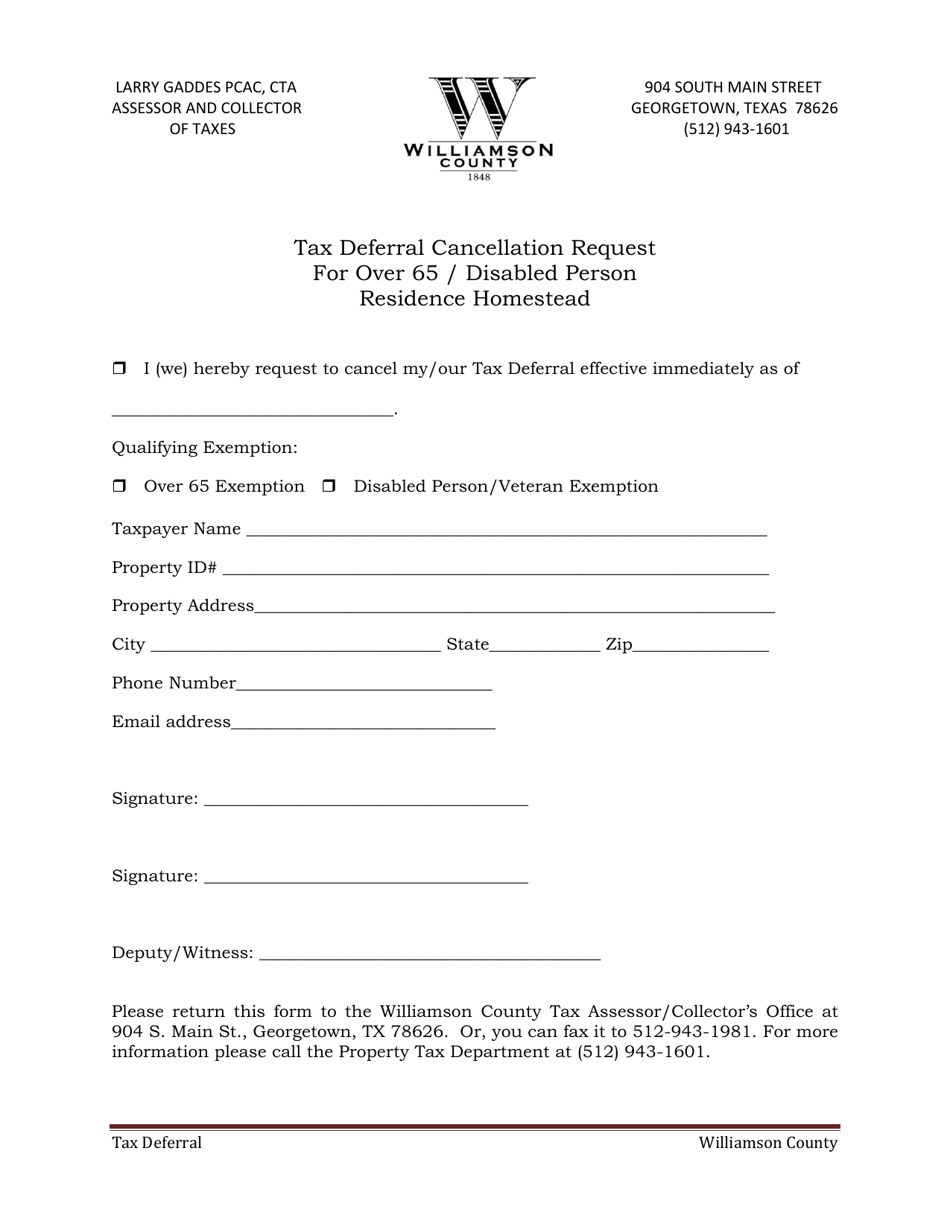

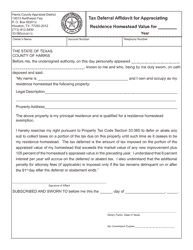

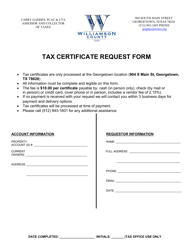

Tax Deferral Cancellation Request for Over 65 / Disabled Person Residence Homestead - Williamson County, Texas

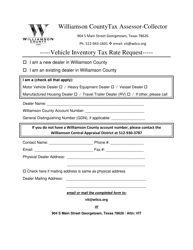

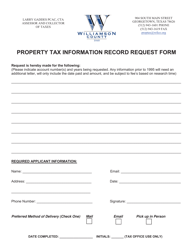

Tax Deferral Cancellation Request for Over 65/Disabled Person Residence Homestead is a legal document that was released by the Tax Assessor/Collector's Office - Williamson County, Texas - a government authority operating within Texas. The form may be used strictly within Williamson County.

FAQ

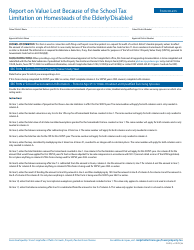

Q: What is a tax deferral cancellation request for over 65/disabled person residence homestead?

A: It is a request to cancel the tax deferral for a residence homestead owned by a person who is over 65 years old or disabled.

Q: Who is eligible for a tax deferral cancellation request for over 65/disabled person residence homestead?

A: Individuals who are over 65 years old or disabled and own a residence homestead in Williamson County, Texas.

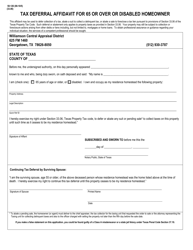

Q: How do I request a tax deferral cancellation?

A: You can request a tax deferral cancellation by submitting a written request to the Williamson County Tax Assessor-Collector's office.

Q: What documents do I need to include with my request?

A: You will need to include proof of your age or disability, such as a birth certificate, driver's license, or disability determination letter.

Q: Is there a deadline for submitting a tax deferral cancellation request?

A: Yes, the deadline for submitting a tax deferral cancellation request is January 31st of the year following the year in which the tax deferral was granted.

Q: What happens after I submit my tax deferral cancellation request?

A: The Williamson County Tax Assessor-Collector's office will review your request and determine if you meet the eligibility criteria.

Q: If my tax deferral cancellation request is approved, what will happen to my taxes?

A: If your request is approved, you will no longer be eligible for the tax deferral and will be responsible for paying your property taxes in full each year.

Q: If my tax deferral cancellation request is denied, can I appeal the decision?

A: Yes, if your request is denied, you can appeal the decision to the Williamson County Appraisal Review Board.

Form Details:

- The latest edition currently provided by the Tax Assessor/Collector's Office - Williamson County, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Tax Assessor/Collector's Office - Williamson County, Texas.