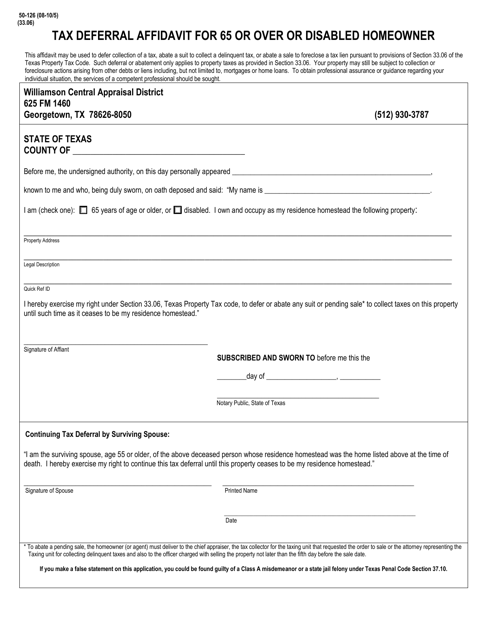

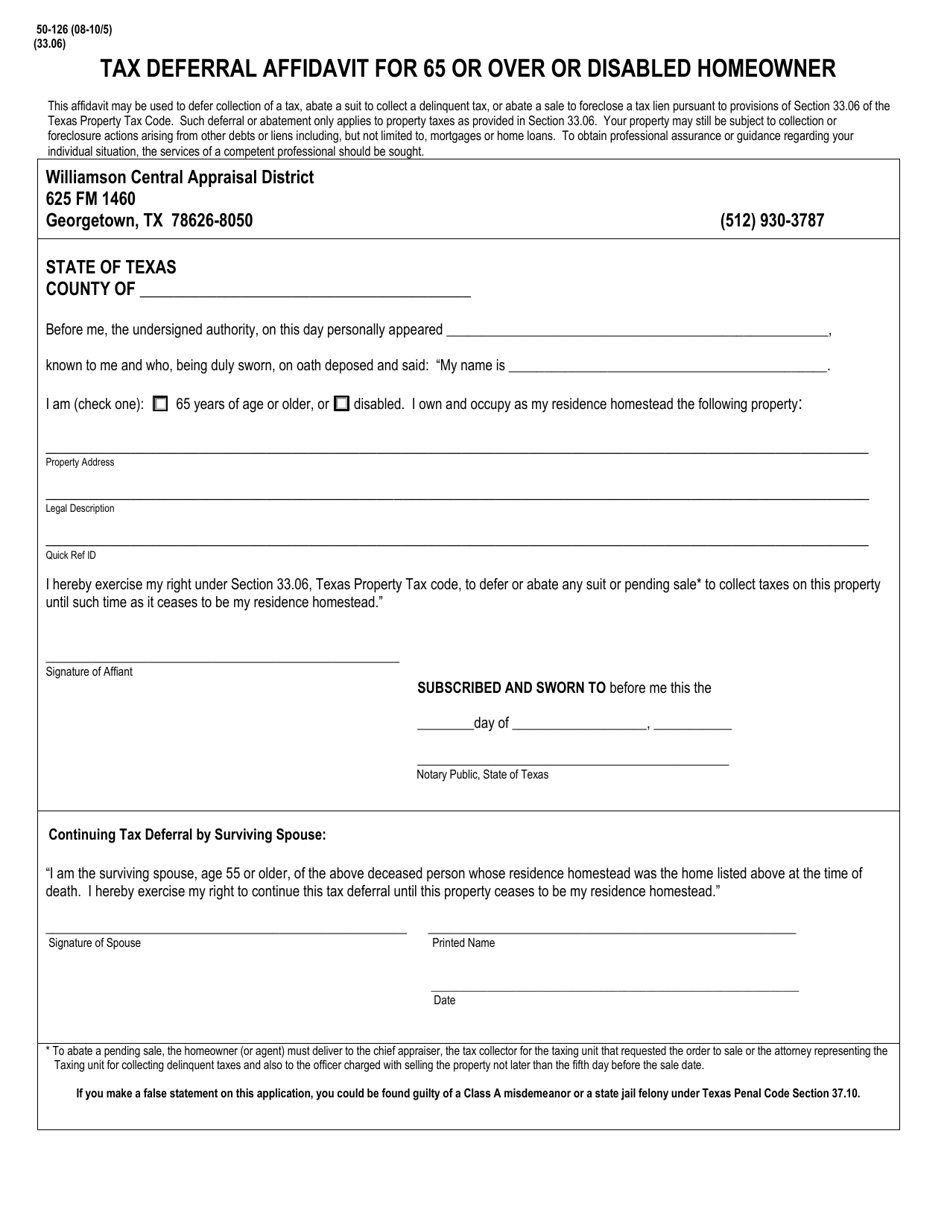

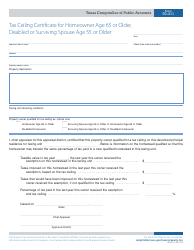

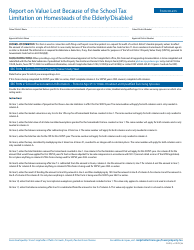

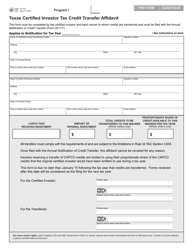

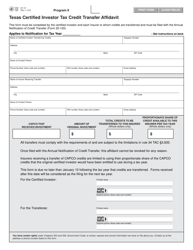

Form 50-126 Tax Deferral Affidavit for 65 or Over or Disabled Homeowner - Williamson County, Texas

What Is Form 50-126?

This is a legal form that was released by the Central Appraisal District - Williamson County, Texas - a government authority operating within Texas. The form may be used strictly within Williamson County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-126?

A: Form 50-126 is the Tax Deferral Affidavit for 65 or Over or Disabled Homeowner in Williamson County, Texas.

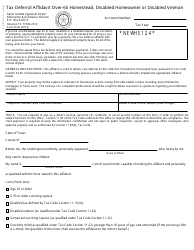

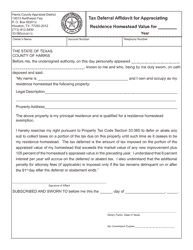

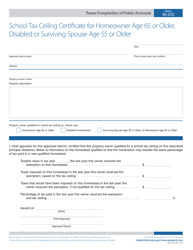

Q: Who is eligible to use Form 50-126?

A: Homeowners who are 65 years or older or disabled may be eligible to use Form 50-126.

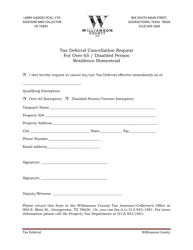

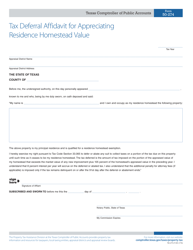

Q: What is the purpose of Form 50-126?

A: The purpose of Form 50-126 is to apply for a deferral of property taxes for eligible homeowners.

Q: What do I need to include when filling out Form 50-126?

A: When filling out Form 50-126, you will need to provide your personal information, property details, and income information.

Q: When is the deadline to submit Form 50-126?

A: The deadline to submit Form 50-126 varies, so it is best to check with the Williamson County, Texas tax office.

Q: What happens after I submit Form 50-126?

A: After you submit Form 50-126, the tax office will review your application and notify you of the decision.

Q: Can I appeal if my Form 50-126 application is denied?

A: Yes, you can appeal if your Form 50-126 application is denied. Contact the Williamson County, Texas tax office for more details.

Q: Is there a fee to file Form 50-126?

A: There may be a fee to file Form 50-126. Contact the Williamson County, Texas tax office for current fee information.

Q: Can I get assistance with filling out Form 50-126?

A: Yes, you can seek assistance with filling out Form 50-126 from the Williamson County, Texas tax office or local organizations that provide tax assistance.

Form Details:

- Released on August 1, 2010;

- The latest edition provided by the Central Appraisal District - Williamson County, Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-126 by clicking the link below or browse more documents and templates provided by the Central Appraisal District - Williamson County, Texas.