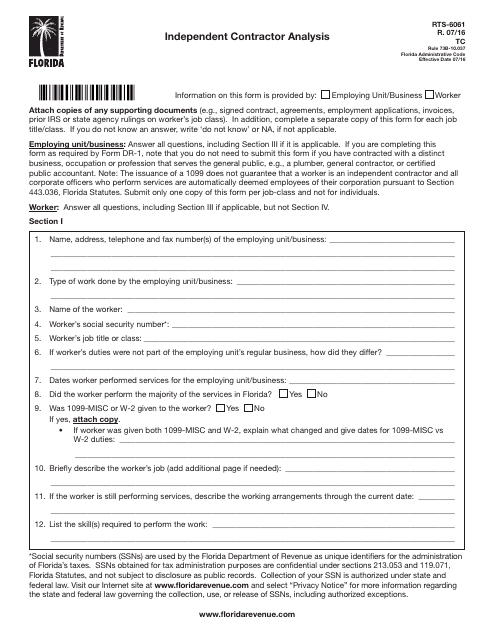

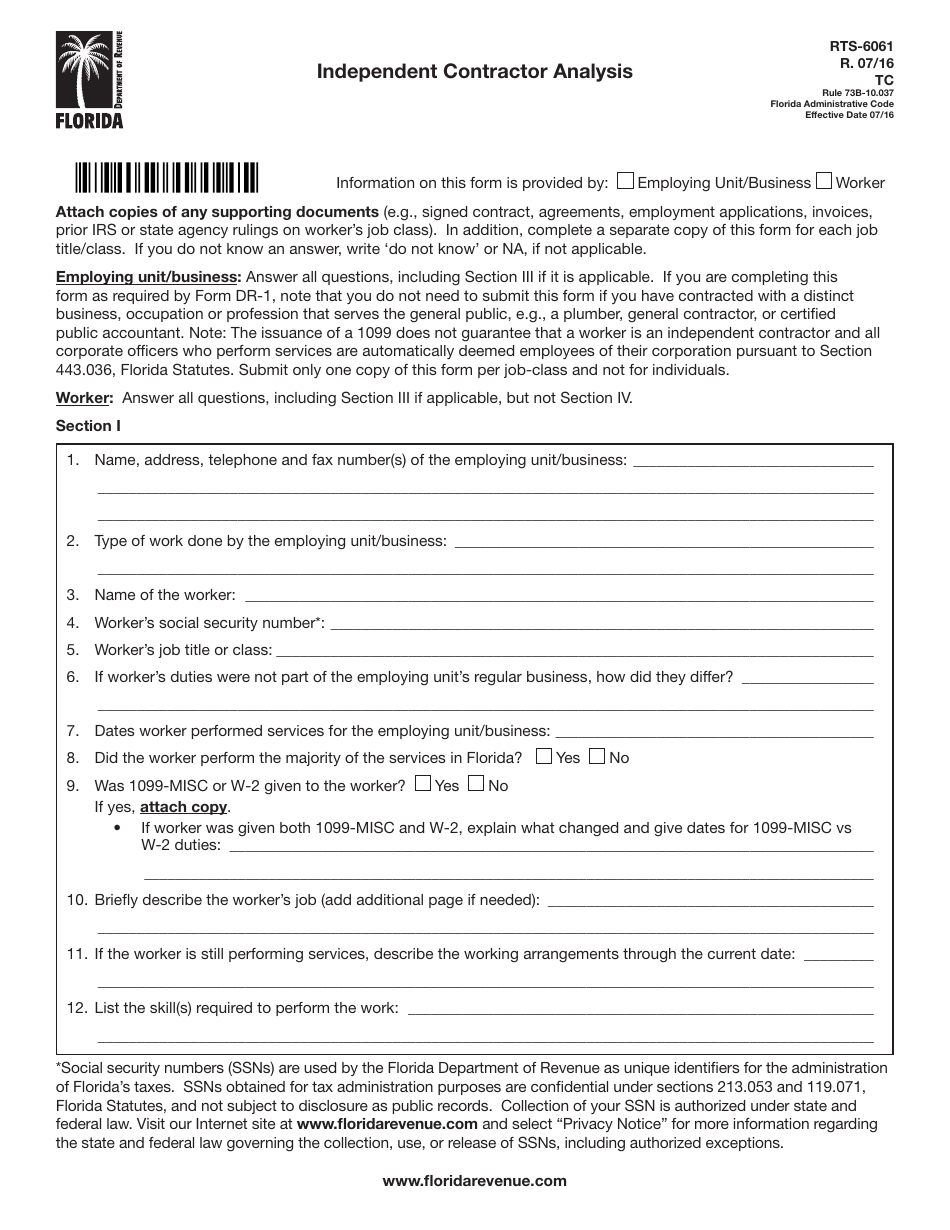

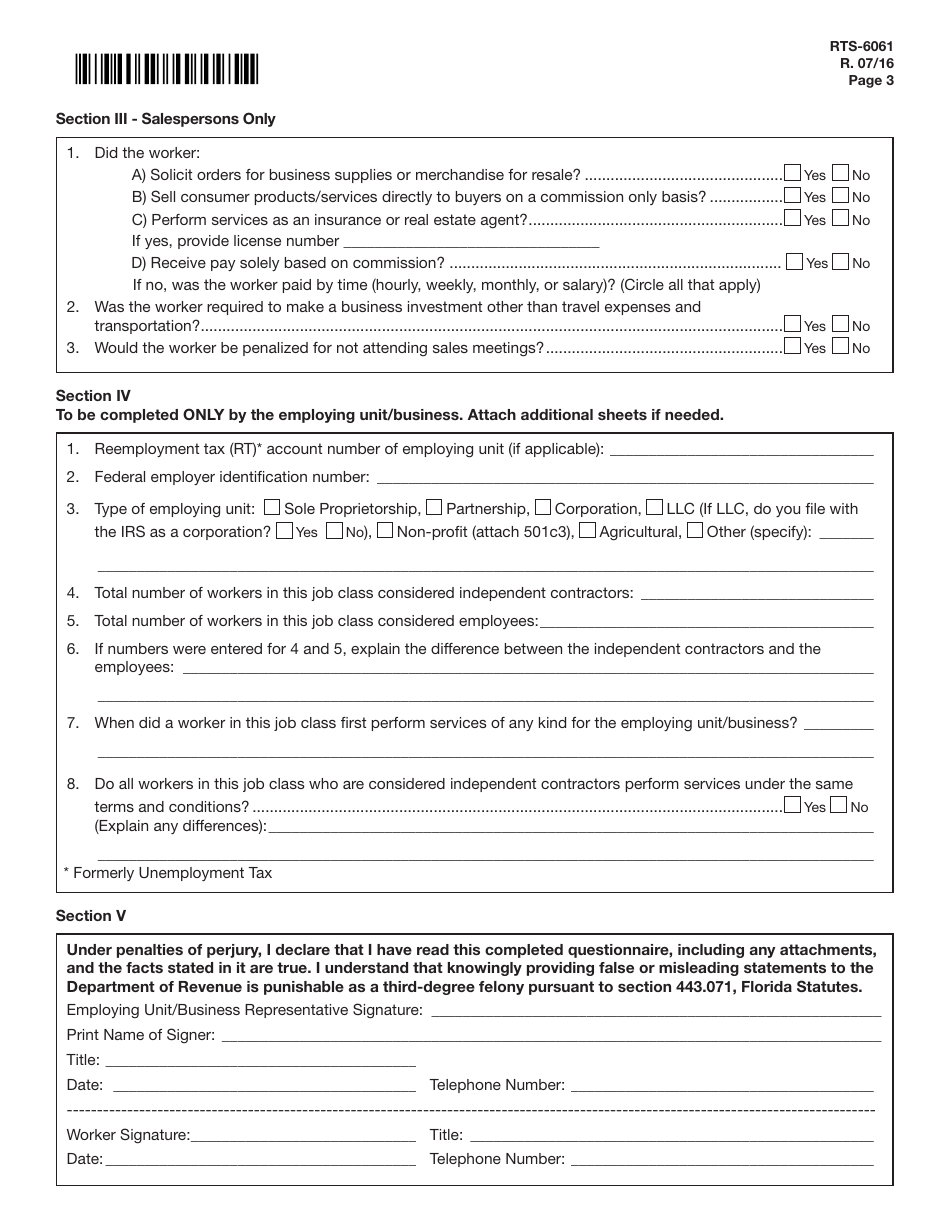

Form RTS-6061 Independent Contractor Analysis - Florida

What Is Form RTS-6061?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RTS-6061?

A: Form RTS-6061 is an Independent Contractor Analysis form.

Q: What is the purpose of Form RTS-6061?

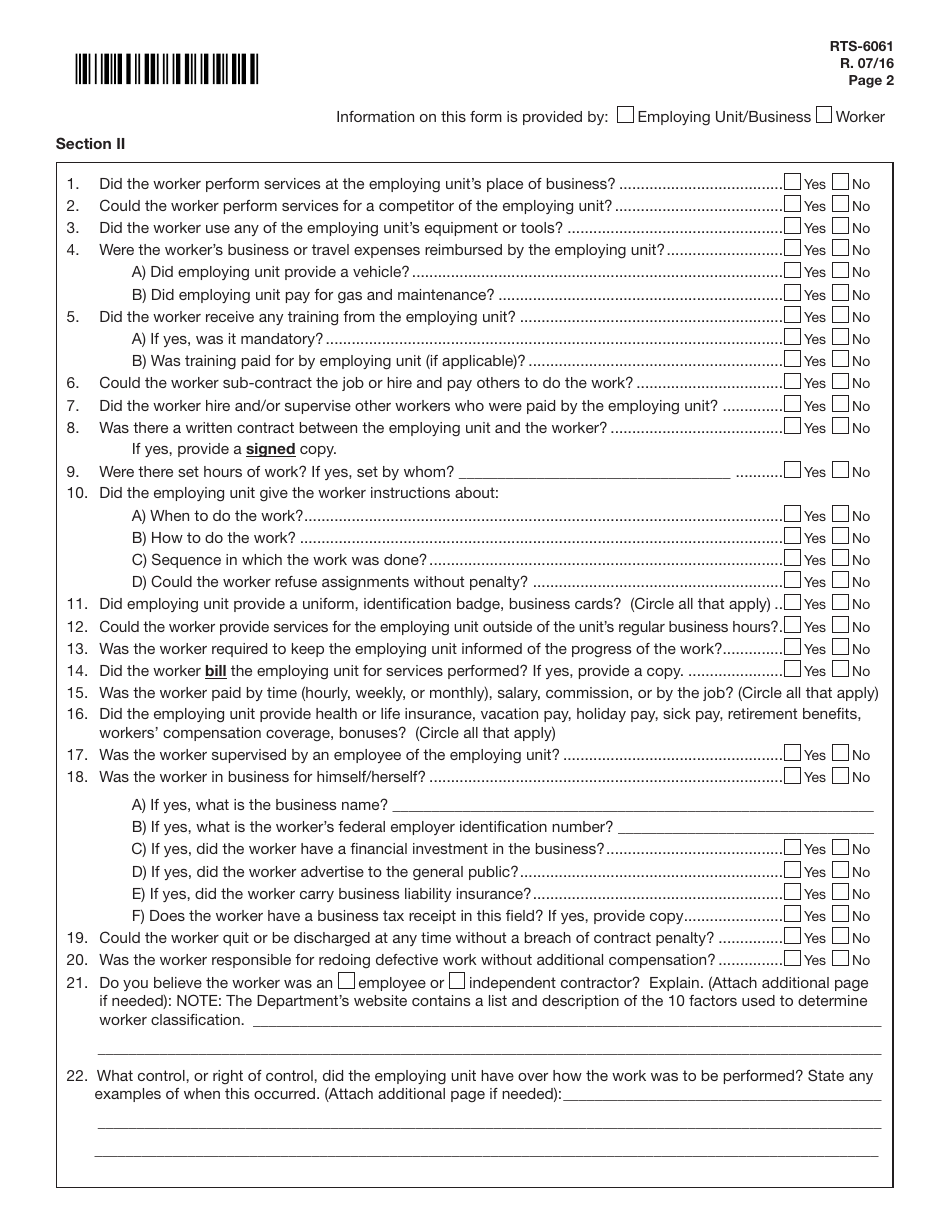

A: The purpose of Form RTS-6061 is to determine if a worker is considered an independent contractor or an employee in the state of Florida.

Q: Who needs to fill out Form RTS-6061?

A: Employers who are unsure about the worker's classification as an independent contractor or employee in Florida may need to fill out Form RTS-6061.

Q: What information is required on Form RTS-6061?

A: Form RTS-6061 requires information about the worker, the employer, and the nature of the work being performed.

Q: What happens after I submit Form RTS-6061?

A: After submitting Form RTS-6061, the Florida Department of Revenue will review the information provided and make a determination on the worker's classification.

Q: What are the consequences of misclassifying a worker?

A: Misclassifying a worker can result in penalties, fines, and other legal consequences. It is important to accurately classify workers to comply with employment laws.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RTS-6061 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.