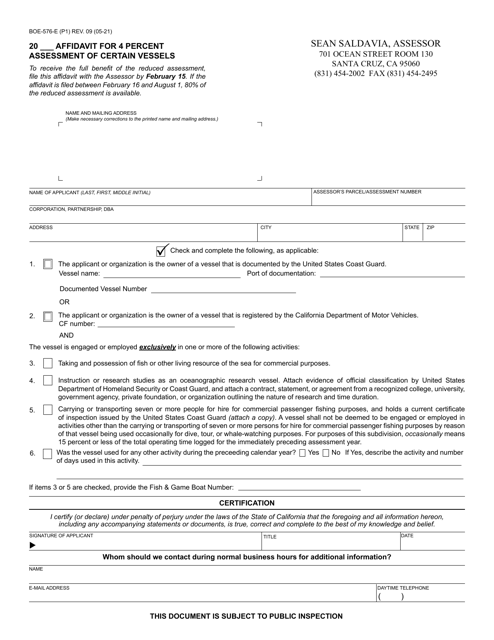

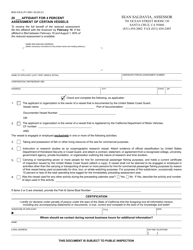

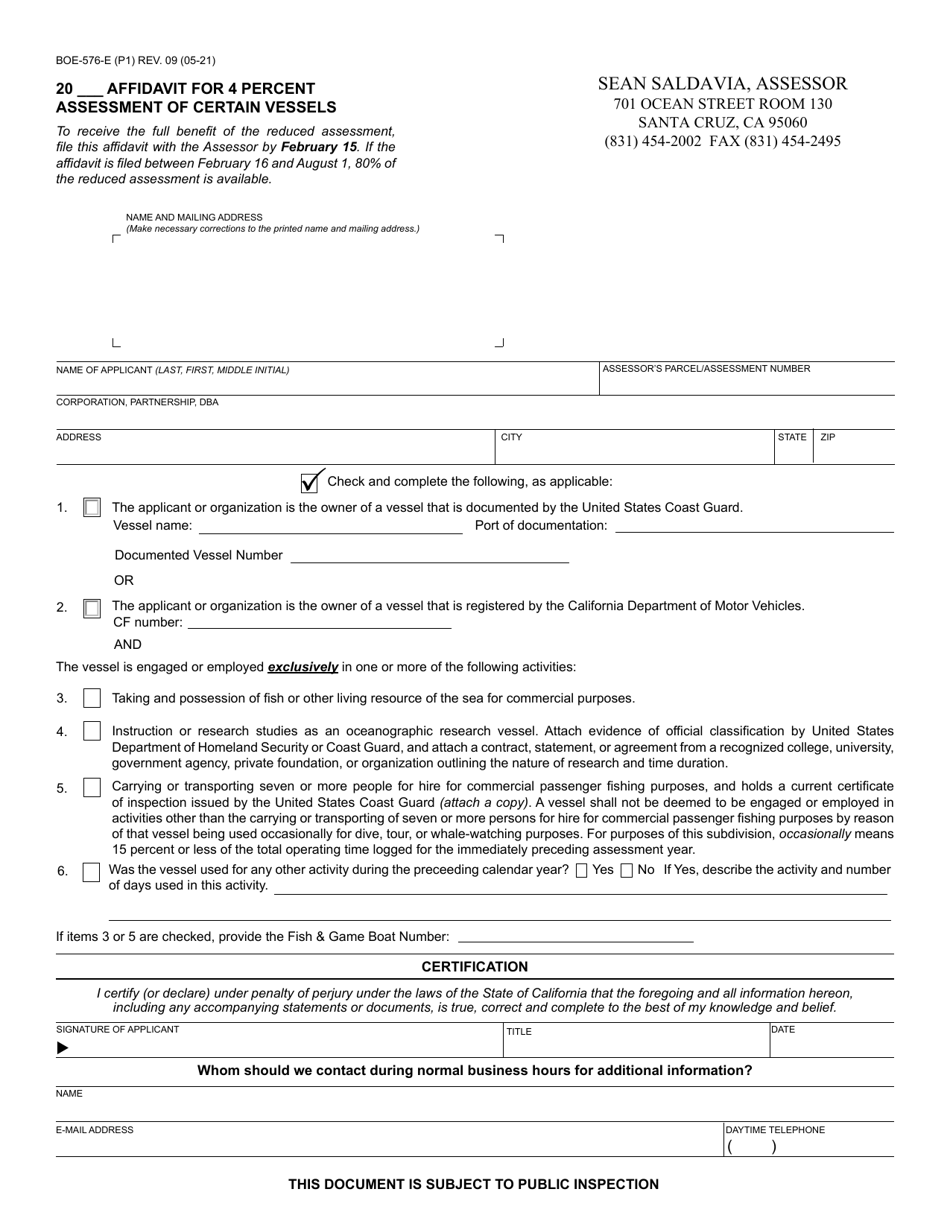

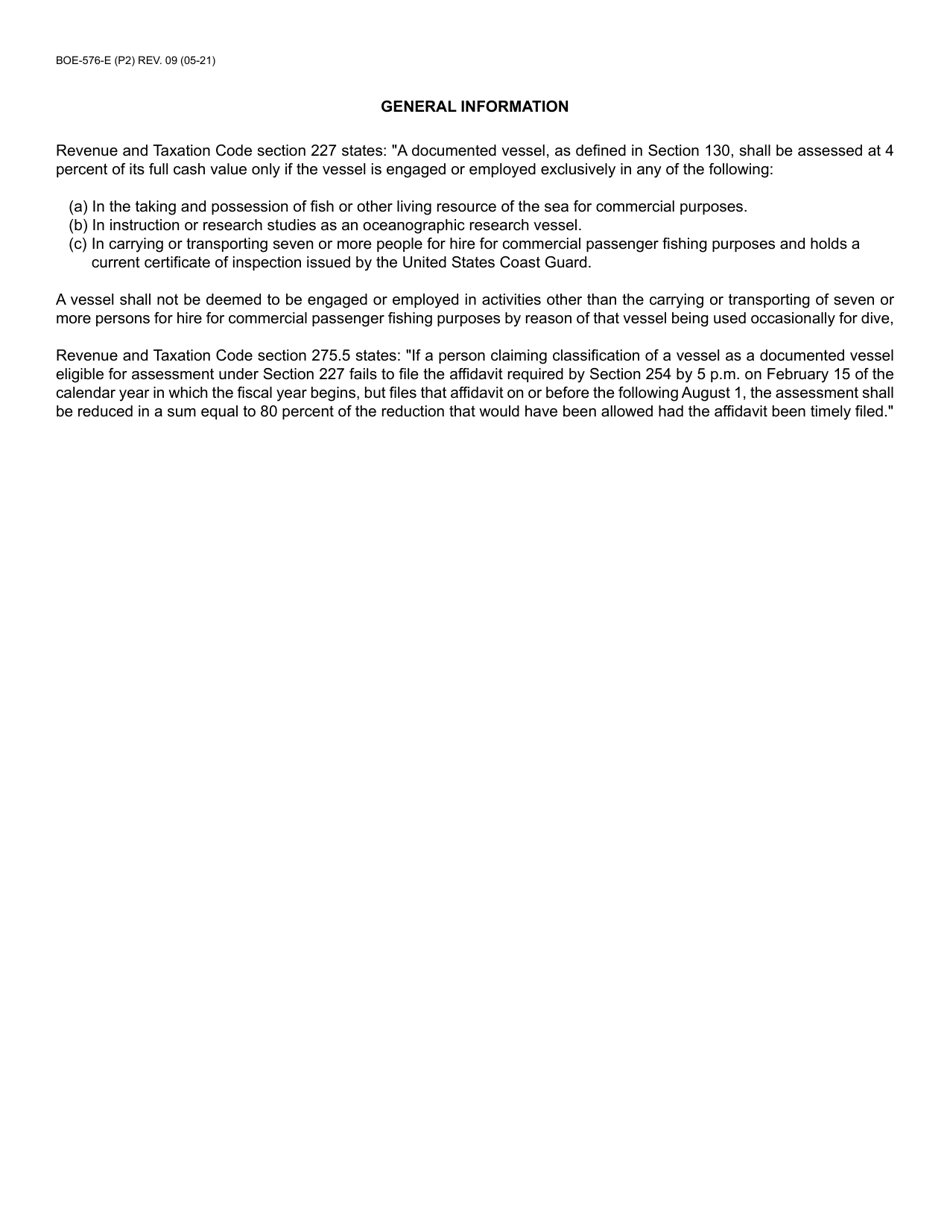

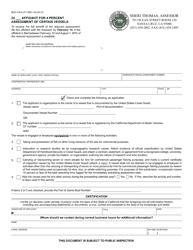

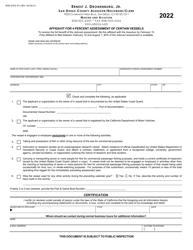

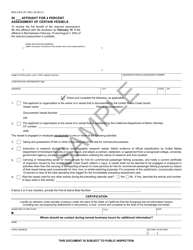

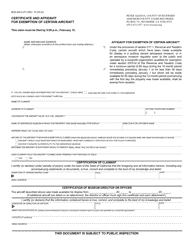

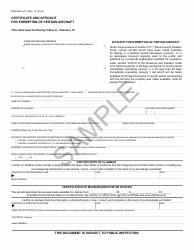

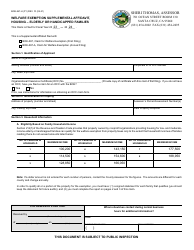

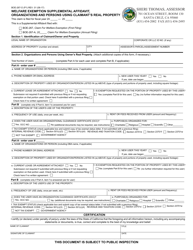

Form BOE-576-E Affidavit for 4 Percent Assessment of Certain Vessels - County of Santa Cruz, California

What Is Form BOE-576-E?

This is a legal form that was released by the Assessor's Office - Santa Cruz County, California - a government authority operating within California. The form may be used strictly within County of Santa Cruz. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-576-E?

A: BOE-576-E is an affidavit form for the 4 percent assessment of certain vessels in Santa Cruz County, California.

Q: What is the purpose of BOE-576-E?

A: The purpose of BOE-576-E is to declare that a vessel qualifies for the 4 percent assessment rate.

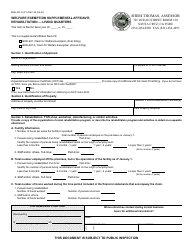

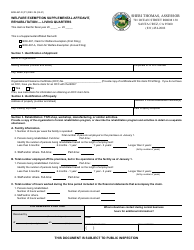

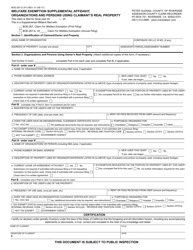

Q: Who needs to fill out BOE-576-E?

A: Owners of certain vessels in Santa Cruz County, California, who wish to claim the 4 percent assessment rate need to fill out BOE-576-E.

Q: What is the 4 percent assessment rate?

A: The 4 percent assessment rate is a reduced property tax assessment rate for certain vessels in Santa Cruz County, California.

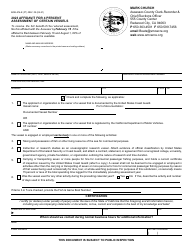

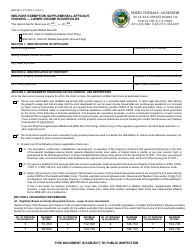

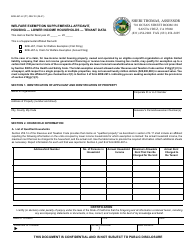

Q: Are there any eligibility requirements for the 4 percent assessment rate?

A: Yes, there are eligibility requirements for the 4 percent assessment rate. The vessel must meet certain criteria, including being primarily used for oceanographic research or operating as a ferry, tour boat, or commercial fishing vessel.

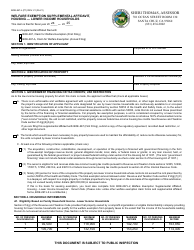

Q: What documentation do I need to submit with BOE-576-E?

A: You may need to submit additional supporting documentation with BOE-576-E, such as vessel registration documents, proof of commercial fishing activity, or other relevant records.

Q: What should I do with the completed BOE-576-E form?

A: Once you have completed BOE-576-E, you should submit it to the Santa Cruz County Assessor's Office.

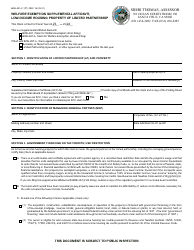

Q: Are there any deadlines for submitting BOE-576-E?

A: Yes, there are deadlines for submitting BOE-576-E. The form should be submitted to the Santa Cruz County Assessor's Office by a specified date each year.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Assessor's Office - Santa Cruz County, California;

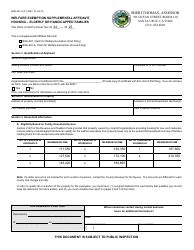

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-576-E by clicking the link below or browse more documents and templates provided by the Assessor's Office - Santa Cruz County, California.