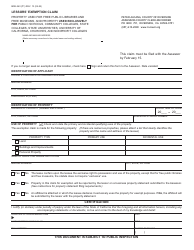

This version of the form is not currently in use and is provided for reference only. Download this version of

Form BOE-265

for the current year.

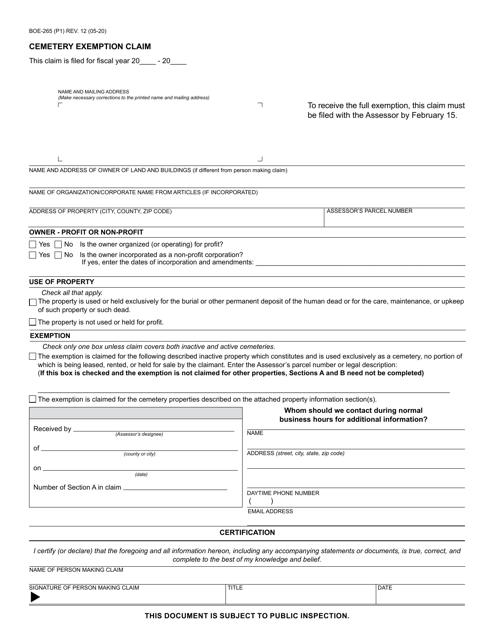

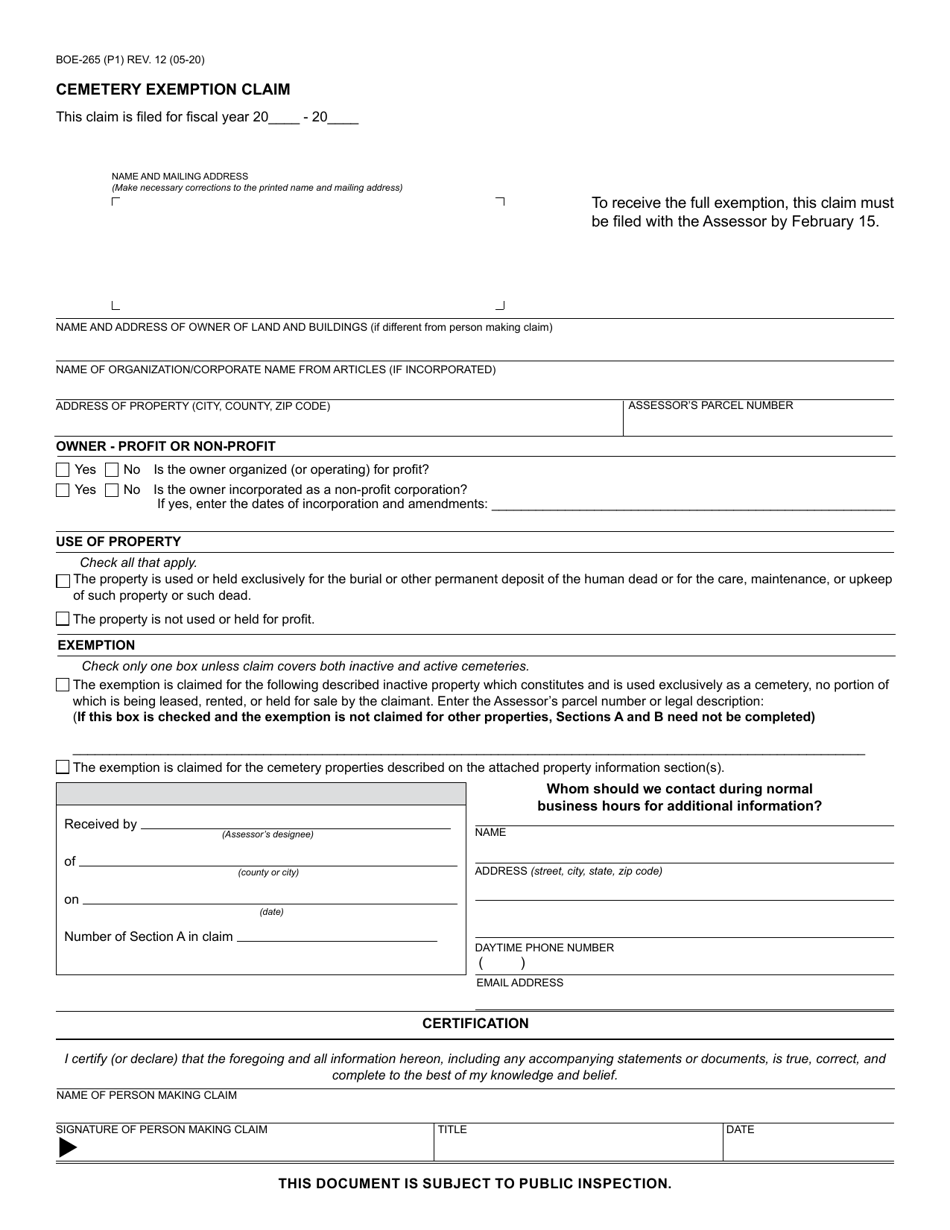

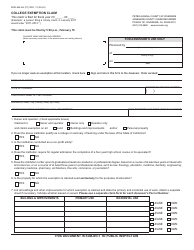

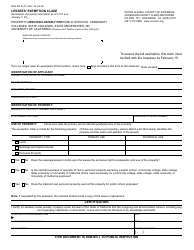

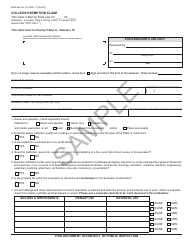

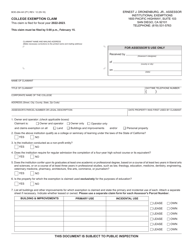

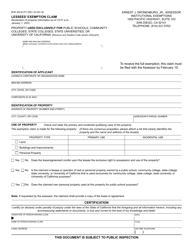

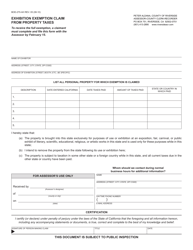

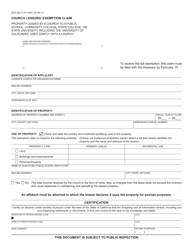

Form BOE-265 Cemetery Exemption Claim - California

What Is Form BOE-265?

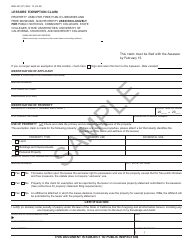

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-265?

A: Form BOE-265 is a document used to claim a cemetery exemption in California.

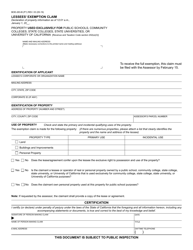

Q: What is a cemetery exemption?

A: A cemetery exemption is a legal provision that allows certain cemetery properties to be exempt from property taxes.

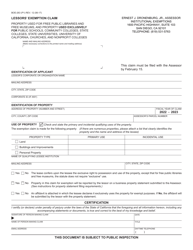

Q: Who can claim a cemetery exemption?

A: Cemetery owners or operators who meet certain criteria can claim a cemetery exemption.

Q: What are the requirements to claim a cemetery exemption?

A: To claim a cemetery exemption, the cemetery must be used solely for burial purposes, not engage in commercial activities, and meet other specified criteria.

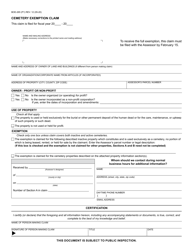

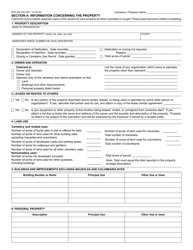

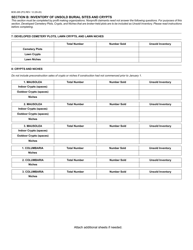

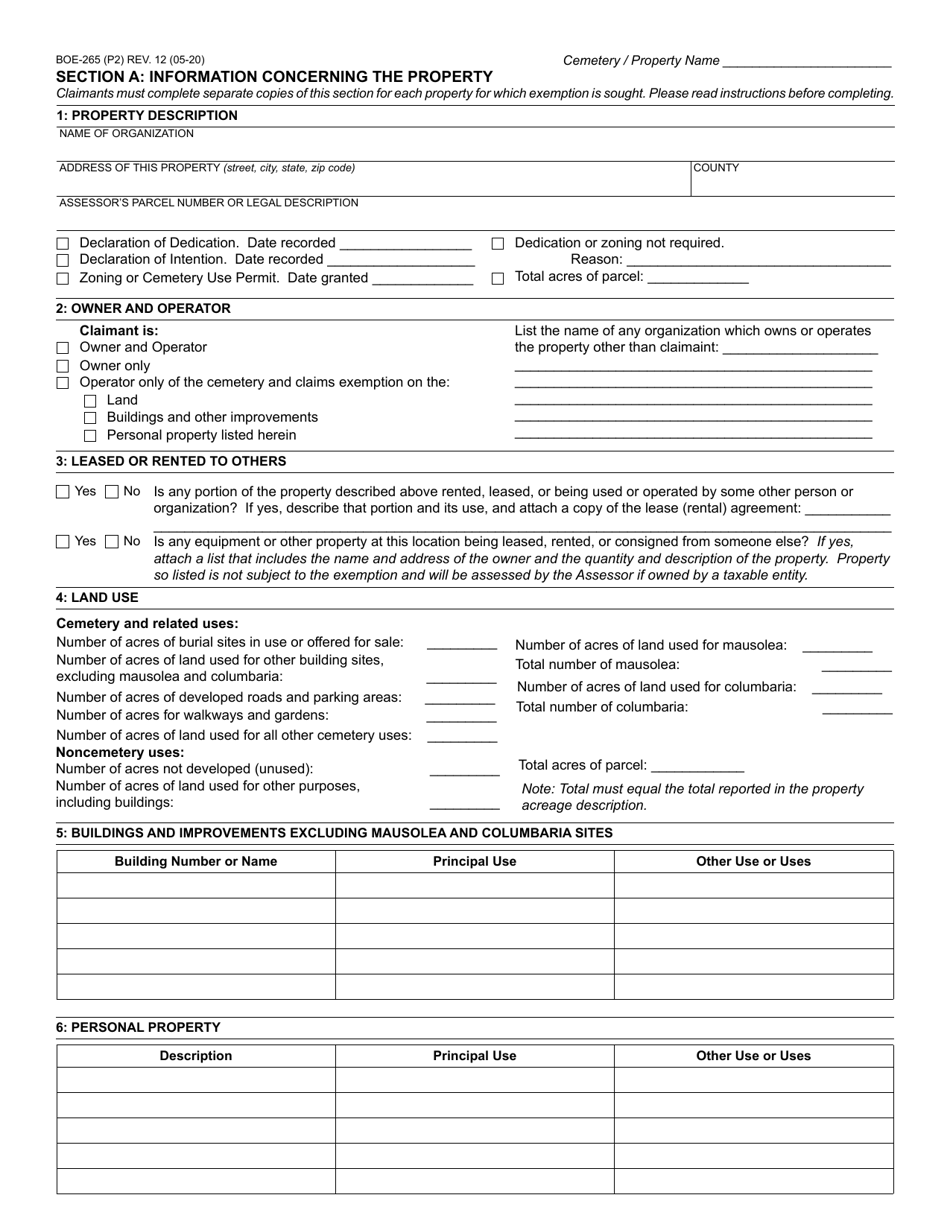

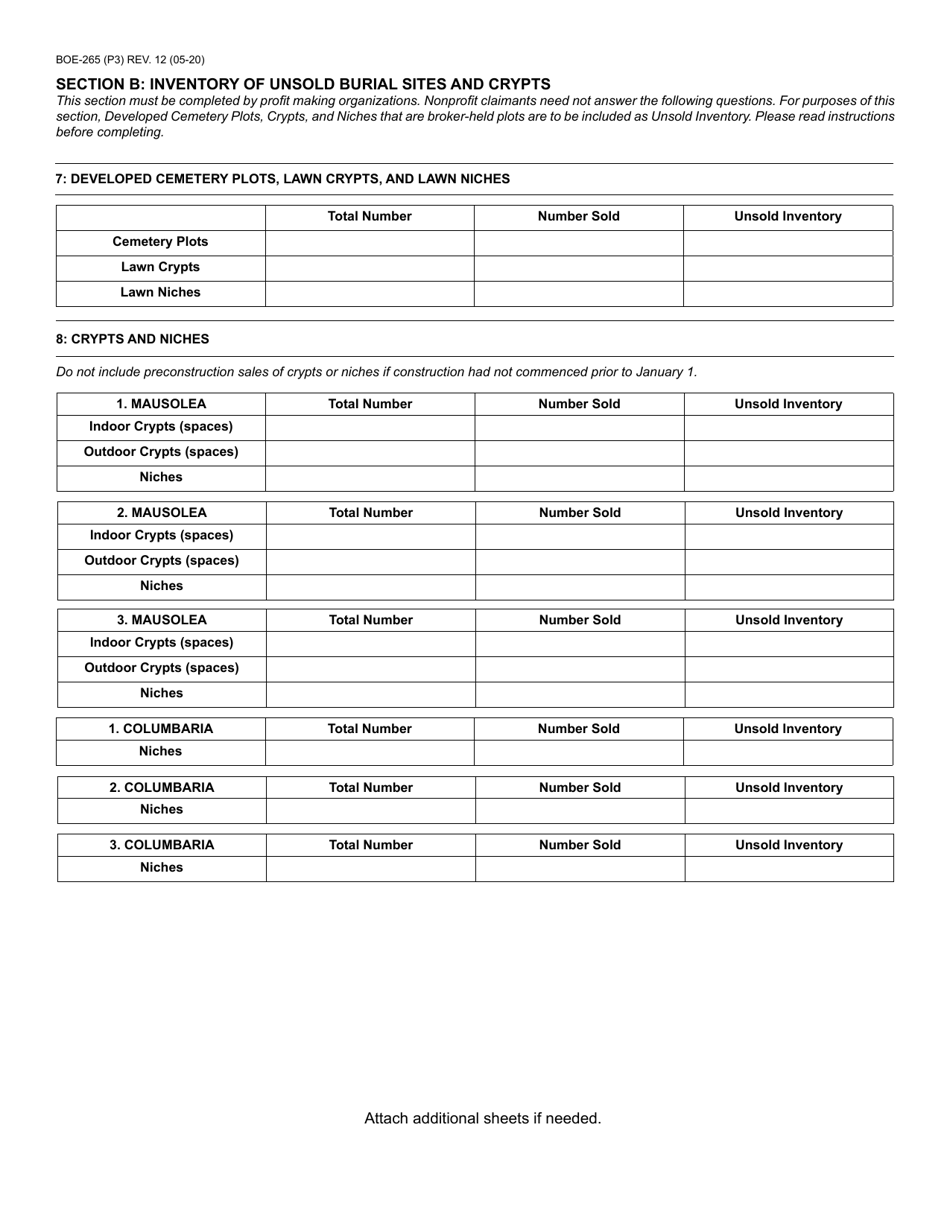

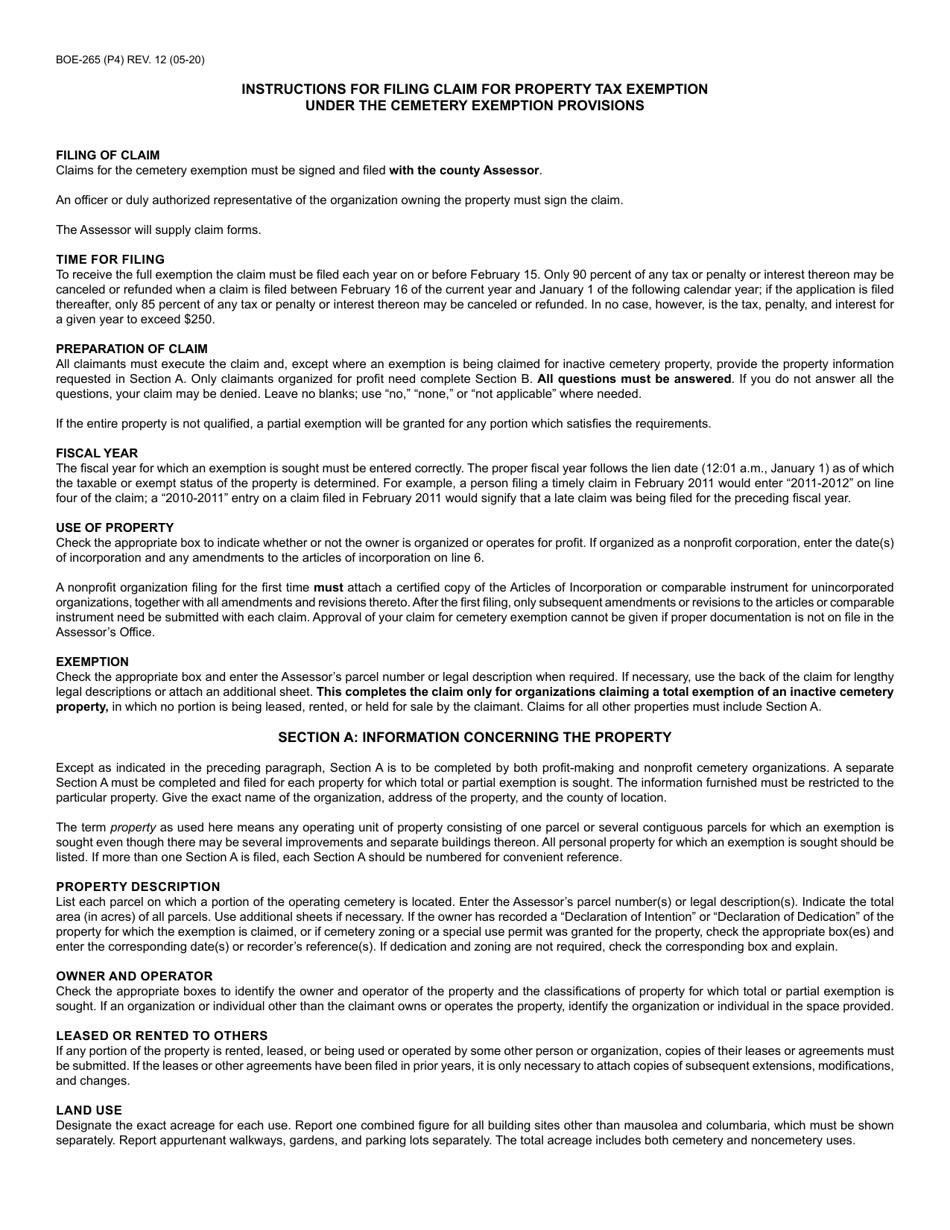

Q: How do I fill out Form BOE-265?

A: Form BOE-265 requires information about the cemetery property, its ownership, and other related details. The instructions provided with the form will guide you in filling it out correctly.

Q: When is the deadline to submit Form BOE-265?

A: The deadline to submit Form BOE-265 is typically February 15th of each year, although certain cemeteries may have different deadlines.

Q: Are there any fees associated with filing Form BOE-265?

A: No, there are no fees associated with filing Form BOE-265.

Q: What happens after I submit Form BOE-265?

A: Once you submit Form BOE-265, the county assessor will review your claim and determine if you qualify for the cemetery exemption.

Q: What should I do if my Form BOE-265 is denied?

A: If your Form BOE-265 is denied, you may have the option to appeal the decision. Contact your local county assessor's office for more information.

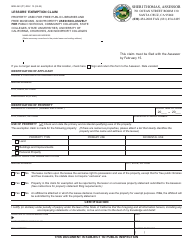

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-265 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.