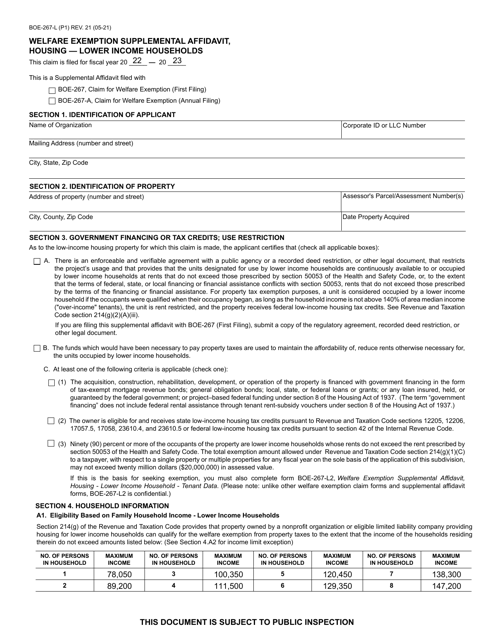

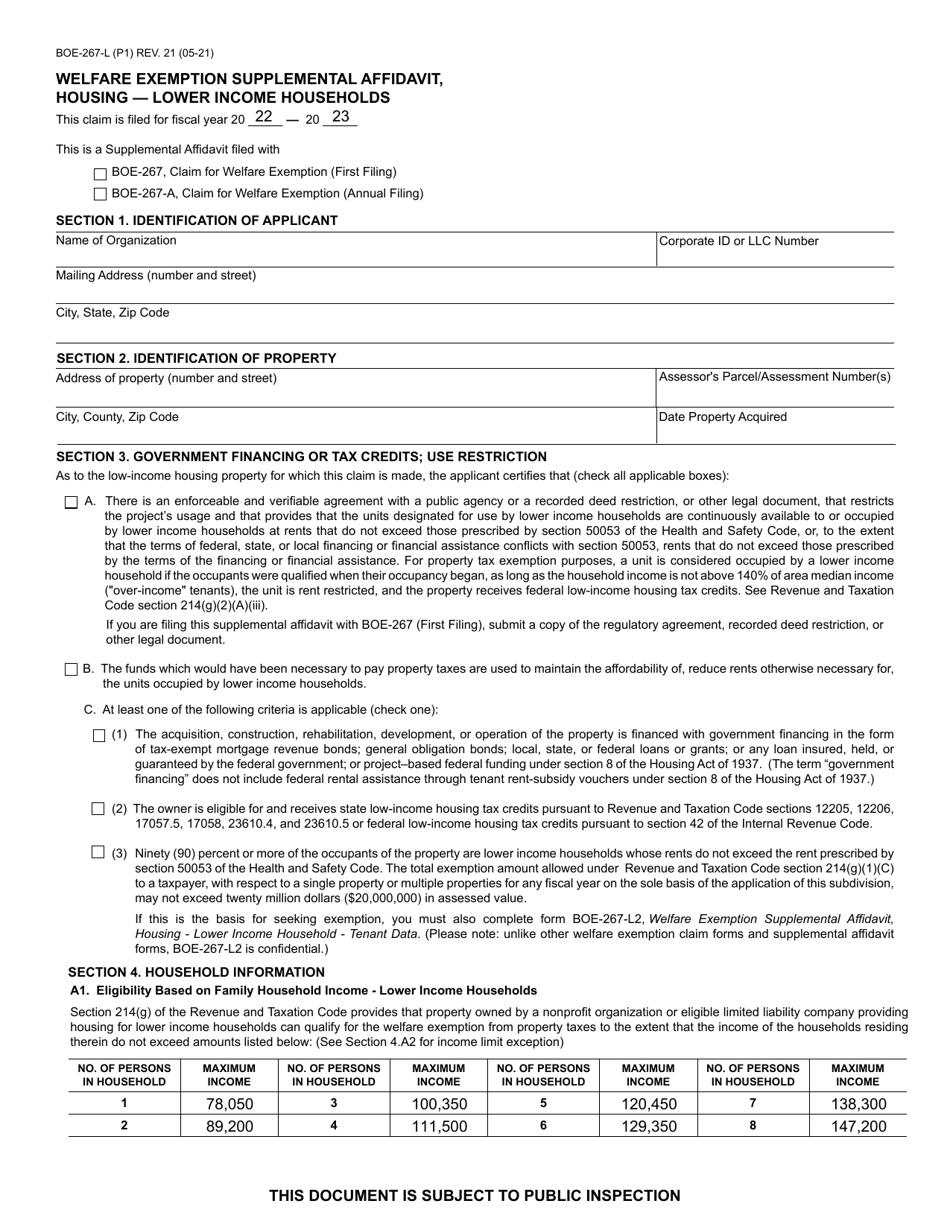

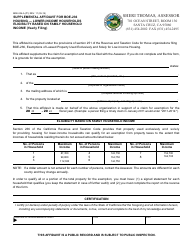

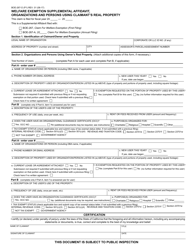

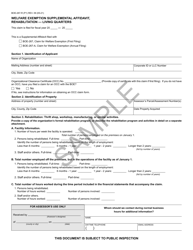

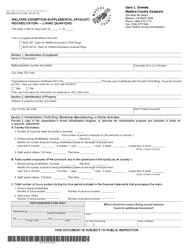

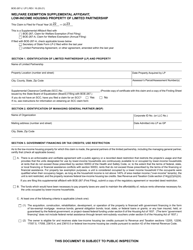

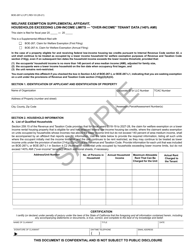

Form BOE-267-L Welfare Exemption Supplemental Affidavit, Housing - Lower Income Households - California

What Is Form BOE-267-L?

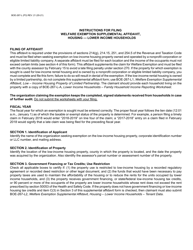

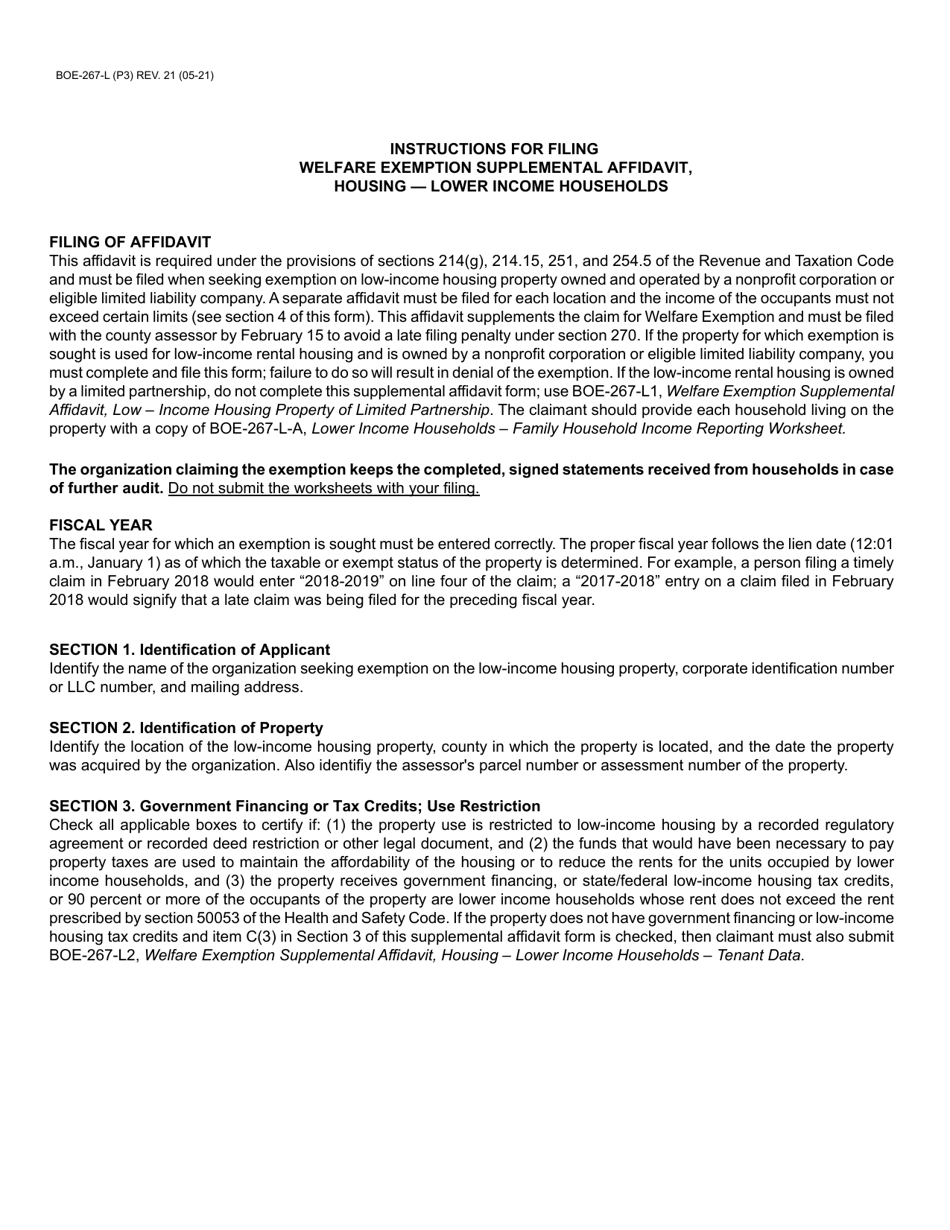

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-267-L?

A: BOE-267-L is a form used for the Welfare Exemption Supplemental Affidavit for Housing - Lower Income Households in California.

Q: What is the purpose of BOE-267-L?

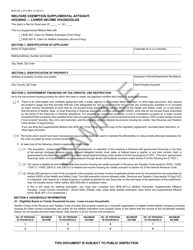

A: The purpose of BOE-267-L is to claim a welfare exemption for eligible housing properties occupied by lower income households.

Q: Who needs to fill out BOE-267-L?

A: Property owners or representatives of eligible housing properties occupied by lower income households in California need to fill out BOE-267-L.

Q: What is the welfare exemption for housing - lower income households?

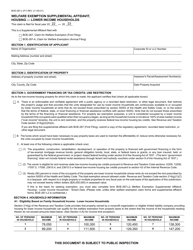

A: The welfare exemption for housing - lower income households is a property tax exemption in California that reduces or eliminates property taxes for eligible housing properties occupied by lower income households.

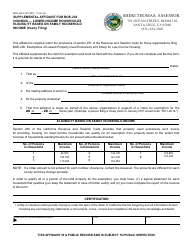

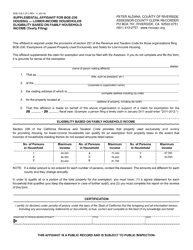

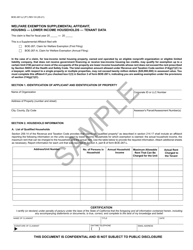

Q: What information is required on BOE-267-L?

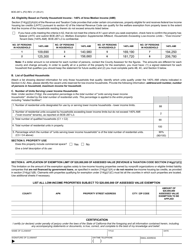

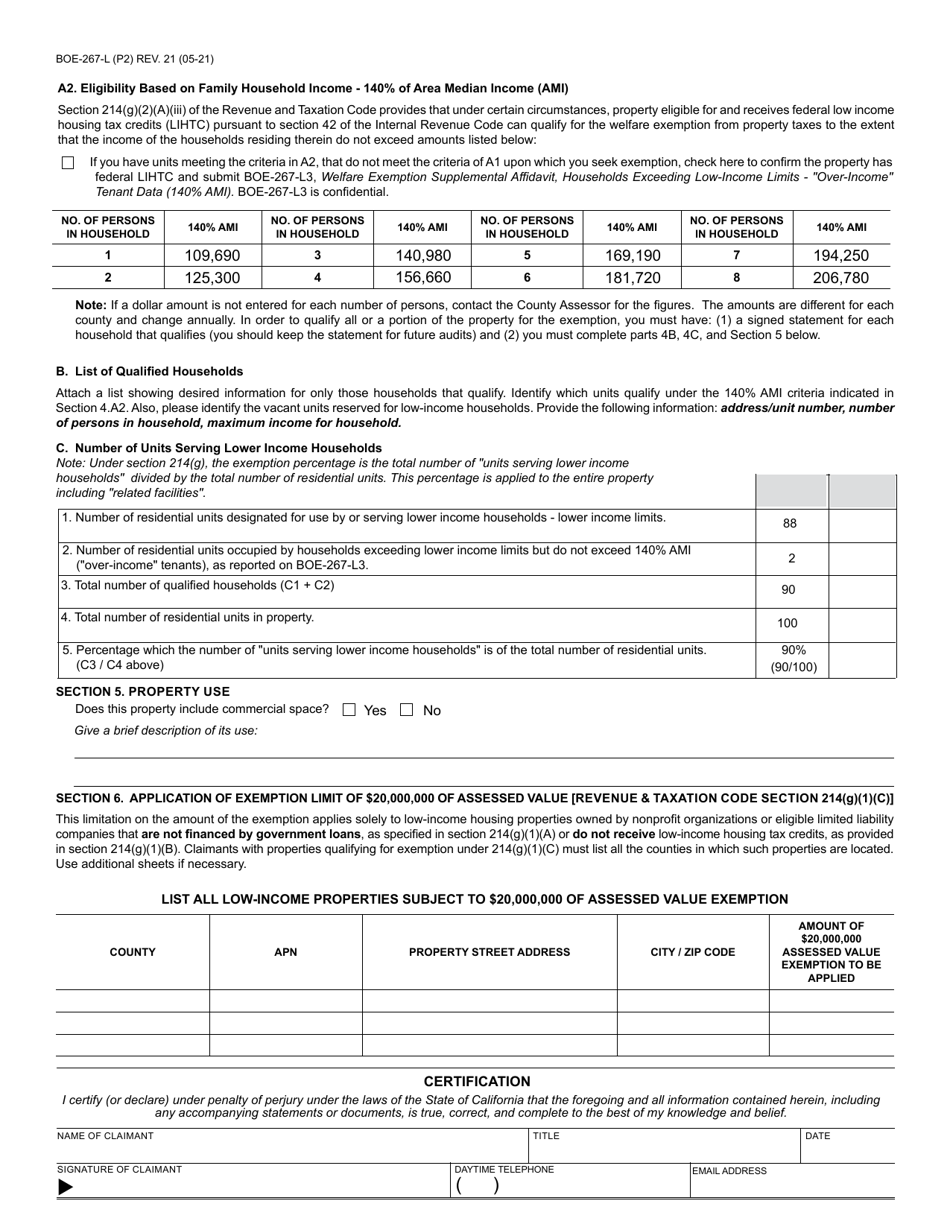

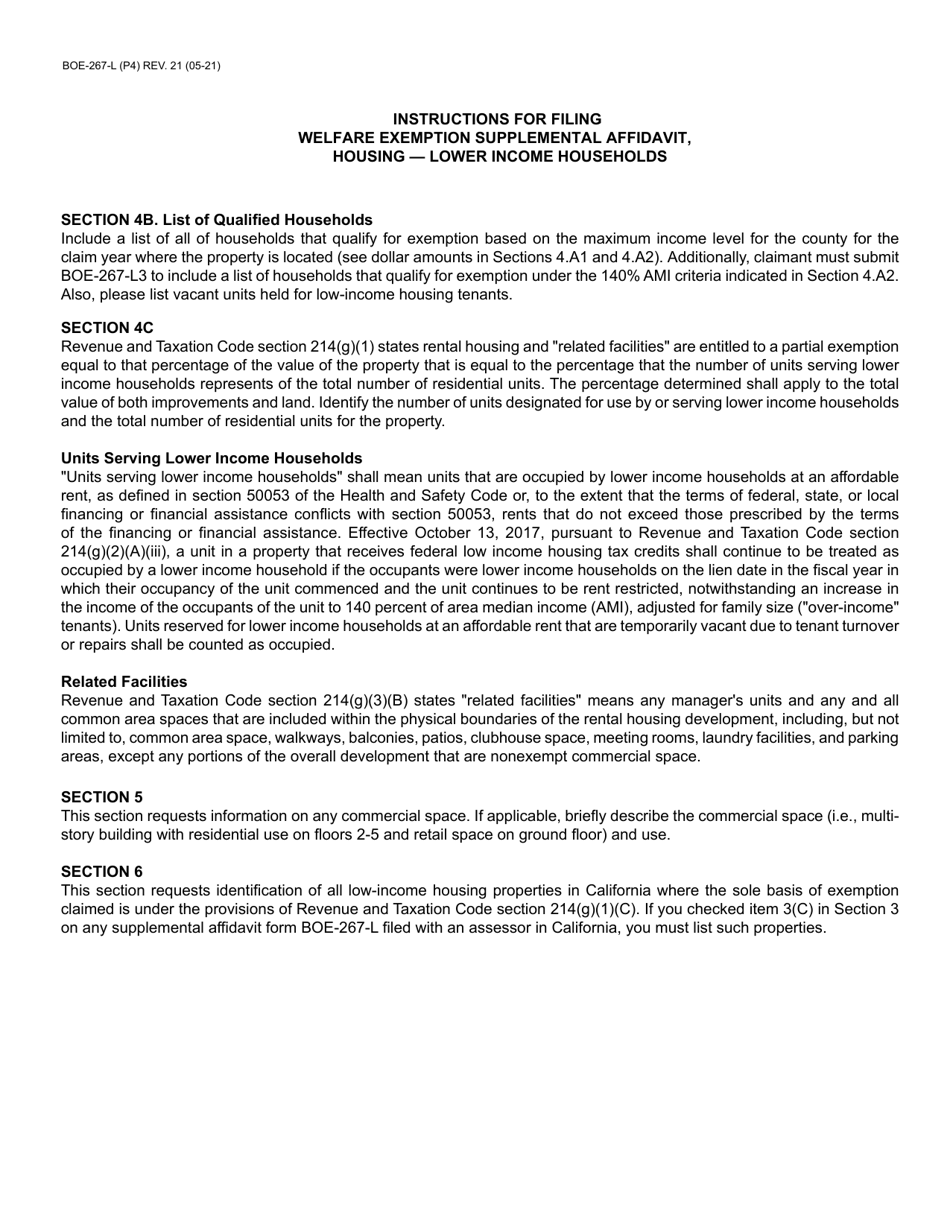

A: BOE-267-L requires information such as property details, income limits, and certification of eligibility.

Q: Are there any deadlines for filing BOE-267-L?

A: Yes, the BOE-267-L form must be filed with the county assessor's office by February 15th of each year.

Q: What happens after filing BOE-267-L?

A: After filing BOE-267-L, the assessor's office will review the application and determine if the property qualifies for the welfare exemption.

Q: Is there a fee for filing BOE-267-L?

A: No, there is no fee for filing BOE-267-L.

Q: Can I claim a welfare exemption for multiple properties?

A: Yes, you can claim a welfare exemption for multiple eligible properties occupied by lower income households using separate BOE-267-L forms.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-267-L by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.