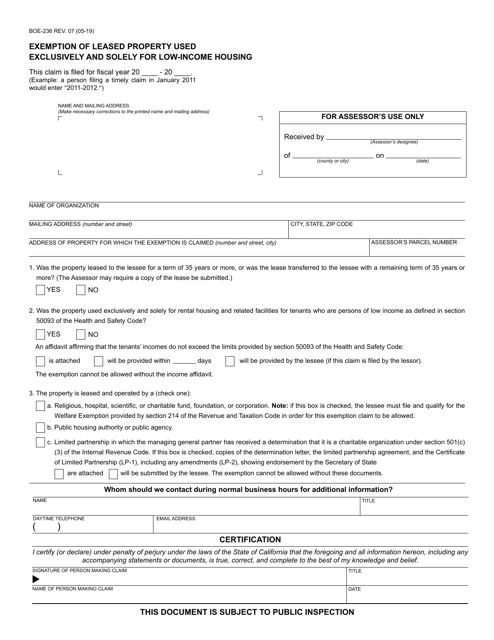

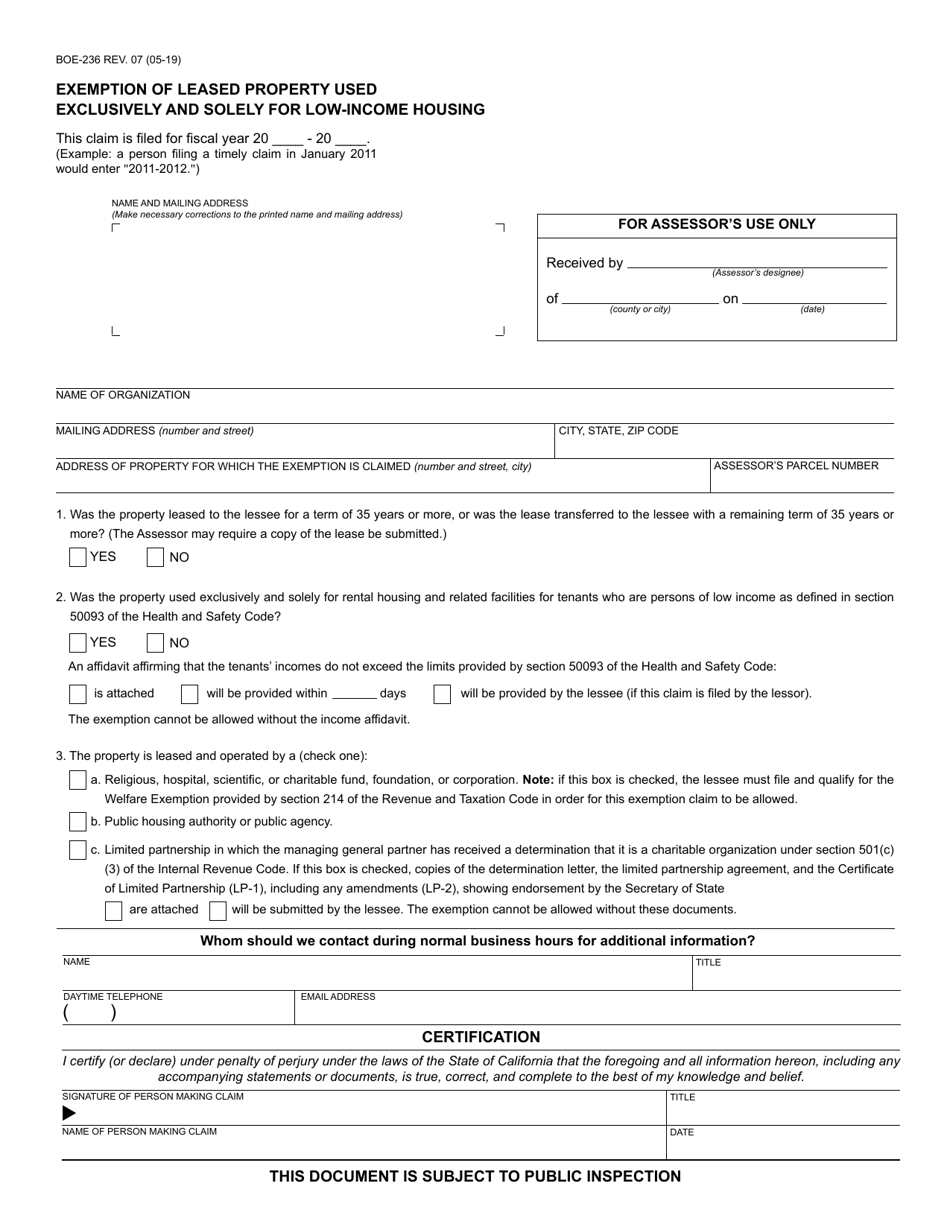

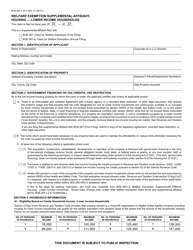

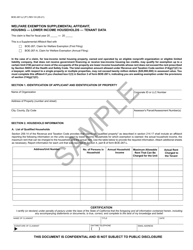

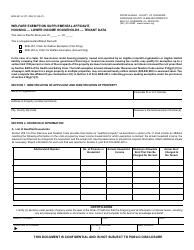

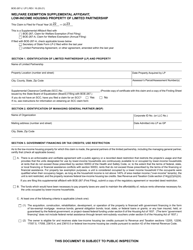

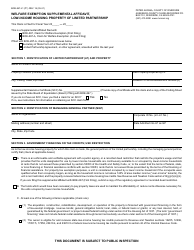

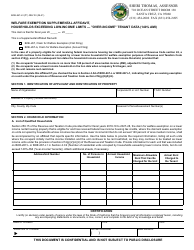

Form BOE-236 Exemption of Leased Property Used Exclusively and Solely for Low-Income Housing - California

What Is Form BOE-236?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-236?

A: Form BOE-236 is a California tax form.

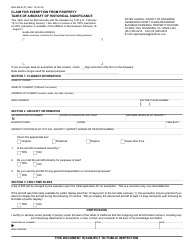

Q: What does Form BOE-236 exempt?

A: Form BOE-236 exempts leased property used exclusively and solely for low-income housing.

Q: Who is eligible for this exemption?

A: Owners or operators of low-income housing in California may be eligible for this exemption.

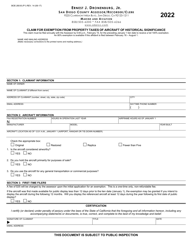

Q: What is the purpose of this exemption?

A: The purpose of this exemption is to provide tax relief for low-income housing projects.

Q: What type of property does this exemption apply to?

A: This exemption applies to leased properties that are used exclusively for low-income housing.

Q: Is there a deadline for filing Form BOE-236?

A: Yes, Form BOE-236 must be filed by February 15th of each year for properties being claimed as exempt for that year.

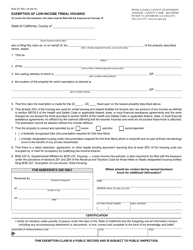

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-236 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.