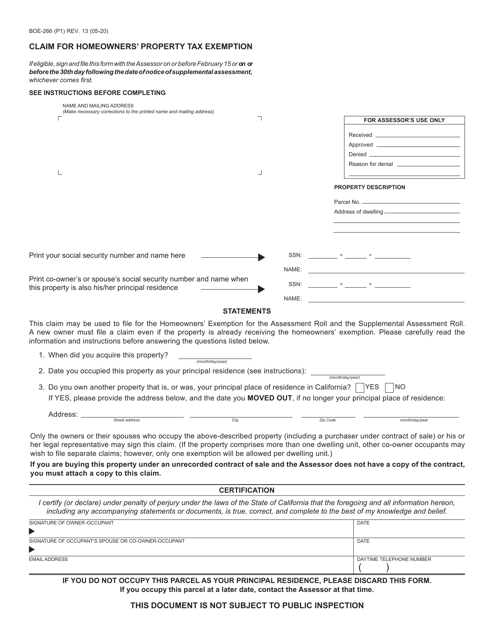

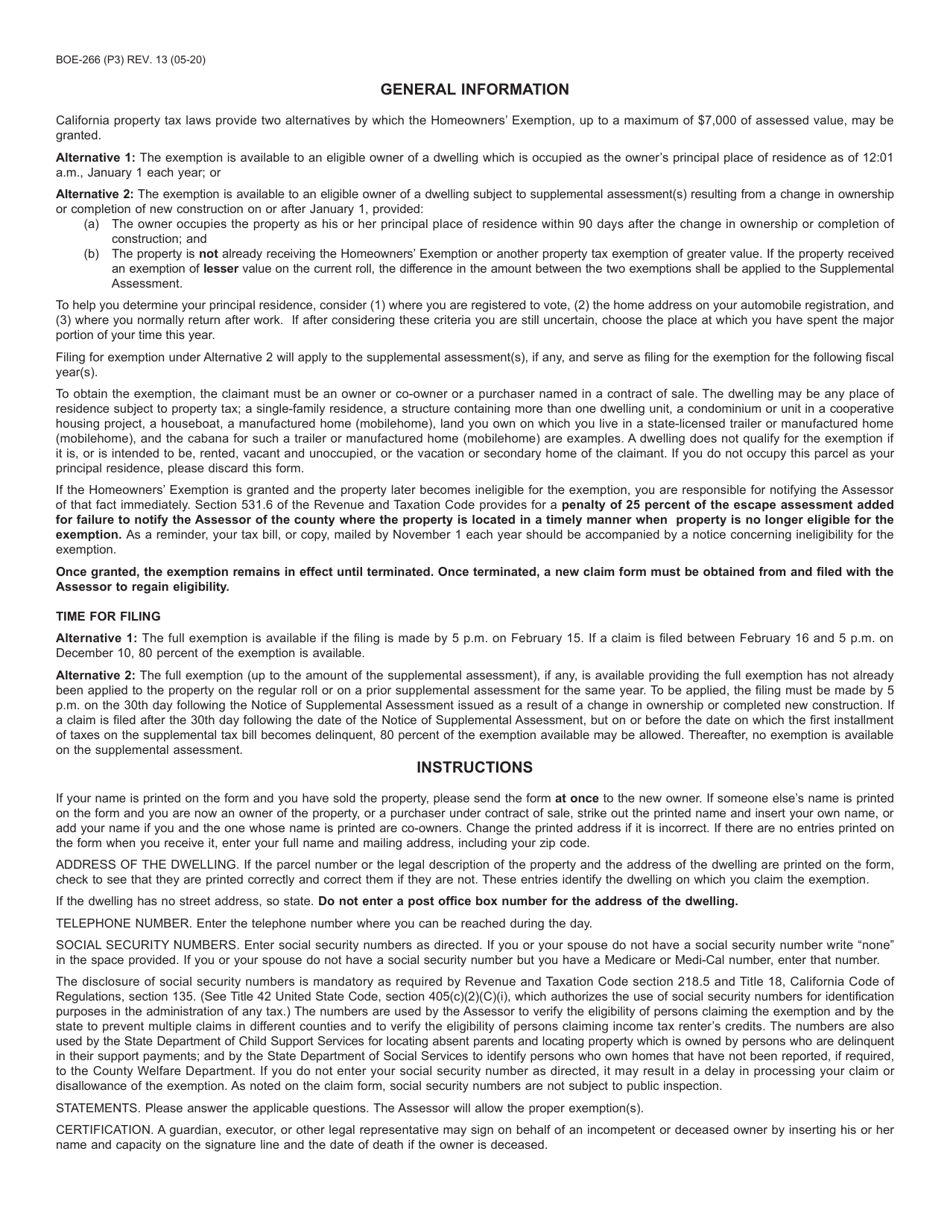

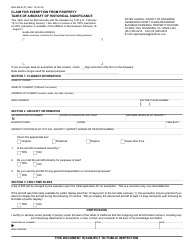

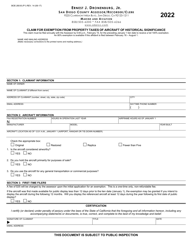

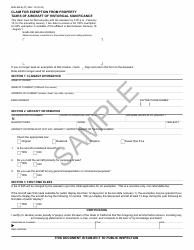

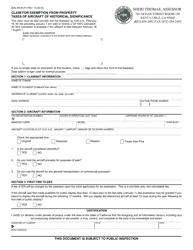

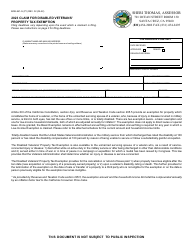

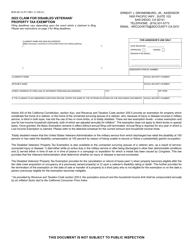

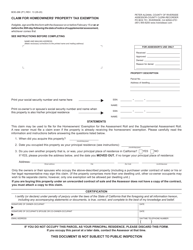

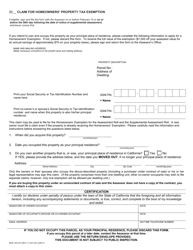

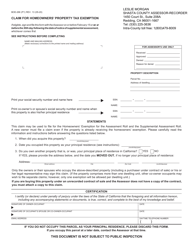

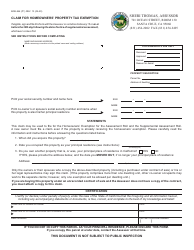

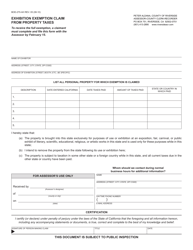

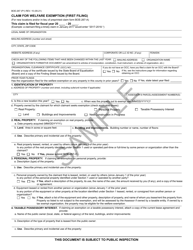

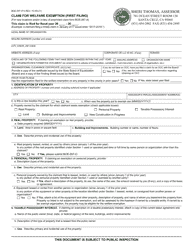

Form BOE-266 Claim for Homeowners' Property Tax Exemption - California

What Is Form BOE-266?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-266?

A: BOE-266 is a form used to claim the Homeowners' Property Tax Exemption in California.

Q: Who can claim the Homeowners' Property Tax Exemption?

A: Homeowners who own and occupy their property as their primary residence in California can claim the exemption.

Q: What is the purpose of the Homeowners' Property Tax Exemption?

A: The exemption helps to reduce the property tax burden for eligible homeowners.

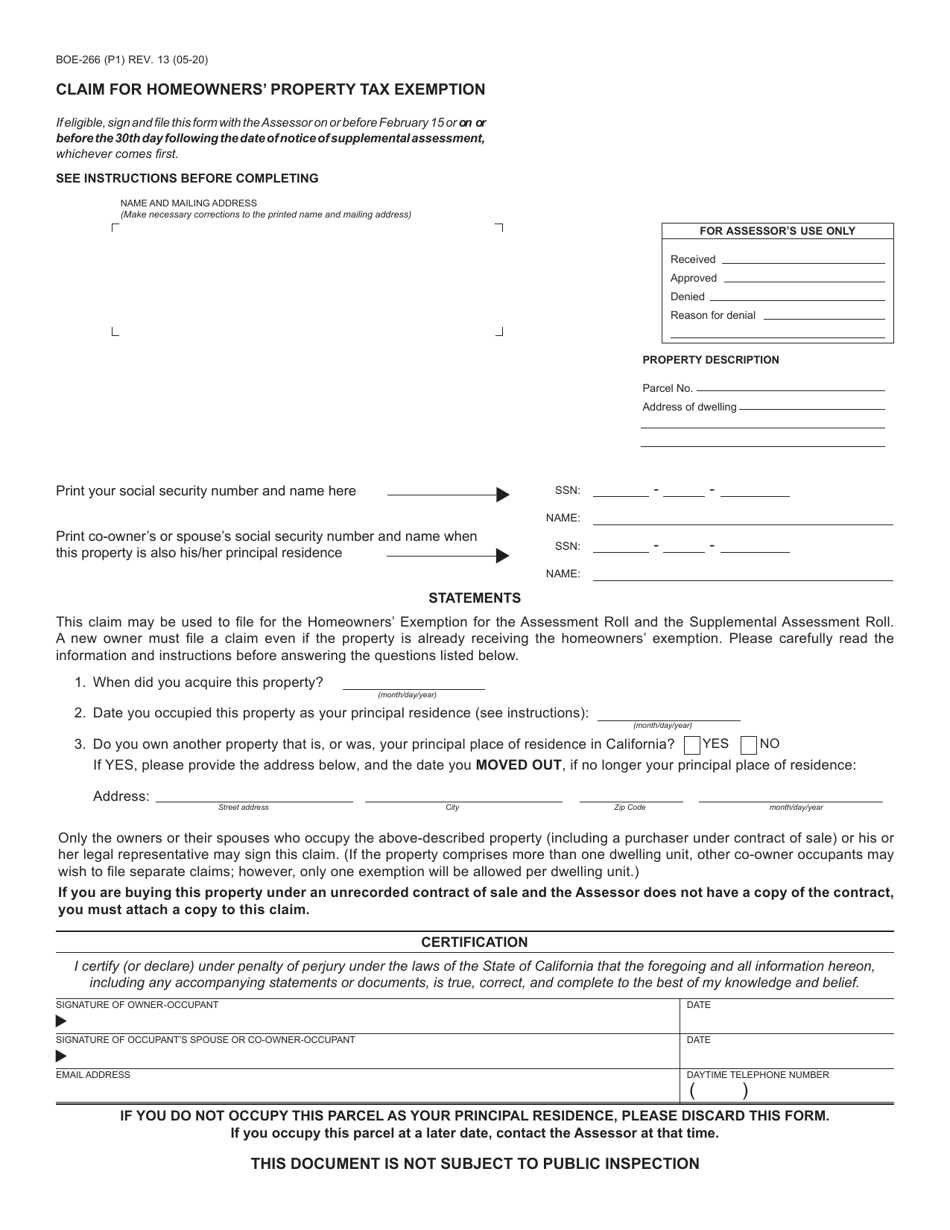

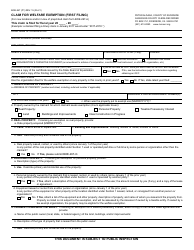

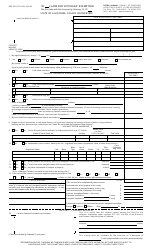

Q: How do I fill out BOE-266?

A: You need to provide your personal information, property details, and sign the form. It is recommended to carefully read the instructions provided with the form.

Q: When is the deadline to submit BOE-266?

A: The deadline varies by county, but it is generally April 1st of each year. You should check with your local county assessor's office for the specific deadline.

Q: What happens after I submit BOE-266?

A: The assessor's office will review your claim and apply the appropriate property tax exemption if you are eligible.

Q: Can I claim the Homeowners' Property Tax Exemption if I rent out a portion of my property?

A: No, the exemption applies only to properties that are owned and occupied as primary residences.

Q: Is there an income limit to qualify for the Homeowners' Property Tax Exemption?

A: No, there is no income limit to qualify for the exemption.

Q: Can I claim the Homeowners' Property Tax Exemption if I recently purchased my property?

A: Yes, as long as you meet the eligibility requirements and occupy the property as your primary residence.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-266 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.