This version of the form is not currently in use and is provided for reference only. Download this version of

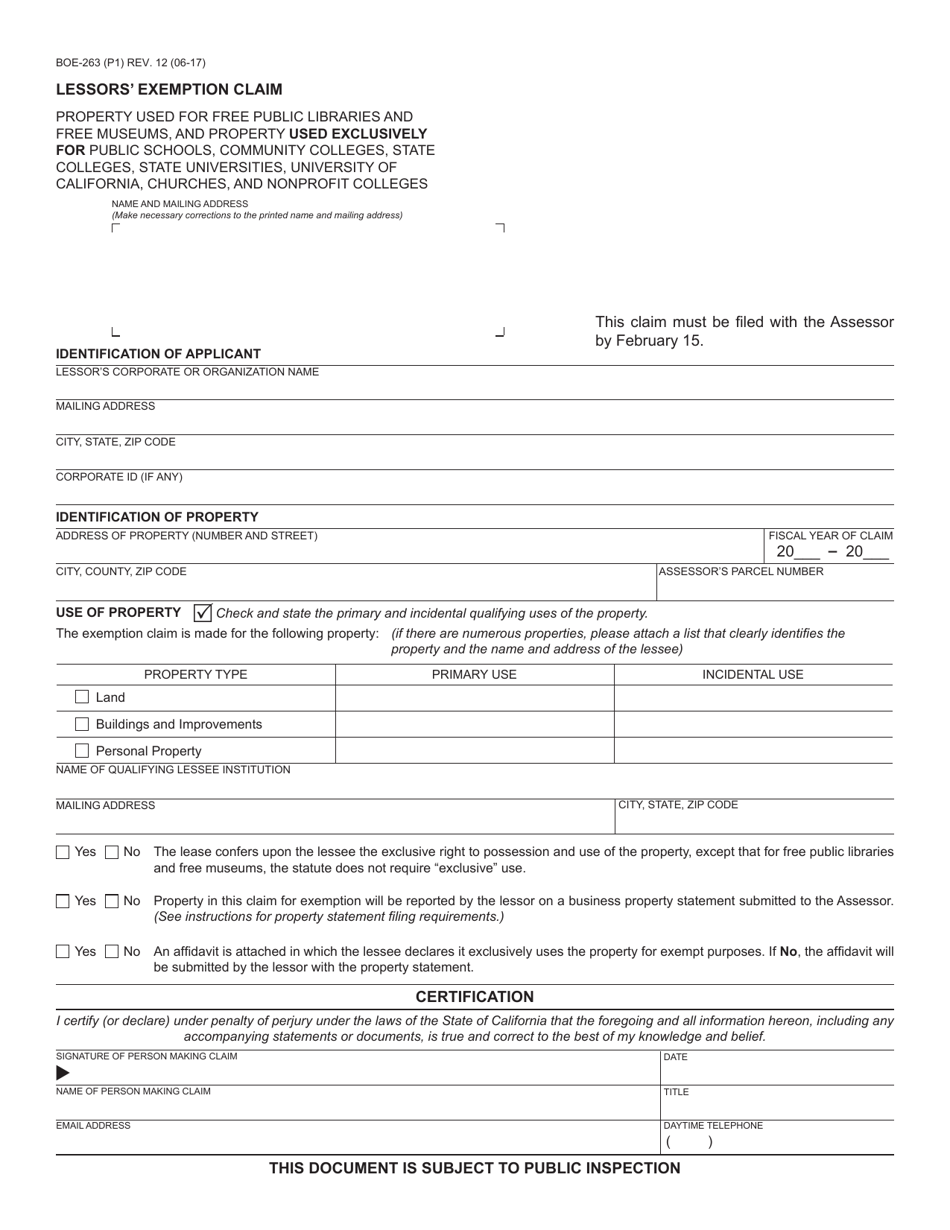

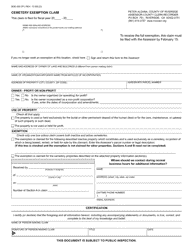

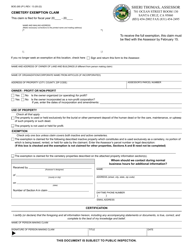

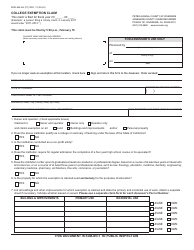

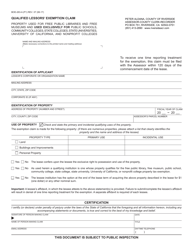

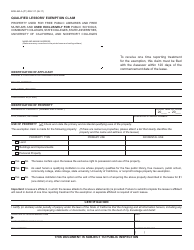

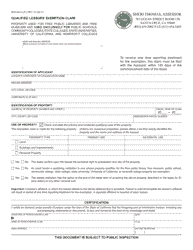

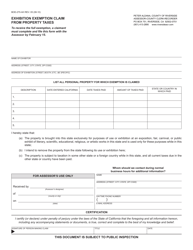

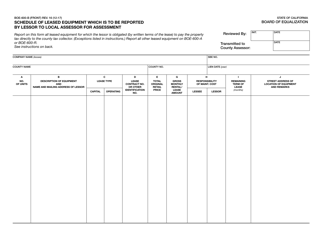

Form BOE-263

for the current year.

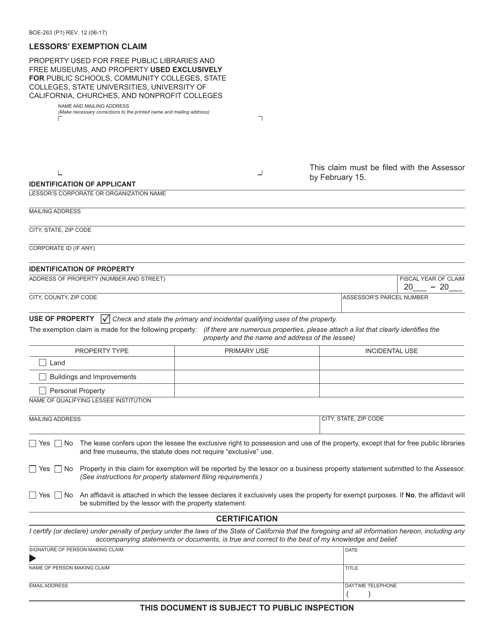

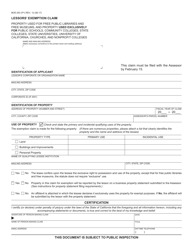

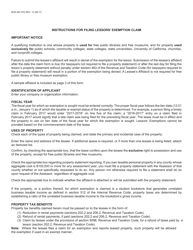

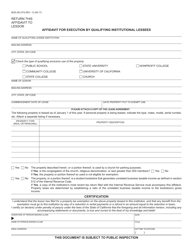

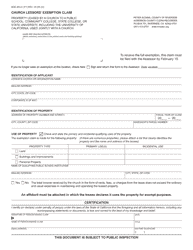

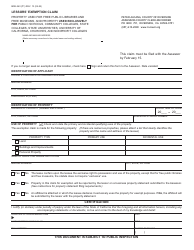

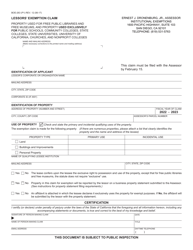

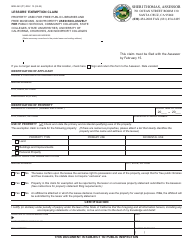

Form BOE-263 Lessors' Exemption Claim - California

What Is Form BOE-263?

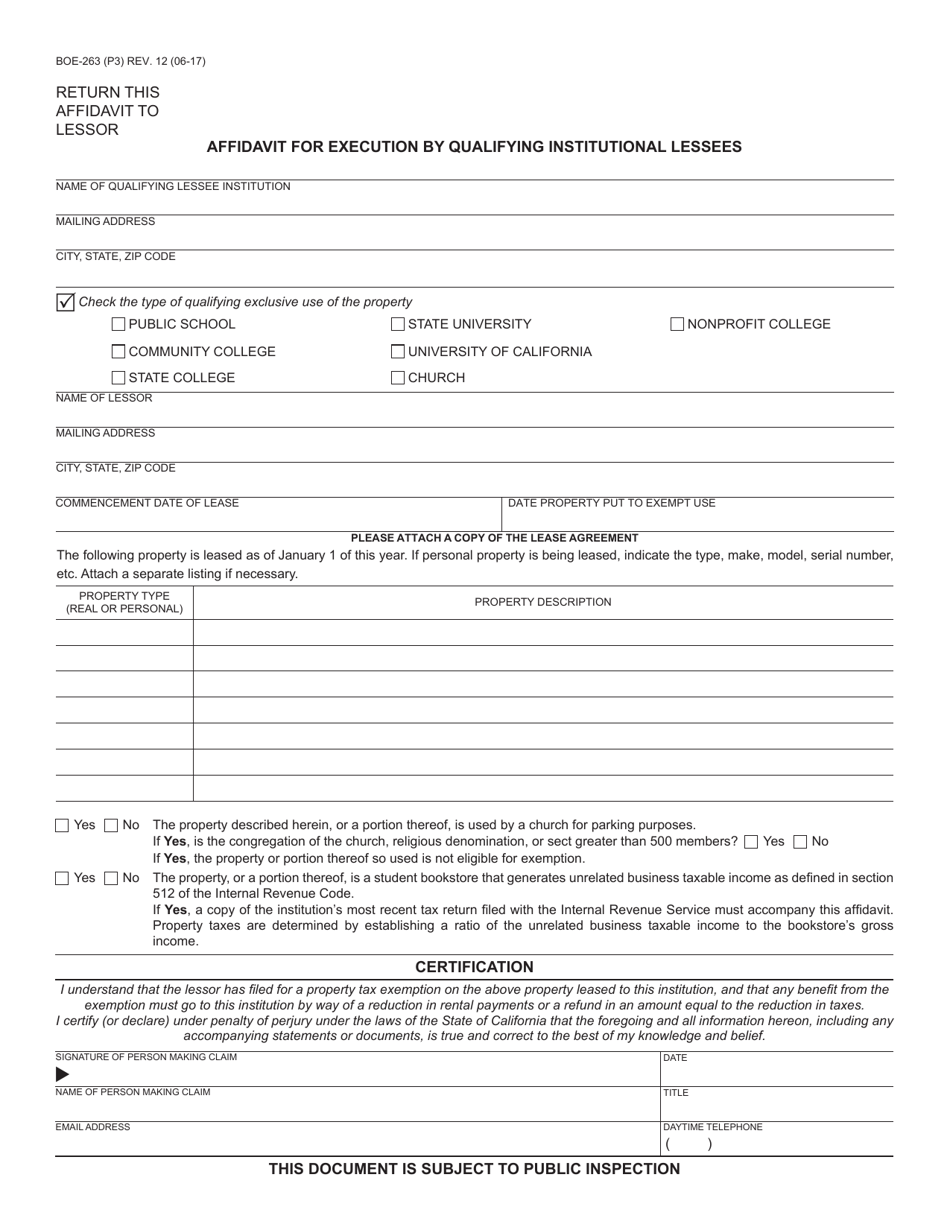

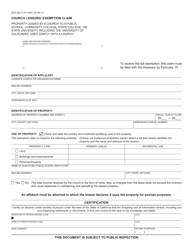

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

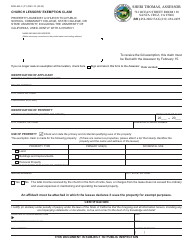

Q: What is Form BOE-263?

A: Form BOE-263 is the Lessors' Exemption Claim form in California.

Q: Who can use Form BOE-263?

A: Form BOE-263 is used by lessors in California.

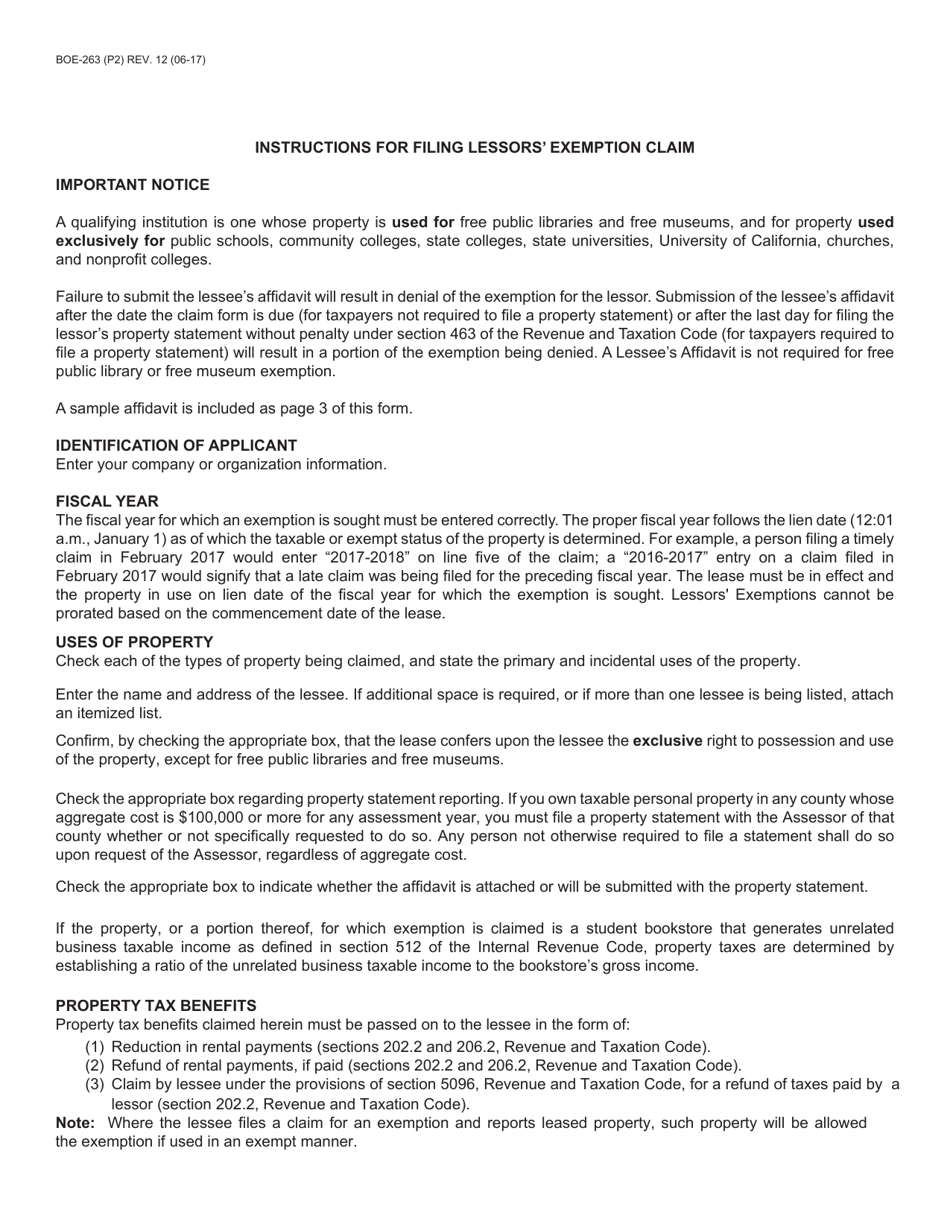

Q: What is the purpose of Form BOE-263?

A: The purpose of Form BOE-263 is to claim the Lessors' Exemption for certain types of leased properties.

Q: What is the Lessors' Exemption?

A: The Lessors' Exemption is an exemption from property tax for certain leased properties in California.

Q: What properties are eligible for the Lessors' Exemption?

A: Properties that are eligible for the Lessors' Exemption include leased machinery, equipment, and fixtures.

Q: Is there a deadline for filing Form BOE-263?

A: Yes, Form BOE-263 must be filed by February 15th of the assessment year for which the exemption is claimed.

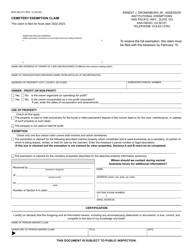

Q: Are there any fees associated with filing Form BOE-263?

A: No, there are no fees associated with filing Form BOE-263.

Q: What should I do if I have additional questions about Form BOE-263?

A: If you have additional questions, you should contact the California State Board of Equalization for assistance.

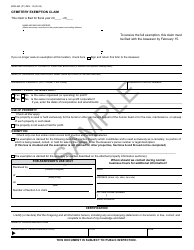

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-263 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.