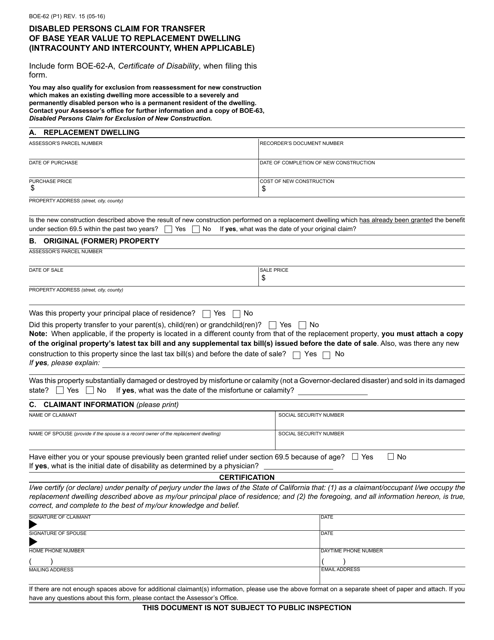

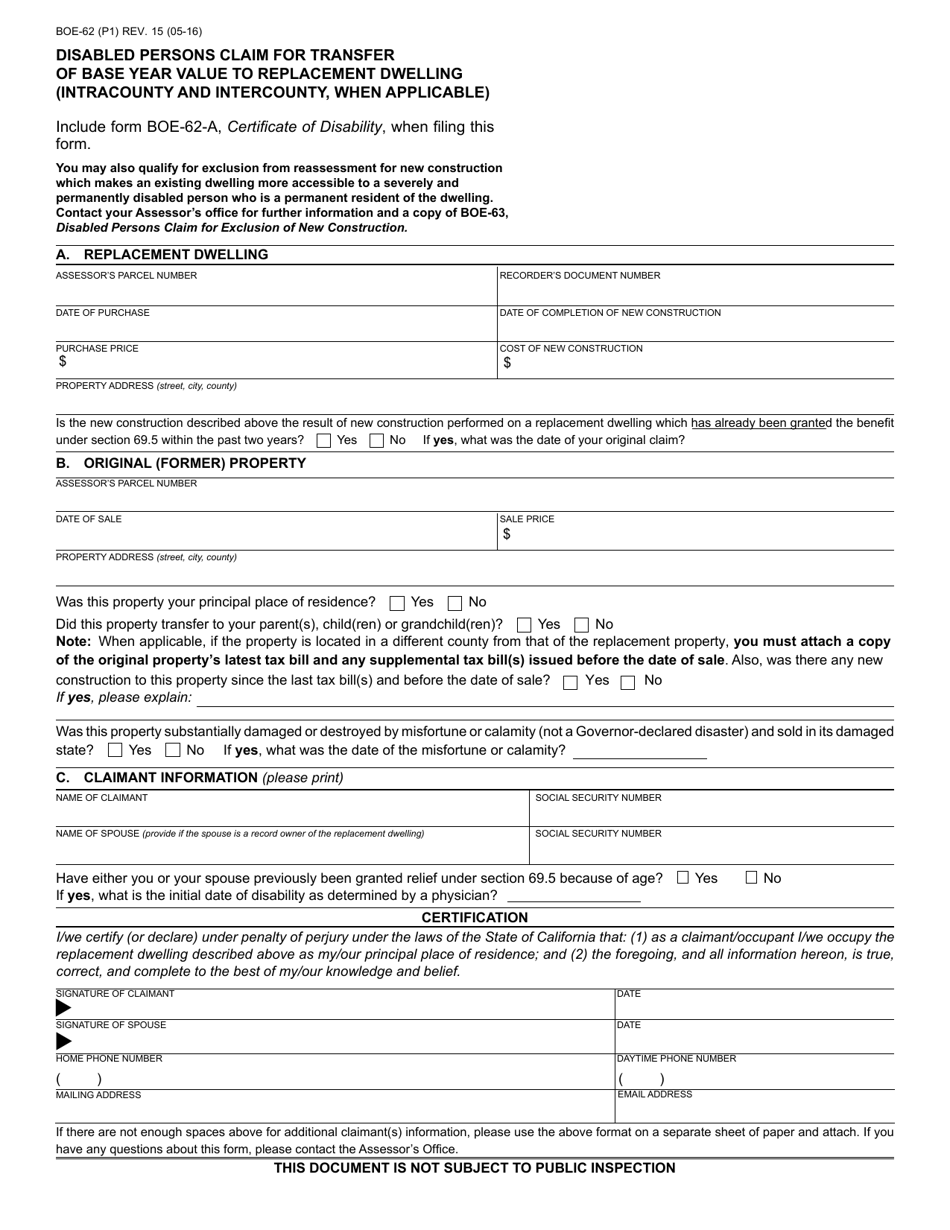

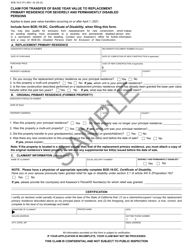

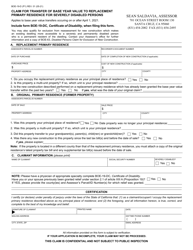

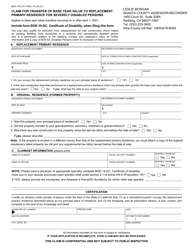

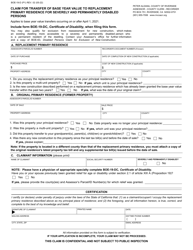

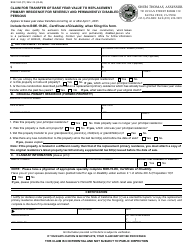

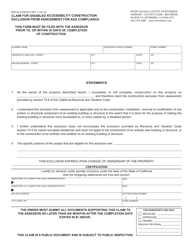

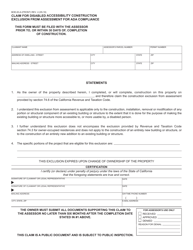

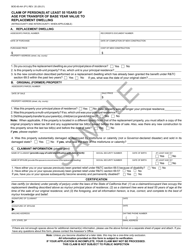

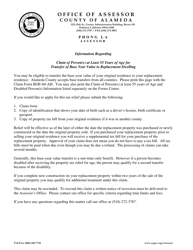

Form BOE-62 Disabled Persons Claim for Transfer of Base Year Value to Replacement Dwelling - California

What Is Form BOE-62?

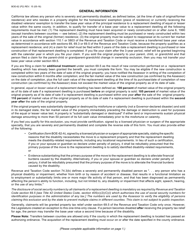

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-62?

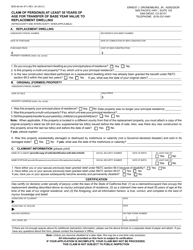

A: Form BOE-62 is a form used in California to claim the transfer of base year value to a replacement dwelling for disabled persons.

Q: Who can use Form BOE-62?

A: Form BOE-62 can be used by disabled persons in California who meet the eligibility criteria.

Q: What is the purpose of Form BOE-62?

A: The purpose of Form BOE-62 is to allow disabled persons in California to transfer the base year value of their current property to a replacement dwelling, which can help lower their property taxes.

Q: What is base year value?

A: Base year value is the taxable value of a property established when it is purchased or constructed.

Q: What is a replacement dwelling?

A: A replacement dwelling is a new property that a disabled person purchases or constructs to replace their current property.

Q: How can Form BOE-62 help lower property taxes?

A: Form BOE-62 allows disabled persons to transfer the base year value of their current property to a replacement dwelling, which means they will be taxed based on the lower value of their original property.

Q: Are there any eligibility requirements to use Form BOE-62?

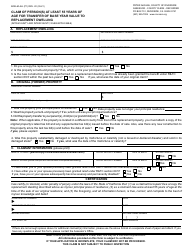

A: Yes, there are eligibility requirements. Disabled persons must meet certain criteria related to their disability, ownership, and use of the replacement dwelling.

Q: Are there any deadlines for filing Form BOE-62?

A: Yes, there are specific filing deadlines for Form BOE-62. It is important to check the instructions on the form or contact the BOE for the most up-to-date information.

Q: Is there a fee to file Form BOE-62?

A: No, there is no fee to file Form BOE-62.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the California State Board of Equalization;

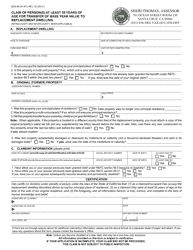

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-62 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.