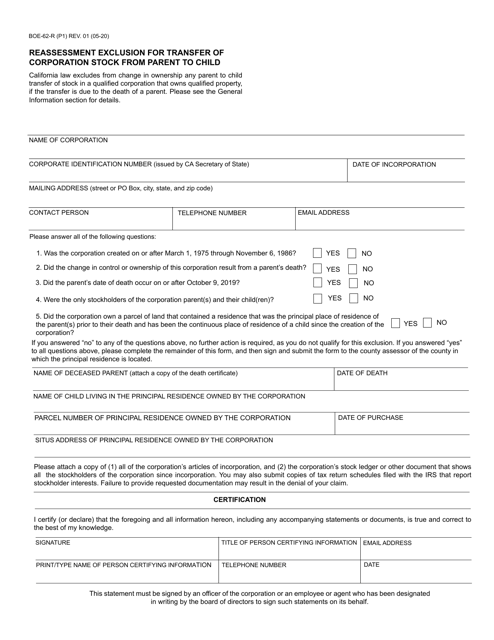

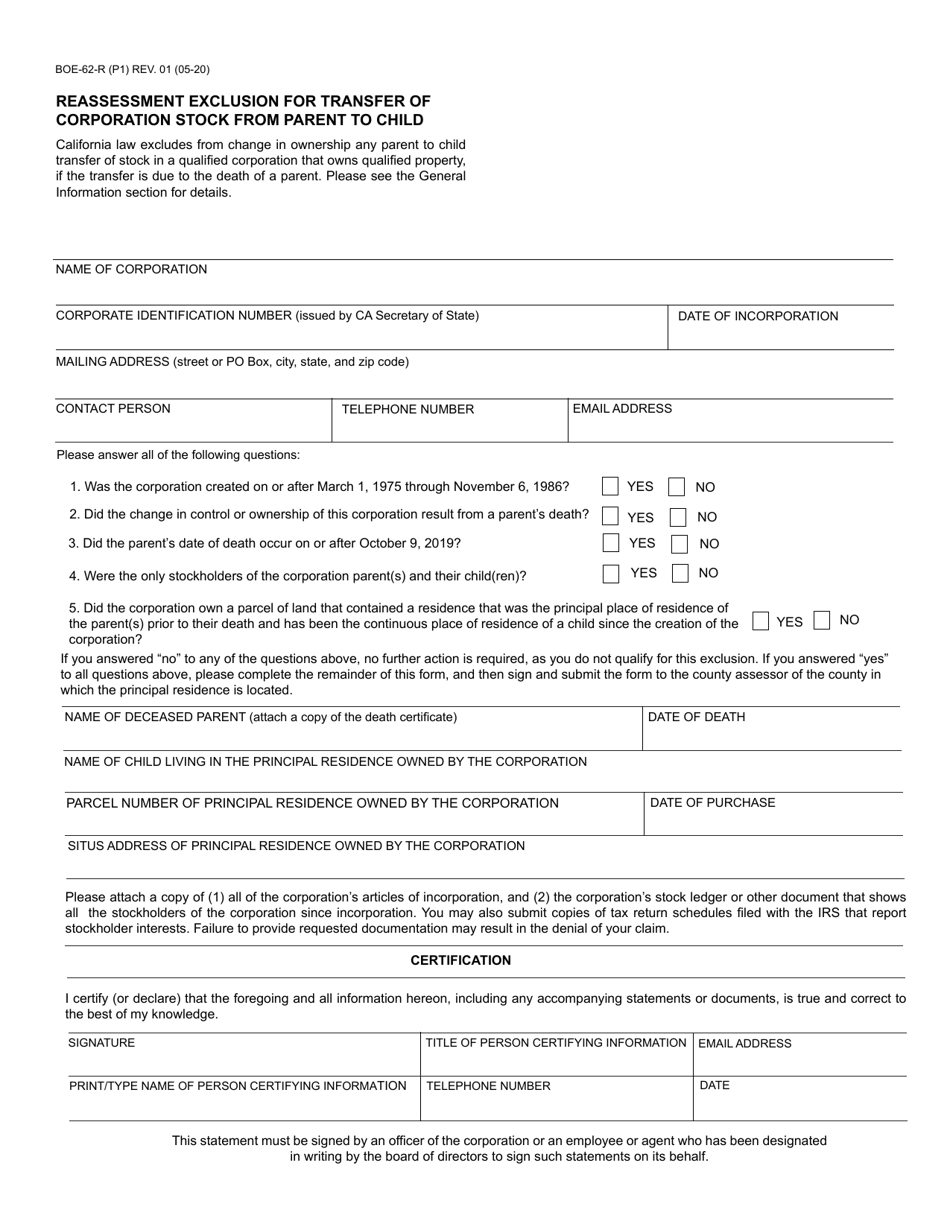

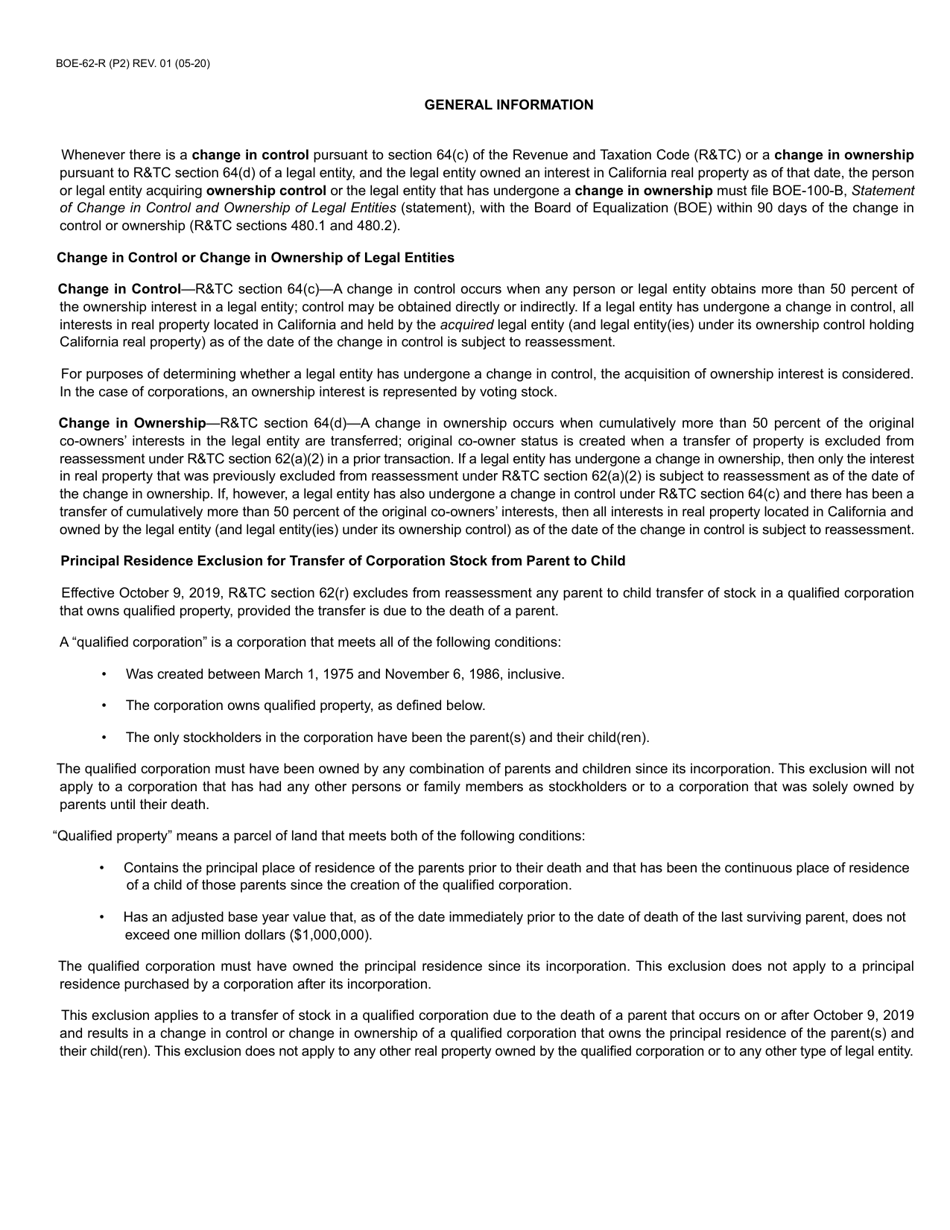

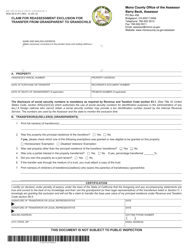

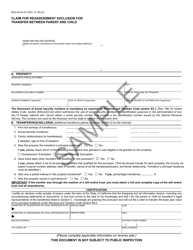

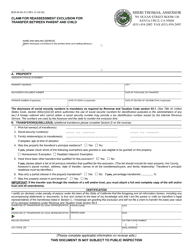

Form BOE-62-R Reassessment Exclusion for Transfer of Corporation Stock From Parent to Child - California

What Is Form BOE-62-R?

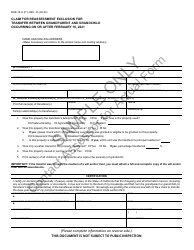

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-62-R?

A: Form BOE-62-R is a tax form used in California.

Q: What is the purpose of Form BOE-62-R?

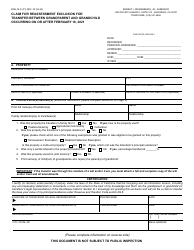

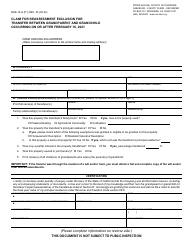

A: Form BOE-62-R is used for claiming reassessment exclusion for transfer of corporation stock from parent to child in California.

Q: Who is eligible to use Form BOE-62-R?

A: Parents who are transferring corporation stock to their children may be eligible to use Form BOE-62-R.

Q: What is the reassessment exclusion for transfer of corporation stock?

A: The reassessment exclusion allows for the transfer of corporation stock from parent to child without triggering reassessment for property tax purposes.

Q: Are there any requirements to qualify for the reassessment exclusion?

A: Yes, there are certain requirements that must be met to qualify for the reassessment exclusion. These requirements may include criteria such as the percentage of stock transferred and the continuation of business operations.

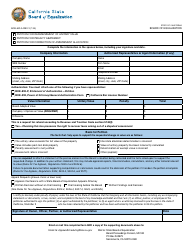

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-62-R by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.