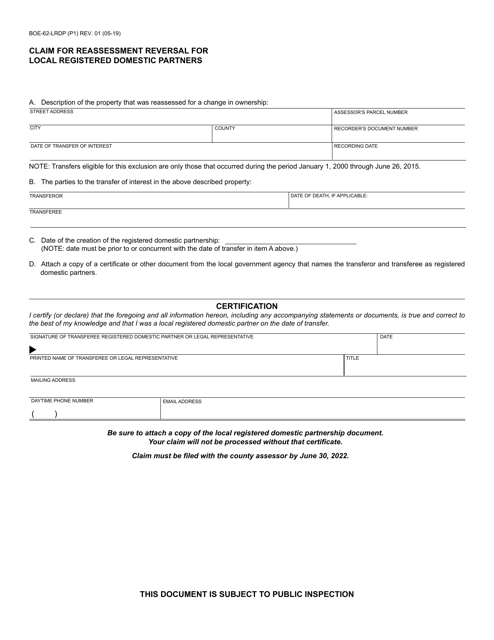

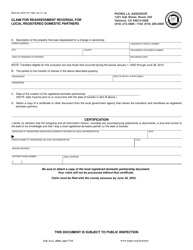

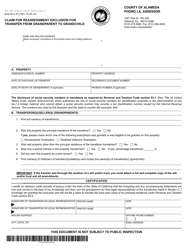

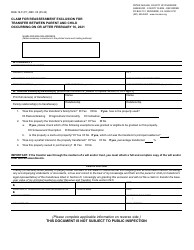

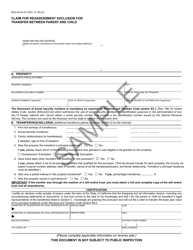

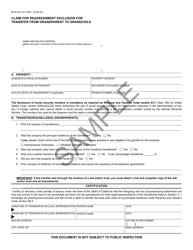

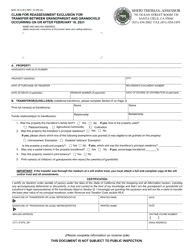

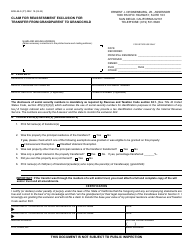

Form BOE-62-LRDP Claim for Reassessment Reversal for Local Registered Domestic Partners - California

What Is Form BOE-62-LRDP?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-62-LRDP?

A: BOE-62-LRDP is a claim form for reassessment reversal for local registered domestic partners in California.

Q: Who can use BOE-62-LRDP?

A: BOE-62-LRDP can be used by local registered domestic partners in California.

Q: What is the purpose of BOE-62-LRDP?

A: The purpose of BOE-62-LRDP is to claim for reassessment reversal.

Q: What does reassessment reversal mean?

A: Reassessment reversal refers to reversing the reassessment of the property for tax purposes.

Q: What is a registered domestic partner?

A: A registered domestic partner is a person who has entered into a domestic partnership with another person under California law.

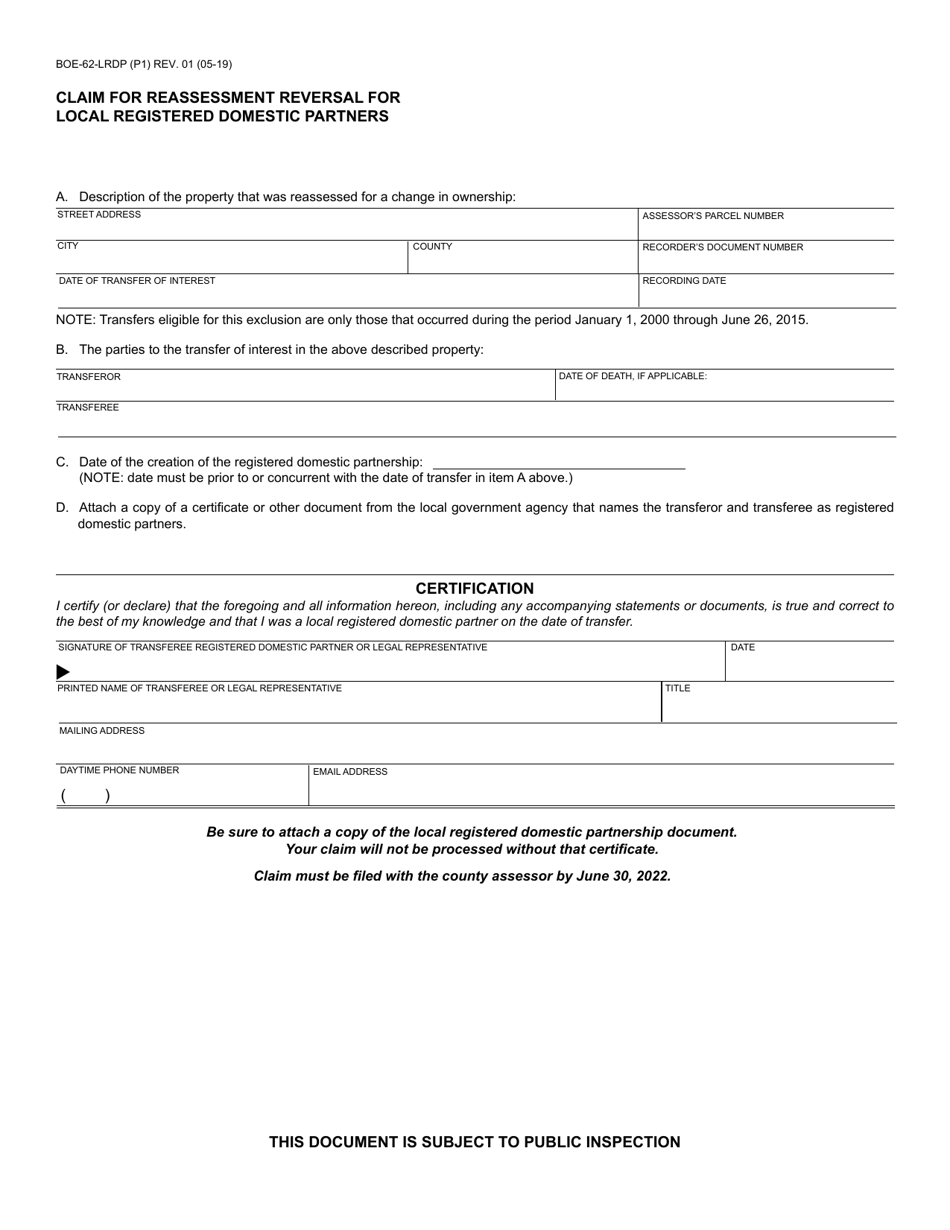

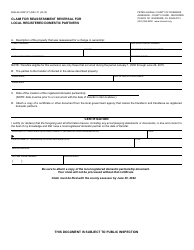

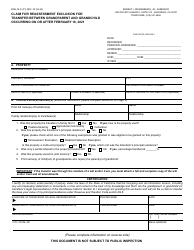

Q: What information is required on BOE-62-LRDP?

A: BOE-62-LRDP requires information such as property address, names of domestic partners, and the date of domestic partnership registration.

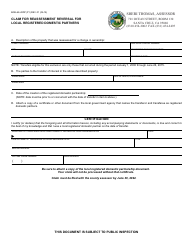

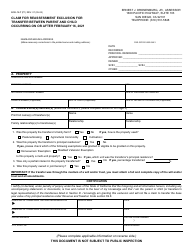

Q: How do I submit BOE-62-LRDP?

A: BOE-62-LRDP can be submitted by mail or electronically, as instructed by the California State Board of Equalization (BOE).

Q: Are there any fees associated with BOE-62-LRDP?

A: There are no fees associated with submitting BOE-62-LRDP.

Q: What should I do if I have questions about BOE-62-LRDP?

A: If you have questions about BOE-62-LRDP, you can contact the California State Board of Equalization (BOE) for assistance.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-62-LRDP by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.