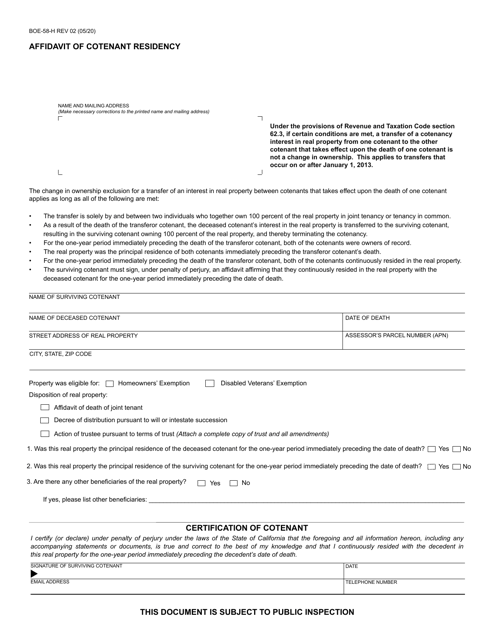

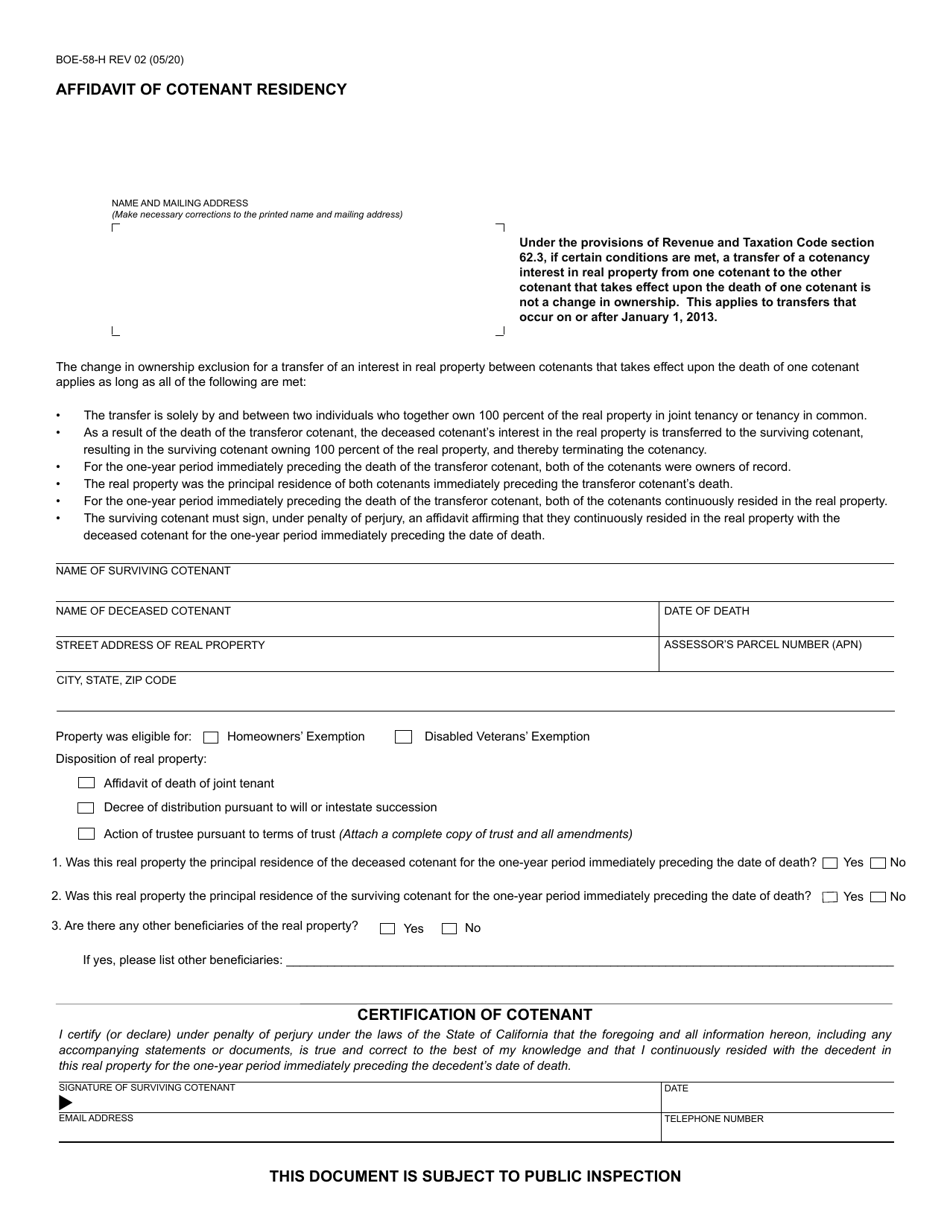

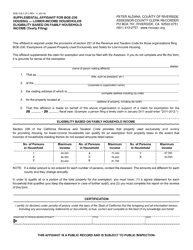

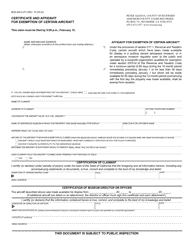

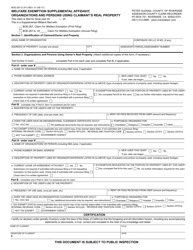

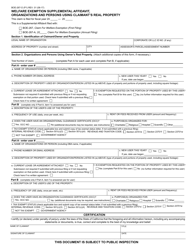

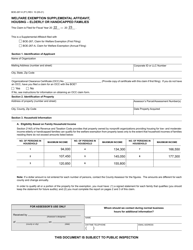

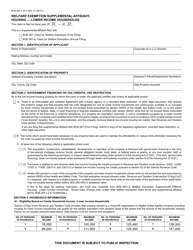

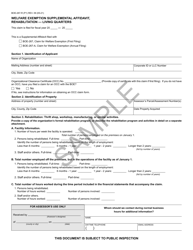

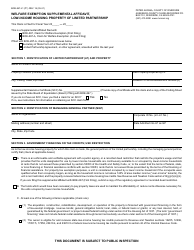

Form BOE-58-H Affidavit of Cotenant Residency - California

What Is Form BOE-58-H?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

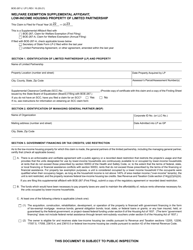

Q: What is the Form BOE-58-H?

A: The Form BOE-58-H is an Affidavit of Cotenant Residency in California.

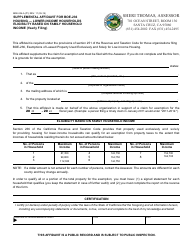

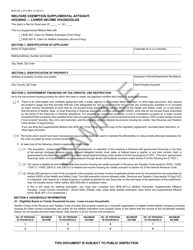

Q: When is Form BOE-58-H used?

A: Form BOE-58-H is used when two or more people co-own and occupy a property in California and are seeking a property tax exemption.

Q: Who can use Form BOE-58-H?

A: Form BOE-58-H can be used by cotenants who co-own and occupy a property in California.

Q: What is the purpose of Form BOE-58-H?

A: The purpose of Form BOE-58-H is to establish and verify the cotenant residency status for property tax exemption purposes.

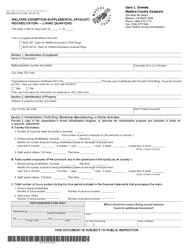

Q: How do I complete Form BOE-58-H?

A: You need to provide your personal information, details about the property, and sign the affidavit on Form BOE-58-H.

Q: What are the supporting documents required with Form BOE-58-H?

A: You may need to provide supporting documents such as lease agreement, utility bills, and identification documents to prove your cotenant residency on Form BOE-58-H.

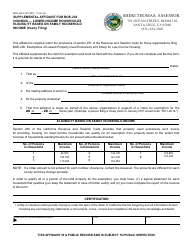

Q: How long does it take to process Form BOE-58-H?

A: The processing time for Form BOE-58-H varies, but it typically takes a few weeks to be reviewed and approved.

Q: Are there any fees associated with filing Form BOE-58-H?

A: There are no fees associated with filing Form BOE-58-H.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-58-H by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.