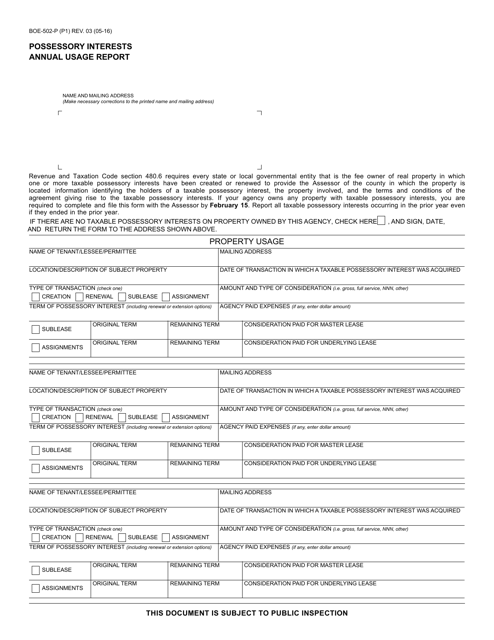

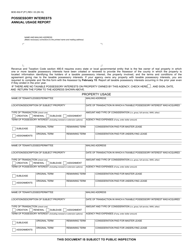

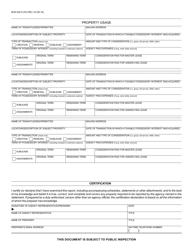

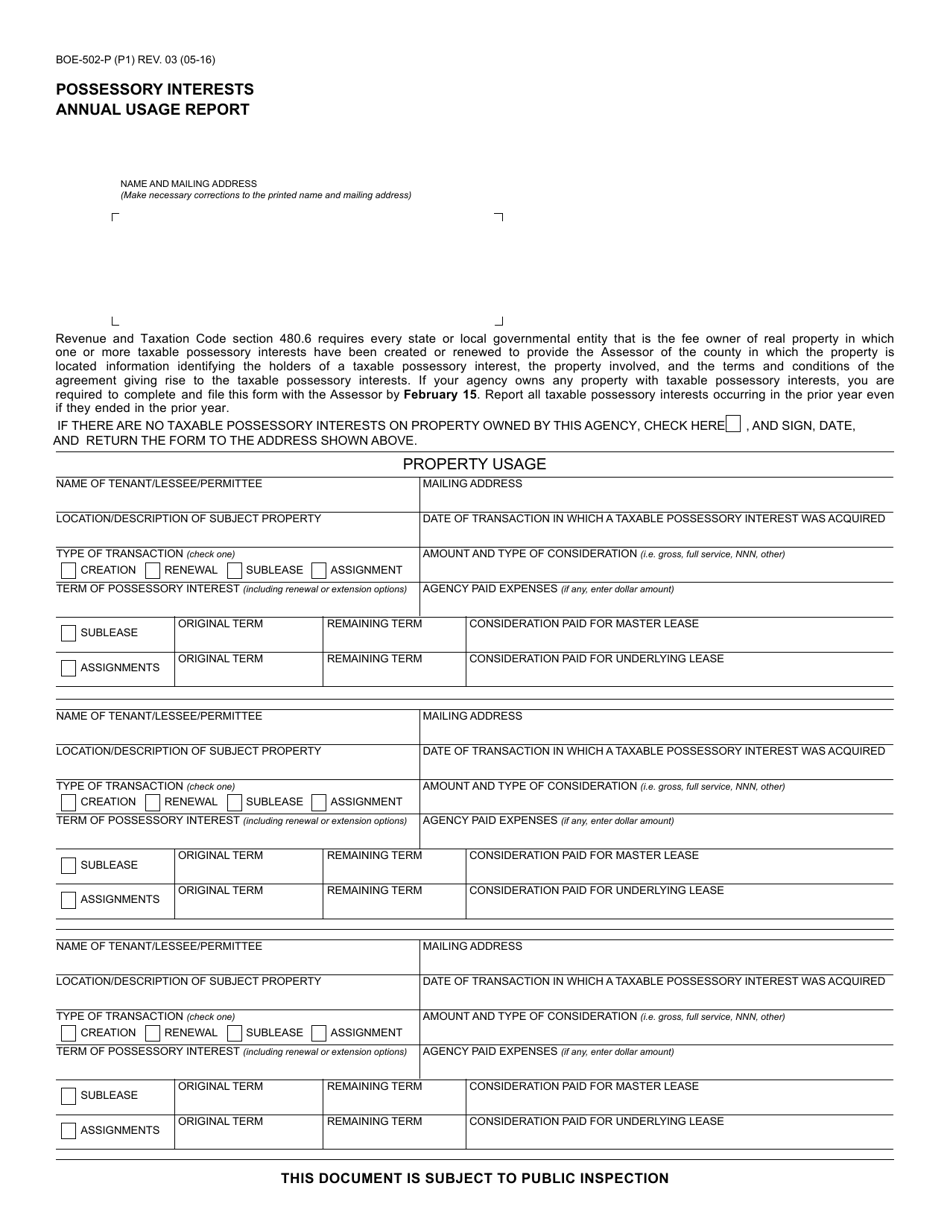

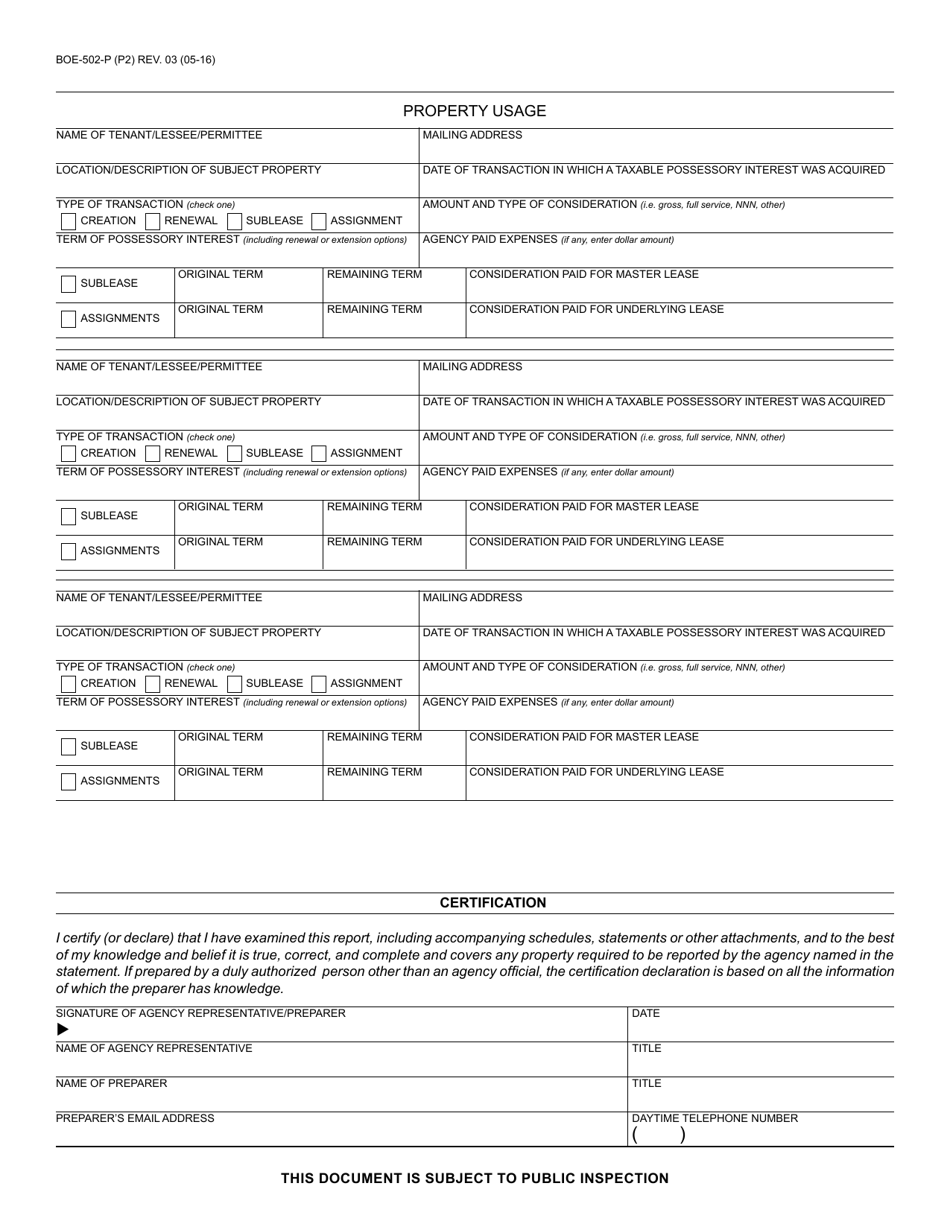

Form BOE-502-P Possessory Interests Annual Usage Report - California

What Is Form BOE-502-P?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-502-P?

A: Form BOE-502-P is the Possessory Interests Annual Usage Report.

Q: Who needs to file Form BOE-502-P?

A: Anyone who has a possessory interest in real property in California needs to file Form BOE-502-P.

Q: What is a possessory interest?

A: A possessory interest is an interest in real property that is separate from the ownership interest.

Q: What is the purpose of Form BOE-502-P?

A: The purpose of Form BOE-502-P is to report and pay the annual usage fee for possessory interests in California.

Q: When is Form BOE-502-P due?

A: Form BOE-502-P is due on or before February 15th of each year.

Q: What information do I need to complete Form BOE-502-P?

A: You will need information about the possessory interest, including the property location, assessed value, and duration of the interest.

Q: Is there a penalty for late filing of Form BOE-502-P?

A: Yes, there is a penalty for late filing of Form BOE-502-P. The penalty is 10% of the annual usage fee, with a minimum penalty of $100.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-502-P by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.