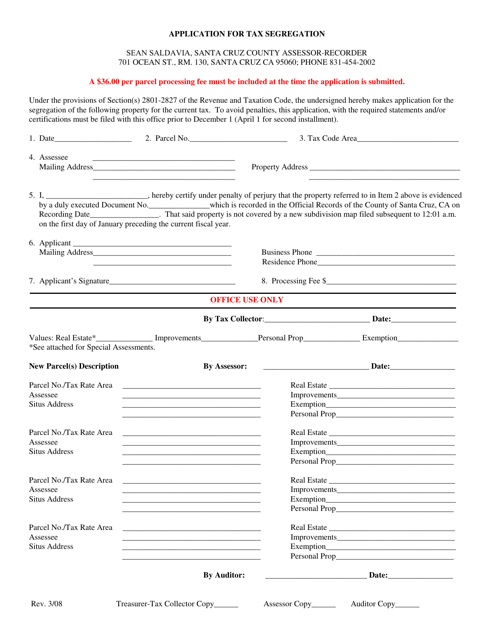

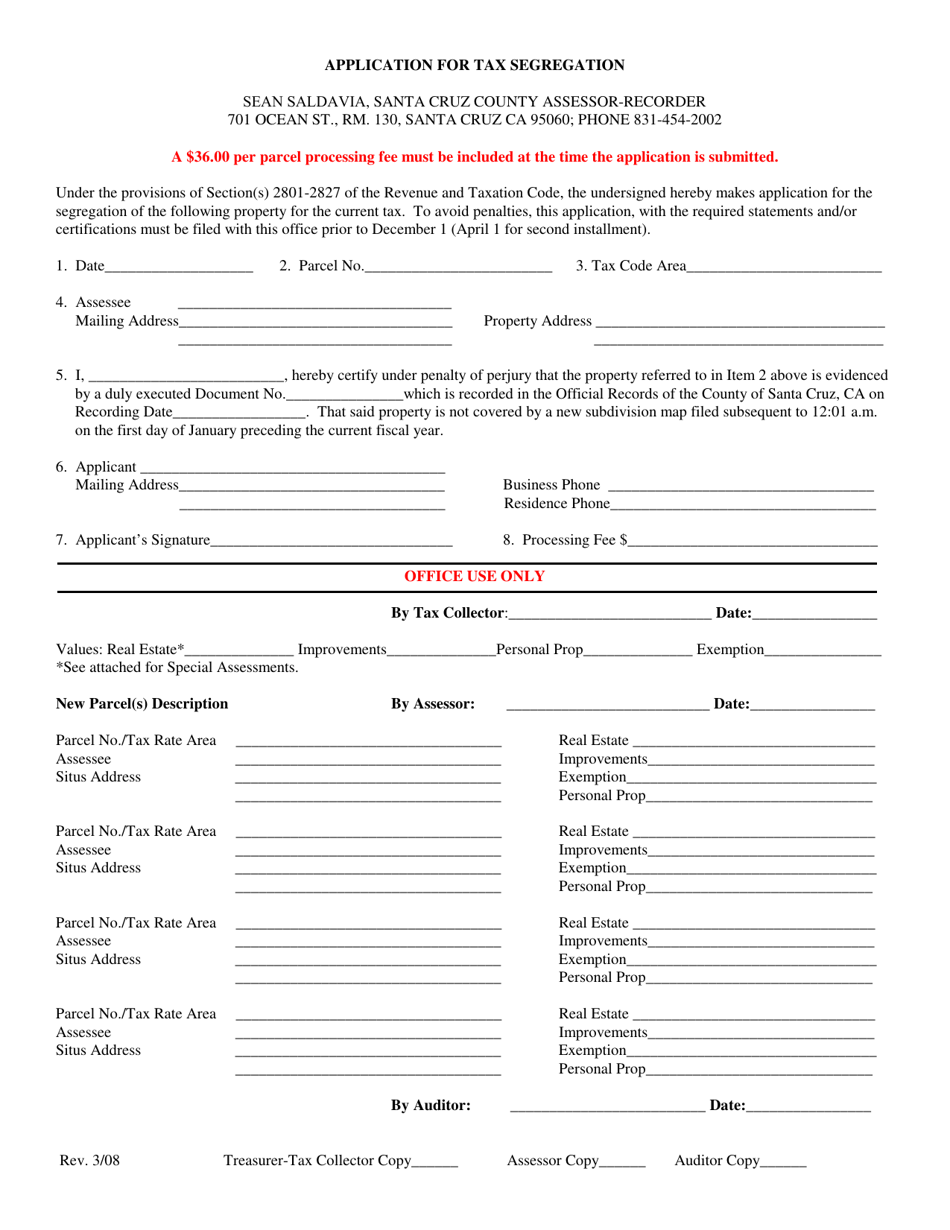

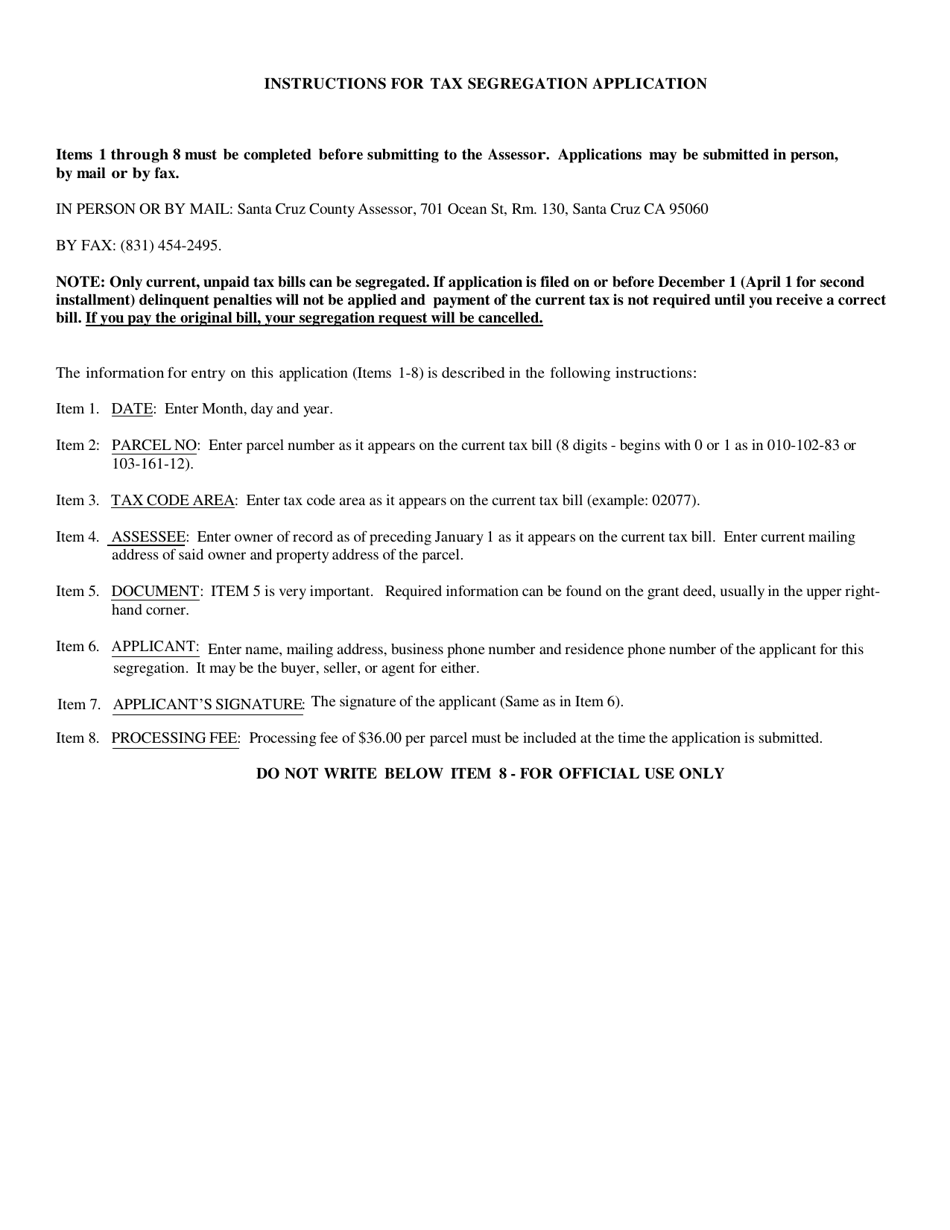

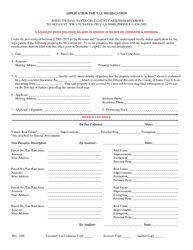

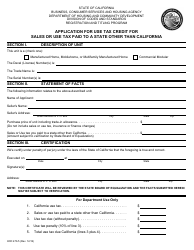

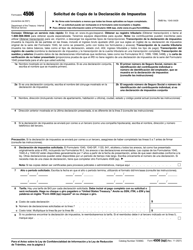

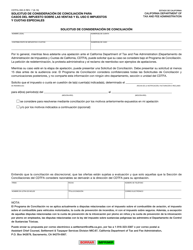

Application for Tax Segregation - Santa Cruz County, California

Application for Tax Segregation is a legal document that was released by the Assessor's Office - Santa Cruz County, California - a government authority operating within California. The form may be used strictly within Santa Cruz County.

FAQ

Q: What is a tax segregation application?

A: A tax segregation application is a request submitted to the Santa Cruz County, California, tax authorities to review and potentially adjust the property's assessed value for tax purposes.

Q: Why would I need to apply for tax segregation?

A: You may need to apply for tax segregation if you believe that the assessed value of your property is inaccurate and should be adjusted for tax purposes.

Q: Is tax segregation applicable only to properties in Santa Cruz County?

A: Yes, tax segregation is specifically applicable to properties in Santa Cruz County, California.

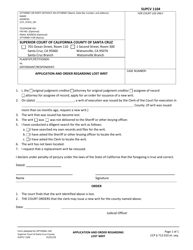

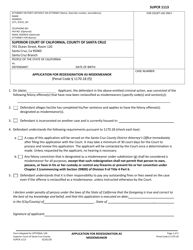

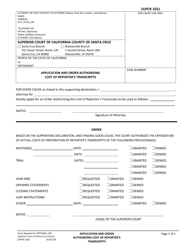

Q: How can I apply for tax segregation in Santa Cruz County?

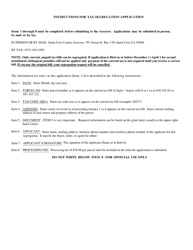

A: To apply for tax segregation in Santa Cruz County, you will need to complete the appropriate application form, provide necessary documentation, and submit it to the Santa Cruz County tax authorities.

Q: What type of documentation is required for a tax segregation application?

A: The required documentation for a tax segregation application may vary, but typically it includes property ownership details, property value assessment records, and any supporting evidence or documentation that substantiates your claim for a value adjustment.

Q: Is there a deadline for submitting a tax segregation application?

A: It's important to check with the Santa Cruz County tax authorities for the specific deadline for submitting a tax segregation application, as it may vary depending on the circumstances.

Form Details:

- Released on March 1, 2008;

- The latest edition currently provided by the Assessor's Office - Santa Cruz County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Assessor's Office - Santa Cruz County, California.