This version of the form is not currently in use and is provided for reference only. Download this version of

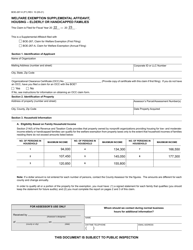

Form BOE-571-D

for the current year.

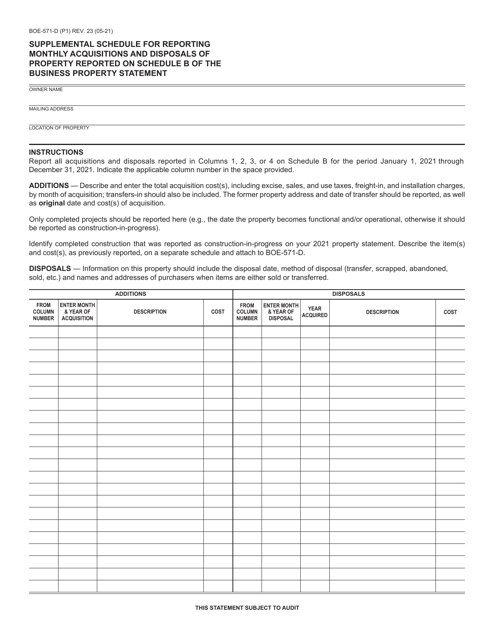

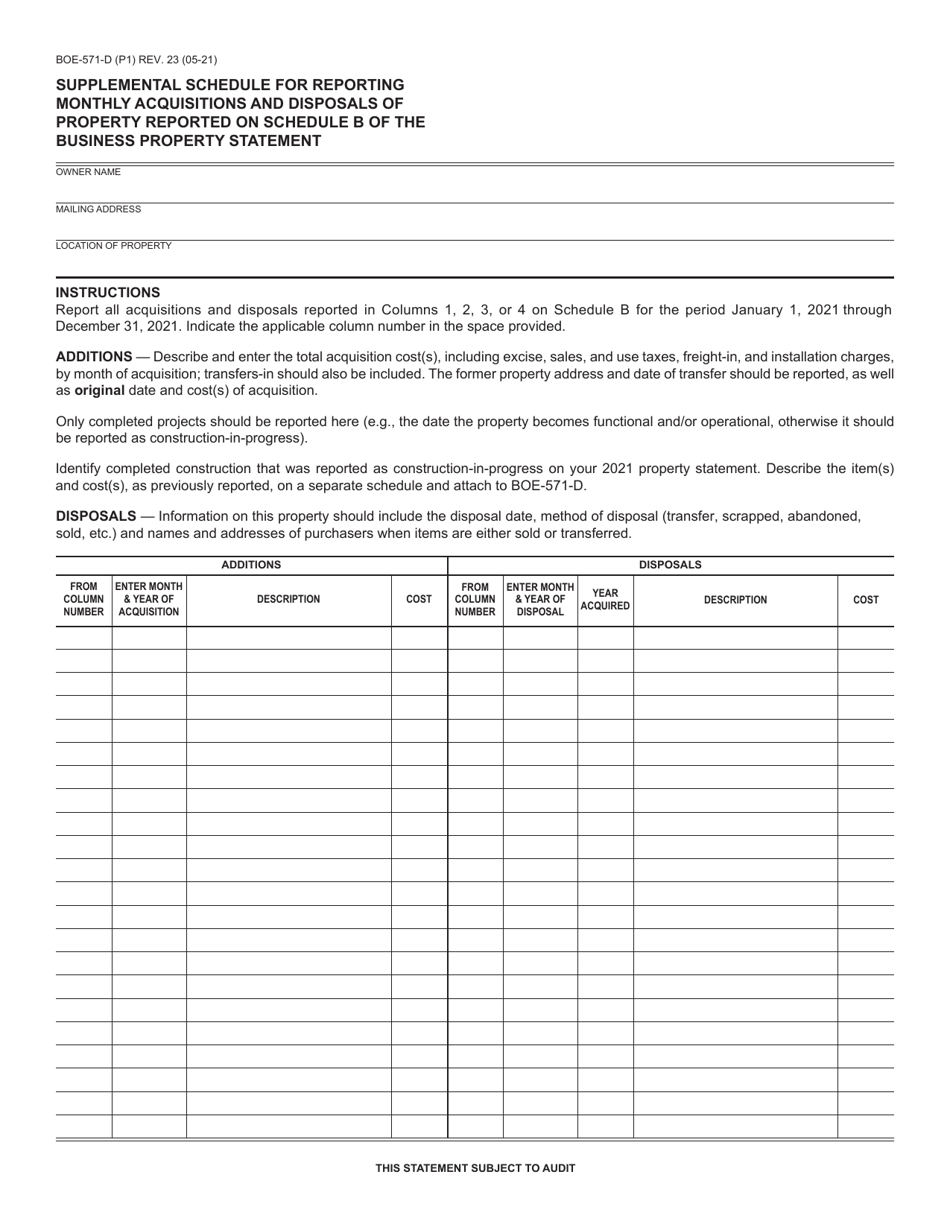

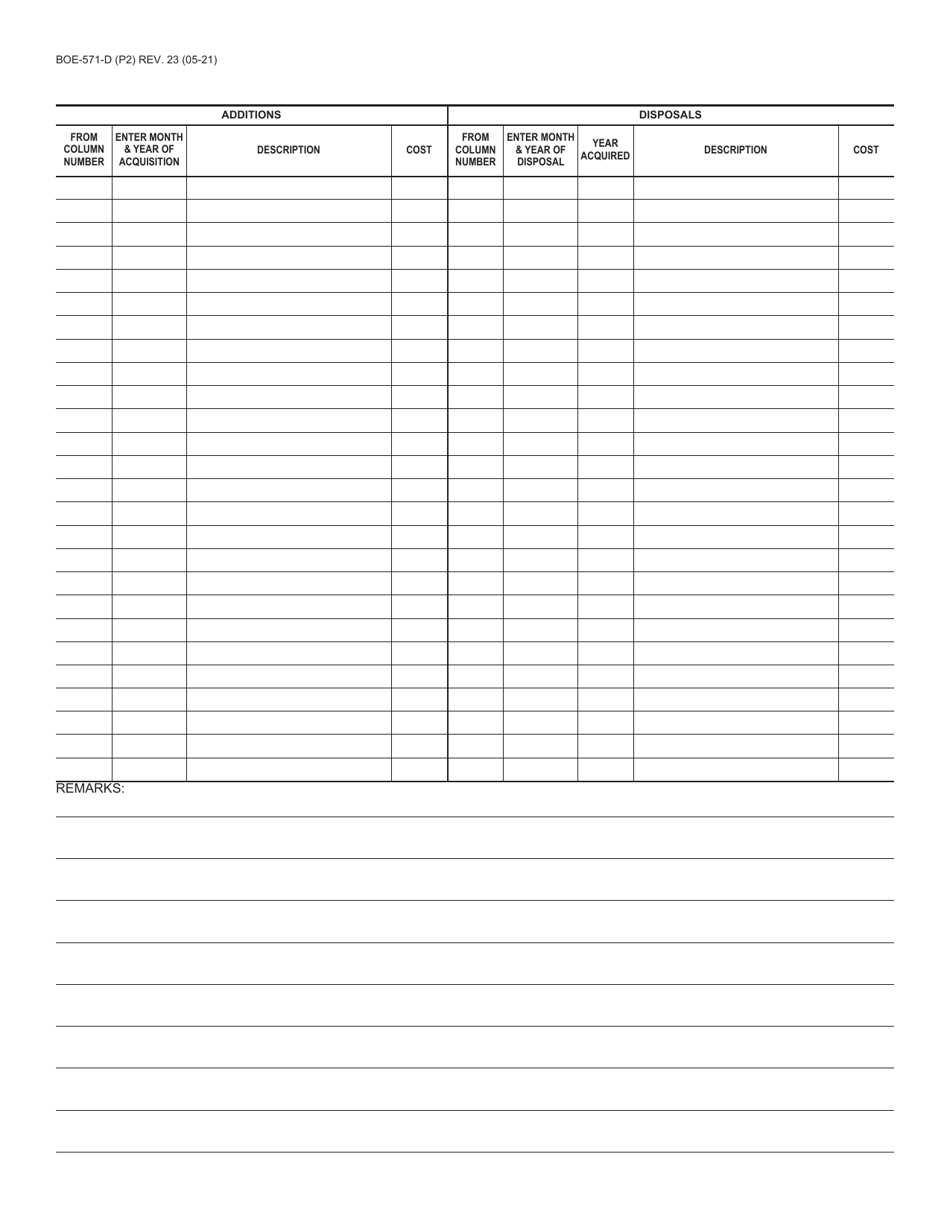

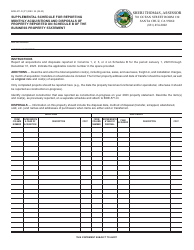

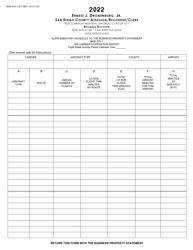

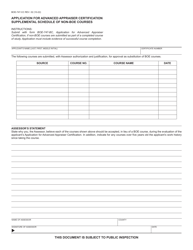

Form BOE-571-D Supplemental Schedule for Reporting Monthly Acquisitions and Disposals of Property Reported on Schedule B of the Business Property Statement - California

What Is Form BOE-571-D?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-571-D?

A: BOE-571-D is a Supplemental Schedule for Reporting Monthly Acquisitions and Disposals of Property Reported on Schedule B of the Business Property Statement in California.

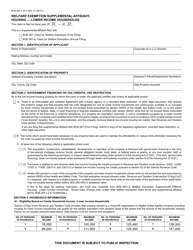

Q: What is Schedule B of the Business Property Statement?

A: Schedule B of the Business Property Statement is a form used to report the acquisition cost of business property by a taxpayer.

Q: What is the purpose of BOE-571-D?

A: The purpose of BOE-571-D is to provide a detailed report of monthly acquisitions and disposals of business property in California.

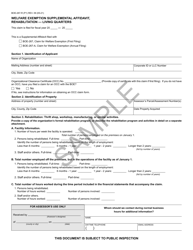

Q: Who needs to file BOE-571-D?

A: Taxpayers in California who have acquired or disposed of business property during the reporting period need to file BOE-571-D.

Q: Do I need to file BOE-571-D if I didn't have any acquisitions or disposals?

A: If you didn't have any acquisitions or disposals of business property during the reporting period, you don't need to file BOE-571-D.

Q: How often do I need to file BOE-571-D?

A: BOE-571-D needs to be filed monthly to report any acquisitions or disposals of business property in California.

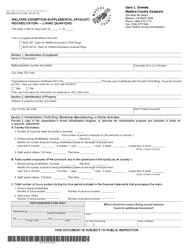

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-571-D by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.