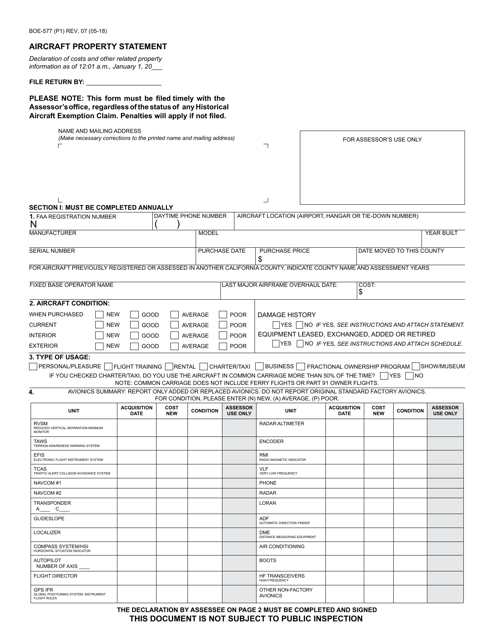

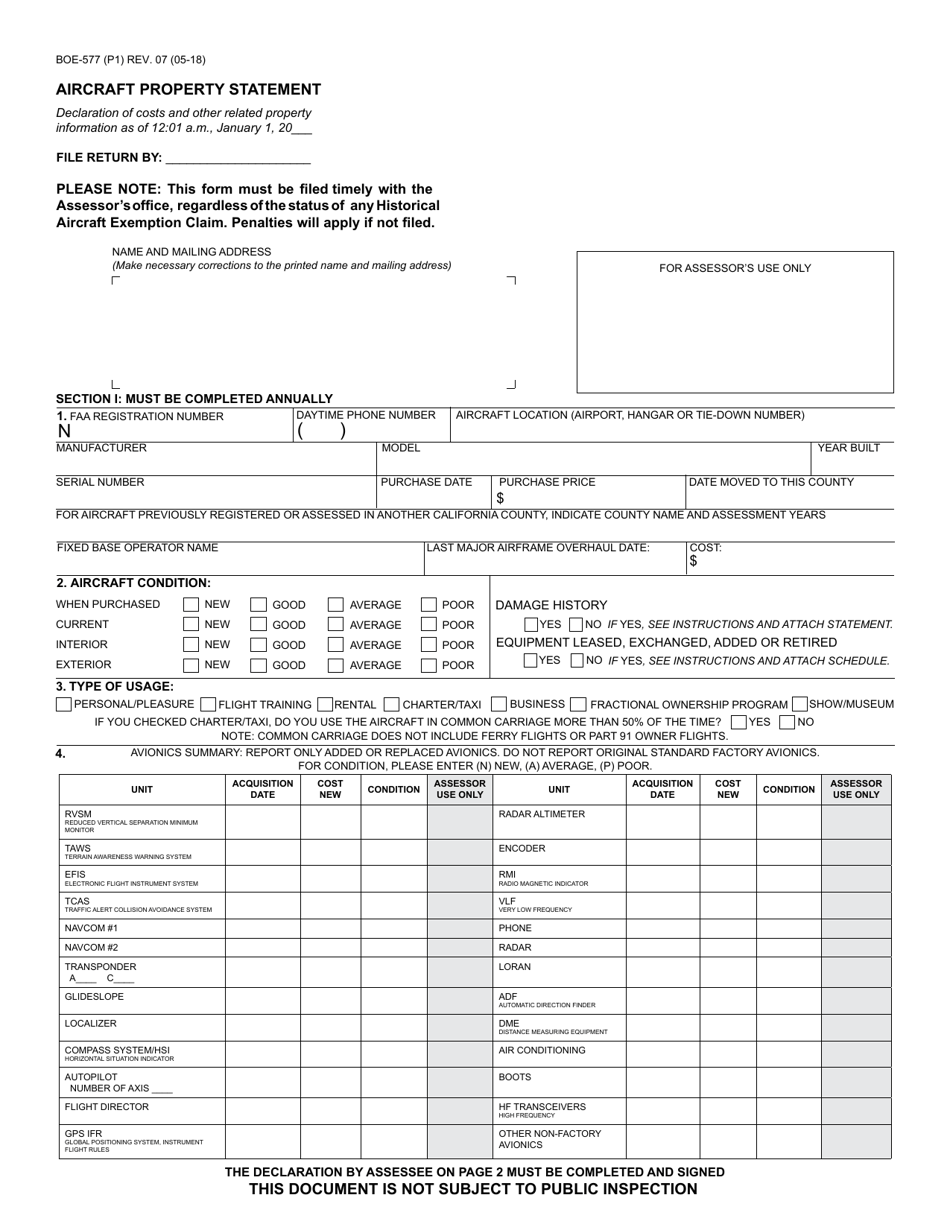

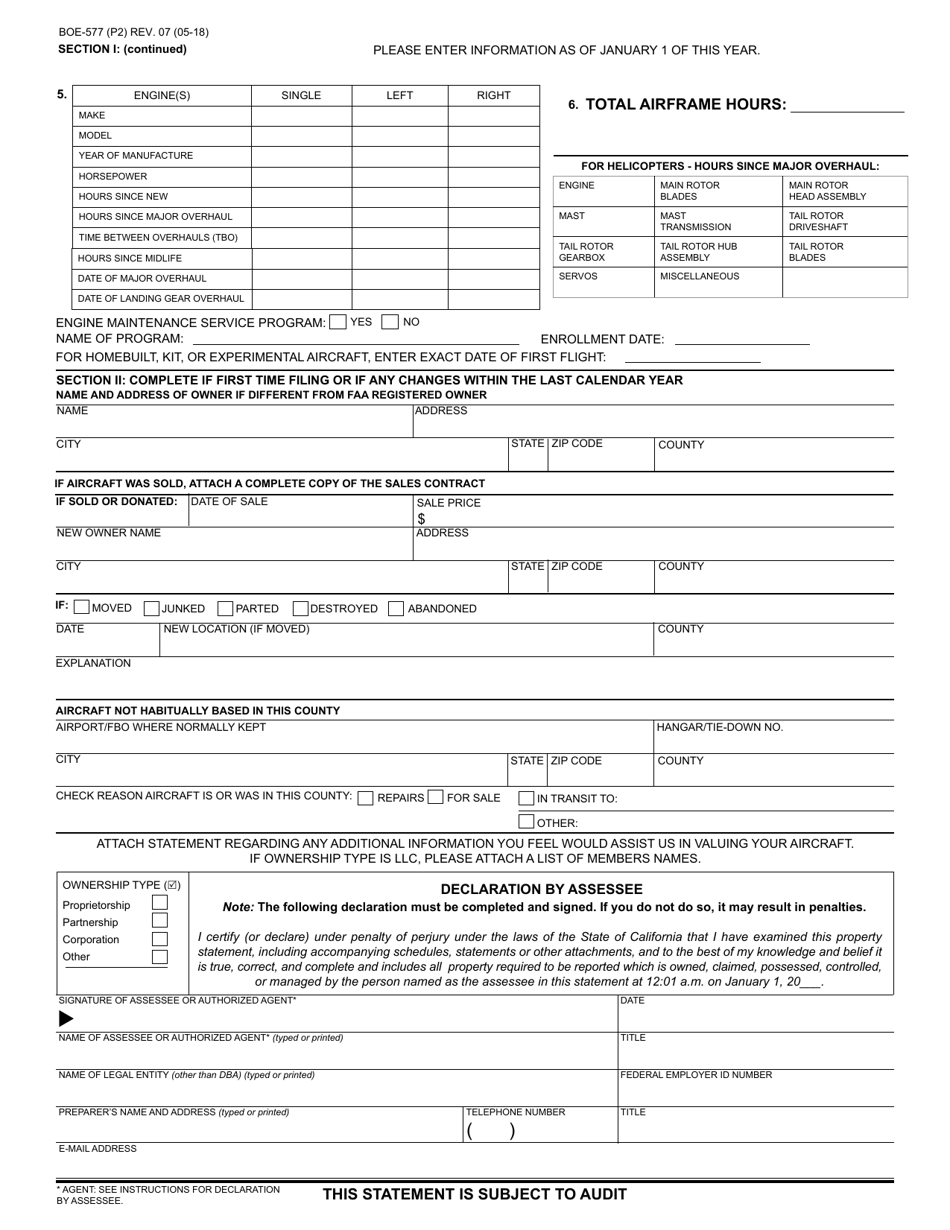

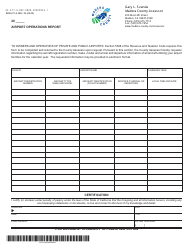

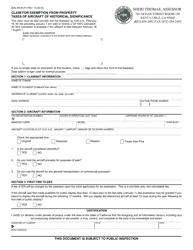

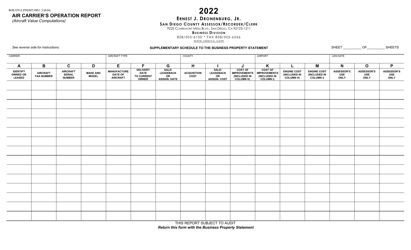

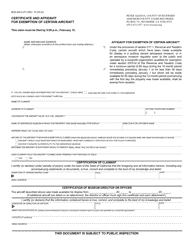

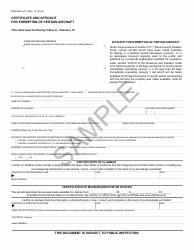

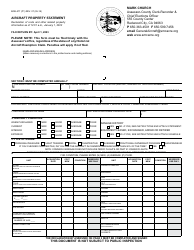

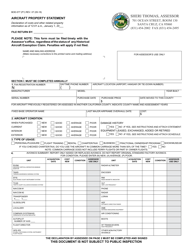

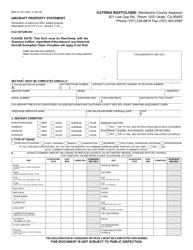

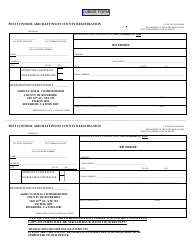

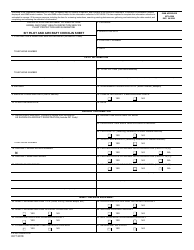

Form BOE-577 Aircraft Property Statement - California

What Is Form BOE-577?

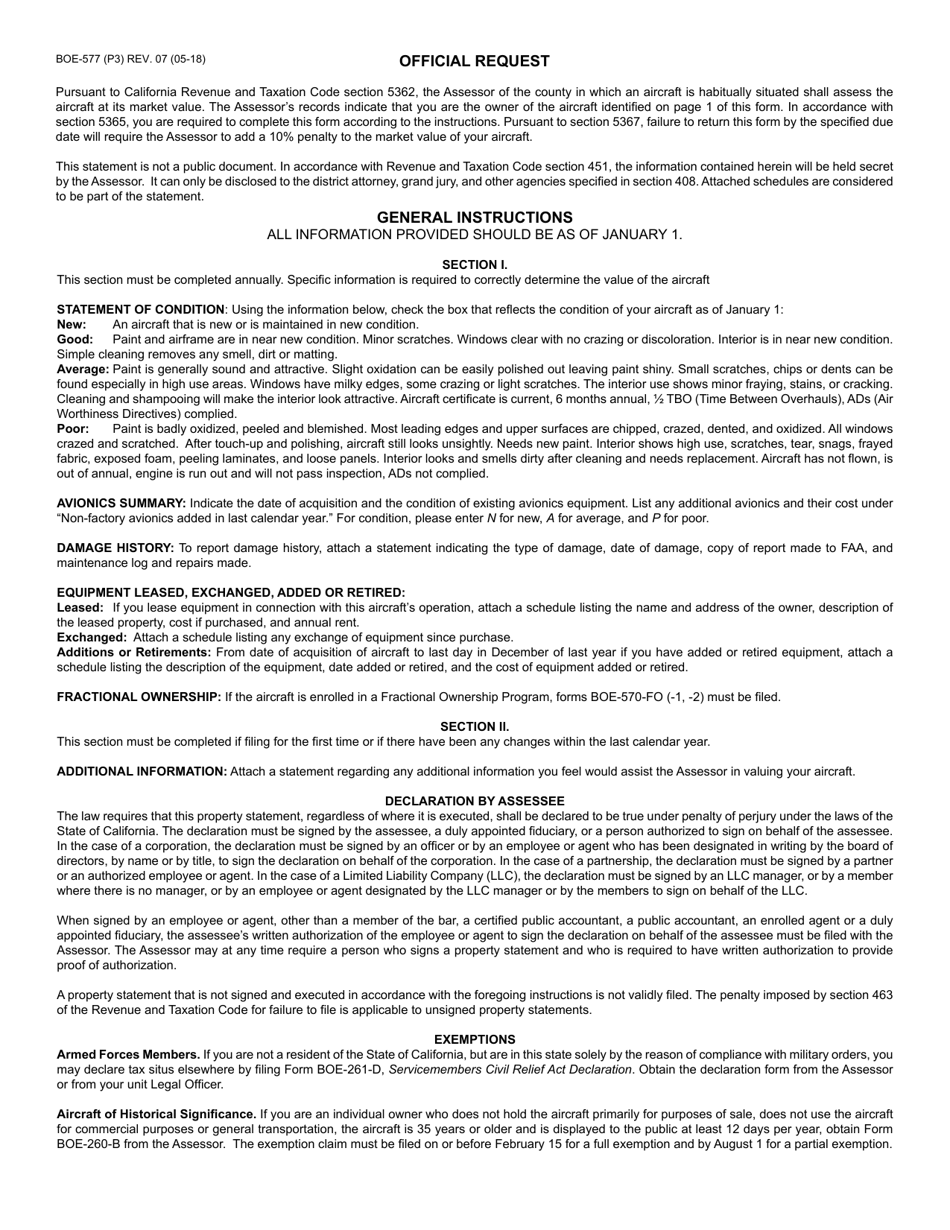

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-577 Aircraft Property Statement?

A: BOE-577 Aircraft Property Statement is a form used in California to report aircraft property and assess property taxes.

Q: Who needs to file the BOE-577 Aircraft Property Statement?

A: Owners of aircraft in California need to file the BOE-577 Aircraft Property Statement.

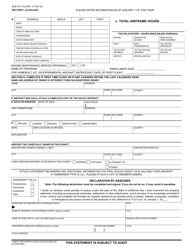

Q: When is the deadline to file the BOE-577 Aircraft Property Statement?

A: The deadline to file the BOE-577 Aircraft Property Statement is March 1st of each year.

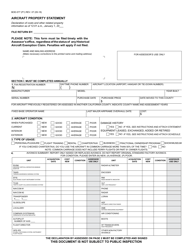

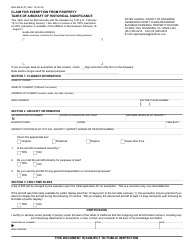

Q: What information is required to complete the BOE-577 Aircraft Property Statement?

A: The BOE-577 Aircraft Property Statement requires information about the aircraft, such as make, model, year, tail number, and the name and address of the owner.

Q: What happens if I don't file the BOE-577 Aircraft Property Statement?

A: Failure to file the BOE-577 Aircraft Property Statement may result in penalties and interest being assessed by the California tax authorities.

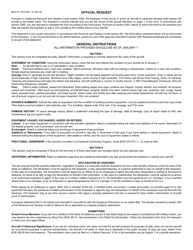

Q: Are there any exemptions or exclusions for aircraft property taxes in California?

A: Yes, there are certain exemptions and exclusions available for aircraft property taxes in California. It's advised to consult the California State Board of Equalization for more information.

Q: What should I do if I sell or dispose of an aircraft during the year?

A: If you sell or dispose of an aircraft during the year, you should notify the California State Board of Equalization (BOE) and provide them with the necessary information.

Q: Is there a fee for filing the BOE-577 Aircraft Property Statement?

A: There is no fee for filing the BOE-577 Aircraft Property Statement. However, failure to file may result in penalties and interest.

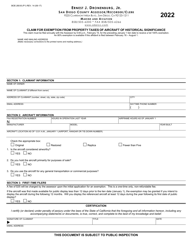

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-577 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.