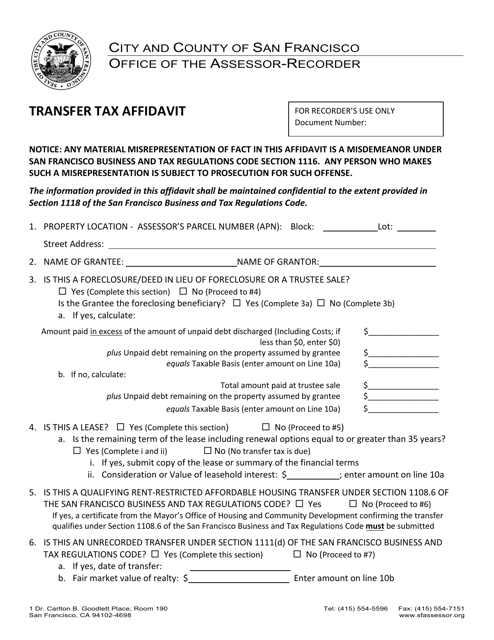

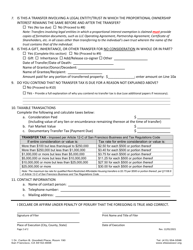

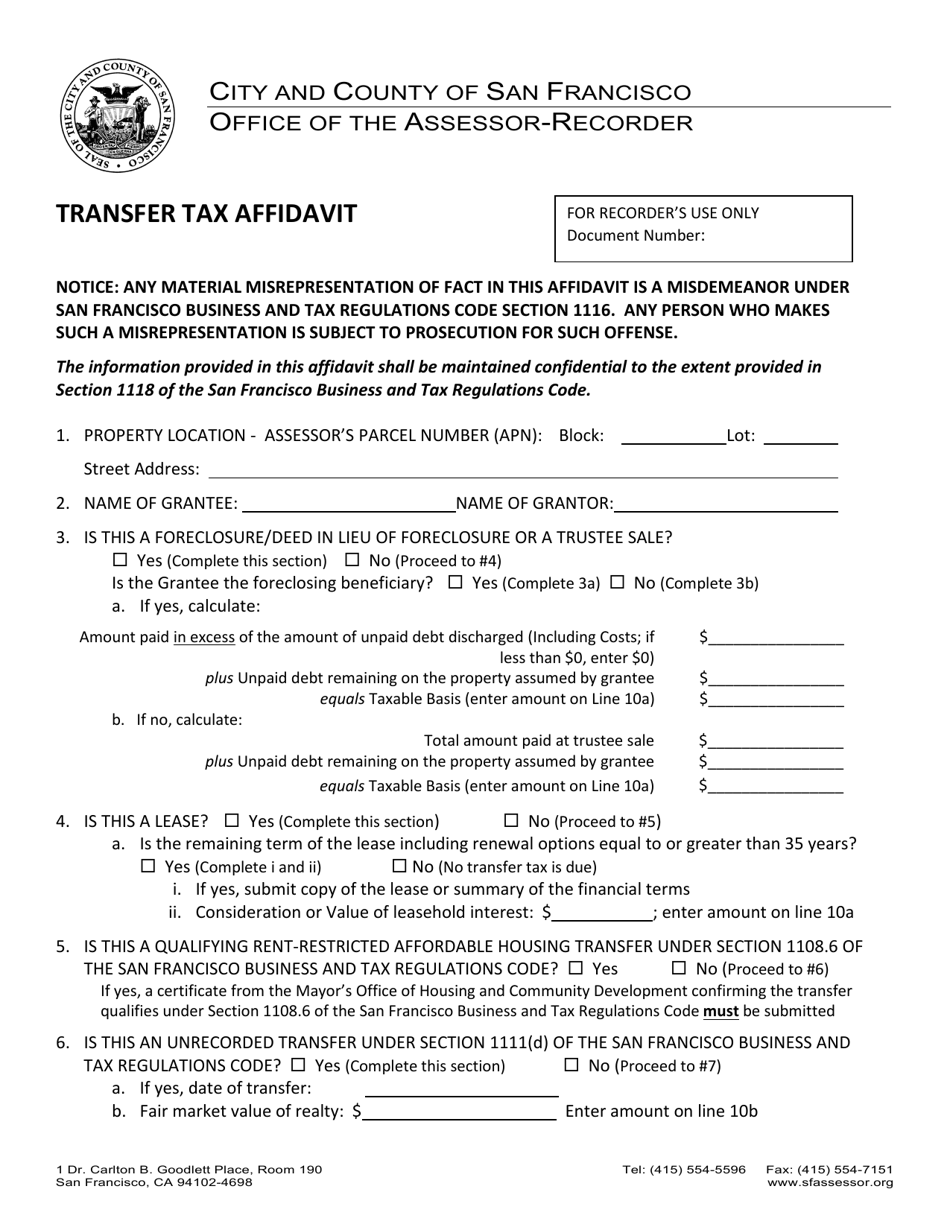

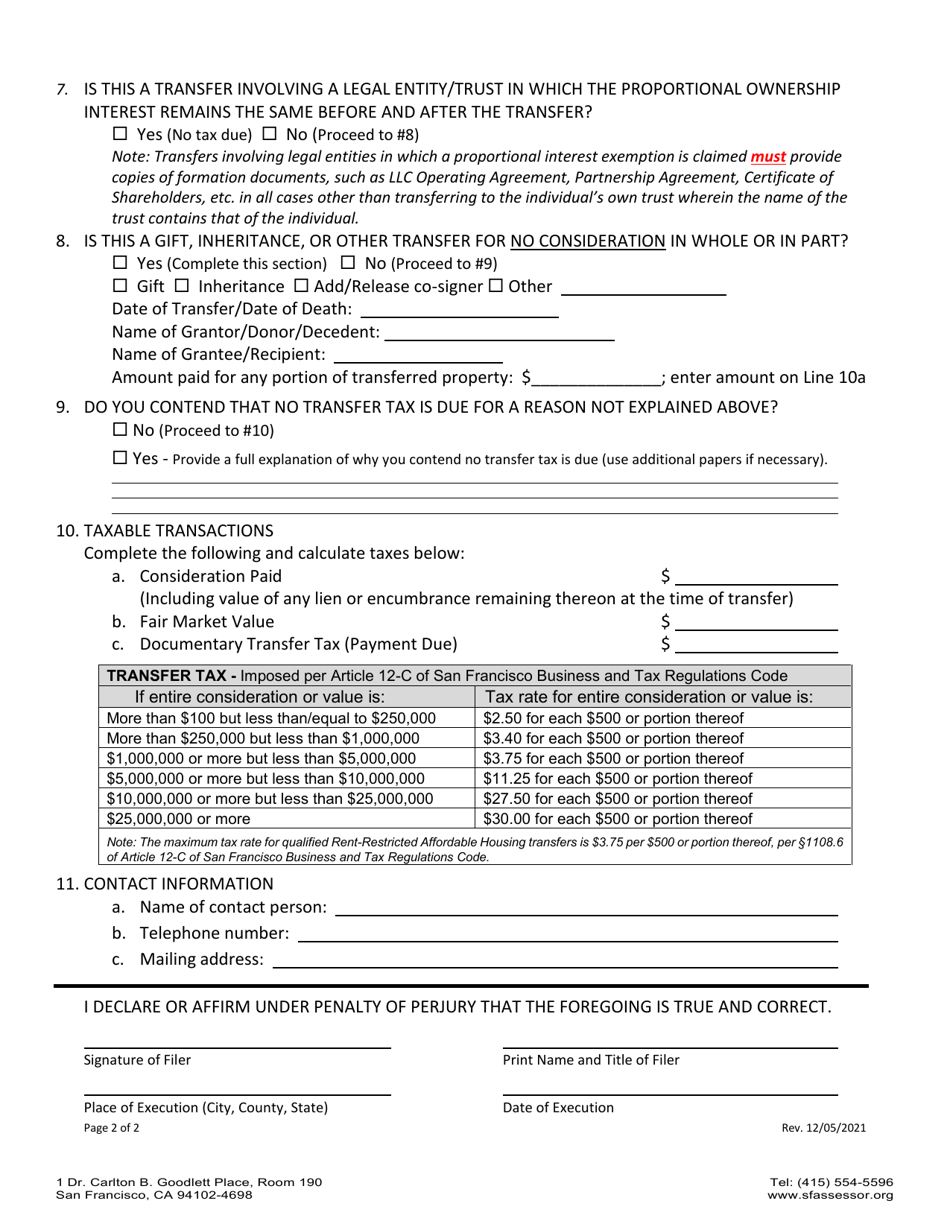

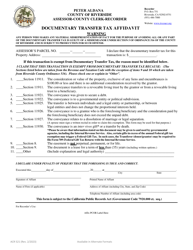

Transfer Tax Affidavit - City and County of San Francisco, California

Transfer Tax Affidavit is a legal document that was released by the Office of the Assessor-Recorder - City and County of San Francisco, California - a government authority operating within California. The form may be used strictly within City and County of San Francisco.

FAQ

Q: What is a Transfer Tax Affidavit?

A: A Transfer Tax Affidavit is a document used in San Francisco, California to report and pay transfer taxes when a property is sold or transferred.

Q: Why do I need a Transfer Tax Affidavit?

A: You need a Transfer Tax Affidavit to comply with the local regulations and tax laws in San Francisco, California.

Q: Who needs to file a Transfer Tax Affidavit?

A: The seller or transferor of a property in San Francisco, California is typically responsible for filing a Transfer Tax Affidavit.

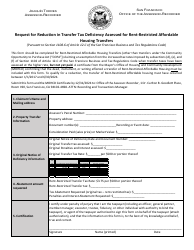

Q: What information is needed to complete a Transfer Tax Affidavit?

A: You will need to provide detailed information about the property being transferred, as well as the value of the transfer and other relevant details.

Q: When should I file a Transfer Tax Affidavit?

A: A Transfer Tax Affidavit should be filed within 30 days of the transfer or sale of the property in San Francisco, California.

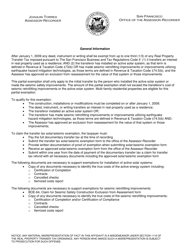

Q: Are there any exemptions from the Transfer Tax?

A: Yes, there are certain exemptions available for transfers between spouses, domestic partners, and other specific situations. It's best to consult with a professional or review the local regulations for more information.

Form Details:

- Released on December 5, 2021;

- The latest edition currently provided by the Office of the Assessor-Recorder - City and County of San Francisco, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the Assessor-Recorder - City and County of San Francisco, California.