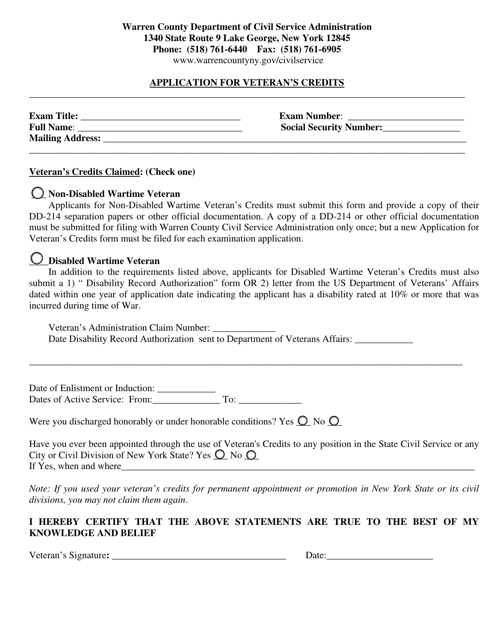

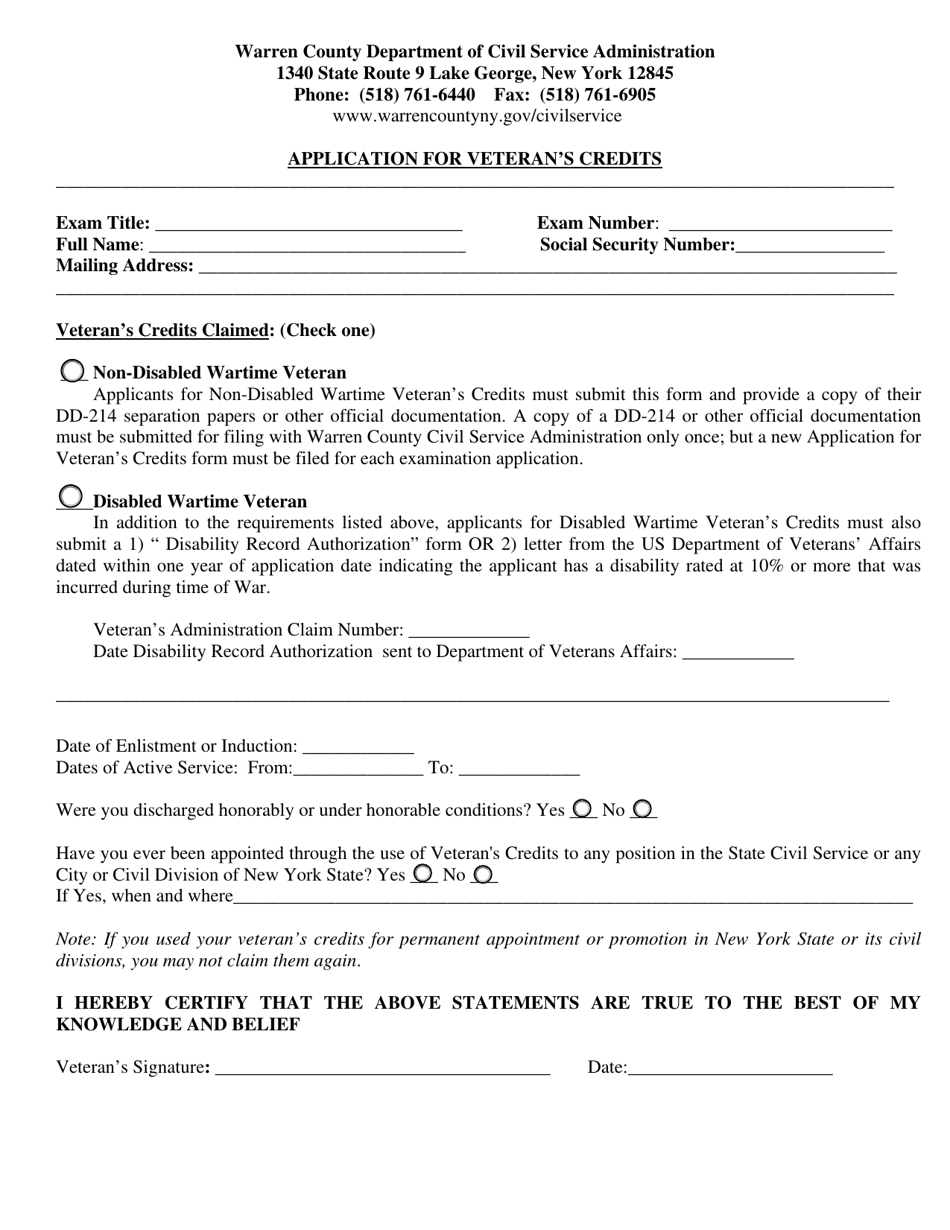

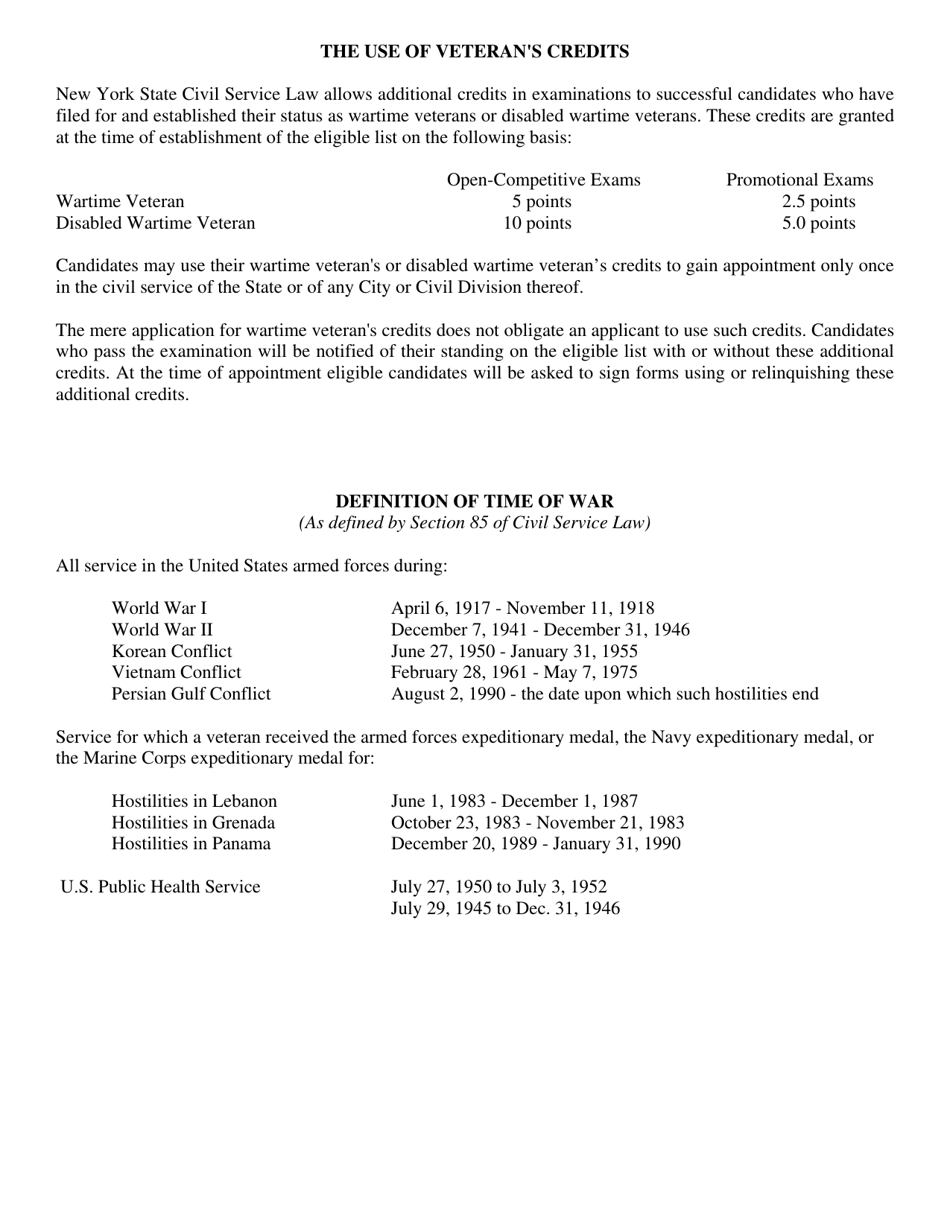

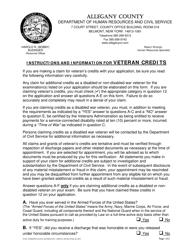

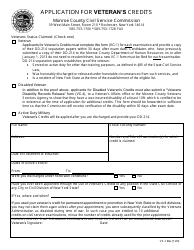

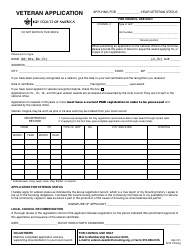

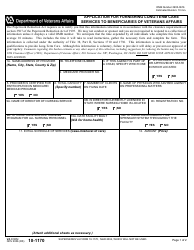

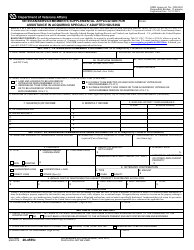

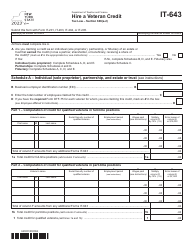

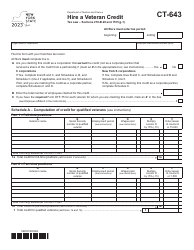

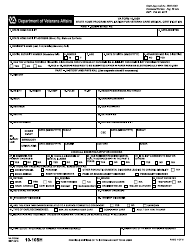

Application for Veteran's Credits - Warren County, New York

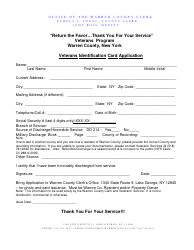

Application for Veteran's Credits is a legal document that was released by the Department of Civil Service Administration - Warren County, New York - a government authority operating within New York. The form may be used strictly within Warren County.

FAQ

Q: What is the application for Veteran's Credits?

A: The application is for Veteran's Credits in Warren County, New York.

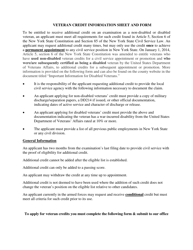

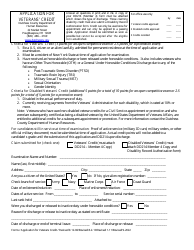

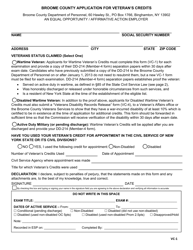

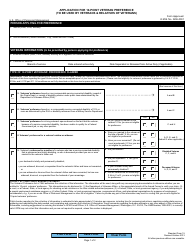

Q: Who can apply for Veteran's Credits?

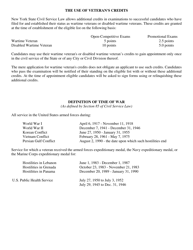

A: Veterans who served during specific times of war or conflict may apply for Veteran's Credits.

Q: What are Veteran's Credits?

A: Veteran's Credits are property tax exemptions available to qualifying veterans.

Q: How do I apply for Veteran's Credits?

A: You can apply for Veteran's Credits by submitting an application to the Warren County Department of Assessment.

Q: When should I submit my application?

A: It is recommended to submit your application at least 30 days before the tax roll is completed.

Q: What documents do I need to provide with the application?

A: You will need to provide proof of military service, such as a DD-214 form, along with your application.

Q: Is there an application deadline for Veteran's Credits?

A: Yes, the application deadline for Veteran's Credits is March 1st of each year.

Q: How much reduction can I receive with Veteran's Credits?

A: The reduction amount varies depending on your wartime service and other factors. It is best to contact the Warren County Department of Assessment for specific details.

Q: Can I still apply if I am a surviving spouse or child of a veteran?

A: Yes, surviving spouses and certain dependent children of qualifying veterans may also be eligible to apply for Veteran's Credits.

Form Details:

- The latest edition currently provided by the Department of Civil Service Administration - Warren County, New York;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Department of Civil Service Administration - Warren County, New York.