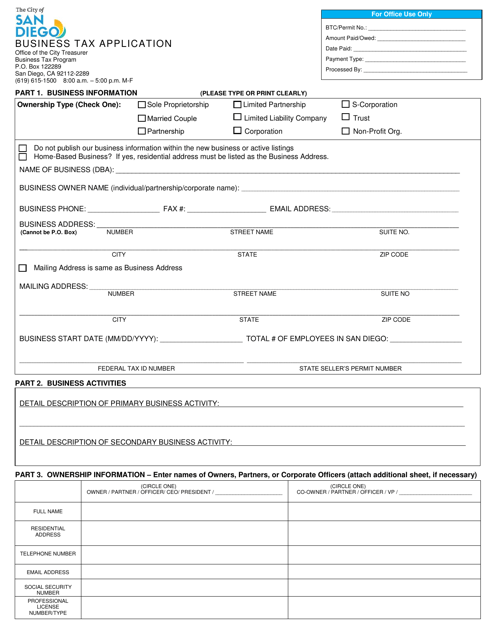

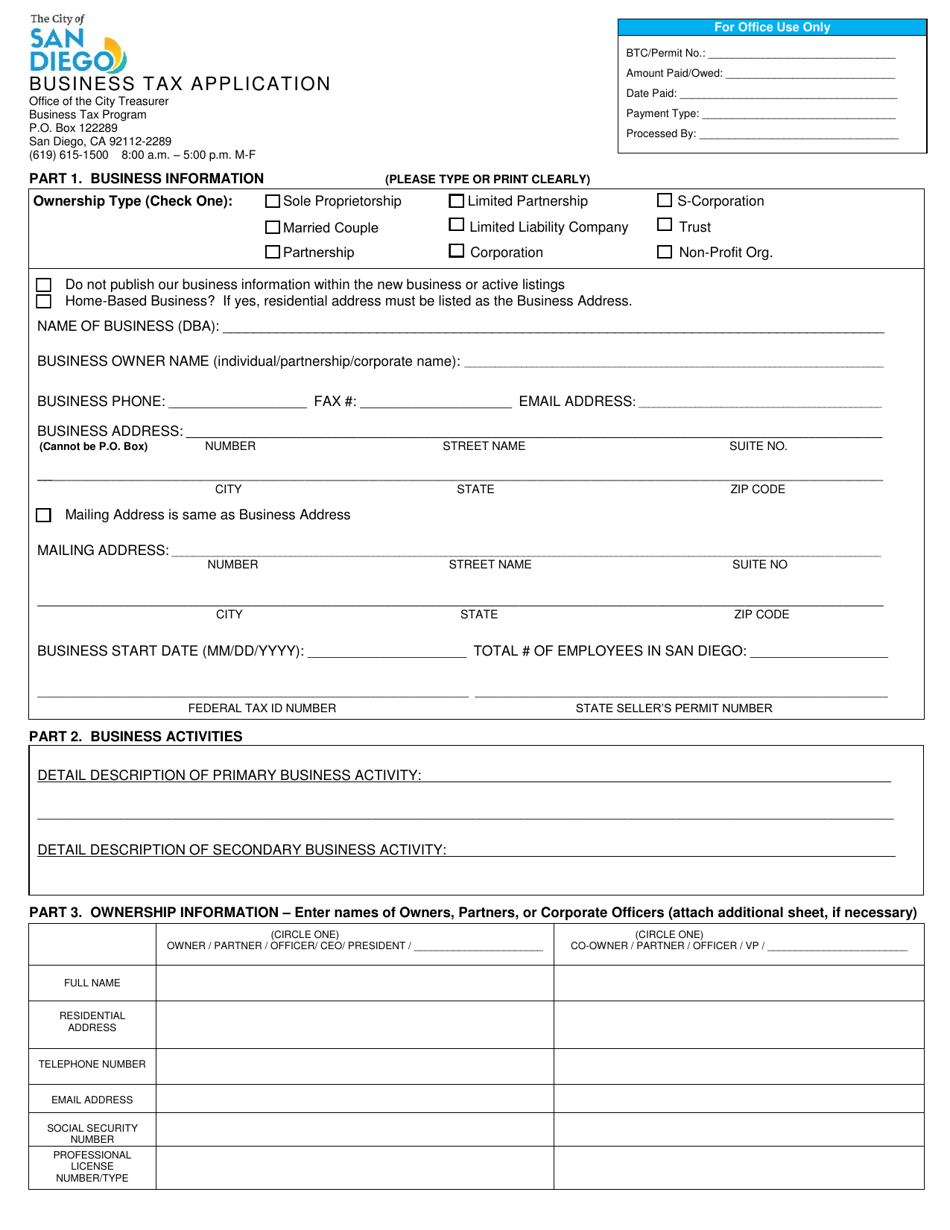

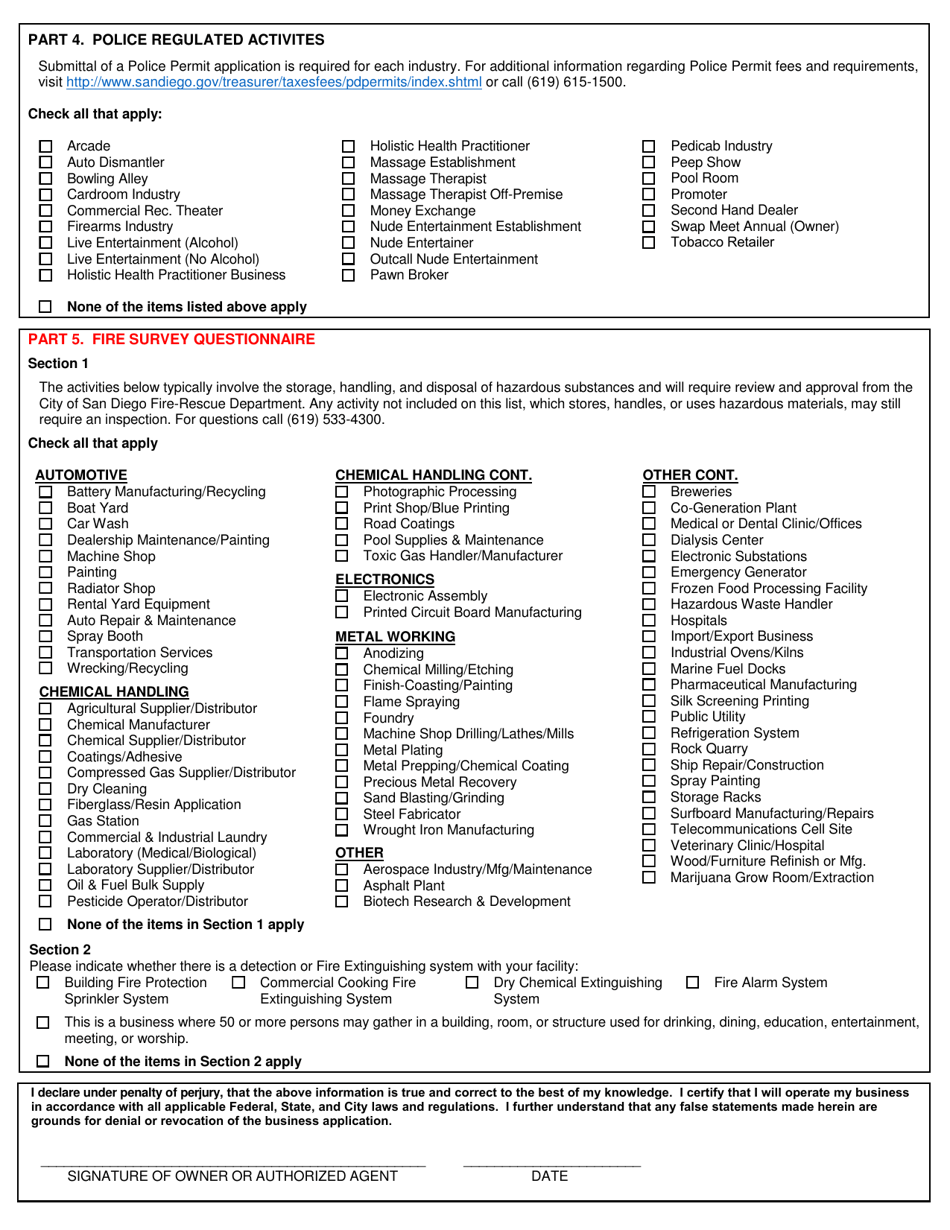

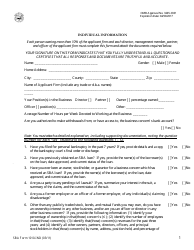

Business T Ax Application - City of San Diego, California

Business T Ax Application is a legal document that was released by the Office of the City Treasurer - City of San Diego, California - a government authority operating within California. The form may be used strictly within City of San Diego.

FAQ

Q: What is the Business Tax Application?

A: The Business Tax Application is a form that businesses in the City of San Diego, California need to fill out.

Q: Who needs to fill out the Business Tax Application?

A: All businesses operating within the City of San Diego, California need to fill out the Business Tax Application.

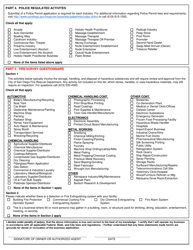

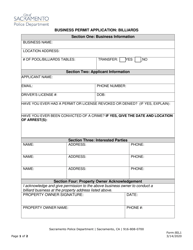

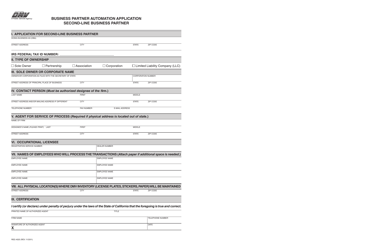

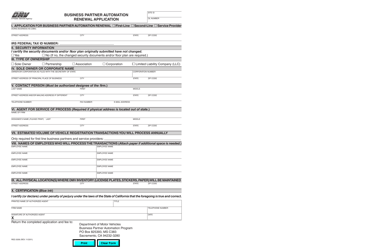

Q: What information is required in the Business Tax Application?

A: The Business Tax Application requires basic information about the business, such as its name, address, and type of business.

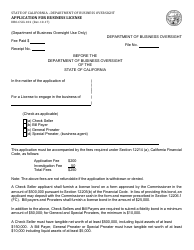

Q: Are there any fees associated with the Business Tax Application?

A: Yes, there are fees associated with the Business Tax Application. The amount of the fee depends on the size and type of business.

Q: When is the deadline to submit the Business Tax Application?

A: The deadline to submit the Business Tax Application varies depending on the business's fiscal year, but it is usually due by the end of February.

Q: What happens if I don't submit the Business Tax Application?

A: Failure to submit the Business Tax Application may result in penalties or legal action.

Q: Who should I contact if I have further questions about the Business Tax Application?

A: For further questions about the Business Tax Application, you can contact the City of San Diego's Business Tax Division.

Form Details:

- The latest edition currently provided by the Office of the City Treasurer - City of San Diego, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the City Treasurer - City of San Diego, California.